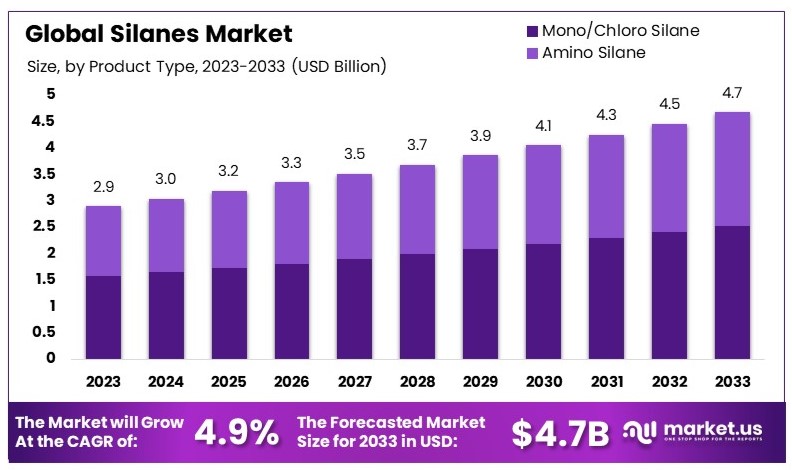

According to Market.us, The Global Silanes Market size is expected to be worth around USD 4.7 Billion by 2033, from USD 2.9 Billion in 2023, growing at a CAGR of 4.9% during the forecast period from 2024 to 2033.

The Global Silanes Market is experiencing significant growth, driven by expanding applications in the automotive, construction, and electronics sectors. Silanes are utilized as adhesion promoters, coupling agents, and surface modifiers, enhancing product performance and durability. The market’s expansion can be attributed to rising demand for green tires and increasing investments in infrastructure development, which necessitate high-performance materials. Asia-Pacific dominates the market, fueled by rapid industrialization and the presence of major automotive manufacturers. The trend towards more environmentally sustainable and energy-efficient materials is further catalyzing market growth. Forecasts suggest a continued upward trajectory, supported by technological advancements and growing demand from emerging economies.

Key Takeaway

- The Global Silanes Market was valued at USD 2.9 billion in 2023 and is expected to reach USD 4.7 billion by 2033, with a CAGR of 4.9%.

- Mono/Chloro Silane dominates the product type segment with 53.6% due to its versatile applications.

- Paints & Coatings leads the application segment with 28.2%, driven by its extensive use in surface protection.

- APAC holds 43.4%, indicating a strong industrial base and demand in the region.

Factors affecting the growth of the Silanes Market

- Industrial Growth and Urbanization: As emerging economies continue to industrialize and urbanize, the demand for construction materials, adhesives, and coatings that utilize silanes increases.

- Technological Advancements: Innovations in product formulations and applications of silanes, especially in sectors like electronics, automotive, and renewable energy, are driving market expansion. The development of high-performance silanes that provide superior adhesion and moisture resistance is particularly significant.

- Environmental Regulations: Stricter environmental regulations worldwide are pushing manufacturers towards more sustainable materials. Silanes that contribute to reduced VOC emissions and improved energy efficiency in products are gaining traction.

- Automotive Sector Demand: The automotive industry’s shift towards lightweight and fuel-efficient vehicles necessitates materials that silanes can enhance, such as composites and plastics used in automotive manufacturing.

- Construction Industry Dynamics: The global construction industry’s growth, especially in Asia-Pacific, necessitates durable and efficient building materials. Silane-modified products offer enhanced performance characteristics such as weather resistance and structural integrity.

- Supply Chain and Raw Material Availability: Fluctuations in the availability and cost of raw materials required to manufacture silanes can impact production costs and market prices, influencing market growth.

- Global Economic Conditions: Economic fluctuations can affect investment in industries that use silanes, such as construction and automotive, thus impacting the demand for silanes.

Top Trends in the Global Silanes Market

- Increased Use in Composite Materials: As industries seek lighter and stronger materials, silanes are increasingly used in composite formulations for automotive, aerospace, and sports equipment to enhance the bonding between organic and inorganic materials.

- Green Tire Technology: With environmental concerns on the rise, the automotive sector is adopting green tires that reduce rolling resistance and improve fuel efficiency. Silanes play a crucial role in the production of these tires, enhancing their performance and sustainability.

- Eco-friendly Product Development: The demand for environmentally friendly and non-toxic silanes is growing. Manufacturers are focusing on developing silanes that comply with stringent global environmental regulations and have a lower ecological impact.

- Advancements in Crosslinking Technology: Silanes are vital in crosslinking processes for cables and pipes in the construction and electrical industries. Innovations in this technology are improving the thermal and mechanical properties of silane-crosslinked products.

- Growth in the Solar Energy Sector: Silanes are used in the production of photovoltaic (PV) cells and modules, serving as encapsulating agents and adhesion promoters. The expansion of the solar energy market is directly contributing to the growth of the silanes sector.

- Expansion in Developing Regions: Increasing industrialization in Asia-Pacific, Latin America, and the Middle East is a significant trend, with these regions experiencing rapid growth in sectors such as construction, automotive, and electronics, all of which utilize silanes extensively.

- Healthcare Applications: There is a rising trend of using silanes in medical applications, where they are used to improve the properties of implants and other medical devices. This trend is expected to expand as the healthcare sector continues to innovate and grow.

Market Growth

The global silanes market is projected to exhibit robust growth, driven by the increasing demand across various end-use industries such as automotive, construction, and electronics. Market growth is primarily fueled by the expanding use of silanes in green tire manufacturing and as coupling agents in composite materials. The Asia-Pacific region is expected to lead this expansion, owing to rapid industrialization and the presence of key automotive and construction sectors.

Additionally, technological advancements and a shift towards sustainable materials are propelling the demand for eco-friendly silanes. The market’s development is further supported by the rising utilization of silanes in healthcare applications and photovoltaic systems. Overall, the market is set to continue its upward trajectory, reflecting broader industrial and environmental trends.

Regional Analysis

The Asia-Pacific (APAC) region dominates the global silanes market with a 43.4% share, valued at USD 1.2 billion, primarily driven by rapid industrial growth and high demand in the automotive and construction sectors. Enhanced by significant manufacturing capabilities, especially in China and India, and competitive production costs, APAC’s influence on the market is expected to increase with continued industrialization and technological advancements.

North America holds a 25% market share (USD 690 million), spurred by demand in automotive, electronics, and construction, supported by advanced manufacturing technologies. Europe follows with a 20% share (USD 552 million), driven by its strong automotive and construction sectors and focus on sustainability. The Middle East and Africa, with a 7% share (USD 193 million), see growth from construction and industrial development, while Latin America captures 4.6% of the market (USD 127 million), driven by industrialization and sectoral growth.

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | USD 2.9 Billion |

| Forecast Revenue (2033) | USD 4.7 Billion |

| CAGR (2024 to 2033) | 4.9% |

| Asia Pacific Market Share | 43.4% |

| Base Year | 2023 |

| Historic Period | 2020 to 2022 |

| Forecast Year | 2024 to 2033 |

Market Drivers

The growth of the Global Silanes Market is primarily driven by significant advancements in industrial sectors that demand high-performance materials. The automotive industry’s shift towards more environmentally sustainable practices, including the production of green tires, heavily relies on silanes for improved performance and efficiency. Similarly, the construction sector’s ongoing expansion, especially in emerging economies, requires durable and advanced materials, where silanes serve as essential additives. The rising demand for energy-efficient solutions and enhanced material properties in electronics and solar energy sectors further stimulates market growth.

Additionally, innovations in silane technology that lead to products with better environmental profiles are aligning with global regulatory trends toward sustainability, thereby propelling the market forward. These drivers collectively underscore the expanding applications and increasing relevance of silanes across multiple industries.

Market Restraints

The expansion of the global silanes market faces several restraints that could temper its growth trajectory. One primary challenge is the volatility in raw material prices, which can lead to fluctuations in production costs and market pricing, affecting profitability for manufacturers. Additionally, stringent environmental regulations across numerous countries pose a constraint, as they require manufacturers to invest in cleaner production technologies and reformulate products to meet compliance standards, increasing operational costs.

Another significant restraint is the complexity associated with the synthesis and application of silanes, which requires specialized knowledge and technology, potentially limiting market entry for new players. Lastly, global economic instability can impact industrial investment and consumer spending, indirectly affecting demand for silanes in various applications like the construction and automotive industries.

Opportunities

The Silanes market presents numerous opportunities for growth and innovation, particularly in the development of environmentally sustainable and high-performance materials. One significant opportunity lies in the expansion of green tire technology, where silanes are integral to enhancing tire performance and fuel efficiency. The ongoing global push for renewable energy also offers potential, with silanes playing a crucial role in improving the durability and efficiency of solar panels.

Additionally, the burgeoning construction industry, especially in Asia-Pacific, provides a fertile ground for increased silane usage in protective coatings and sealants. Furthermore, advances in healthcare technology present new prospects for silanes in medical applications, where their biocompatibility and robustness can improve the performance of medical implants. These opportunities highlight the diverse applications of silanes and their critical role in advancing sustainable industrial solutions.

Report Segmentation of the Silanes Market

By Product Type Analysis

The Silanes market is prominently led by Mono/Chloro Silane, which holds a significant share of 53.6%, primarily fueled by its critical applications in the electronics and solar sectors. This segment’s leadership is attributed to its vital role in semiconductor and photovoltaic cell production, where its purity and reactivity are essential for high-quality silicon wafer and solar panel manufacturing. The demand for Mono/Chloro Silane is further bolstered by the growing market for consumer electronics and the increasing shift towards solar energy.

Concurrently, Amino Silane, although not as dominant, is integral in producing adhesives and sealants, enhancing bonding properties for various industrial uses. Its utility in surface treatment applications also contributes to its market growth, driven by the demand for improved material performance across the automotive, construction, and aerospace industries.

By Application Analysis

The Silanes market is significantly influenced by its application in Paints & Coatings, which commands a 28.2% share due to its critical role in the construction and automotive sectors. These sectors utilize Silane-enhanced paints and coatings for their durability and resistance to environmental stressors, thus extending infrastructure lifespan and boosting vehicle performance. Other notable applications include fiberglass & mineral wool for energy-efficient insulation, and polyolefin compounds where Silanes enhance material properties for diverse industrial uses. Additionally, Silanes are pivotal in improving the performance of adhesives & sealants, sol-gel systems, fillers & pigments, and silicones, further broadening their market impact.

Recent Development of the Silanes Market

- August 2023: Evonik Industries expanded its rubber silanes production in China at the Evonik Lanxing (Rizhao) Chemical Industrial Co., Ltd. This expansion aims to meet the growing demand for sustainable solutions within the tire and rubber industry. The facility focuses on enhancing efficiency, reducing waste, and lowering CO2 emissions. Evonik reported a 2022 revenue of €18.5 billion, reflecting its robust position in the specialty chemicals sector.

- 2023: According to the American Chemistry Council, the U.S. chemical industry saw a slight increase in plastic resins production by 0.5%, attributed to stronger exports. However, basic chemicals, petrochemicals, and organic intermediates observed a decline. Overall, the U.S. chemical industry faced a 2.5% decline in output, with a forecasted rebound in 2024.

Competitive Landscape

The global Silanes market in 2024 is characterized by a diversified presence of key players, each contributing distinctively to the industry dynamics. Notable among them are Dow Inc., Wacker Chemie AG, and Shin-Etsu Chemical Co. Ltd., which are pivotal in driving technological innovation and expanding silane applications across various sectors including automotive, construction, and electronics. Evonik Industries AG and Momentive Performance Materials Inc. are also significant for their contributions to the development of specialty silanes, which are critical in enhancing product performance and environmental sustainability.

The competitive landscape is further enriched by regional players such as KCC Corporation and OCI Company Ltd., which leverage local market insights and regulatory landscapes to optimize production and distribution strategies. New entrants and emerging companies like Nanjing Union Silicon Chemical Co. Ltd. and Qufu Chenguang Chemical Co. Ltd. are poised to disrupt the market with novel solutions and competitive pricing strategies, potentially increasing market fragmentation and intensifying competition.

Collectively, these companies are anticipated to focus on strategic collaborations, technological advancements, and capacity expansions to meet the growing demand for high-quality silanes, thereby fostering a robust growth trajectory for the global Silanes market.