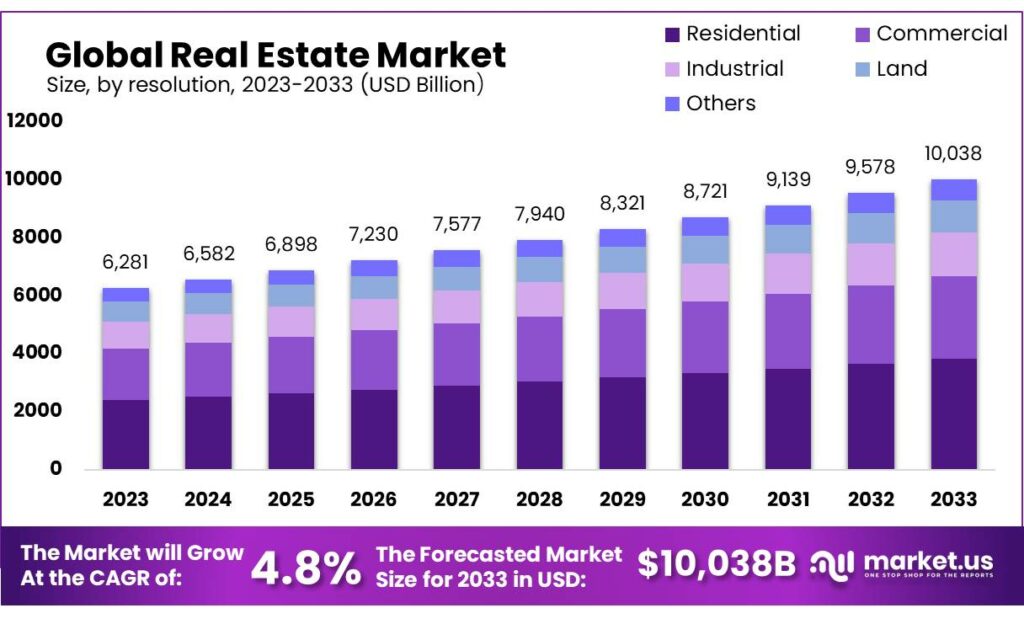

According to Market.us, The Global Real Estate Market size is expected to be worth around USD 10038 Billion by 2033, from USD 6281 Billion in 2023, growing at a CAGR of 4.8% during the forecast period from 2023 to 2033.

The Real Estate Market has experienced a complex trajectory characterized by fluctuating demand influenced by economic conditions, interest rates, and demographic shifts. In recent years, urbanization and the increasing preference for sustainable and smart housing solutions have propelled market growth. The residential sector dominates, driven by rising homeownership rates and government incentives aimed at first-time buyers.

Conversely, commercial real estate has faced challenges, notably in retail and office spaces, due to evolving work patterns and e-commerce growth. The demand for industrial properties, however, remains robust, driven by the surge in online shopping and the need for logistics spaces. Market forecasts suggest a cautiously optimistic outlook, with growth potential in suburban and rural areas, reflecting changing lifestyle preferences post-pandemic.

Key Takeaway

- The Global Real Estate Market is projected to reach USD 10038 billion by 2033, growing at 4.8% CAGR from USD 6281 billion in 2023.

- The Residential segment captured over 38.3% market share in 2024, indicating strong demand for housing properties.

- Property Preferences: Fully furnished properties held 41.6% market share in 2024, followed by semi-furnished and unfurnished options.

- Business Segment Significance: Rental properties accounted for over 54.5% market share in 2024, reflecting demand for flexible accommodation.

- Mode Analysis: Offline transactions dominated with 76.3% market share in 2024, although online transactions are expected to grow rapidly.

- Global urbanization and technological integration drive market growth, particularly in the Asia Pacific region, which captured 53% market share in 2024.

- Home prices are expected to rise by around 5.4% in 2023, according to Fannie Mae’s housing forecast.

- The median rent in the United States was $1,717 in February 2023, an increase of 6.7%.

Factors affecting the growth of the Real Estate Market

- Economic Conditions: The overall health of the economy is a major determinant of real estate demand, prices, and investment viability. Metrics such as GDP growth rates, employment data, and consumer spending give insights into economic stability which directly affects real estate market performance.

- Interest Rates: Changes in interest rates can significantly affect a person’s ability to buy a residential property. Lower interest rates make loans cheaper and can boost the real estate market, while higher rates might decrease demand as borrowing costs rise.

- Government Policies/Subsidies: Tax credits, deductions, and subsidies can help boost the demand for real estate by making it more affordable to consumers. Conversely, increases in property taxes or changes in land use or zoning laws can reduce demand.

- Demographic Trends: Shifts in demographics can have profound impacts on real estate trends. For example, aging populations may increase the demand for retirement homes, whereas a boom in younger populations might boost the demand for rentals.

- Foreign Investment: Inflows of foreign investment into a country can increase demand for real estate, driving up property values and promoting development.

- Supply and Demand: The basic economic principle of supply and demand plays a major role in real estate prices. Limited supply in the face of increasing demand tends to drive up prices, whereas if the construction of new properties boosts supply, it might help keep prices in check.

- Infrastructure Development: New infrastructure such as roads, schools, and hospitals makes a region more attractive and can boost real estate demand in those areas.

Top Trends in the Global Real Estate Market

- Sustainable and Green Buildings: The demand for sustainable development is escalating as environmental concerns become more prominent. This trend is characterized by an increased investment in green buildings that are energy-efficient and have a minimal carbon footprint.

- Technological Integration: The integration of technology in real estate, known as PropTech, is transforming the market landscape. This includes the adoption of big data, artificial intelligence, virtual reality, and blockchain technology, which are enhancing the way properties are bought, sold, managed, and marketed.

- Urbanization and Smart Cities: Urbanization continues to be a driving force in real estate, with a significant migration of the population to cities. In response, there is a growing focus on developing smart cities that leverage IoT and other technologies to manage urban services and infrastructure efficiently, thereby making cities more livable and sustainable.

- Shifts in Office Space Demand: The pandemic has irreversibly changed the dynamics of office spaces. There is a growing trend towards flexible workspaces, co-working spaces, and hybrid work models, impacting the demand for traditional office spaces.

- Rise of E-commerce and the Impact on Retail and Industrial Real Estate: E-commerce growth is reshaping retail real estate, significantly reducing demand for traditional retail spaces while simultaneously boosting demand for warehouse and distribution centers. This trend highlights the need for strategic locations and technologically equipped facilities to handle logistics and distribution effectively.

- Housing Market Affordability Issues: Housing affordability continues to be a critical issue in many parts of the world, influenced by limited housing supplies and rising prices. This has led to increased governmental intervention in some markets and a surge in demand for affordable housing solutions.

Market Growth

The real estate market has shown robust growth over recent years, driven by various factors including low interest rates, increased demand for housing, and a shift toward remote work. Residential real estate has experienced a surge, with home prices rising significantly in many regions due to limited inventory and heightened buyer interest. Commercial real estate is also evolving, with a focus on flexible office spaces and logistics facilities catering to e-commerce growth. Urbanization trends and population growth contribute to ongoing demand, particularly in metropolitan areas.

Additionally, government initiatives and incentives for homebuyers bolster market activity. As economies recover and interest rates fluctuate, the real estate market is expected to continue its growth trajectory, albeit with potential adjustments in pricing and demand dynamics based on regional factors and economic conditions. Overall, the outlook remains positive, with opportunities for both investors and homeowners.

Regional Analysis

The Asia Pacific region claimed a dominant 53% share of the global real estate market, driven by rapid urbanization, population growth, and extensive infrastructure projects. China and India played pivotal roles, with their booming economies and large-scale urbanization fueling demand for residential, commercial, and industrial properties. This surge in real estate activity attracted significant investment and development across the region.

Beyond traditional real estate, the Asia Pacific market expanded its influence through diverse applications in retail, hospitality, healthcare, and education sectors. Robust construction capabilities in China and India further supported the development of new properties and infrastructure to meet escalating demand. The region’s dynamic growth positions it as a critical player in the global real estate landscape.

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | USD 6281 Billion |

| Forecast Revenue (2033) | USD 10038 Billion |

| CAGR (2024 to 2033) | 4.8% |

| Asia Pacific Market Share | 53% |

| Base Year | 2023 |

| Historic Period | 2020 to 2022 |

| Forecast Year | 2024 to 2033 |

Market Drivers

The Real Estate Market is driven by several key factors. Economic growth plays a crucial role, as rising GDP and employment rates increase consumer purchasing power, boosting demand for residential and commercial properties. Urbanization and population growth further fuel demand, especially in metropolitan areas where housing shortages are common. Low interest rates make mortgage financing more accessible, encouraging investments. Government policies, such as tax incentives or housing subsidies, stimulate market activity.

Additionally, foreign investment has become a notable driver in many regions, with investors seeking stable returns in prime real estate markets. Technological advancements, like property tech (PropTech) innovations, streamline processes and attract more buyers, especially millennials. Environmental considerations are also influencing the market, as sustainable and energy-efficient buildings gain popularity due to rising awareness and regulatory support.

Market Restraints

The Real Estate Market faces several restraints that could hinder its growth. High interest rates increase borrowing costs, deterring both homebuyers and investors. Stringent government regulations, including zoning laws and property taxes, further limit market flexibility. Economic instability, such as inflation or a recession, can reduce consumer spending power and confidence in real estate investments.

Additionally, affordability issues, driven by rising property prices, restrict access for first-time buyers. Environmental concerns and sustainable development requirements add to construction costs, delaying project completion. Limited availability of prime land, particularly in urban areas, constrains new developments. Furthermore, global supply chain disruptions can escalate material and labor costs, affecting project timelines and profitability. These factors collectively pose significant challenges to the growth and stability of the real estate sector.

Opportunities

The real estate market presents diverse opportunities driven by evolving trends. Urbanization and population growth continue to fuel demand for residential properties, particularly in metropolitan areas. The rise of remote work is boosting suburban and rural property markets. Additionally, the commercial real estate sector benefits from growing interest in logistics hubs and data centers, spurred by e-commerce and technological advancements.

Sustainability is emerging as a key focus, with demand increasing for energy-efficient and green buildings. Investment opportunities in REITs and fractional ownership platforms provide accessible options for small investors. Moreover, government initiatives, such as tax incentives and housing schemes, create favorable conditions for market entry. With real estate often considered a hedge against inflation, the sector remains a resilient and potentially lucrative investment avenue.

Report Segmentation of the Real Estate Market

By Property Analysis

The residential real estate sector led the market, securing a 38.3% revenue share, primarily from housing units like single-family homes, apartments, and condos, which serve the living needs of individuals and families. The commercial sector also held a substantial portion of the market, encompassing office spaces, retail locations, and hotels, attracting businesses and investors focused on commercial ventures and rental income.

Additionally, the industrial segment, including warehouses and manufacturing facilities, saw increased demand driven by the logistics and e-commerce sectors, particularly in major logistics hubs. The land market, comprising undeveloped and agricultural land, attracted developers and investors for various projects. Other real estate types, such as healthcare and educational facilities, though smaller in share, catered to specific sectoral requirements, enhancing the market’s diversity.

By Property Type Analysis

The real estate market saw the Fully Furnished segment command a dominant position, securing over 41.6% of the market share. This segment primarily attracts tenants or buyers seeking immediate occupancy with properties that are ready to live in, complete with furniture, appliances, and other amenities.

The Semi-Furnished properties also maintained a substantial market presence, representing a compromise between fully furnished and unfurnished options. These properties usually come with essential fixtures and some appliances, providing tenants the opportunity to personalize their living spaces.

Meanwhile, Unfurnished properties, despite capturing a smaller market share, continued to play a crucial role. These properties appeal to those who prefer a blank slate, allowing for full customization of their space, which can lead to cost savings over time and a more personalized living environment.

By Business Analysis

The rental sector maintained a prominent stance within the real estate market, securing over 54.5% of the market share. This sector focuses on the temporary occupation of properties via periodic payments, appealing to both individuals and enterprises in search of flexibility and brief lodging solutions.

Conversely, the sales segment plays a crucial role, encompassing the transfer of property ownership through single transactions, which include residential and commercial properties and lands. Furthermore, the leasing segment equivalent to long-term rentals remains integral, offering extended occupancy under fixed contractual terms, favored by both businesses and individuals desiring stable and predictable living or working conditions.

By Mode Analysis

The offline mode dominated the real estate market, securing over 76.3% of the market share. This segment, favoring traditional transactions through physical offices and agents, caters to those preferring direct interactions and personalized services. Conversely, the online segment, though smaller, is expanding rapidly due to its convenience and the technological ease it offers, making it the fastest-growing mode in the forecast period.

The shift towards online real estate platforms was notably accelerated by the COVID-19 pandemic, pushing more consumers towards digital solutions to minimize physical contact. Online platforms also enhance transparency and access to information, empowering users to make well-informed decisions and benefit from lower transaction costs compared to traditional methods.

Recent Development of the Real Estate Market

- 2023 Brookfield Asset Management Inc.: As a major institutional investor, they likely focused on acquiring high-quality assets in sectors poised for growth, such as industrial and logistics.

- 2023 ATC IP LLC (American Tower Corporation): The cell tower business is somewhat insulated from general market fluctuations. They likely continued steady growth driven by increasing demand for mobile data.

- 2023 Prologis Inc.: This industrial real estate giant likely benefitted from the continued strong demand for warehouse space due to e-commerce growth.

Competitive Landscape

In 2024, the global real estate market will be influenced significantly by several key players, each contributing to the dynamics of the industry through strategic expansions, technological integration, and market adaptation strategies. Brookfield Asset Management Inc. and The Blackstone Group Inc. are notable for their diversified portfolios and aggressive capital deployment strategies in both commercial and residential assets, reinforcing their market presence globally.

CBRE Group, Inc., and Jones Lang LaSalle (JLL) continue to lead in commercial real estate services, facilitating major transactions and providing comprehensive management solutions that enhance property values. Their focus on sustainability and technological adoption has set new standards in the management of real estate assets.

In the specialized sectors, Digital Realty Trust, Inc. and Prologis, Inc. are prominent for their investments in data centers and logistics real estate, respectively, driven by the surge in e-commerce and data consumption.

Residential market growth is robust, with Equity Residential demonstrating strong performance through strategic acquisitions and a focus on high-demand urban areas. Similarly, companies like Host Hotels & Resorts, Inc., and Vornado Realty Trust are adapting to the changing dynamics of hospitality and retail sectors by enhancing their property offerings to meet evolving consumer preferences.