Introduction

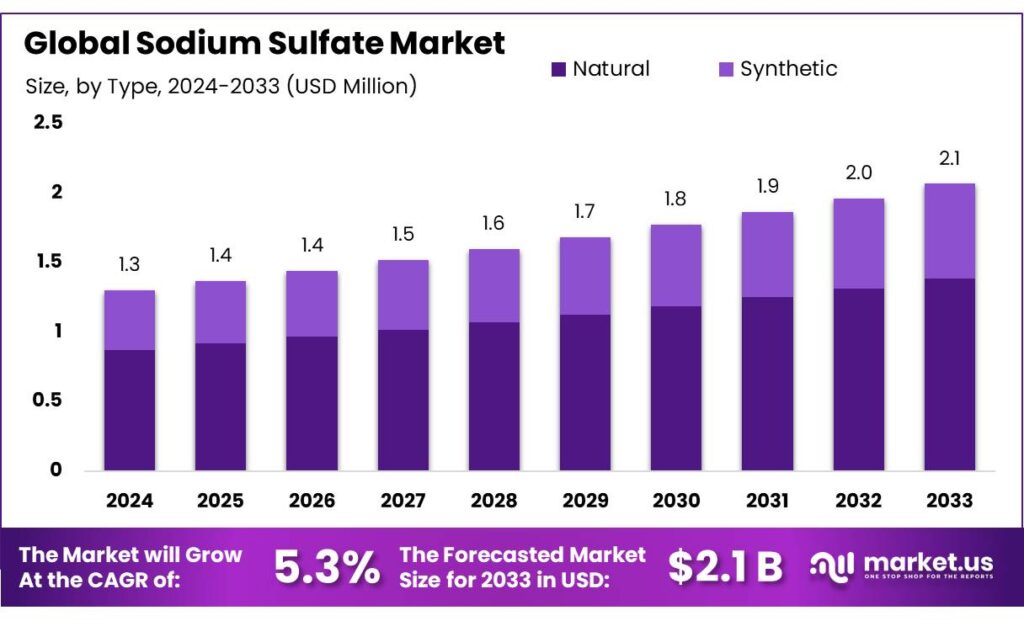

According to Market.us, The global Sodium Sulfate Market is poised for substantial growth, anticipated to increase from a valuation of USD 1.3 Billion in 2023 to an estimated USD 35.3 Billion by 2033, achieving a compound annual growth rate (CAGR) of 5.3% throughout this period.

This expansion is primarily driven by its widespread use in various industrial applications, particularly in the detergent, paper, and textile sectors. The market’s growth is underpinned by increasing demand for sodium sulfate in these industries due to its cost-effectiveness and functional properties, such as acting as a filler in powdered detergents and facilitating the kraft process in paper production.

Opportunities for market expansion are also evident in the development of bio-based and sustainable alternatives to traditional sodium sulfate, responding to growing environmental concerns and stricter regulatory standards, particularly in Europe. Innovations aimed at enhancing production efficiency and reducing environmental impact are setting the stage for continued industrial demand. Additionally, the Asia Pacific region, led by China’s extensive production capabilities and low manufacturing costs, remains a significant growth driver, offering lucrative opportunities for market participants.

Key Takeaway

- Sodium Sulfate Market size is expected to be worth around USD 35.3 Billion by 2033, from USD 1.3 Billion in 2023, growing at a CAGR of 5.3%.

- Natural sodium sulfate held a dominant market position, capturing more than a 67.8% share.

- Salt Cake held a dominant market position in the sodium sulfate market, capturing more than a 55.5% share.

- Technical-grade sodium sulfate held a dominant market position, capturing more than a 57.7% share.

- Soaps and Detergents held a dominant market position in the sodium sulfate market, capturing more than a 44.6% share.

- Building and Construction sector held a dominant market position in the sodium sulfate market, capturing more than a 28.9% share.

- North America emerging as the dominant region, capturing 41.5% of the global market, equivalent to approximately USD 0.53 billion.

Factors affecting the growth of the Sodium Sulfate Market

- Industrial Demand: Sodium sulfate is extensively used across various industries, including detergents, textiles, paper, and glass manufacturing. Its role as a filler in detergents and a dyeing agent in textiles significantly drives its consumption.

- Environmental Regulations: Increasing environmental regulations, particularly in Europe, affect the production and use of sodium sulfate. These regulations push for more sustainable and less polluting industrial processes, which can limit the use of traditional sodium sulfate but also open up opportunities for innovation in green chemistry.

- Technological Advancements: Advances in production technologies that enhance efficiency and reduce costs are crucial for market growth. Innovations such as improved crystallization techniques and alternative processing methods help in addressing the environmental concerns associated with sodium sulfate production.

- Economic Conditions: Fluctuations in raw material prices and the economic viability of sodium sulfate production can also impact the market. Volatility in these areas can affect profitability and influence market dynamics.

- Consumer Preferences: There is a shifting preference among consumers, especially in developed markets, from powder detergents (which use sodium sulfate as a filler) to liquid detergents, which typically do not use sodium sulfate. This shift is gradually altering the demand dynamics within the detergent industry.

- Market Expansion in Emerging Economies: The growth in emerging markets, where there is rising urbanization and industrialization, particularly in Asia, fosters increased demand for products containing sodium sulfate. This demand is spurred by the growth of industries such as construction, textiles, and automotive, which utilize sodium sulfate in various applications.

Top Trends in the Global Sodium Sulfate Market

- Industrial Demand: The largest demand for sodium sulfate comes from its use as a filler in detergents and as a dyeing agent in the textile industry. These applications capitalize on its cost-effectiveness and functional properties, making it a staple ingredient in these sectors.

- Geographical Expansion: Asia Pacific is emerging as a significant player in the sodium sulfate market, driven by robust industrial demand and rapid economic development, particularly in China and India. This region is expected to maintain its lead due to the continuous growth of end-use industries such as paper and pulp, detergents, and textiles.

- Environmental Regulations: In Europe, stringent environmental regulations are shaping the market, influencing manufacturers to explore sustainable and less environmentally damaging production methods. This regulatory pressure is spurring innovation in green chemistry and cleaner production processes.

- Technological Advancements: Innovations in production processes are critical for the growth of the sodium sulfate market. Enhanced crystallization techniques and alternative processing methods are being developed to address environmental concerns and improve production efficiency.

- Market Fragmentation and Competitive Dynamics: The market is fairly fragmented with a mix of large and medium-sized players. Companies are increasingly engaging in strategic mergers, acquisitions, and collaborations to strengthen their market position and expand their geographical footprint.

Market Growth

The global market for sodium sulfate is expected to experience healthy growth over the next decade. Projections indicate that the market size, which was valued at around USD 1.3 Billion in 2023, is forecasted to reach approximately USD 35.3 Billion by 2033, growing at a compound annual growth rate (CAGR) of about 5.3%. This growth is primarily fueled by the increasing use of sodium sulfate in various industrial applications such as detergents, textiles, paper and pulp, and glass manufacturing.

In particular, the demand in the detergents sector is a significant driver due to sodium sulfate’s cost-effectiveness as a filler. Additionally, its usage in the textile industry as a dyeing agent continues to support its market expansion. The Asia Pacific region is expected to lead this growth, driven by rapid industrialization and urbanization, particularly in countries like China and India, where there is a booming demand for products that use sodium sulfate.

Moreover, the market is witnessing a trend towards sustainable and environmentally friendly production processes, influenced by stringent environmental regulations, especially in Europe. This has encouraged innovations in production technology to minimize environmental impact and comply with regulatory standards. These factors collectively contribute to the ongoing expansion and evolution of the sodium sulfate market.

Regional Analysis

The Sodium Sulfate market in 2023 is dominated by North America, accounting for 41.5% of the global market, with Europe playing a crucial role due to its focus on sustainability and environmental regulations. Asia Pacific is a fast-growing region, driven by China and India’s rapid industrialization and manufacturing sectors. The Middle East & Africa and Latin America are experiencing gradual growth, driven by increasing industrial activities and sectors like construction and personal care.

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | USD 1.3 Billion |

| Forecast Revenue 2033 | USD 35.3 Billion |

| CAGR (2023 to 2033) | 5.3% |

| North America Market Share | 41.5% |

| Base Year | 2023 |

| Historic Period | 2020 to 2022 |

| Forecast Year | 2023 to 2033 |

Market Drivers

The global sodium sulfate market, valued at USD 2.1 billion in 2023, is fueled by its significant applications in the detergent and paper industries. Its role in powdered detergents enhances cleaning performance and is cost-effective. In the paper industry, sodium sulfate is crucial in the kraft process, aiding in chemical recovery and supporting sustainability. The demand for sodium sulfate is driven by consumer goods market growth, hygiene awareness, and the push towards sustainable manufacturing processes.

Market Restraints

The sodium sulfate market faces competition from substitute products, offering similar functionalities in detergents and industrial processes. These substitutes often come at lower costs or with enhanced performance, limiting market growth. Supply chain vulnerabilities, influenced by geopolitical tensions and global economic fluctuations, can disrupt raw material supply, affecting production and pricing. Limited suppliers increase bargaining power but also increase supply shortage risks, restraining market growth.

Opportunities

The sodium sulfate market is experiencing significant growth due to its increasing application in detergent and glass manufacturing industries. In 2023, it was a key filler in powdered detergents, enhancing product stability and performance. The glass industry also uses sodium sulfate as a fluxing agent, reducing silica melting point for clear, durable glass. Technological innovations, such as flue gas desulfurization gypsum, are enhancing efficiency and sustainability, aligning with global green chemistry initiatives.

Report Segmentation of the Sodium Sulfate Market

By Type

In 2023, Natural sodium sulfate dominated the market with over 67.8% share, primarily due to its availability and lower production costs. It is used in industries like paper, glass, and detergents. Synthetic sodium sulfate, smaller in market share, is crucial in specialized applications like pharmaceuticals and food processing. Technological advancements and increasing purity standards drive its growth in this segment.

By Form

Salt Cake, a cost-effective and widely used sodium sulfate, dominated the market in 2023, accounting for over 55.5%. It is used in industrial applications like detergents and glass manufacturing. Glauber’s Salt, a more specific form, is used in textile and dyeing industries for fabric processing and dye levelling. Niter Cake, a niche form, is crucial for chemical synthesis processes in pharmaceutical and agricultural sectors.

By Grade

In 2023, technical-grade sodium sulfate dominated the market with 57.7% share, used in industrial applications like detergents, glass, and textiles. Food Grade sodium sulfate is used in food processing, food additives, and preservation processes. Pharma Grade sodium sulfate is crucial in pharmaceutical applications, used as an inert bulking agent in tablets and laxatives, ensuring safety and effectiveness.

By Packaging

Bottles are commonly used for small quantities of high-purity sodium sulfate in pharmaceutical and laboratory settings, protecting against moisture and contaminants. HDPE and PP bags are used for bulk handling and transport, providing durability and resistance to environmental factors. Drums or bulk containers are used for large-scale industrial applications, ensuring ease of access and use in manufacturing processes.

By Application

In 2023, soaps and detergents held a 44.6% market share in sodium sulfate, primarily used as a filler in powdered detergents. Its high solubility and cost-effectiveness make it ideal for the detergent industry. The textile industry also relies on sodium sulfate as a dyeing agent, ensuring even distribution and proper fixation. In the glass manufacturing sector, it’s crucial for clear and structurally sound products.

By End-Use

In 2023, the Building and Construction sector held a 28.9% market share in sodium sulfate due to its use in concrete formulations, personal care and cosmetics, textiles and apparel, food and beverages, and agrochemicals. Demand is driven by global urbanization trends and infrastructure projects. The Personal Care and Cosmetics industry uses sodium sulfate to stabilize formulations and improve product texture. The Food and Beverages industry uses sodium sulfate as a food additive.

Recent Development of the Sodium Sulfate Market

- In the field of sodium sulfate, Aditya Birla Chemicals Limited, a prominent participant in the global chemicals industry, has achieved notable progress. Although the company is well-known for its wide range of chemical goods, its contributions to the sodium sulfate market are especially noteworthy.

- A major participant in the Turkish chemical sector, Alkim Alkali Kimya A.S. is well-known for producing and distributing sodium sulfate.

Competitive Landscape

The competitive landscape of the global sodium sulfate market is highly fragmented with a mixture of large and medium-sized companies competing. Key players in this market include well-known chemical giants such as Wacker Chemie AG, Dow Inc., and BASF SE, which are complemented by specialized firms like Celanese Corporation and Acquos Pty Ltd. These companies are heavily involved in innovation and the development of more efficient and sustainable production processes.

Other significant participants include Synthomer plc, Ashland Global Holdings Inc., and Japan Coating Resin Corporation, which contribute to the market’s dynamics through their specialized applications in industries such as coatings and construction materials. The landscape is further diversified with companies like Bosson Chemical Co., Ltd., Dairen Chemical Corporation, and Organik Kimya, which serve specific niches within the broader sodium sulfate market.

In the Asian market, companies like Puyang Yintai New Building Materials Company Ltd., Anhui Wanwei Group Co., Ltd., and Shanxi Sanwei Group Co., Ltd. play crucial roles, particularly in the production of materials for construction and textile industries. Additionally, firms like Archroma and Guangzhou Yuanye Industrial Co., Ltd. enhance the competitive environment by focusing on the development of innovative and environmentally friendly chemicals.

Lastly, emerging players such as Quanzhou Sailun Building Materials Technology Co., Ltd., Divnova Specialties Pvt. Ltd., and Sidley Chemical Co., Ltd., along with Vinavil S.p.A., are increasingly making their mark by catering to specialized demands and adapting swiftly to changing market needs. This diverse group of companies creates a dynamic and competitive environment, constantly driving advancements in the sodium sulfate industry.