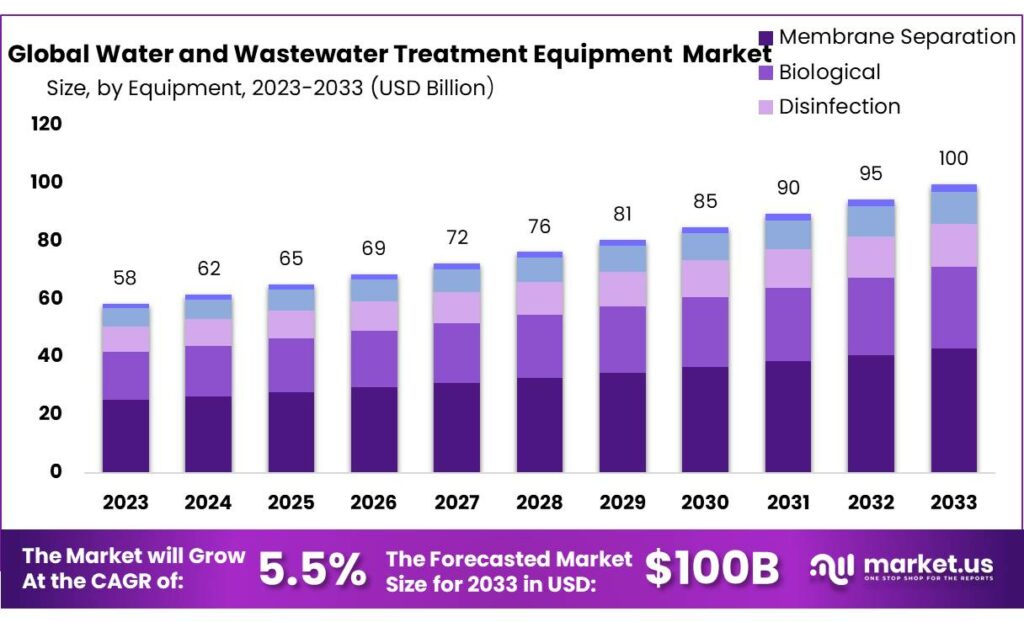

According to Market.us, the Global Water and Wastewater Treatment Equipment Market size is forecasted to exceed USD 100 billion by 2033, with a promising CAGR of 5.5% from 2024 to 2033.

Water and Wastewater Treatment Equipment encompasses a range of tools and technologies designed to clean wastewater, making it safe for environmental discharge or reuse. Wastewater treatment equipment utilizes physical, chemical, and biological methods to remove pollutants, ensuring safe environmental discharge or reuse. Rising demand is driven by population growth, stricter regulations, and water quality concerns. Municipal services dominate, holding over 69% of the market share.

Regulatory frameworks like the EU’s Urban Wastewater Treatment Directive and U.S. standards push for advanced technologies. Industrial sectors, including food, pharma, and energy, require specialized solutions. Innovations like bioremediation and advanced filtration are key investment areas, enhancing efficiency and sustainability in wastewater management.

Key Takeaway

- The Global Water and Wastewater Treatment Equipment Market size is expected to be worth around USD 100 Bn by 2033, from USD 58 Bn in 2023, growing at a CAGR of 5.5% during the forecast period from 2024 to 2033.

- Membrane Separation Dominance: Membrane Separation technology captured 43.2% market share in 2023, vital for water purification.

- Filtration and Adsorption Importance: Filtration (34.3% market share) removes impurities, while adsorption tackles organic compounds and heavy metals.

- Primary Treatment Dominance: Captured 49.3% market share in 2023, essential for removing solids and organic matter from wastewater.

- Municipal Application Dominance: Captured 69.3% market share in 2023, crucial for ensuring public health and environmental protection.

- Asia Pacific Market Leadership: Held a commanding 38.4% market share, driven by industrial activities and urbanization.

- According to the World Bank, an estimated $1.6 trillion in investment will be needed globally by 2030 to address water and sanitation challenges.

Factors affecting the growth of the Water and Wastewater Treatment Equipment Market

- Regulatory Standards and Environmental Policies: Regulatory requirements for water quality, driven by environmental protection policies across various countries, have intensified. Governments worldwide are implementing stringent water purification standards to address pollution levels, which necessitates the adoption of advanced treatment technologies.

- Industrial Expansion: As industrial activities expand, the need for water treatment in sectors such as pharmaceuticals, power generation, chemicals, and oil & gas escalates. These industries often require large volumes of water of varying qualities, including ultra-pure water for certain processes, driving the need for sophisticated water treatment solutions.

- Water Scarcity and Conservation Efforts: Global water scarcity issues are prompting countries and businesses to invest in water recycling and reuse technologies as a way to conserve water resources.

- Urbanization and Infrastructure Development: Rapid urbanization in emerging economies leads to increased wastewater generation, which in turn requires the development of municipal water treatment infrastructure. This is particularly relevant in regions like Asia-Pacific, where urban growth aligns directly with increased investment in water treatment facilities.

- Public Health Concerns: Public health campaigns and awareness about the risks associated with waterborne diseases have led to public pressure on governments and industries to ensure water safety.

- Investment and Funding: Financial support from governments, international organizations, and private entities for water infrastructure projects is a critical enabler of market growth. Such investments are often supported by public-private partnerships, particularly in regions where capital costs might otherwise be prohibitive.

Top Trends in the Global Water and Wastewater Treatment Equipment Market

- Rise of Smart Water Management Solutions: Digital solutions, including IoT sensors, real-time data monitoring, and cloud technologies, are being increasingly integrated into water treatment systems. These advancements enable more precise control over treatment processes and optimize resource use, leading to enhanced operational efficiencies.

- Sustainability Initiatives: There is a growing emphasis on sustainable practices within the industry, driven by environmental concerns and the need to reduce energy consumption. Technologies that support water recycling and zero liquid discharge are becoming more prevalent as companies aim to minimize their environmental impact.

- Decentralized Water Treatment Systems: Decentralized systems are expanding, particularly in rural and remote areas, due to their cost-effectiveness and ability to provide localized treatment. This trend is supported by modular water treatment equipment that can be easily scaled and adapted to varying needs.

- Emergence of Ballast Water Treatment Systems: The implementation of international regulations on ballast water treatment has propelled the development and deployment of systems designed to treat invasive species and pathogens in ship ballast water, presenting new opportunities within the maritime sector.

- Innovations in Chemical Treatment Methods: There is ongoing innovation in chemical treatments, including advanced oxidation processes and alternative disinfectants like chlorine dioxide. These developments are improving the effectiveness of treatment processes, particularly in industrial applications.

Market Growth

The global water and wastewater treatment equipment market is experiencing significant growth, driven by increasing water scarcity, urbanization, and stringent environmental regulations.This expansion is fueled by the rising demand for clean water, advancements in treatment technologies, and heightened awareness of sustainable water management practices.

Regional Analysis

The Asia Pacific region dominates the global water and wastewater treatment equipment market with a 38.4% share, driven by rising demand in municipal and industrial sectors, particularly in China, India, and Japan. North America experiences significant growth, fueled by economic advancements and the shift towards sustainable water management in the U.S. and Canada. Europe’s market is bolstered by its focus on efficient water treatment technologies and sustainability initiatives, positioning it as a key player. Urbanization, industrial expansion, and environmental regulations are major drivers across these regions.

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | USD 58 Billion |

| Forecast Revenue (2033) | USD 100 Billion |

| CAGR (2024 to 2033) | 5.5% |

| Asia Pacific Market Share | 38.4% |

| Base Year | 2023 |

| Historic Period | 2020 to 2022 |

| Forecast Year | 2024 to 2033 |

Market Drivers

The growth of the water and wastewater treatment equipment market is driven by several key factors. Increasing urbanization and industrialization have led to rising water consumption and wastewater generation, necessitating advanced treatment solutions. Stringent government regulations on water quality and effluent discharge are further propelling demand.

Additionally, growing awareness regarding water scarcity and environmental sustainability has spurred investments in water reuse and recycling technologies. The expansion of municipal infrastructure, coupled with advancements in treatment technologies such as membrane filtration and biological processes, is also contributing to market growth. Moreover, the increasing adoption of decentralized treatment systems in rural and remote areas is expected to provide significant opportunities.

Market Restraints

The water and wastewater treatment equipment market faces several restraints, including high initial investment and operational costs, which can deter adoption, particularly in developing regions. Additionally, the complexity of retrofitting aging infrastructure with modern technologies poses significant challenges. Regulatory compliance, while essential, can lead to increased costs and prolonged project timelines. Limited public awareness and reluctance from industries to adopt advanced treatment solutions due to cost considerations further hinder market growth.

Moreover, the availability of alternative water treatment methods, such as chemical treatments and traditional filtration systems, competes with advanced equipment. These factors collectively slow the expansion of the market despite growing environmental and regulatory pressures.

Opportunities

The global water and wastewater treatment equipment market presents significant growth opportunities driven by escalating urbanization, industrialization, and stringent environmental regulations. Advancements in membrane filtration, biological treatment technologies, and smart water management systems offer avenues for innovation. Emerging markets in Asia-Pacific and Africa exhibit strong demand due to growing infrastructure investments and increasing water scarcity.

Additionally, the rising adoption of decentralized treatment solutions and the integration of the Internet of Things (IoT) in monitoring systems provide substantial growth potential. Expanding industries such as pharmaceuticals, chemicals, and food and beverages further amplify the need for efficient wastewater treatment systems, fostering a robust market landscape for equipment manufacturers and service providers.

Report Segmentation of the Water and Wastewater Treatment Equipment Market

By Equipment Analysis

Membrane Separation led the water treatment market with a 43.2% share, driven by its efficiency in removing harmful particles across industrial and potable applications. Biological Treatment methods, leveraging natural organisms, ranked second, favored for their sustainability in municipal and industrial wastewater treatment. Disinfection technologies, crucial for pathogen removal, are advanced with eco-friendly solutions like UV and ozonation. Sludge Treatment focuses on waste reduction and resource recovery, aligning with circular economy goals by converting byproducts into energy and materials.

By Type Analysis

Filtration dominated the water treatment market with a 34.3% share, driven by its versatility in purifying drinking water and wastewater. Disinfection technologies, including chlorination and UV light, were vital for eliminating pathogens and preventing waterborne diseases. Adsorption, primarily using activated carbon, effectively addressed organic pollutants and heavy metals. Desalination advanced as a solution to global water scarcity, while testing equipment ensured compliance with health standards. These segments collectively underscored the market’s focus on clean water supply and environmental protection.

By Process Analysis

Primary treatment dominated the wastewater treatment market with a 49.3% share, reflecting its critical role in removing solids and organic matter. Secondary treatment, utilizing biological processes, further enhances water quality, driven by regulatory standards. Tertiary treatment, though smaller in market share, addresses advanced purification needs, including disinfection and nutrient removal, supporting water recycling and reuse. Rising demand across all stages highlights the focus on efficiency, sustainability, and compliance with environmental regulations.

By Application Analysis

Municipal Applications dominated the market with a 69.3% share, driven by urban population growth, regulatory mandates, and aging infrastructure upgrades. This sector prioritizes efficient, high-volume water treatment technologies. The industrial segment, though smaller, addresses specific pollutants across industries like manufacturing and power generation, focusing on compliance, sustainability, and resource recovery. Advanced technologies in both segments are vital for water reuse and reducing environmental impact, aligning with global sustainability goals.

Recent Development of the Water and Wastewater Treatment Equipment Market

- In January 2023, Veolia Water Technologies launched a new range of MBRs that are designed to be more energy-efficient and have a smaller footprint.

- In February 2023, Evoqua Water Technologies announced the development of a new AOP technology that is capable of removing a wide range of contaminants from wastewater, including PFAS chemicals.

- In March 2023, Xylem Inc. launched a new digital water management platform that uses AI and ML to help utilities optimize their water and wastewater treatment operations.

Competitive Landscape

The global water and wastewater treatment equipment market is poised for significant growth driven by rising environmental regulations, increased industrialization, and growing demand for clean water. Key players such as Ecolab Inc. and Veolia Group are expected to leverage their strong market presence and advanced technologies to address complex treatment needs.

DuPont and Xylem, Inc. will likely continue their focus on innovative membrane and filtration solutions, crucial for industrial and municipal applications. Companies like Evoqua Water Technologies LLC and Aquatech International LLC are anticipated to capitalize on their expertise in smart water systems, while Calgon Carbon Corporation and Pentair plc could gain momentum through their specialty treatment products.

Moreover, firms such as General Electric and Toshiba Water Solutions are well-positioned to expand their global footprint, particularly in emerging markets. Collaboration and R&D investments will be key strategies across the competitive landscape.