According to Market.us, The Global Polysilicon market size is expected to be worth around USD 78.0 billion by 2033, from USD 40.8 billion in 2023, growing at a CAGR of 6.7% during the forecast period from 2023 to 2033. In 2023, Asia Pacific held a 63.2% market share, leading the polysilicon industry. Moreover, the electronics industry’s strong need for semiconductor manufacturing is expected to fuel the growth of the U.S. polysilicon market, which is expected to reach an estimated volume of $25 billion by 2033.

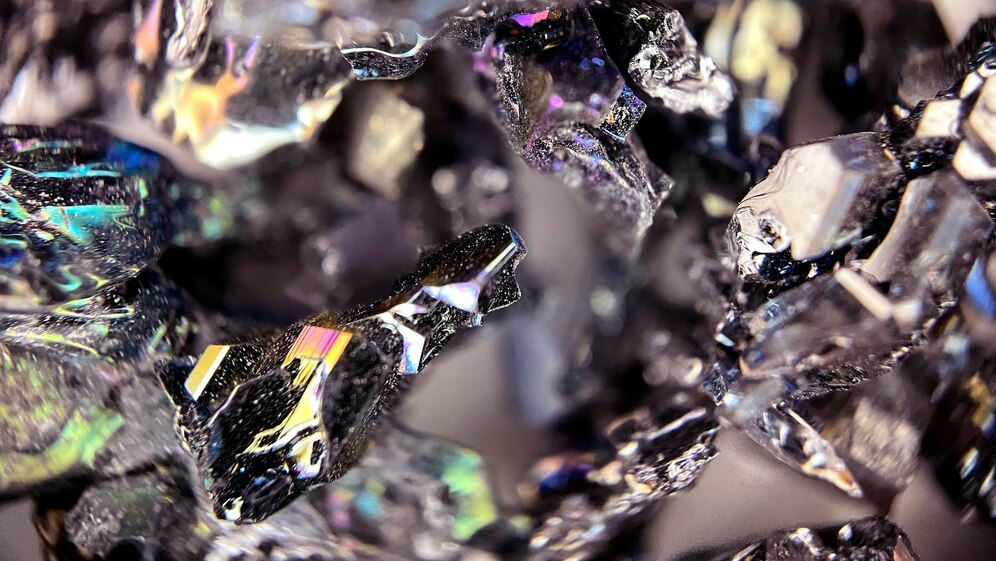

The demand for polysilicon in the United States is escalating due to its crucial role in manufacturing semiconductors and solar photovoltaic (PV) systems, spurred by advancements in technologies like 5G, IoT, and AI, as well as governmental incentives for renewable energy. While exceptionally pure for electronics impurities less than one part per billion the polysilicon used in solar applications, though slightly less pure, still fulfills the stringent requirements for solar technology effectiveness, underscoring its importance in both renewable energy and electronic device production.

Key Takeaway

- The Global Polysilicon market size is expected to be worth around USD 78.0 billion by 2033, from USD 40.8 billion in 2023, growing at a CAGR of 6.7%.

- The Series Connection segment held a dominant market position, capturing more than a 65% share.

- Siemens Process held a dominant market position in the polysilicon market, capturing more than a 41.2% share.

- Chips held a dominant market position in the polysilicon market, capturing more than a 34.2% share.

- Photovoltaic held a dominant market position in the polysilicon market, capturing more than a 78% share.

- Asia Pacific held the largest share of 63.2% in 2023 total market share due to its rapid growth in the solar energy sector

Factors affecting the growth of the Polysilicon Market

- Demand for Solar Photovoltaics: The escalating global shift towards renewable energy sources significantly fuels the demand for solar panels, which in turn boosts the polysilicon market. Government policies promoting solar energy, along with decreasing costs of PV technology, are pivotal in driving this demand.

- Pricing Volatility: The market is susceptible to price fluctuations due to changes in supply and demand dynamics. Overcapacity or shortages in the supply chain can lead to significant price adjustments, impacting profitability for manufacturers and affordability for consumers.

- Regulatory Frameworks: National and international regulations concerning environmental protection and trade policies can affect the polysilicon market. For instance, tariffs imposed on imported polysilicon can alter competitive landscapes, while environmental regulations can influence manufacturing practices and costs.

- Energy Costs: The production of polysilicon is energy-intensive, making the cost and availability of electricity a critical factor in determining production costs. Regions with lower energy costs may see more robust growth in polysilicon manufacturing capabilities.

- Global Economic Conditions: Economic downturns or upturns can influence investment in solar projects and electronics manufacturing, subsequently affecting the demand for polysilicon. Economic stability and growth in emerging markets, particularly in Asia, are crucial for sustained market expansion.

- Expansion of Semiconductor Industry: As technologies such as smartphones, computers, and electric vehicles continue to evolve and penetrate new markets, the demand for semiconductors and by extension, high-purity polysilicon rises.

Top Trends in the Global Polysilicon Market

- Expansion in Solar PV Demand: The demand for polysilicon is primarily driven by the solar PV industry. The global push towards renewable energy sources to mitigate climate change effects has significantly increased investments in solar energy.

- Technological Advancements in Production: Technological improvements in the manufacturing process of polysilicon are aimed at reducing production costs and enhancing the quality of the output. Manufacturers are increasingly adopting the fluidized bed reactor (FBR) technology, which is more energy-efficient than the traditional Siemens process and also produces higher-purity polysilicon.

- Supply Chain Localization and Diversification: In response to trade tensions and supply chain disruptions, such as those experienced during the COVID-19 pandemic, companies are looking to localize and diversify their supply chains.

- Price Volatility: The polysilicon market has experienced significant price fluctuations. Factors such as governmental policies, production capacities, and global economic conditions heavily influence prices. Market players continue to monitor these dynamics closely, as price volatility directly affects profitability and investment strategies.

- Environmental Regulations and Sustainability Practices: Increasing environmental regulations globally are pushing polysilicon manufacturers towards more sustainable production practices. Companies are investing in recycling technologies and reducing waste and energy consumption during production to comply with stringent environmental standards.

- Market Consolidation: The polysilicon industry is witnessing a trend of consolidation, where larger companies are acquiring smaller entities to enhance their market share and reduce competition. This consolidation is expected to lead to more efficient production practices and a stabilization of prices in the long term.

Market Growth

The polysilicon market has been experiencing significant growth, driven by the expanding solar photovoltaic (PV) industry and the increasing demand for electronic devices requiring high-grade polysilicon. As countries accelerate their renewable energy installations to meet climate targets, the demand for polysilicon, a key material in solar panel production, continues to rise. This has been further propelled by technological advancements that improve the efficiency and reduce the cost of polysilicon production.

Additionally, government policies supporting solar energy adoption and reducing carbon footprints have bolstered market growth. However, the market faces challenges such as supply chain disruptions and price volatility. Overall, the polysilicon market is poised for robust growth in the coming years.

Regional Analysis

The Asia Pacific region leads the polysilicon market with a 63.2% share, valued at approximately USD 25 billion, primarily driven by China’s significant production capabilities and strong governmental support for renewables. North America is experiencing growth due to incentives promoting solar installations and advancements in polysilicon technologies. Europe progresses through strict environmental mandates and renewable energy targets. The Middle East & Africa are developing their market via investments in solar energy, while Latin America shows potential with increasing solar projects and government incentives for clean energy.

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | USD 40.8 Billion |

| Forecast Revenue (2033) | USD 78 Billion |

| CAGR (2024 to 2033) | 6.7% |

| Asia Pacific Market Share | 63.2% |

| Base Year | 2023 |

| Historic Period | 2020 to 2022 |

| Forecast Year | 2024 to 2033 |

Market Drivers

The expansion of the polysilicon market is closely tied to the growth of the solar photovoltaic (PV) industry, which accounted for approximately 76% of the market’s revenue in 2023. This is primarily driven by the escalating global installations of solar PV systems that depend on high-purity polysilicon. The push towards renewable energy, supported by government incentives and regulations, further fuels this demand.

Technological advancements in polysilicon production have enhanced the efficiency and cost-effectiveness of solar cells, bolstering their competitiveness against conventional energy sources. Additionally, manufacturers are increasing production capacities to meet the rising demand and support the continued growth in solar energy adoption, propelled by both policy and market dynamics.

Market Restraints

The polysilicon market faces notable challenges from supply chain volatility and rising production costs. Instability arises from periodic oversupply, trade disputes, and tariffs, particularly with China controlling over 90% of production. This situation has spurred price fluctuations and supply inefficiencies. Additionally, the energy-intensive nature of producing high-purity polysilicon has increased costs by 40%, impacting the affordability of solar and semiconductor technologies. Environmental regulations and ethical sourcing demands further complicate production, adding to operational expenses and potentially prolonging project timelines.

Opportunities

The polysilicon market is poised for expansion, driven by escalating demand in the photovoltaic (PV) and electronics sectors. Enhanced production capacities, technological advancements, and cost reductions in solar energy are amplifying growth prospects. Geographically, Asia-Pacific dominates, with China leading in both consumption and production, although new manufacturing facilities in Europe and the Middle East signal a shift towards diversification. The increasing adoption of renewable energy sources globally further supports market robustness, offering substantial opportunities for industry stakeholders to capitalize on the surging need for high-purity polysilicon.

Report Segmentation of the Polysilicon Market

By Type Analysis

The Series Connection segment dominated the polysilicon market, commanding over 65% of the market share. This method is prized for its ability to deliver consistent voltage outputs, crucial in solar panels and electronic applications that require high voltage levels. Although less prevalent, Parallel Connections are essential for high-current applications, improving current flow and reducing system overload risks. These connections support energy distribution in large solar installations, ensuring stability and optimal performance.

By Manufacturing Technology Analysis

The Siemens Process was preeminent in the polysilicon market, securing over 41.2% market share, favored for its ability to produce high-purity polysilicon via chemical vapor deposition ideal for semiconductor and photovoltaic applications. Meanwhile, the Fluidized Bed Reactor (FBR) Process, noted for its energy efficiency and reduced costs, is emerging as a cost-effective alternative, especially in environmentally conscious solar panel production. Additionally, the Upgraded Metallurgical Grade Silicon Process offers a less expensive option by purifying silicon through metallurgical routes, appealing in cost-sensitive markets.

By Form Analysis

Chips dominated the polysilicon market with a 34.2% share, prized for their application in semiconductor manufacturing due to their uniformity and purity. Their compact size and high quality enhance processing and integration into electronic components. Chunks also hold a significant market segment, valued for their adaptability in the semiconductor and solar sectors, where their ease of melting and refining is beneficial. Polysilicon rods, primarily utilized in the solar industry, are produced via the Siemens process to create wafers for solar cells. Their structured form allows for precise slicing, crucial for high-efficiency solar panels.

By Application Analysis

The Photovoltaic segment dominated the polysilicon market, commanding over a 78% share, significantly driven by the global shift towards renewable energy. Polysilicon is vital for solar panels due to its high purity levels that enhance energy conversion efficiency, making it indispensable for photovoltaic applications prioritizing performance.

Concurrently, the Electronics segment maintains a crucial presence in the polysilicon market, as it is integral to producing various electronic components, including microchips and semiconductors. This sector’s demand is fueled by ongoing advancements and the miniaturization of electronic devices that necessitate high-quality silicon for optimal performance and reliability.

Recent Development of the Polysilicon Market

- August 2022: REC Silicon ASA and Mississippi Silicon collaborated to develop a solar supply chain in the United States. They plan to develop this solar supply chain from raw silicon to polysilicon and finally to fully assembled modules.

- April 2022: OCI Company Ltd signed a binding memorandum of understanding (MoU) with the South Korean-based solar manufacturer Hanwha Solutions, which is a unit of Hanwha, for the supply of polysilicon. The order was valued at about USD 1.2 billion. This has helped the company in increasing its profit margins.

Competitive Landscape

In the global polysilicon market, key players are expected to navigate the landscape through strategic expansions and technological advancements. High-Purity Silicon America Corporation, along with its counterparts like OCI COMPANY Ltd. and Wacker Chemie AG, continue to emphasize innovations in production efficiency and environmental sustainability. Companies such as Tongwei Group Co., Ltd, and Tokuyama Corporation are likely to expand their market presence through capacity enhancements and penetration into emerging markets.

REC Silicon ASA and Qatar Solar Technologies are set to capitalize on increasing demands for solar energy, focusing on supply chain robustness and cost competitiveness. Meanwhile, Xinte Energy Co., Ltd. and DAQO NEW ENERGY CO., LTD. are anticipated to leverage advanced manufacturing techniques to improve product quality and reduce production costs.

GCL-TECH and Hemlock Semiconductor Operations LLC are poised to strengthen their positions through strategic partnerships and investments in research and development. These initiatives are expected to enable them to meet the evolving technological and regulatory landscapes effectively. Collectively, these companies’ strategies and operational enhancements are pivotal in driving the growth and sustainability of the polysilicon market in 2024.