Introduction

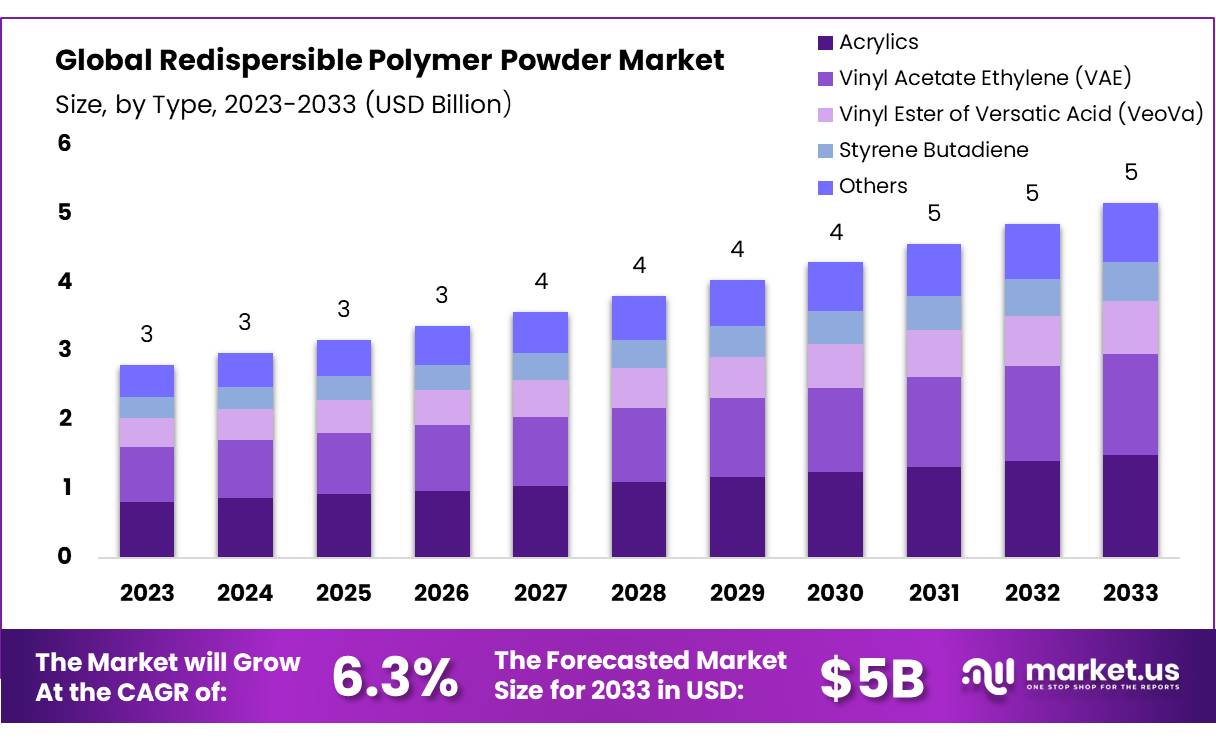

According to Market.us, The global Redispersible Polymer Powder Market is poised for substantial growth, expected to increase from USD 3 Billion in 2023 to approximately USD 5 Billion by 2033, progressing at a CAGR of 6.3%.

This market expansion can be attributed to a combination of factors including heightened demand in the construction sector, technological advancements, and the development of sustainable products. Asia Pacific leads in market share, driven by robust construction activities and urbanization in countries like China and India, which significantly amplify the demand for construction materials including redispersible polymer powders. In North America, the surge in residential building constructions and renovations is also contributing to market growth, with the U.S. showing strong demand linked to remodeling activities that require high-quality construction materials.

Redispersible polymer powders are extensively used due to their ability to improve the properties of construction materials such as mortars, cements, plasters, and adhesives. Their key benefits include enhanced adhesion, flexibility, and water resistance, which are crucial for applications in tile adhesives and grouts, insulation and finish systems, and self-leveling underlayments. The versatility of these powders ensures their applicability in both residential and non-residential sectors, thereby broadening the scope for market penetration and expansion.

Opportunities for market expansion also arise from the increasing adoption of green building practices and energy-efficient materials, driving further innovations and development within the industry. These trends underscore the redispersible polymer powder market’s potential for continued growth and expansion across various regions and applications.

Key Takeaway

- Redispersible Polymer Powder Market size is expected to be worth around USD 5 Billion by 2033, from USD 3 Billion in 2023, growing at a CAGR of 6.3%.

- Acrylics held a dominant market position, capturing more than a 29.7% share.

- Tiling & Flooring held a dominant market position, capturing more than a 36.7% share.

- Residential Construction held a dominant market position, capturing more than a 44.5% share.

- Direct Sales held a dominant market position, capturing more than a 57.7% share.

- Asia Pacific (APAC) dominated the redispersible polymer powder market, accounting for approximately 35%.

Factors affecting the growth of the Redispersible Polymer Powder Market

- Construction Industry Growth: The primary driver is the booming construction industry globally, especially in emerging economies. Redispersible polymer powders are widely used in construction materials to improve the properties of dry mix mortars and other cement-based mixes. As the construction sector expands, so does the demand for these polymer powders.

- Increasing Demand for Green Buildings: With a rising emphasis on sustainability, there is growing demand for eco-friendly and energy-efficient building materials. Redispersible polymer powders contribute to this need by enhancing the thermal insulation properties of construction materials, supporting the development of green buildings.

- Technological Innovations: Advances in technology that lead to improved product quality and characteristics (like increased durability and reliability of construction materials) also propel the market growth. Innovations in polymer chemistry that result in better performance parameters of redispersible polymer powders make them more attractive to manufacturers of construction products.

- Regulatory Support and Standards: Regulations and building standards promoting energy efficiency and durability in construction materials encourage the use of redispersible polymer powders. As governments impose stricter regulations to ensure building safety and sustainability, the adoption of advanced materials like redispersible polymer powders increases.

- Economic Fluctuations: The market is also sensitive to economic cycles. Economic downturns can reduce construction activity, impacting the demand for redispersible polymer powders. Conversely, economic upswings enhance market growth through increased construction and renovation projects.

- Competition from Alternatives: The presence of alternative binding agents and technologies may restrict market growth to some extent. The ability of these alternatives to offer similar benefits at competitive prices can sway consumer preference away from redispersible polymer powders.

Top Trends in the Global Redispersible Polymer Powder Market

- Sustainability and Eco-Friendliness: There is an increasing trend towards sustainable construction practices, which is driving demand for eco-friendly building materials. Redispersible polymer powders that are environmentally friendly and contribute to green building certifications are gaining traction in the market.

- Advancements in Construction Technology: With the construction industry evolving rapidly, there is a continuous demand for materials that can improve the efficiency, durability, and resilience of building projects. Redispersible polymer powders are being developed with advanced properties, such as enhanced water resistance, improved adhesion, and increased flexibility, which make them ideal for modern construction needs.

- Rising Popularity in Residential Projects: As the global housing market grows, especially in developing regions, the use of redispersible polymer powders in residential construction projects is increasing. These polymers are used to improve the properties of mortars and plasters, which are essential in residential buildings for wall construction, flooring, and tiling.

- Increased Focus on Energy Efficiency: Energy-efficient buildings are becoming a priority worldwide to reduce environmental impact and operational costs. Redispersible polymer powders play a crucial role in enhancing the thermal insulation properties of construction materials, thereby supporting the energy efficiency of buildings.

- Growth in Renovation and Repair Activities: There is a significant trend towards the renovation and repair of existing infrastructure, driven by aging buildings and infrastructure across developed countries. Redispersible polymer powders are extensively used in repair works due to their ability to improve the adhesion and durability of repair mortars.

- Globalization of Supply Chains: The globalization of supply chains is enabling manufacturers to access new markets and distribute redispersible polymer powders more efficiently. This trend is helping companies expand their reach and cater to a broader range of customers across different geographies.

Market Growth

The global redispersible polymer powder market is experiencing steady growth, driven by the expanding construction industry and the increasing demand for high-performance building materials. These powders are essential in enhancing the properties of construction products like mortars, plasters, and adhesives, improving their flexibility, adhesion, and water resistance. As urbanization continues and infrastructure projects rise, especially in developing regions, the need for such advanced materials grows.

Additionally, the trend towards sustainable and energy-efficient buildings boosts the market, as redispersible polymer powders contribute to the durability and longevity of structures. Technological advancements in manufacturing processes also play a role, leading to the development of more efficient and cost-effective products.

Regional Analysis

In 2023, Asia Pacific (APAC) dominated the redispersible polymer powder market, accounting for 35% of the global share and valued at around USD 1.02 billion. This dominance is attributed to rapid urbanization, infrastructure development, and growing construction activities, particularly in China and India. North America, particularly the United States, is also a key market, with over 1.41 million housing units completed in 2024.

Europe, particularly Germany, France, and the UK, is focusing on sustainable construction practices and has a strong demand for RDP in renovation projects. The Middle East & Africa region shows potential due to increasing commercial construction investments, while Latin America, led by Brazil and Mexico, is witnessing infrastructure development.

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | USD 3 Billion |

| Forecast Revenue 2033 | USD 5 Billion |

| CAGR (2023 to 2033) | 6.3% |

| North America Market Share | 35% |

| Base Year | 2023 |

| Historic Period | 2020 to 2022 |

| Forecast Year | 2023 to 2033 |

Market Drivers

The demand for green building practices is on the rise globally, driven by the need for sustainable and energy-efficient construction. The buildings and construction sector accounts for 37% of global energy and CO2 emissions, leading to a push for sustainable practices. Governments and international bodies are promoting green construction to meet climate goals, such as those set by the Paris Agreement.

The IEA’s Breakthrough Agenda Report 2023 emphasizes the need for net-zero buildings, with operational emissions needing to fall by 50% by 2030. Advanced materials, such as redispersible polymer powders, are being used to enhance energy efficiency and resilience. As global urbanization continues, the demand for sustainable building materials is expected to rise, particularly in emerging economies.

Market Restraints

The high production costs of redispersible polymer powders, due to their complex process, can deter buyers in cost-sensitive markets, especially in developing regions. Alternative construction chemicals like liquid polymers and pre-mixed solutions also pose a challenge, offering competitive advantages in cost or performance. Economic barriers in emerging markets further complicate the adoption of these advanced materials, as the additional cost may not justify the investment in cheaper, traditional materials.

Opportunities

The redispersible polymer powder market is experiencing growth due to the growing demand for sustainable construction materials. These powders enhance durability, energy efficiency, and sustainability in applications like tiling, flooring, insulation systems, and plastering. They also improve the performance of mortars and cements, reducing maintenance needs.

The market is poised for expansion, especially in Asia-Pacific regions due to rapid infrastructure development. Innovations in bio-based redispersible polymer powders align with global sustainability goals, opening new avenues for market expansion.

Report Segmentation of the Redispersible Polymer Powder Market

By Type

Acrylics dominate the market with over 29.7% share in 2023, offering superior adhesive properties and durability. Vinyl Acetate Ethylene (VAE) powders are cost-effective and versatile, used in tile adhesives, grouts, and sealants. VeoVa powders are preferred for high moisture resistance in bathrooms and kitchens. Styrene Butadiene powders are used in heavy-duty applications, providing robust resistance against abrasion and wear. Despite competition, these polymers remain popular due to their versatility and durability.

By Application

In 2023, Tiling & Flooring held a 36.7% share of the redispersible polymer powder market, driven by global urbanization and construction projects. Mortars and plastering also benefit from these powders, improving workability and mechanical strength. Insulation Systems use these powders to enhance bonding strength and flexibility, while self-leveling underlayment is crucial for level surfaces with high mechanical resistance, driven by industrial and commercial flooring needs.

By End-use

In 2023, Residential Construction held a 44.5% share of the redispersible polymer powder market, driven by global housing development and renovations. These powders enhance the durability and performance of construction materials, meeting high demand for quality living spaces. Commercial Construction uses them in robust projects, while Industrial Construction relies on them for heavy-duty flooring and protective coatings. Growth is expected in this segment.

By Sales Channel

In 2023, Direct Sales held a dominant market position, capturing 57.7% of the redispersible polymer powder market. This channel is preferred by manufacturers for its ability to establish relationships with major construction firms and industrial clients, offering tailored solutions and rapid response to specialized requirements. Distributor Sales enhance accessibility to geographically dispersed markets.

Recent Development of the Redispersible Polymer Powder Market

- Wacker made a significant investment of about USD 100 million in 2023 to increase its production capacity at its Nanjing site in China. This investment comprised a new reactor and spray dryer designed especially for vinyl-acetate-ethylene (VAE) dispersible polymer powders.

- Dow concentrated on adding cutting-edge redispersible latex powders, namely DLP 212 and DLP 2300, to its portfolio in 2023. These products, such as tile adhesives and self-leveling compounds, are made to enhance the overall performance, flexibility, and adherence of construction applications.

Competitive Landscape

The redispersible polymer powder (RDP) market is characterized by a mix of global leaders and regional players, each contributing to the industry’s growth through innovation and strategic initiatives. Key companies in this sector include Wacker Chemie AG, Dow Inc., and BASF SE, which are recognized for their extensive product portfolios and strong global presence. These firms focus on developing high-performance RDPs that enhance the properties of construction materials, catering to the increasing demand for durable and sustainable building solutions.

Celanese Corporation and Synthomer plc are also significant contributors, leveraging advanced technologies to produce RDPs that improve the flexibility and adhesion of cementitious products. Their commitment to research and development enables them to offer innovative solutions tailored to specific construction needs.

Regional players such as Acquos Pty Ltd in Australia and Divnova Specialties Pvt. Ltd. in India play crucial roles in their respective markets by providing customized RDP solutions that meet local construction requirements. Companies like Ashland Global Holdings Inc. and Organik Kimya focus on expanding their product lines to include eco-friendly RDPs, aligning with the global shift towards sustainable construction practices.

Asian manufacturers, including Japan Coating Resin Corporation, Dairen Chemical Corporation, and Shanxi Sanwei Group Co., Ltd., contribute significantly to the market by offering cost-effective RDPs, thereby enhancing the competitiveness of the industry. Additionally, firms like Vinavil S.p.A. and Archroma are investing in expanding their production capacities and strengthening their distribution networks to cater to the growing global demand.