Introduction

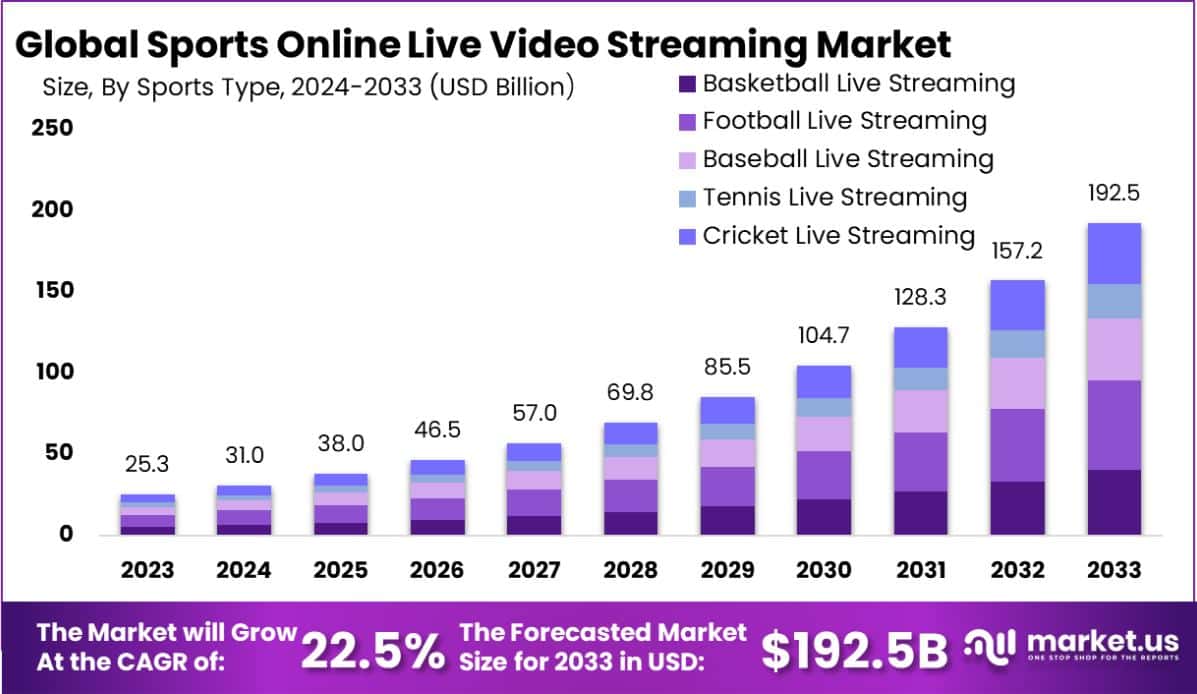

Based on the research findings of Market.us, The Global Sports Online Live Video Streaming Market is poised for significant growth, with projections indicating a rise from USD 25.3 Billion in 2023 to USD 192.5 Billion by 2033. This marks a robust CAGR of 22.5% over the ten-year forecast period from 2024 to 2033. In 2023, North America held the largest market share, dominating 36.8% of the global market, which translated into revenues of USD 9.31 Billion. This region’s strong performance is pivotal in driving the overall market expansion.

Sports online live video streaming allows viewers to watch sports events in real-time over the internet without the need for traditional broadcasting methods. This technology offers fans the convenience of accessing their favorite sports from anywhere, using devices like smartphones, tablets, laptops, or smart TVs. Platforms providing these services often include features such as multi-angle views, in-depth analytics, and interactive elements to enhance the viewing experience.

The market for sports online live video streaming is expanding rapidly, driven by the growing penetration of the internet and mobile devices globally. Increasingly, sports leagues and broadcasters are partnering with technology companies to offer live streaming services, catering to a broader audience that prefers online platforms over conventional TV. This market includes a range of services from subscription-based platforms to ad-supported models, which vary in their content offerings from exclusive sports events to mixed content channels.

The demand for sports online live video streaming is fueled by several factors. Firstly, the global increase in internet speed and accessibility allows more consumers to stream high-quality video content without significant delays or buffering. Secondly, the shift in consumer preference towards on-demand content lets viewers choose what they watch and when, contrary to the fixed schedules of traditional TV.

Key Takeaways

- The Global Sports Online Live Video Streaming Market is projected to reach USD 192.5 Billion by 2033, up from USD 25.3 Billion in 2023, growing at a compound annual growth rate (CAGR) of 22.5% from 2024 to 2033.

- In the Sports Type segment, Football Live Streaming was the most popular, holding a significant market share of 28.6% in 2023.

- For the application segment, Television live streaming was the leading choice, capturing more than 58% of the market in 2023.

- North America was the leading region in the market, with a 36.8% share, translating to revenues of USD 9.31 Billion in 2023.

Sports Online Live Video Streaming Statistics

- The global Esports Market is projected to surge to USD 16.7 billion by 2033, up from USD 2.3 billion in 2023. This growth represents a robust CAGR of 21.9% from 2024 to 2033.

- The Virtual Sports Market is on track to grow from USD 15.8 billion in 2023 to USD 72.8 billion by 2033, showcasing a notable CAGR of 16.48% during the forecast period.

- The AI in Sports Market is expected to expand significantly, jumping from USD 2.6 billion in 2023 to USD 36.7 billion by 2033, with an impressive CAGR of 30.3%.

- 53% of sports fans paid for a streaming video service last year to access sports content.

- About 49% of consumers feel overwhelmed by too many subscriptions, and 62% are frustrated by difficulties in finding content.

- 54% of respondents missed events they wanted to see due to these content access issues.

- In 2023, 73% of young global respondents (aged 15-29) confirmed playing games involving augmented or virtual reality.

- Technology sponsorships in ten major sports leagues globally in 2023 were valued at USD 375.6 million annually, making up 7% of the total sponsorship value.

- As of late 2023, 30% of internet users worldwide watched live streaming content weekly, showing a clear trend towards digital sports consumption.

- The 2023 Super Bowl became the most streamed event in history, marking a significant shift from traditional TV to streaming for major sports events.

- 54% of China’s population engages in live sports streaming, whereas 83% of Peru’s population still prefers live TV for sports.

- Younger audiences are adopting streaming services more rapidly, with 30% of individuals aged 18-34 subscribing to multiple services, compared to 14% of those over 35.

- Live streaming holds an engagement rate of 6.59%, surpassing the 4.25% rate for on-demand videos.

- Viewers spend up to three times longer engaging with live content compared to recorded videos.

- Broadcasting rights are costly; Amazon’s deal for NFL Thursday Night Football is valued at about $13 billion.

- 80% of consumers prefer watching live video from a brand over reading a blog, highlighting the effectiveness of live content.

- 70% of marketing professionals view video as the most effective tool for driving conversions.

- Over 60% of live streaming viewers would watch live content from a brand before reading a blog.

- According to Nielsen Fan Insights, 80% of sports fans, 76% of NFL fans, and 89% of soccer fans watch sports regularly or occasionally on streaming or online channels.

- Sports programming makes up only 2.7% of US broadcast TV content but generates billions in revenue annually.

- Streaming viewership of women’s college basketball tournaments has increased by 11%, indicating a rise in popularity.

- 65% of sports fans prefer paying for online streaming services over pay-TV subscriptions for sports content.

- Live streaming accounts for 23% of global viewing time and 17% of all internet traffic, underscoring its dominance in content consumption.

- As of early 2024, 27.6% of global internet users watch live streams weekly.

- 80% of users prefer live streaming over reading blogs, and 67% of viewers prioritize video quality as the most crucial factor.

- Over 90% of viewers favor live video over on-demand content, with 56% of live videos being viewed on mobile devices.

- Marketers using live streaming have seen a 23% increase in video reach.

Emerging Trends

- Direct-to-Consumer Offerings: Sports organizations are increasingly launching their own streaming services to better control content distribution and engage directly with fans, enhancing personalization and data monetization efforts.

- AI Integration: The adoption of AI technologies is transforming fan interactions, with personalized content delivery and improved user experiences becoming more prevalent.

- Enhanced Production Quality: Investments in production enhancements are aiming to provide viewers with high-quality, immersive experiences that mimic live attendance.

- 5G Adoption: The rollout of 5G technology is expected to significantly improve streaming quality with faster, more reliable connectivity, enhancing live sports viewing experiences.

- Social Features Integration: Streaming platforms are incorporating social interaction tools such as synchronized watch parties and chat functions to enrich the community experience for viewers.

Top Use Cases

- Global Fan Engagement: Platforms use streaming to connect with international audiences, providing access to games and events outside of the teams’ local markets.

- Monetizing Niche Sports: Smaller sports leagues and less mainstream sports are finding valuable opportunities in streaming to reach dedicated fanbases globally.

- Real-Time Sports Betting: Integrating betting features into live streams, offering viewers the chance to engage interactively with the sports events they are watching.

- Virtual Reality (VR) Experiences: Offering VR experiences that allow fans to view games from various angles or positions, as if they were in the stadium.

- E-Sports and Virtual Leagues: Leveraging the popularity of gaming by integrating e-sports elements into traditional sports broadcasting, attracting a younger audience.

Major Challenges

- High Infrastructure Costs: Adapting existing digital platforms to handle the demands of live high-definition sports streaming involves significant investment.

- Complex Rights Management: Navigating complex broadcast rights issues that vary by region and sport poses a significant hurdle.

- Latency Issues: Ensuring low-delay streams to provide a real-time viewing experience that can compete with traditional broadcasting.

- Piracy and Security Concerns: Protecting streamed content from unauthorized distribution and handling digital rights effectively.

- Fragmented Market: Offering a cohesive user experience in a market where fans may need multiple subscriptions to access all their desired content.

Top Opportunities

- Personalization of Viewer Experience: Utilizing data analytics to offer personalized content and advertisements, thereby increasing viewer engagement and loyalty.

- Expansion into Emerging Markets: With the global nature of digital platforms, there is significant growth potential in previously untapped markets.

- Integration with Social Media: Deepening the integration with social media to leverage influencer partnerships and viral marketing campaigns.

- Interactive and Immersive Formats: Developing more interactive and immersive content formats, such as augmented reality (AR) overlays or choice-driven sports narratives.

- Sustainability Practices: Adopting eco-friendly streaming practices to appeal to environmentally conscious consumers.

Conclusion

The Sports Online Live Video Streaming market is set for continued growth, fueled by technological advancements and the increasing demand for real-time sports access across the globe. Businesses stand to benefit from enhanced audience engagement, new revenue streams, and valuable data insights.

With innovations like HD, 4K, and VR driving immersive experiences, and a broad range of use cases from mainstream events to niche sports, this market presents vast opportunities for both sports organizations and streaming platforms alike. The future of sports broadcasting is undeniably digital, offering more interactive, accessible, and engaging experiences for fans worldwide.