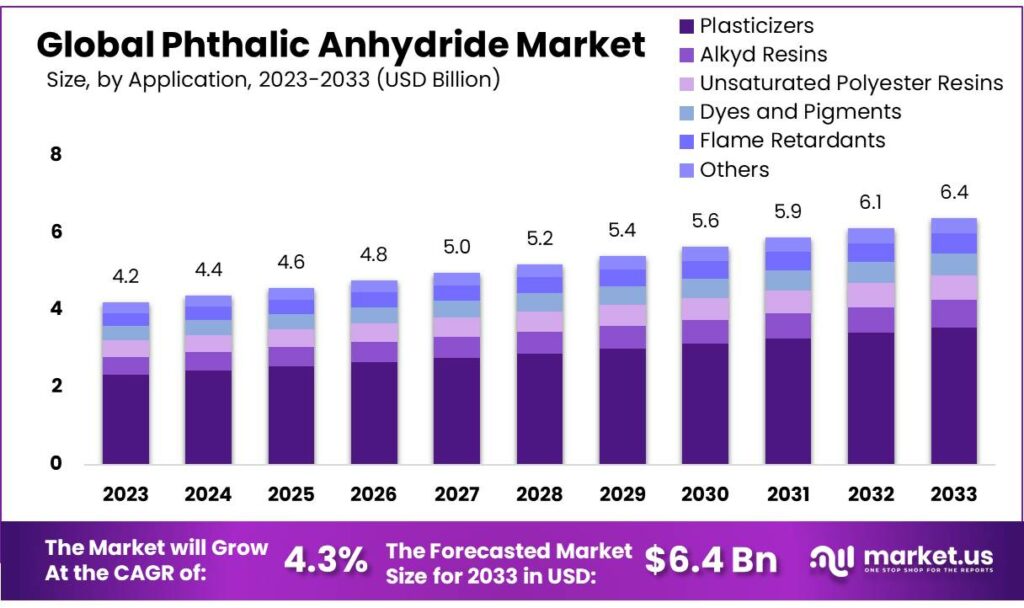

According to Market.us, The Global Phthalic Anhydride Market size is expected to be worth around USD 6.4 billion by 2033, from USD 4.2 billion in 2023, growing at a CAGR of 4.3% during the forecast period from 2023 to 2033.

The Global Phthalic Anhydride Market is experiencing substantial growth, primarily driven by its extensive applications in the production of plasticizers, unsaturated polyester resins, and alkyd resins. As of recent assessments, the market is significantly propelled by the demand from the plastics industry, where Phthalic Anhydride is used to manufacture flexible PVC. This surge is closely tied to the increasing consumption of PVC in the construction, automotive, and packaging industries worldwide.

Asia-Pacific holds a dominant position in the market due to robust manufacturing sectors in countries such as China and India. The region’s market leadership is supported by both high domestic demand and expansive production capacities. Market expansion is further anticipated as innovations in plastic formulations and a rising inclination towards recyclable and sustainable materials continue to evolve.

Key Takeaway

- The Global Phthalic Anhydride Market Size Expected value is USD 6.4 billion by 2033, growing from USD 4.2 billion in 2023, with a CAGR of 4.3%.

- Plasticizers held a dominant market position in the Phthalic Anhydride industry, capturing more than a 55.6% share.

- Building & Construction sector held a dominant market position in the Phthalic Anhydride market, capturing more than a 44.7% share.

- Asia Pacific: Leading with 58.6% market share, valued at USD 2.46 billion.

Factors affecting the growth of the Phthalic Anhydride Market

- Industrial Demand: The primary driver is the high demand for phthalic anhydride in manufacturing plasticizers, which are extensively used in producing flexible polyvinyl chloride (PVC). The construction, automotive, and packaging sectors are significant consumers of these materials, driving market growth.

- Advancements in Resin Technologies: Innovations in unsaturated polyester resins and alkyd resins, particularly for coatings and fiberglass-reinforced plastics, also stimulate demand.

- Geographic Expansion: Emerging markets in Asia-Pacific, particularly China and India, are central to market growth due to their expanding manufacturing bases and domestic market consumption.

- Regulatory Impact: Environmental regulations significantly impact the market. Restrictions on phthalate plasticizers in consumer products and PVC applications in Europe and North America have pushed for the development of non-phthalate alternatives, which can either constrain or redirect market trajectories.

- Economic Fluctuations: Economic downturns can reduce demand in key end-use sectors like construction and automotive, affecting the phthalic anhydride market. Conversely, economic upturns bolster market growth through increased industrial activity and consumer spending.

- Supply Chain Volatility: Fluctuations in the availability and price of ortho-xylene, the primary raw material for phthalic anhydride, can affect production costs and market stability.

Top Trends in the Global Phthalic Anhydride Market

- Shift Towards Non-Phthalate Plasticizers: In response to stringent environmental regulations and increased health awareness, there is a notable shift from traditional phthalate plasticizers to non-phthalate alternatives.

- Increased Use in Recyclable and Renewable Materials: There is a growing trend toward integrating phthalic anhydride in the production of recyclable and renewable polymers. Manufacturers are focusing on sustainable practices that align with global efforts to reduce plastic waste and promote circular economy principles.

- Technological Advancements in Production Processes: Technological innovations aimed at improving the efficiency and sustainability of phthalic anhydride production processes are gaining traction.

- Expansion in Emerging Markets: The market is experiencing geographical expansion, particularly in Asia-Pacific and other emerging regions, driven by economic growth, urbanization, and industrialization.

- Growth in End-Use Industries: The market is benefitting from growth in key end-use industries such as automotive, construction, and consumer goods, where phthalic anhydride-based products are widely used.

Market Growth

The Global Phthalic Anhydride Market is poised for sustained growth, driven by its critical applications across various industries. Forecasted to expand at a compound annual growth rate (CAGR) of approximately 3% to 4% in the upcoming years, this growth trajectory is underpinned by robust demand for phthalic anhydride-derived plasticizers in the automotive and construction industries.

Additionally, the market benefits from increasing usage in polyester resins and coatings, particularly in emerging economies where rapid industrialization and urban development are ongoing. However, market expansion faces potential constraints from stringent environmental regulations promoting a shift towards non-phthalate alternatives. Despite these challenges, Asia-Pacific remains the epicenter of growth, with China and India leading in both production and consumption, ensuring a dynamic market environment.

Regional Analysis

The Asia Pacific (APAC) region leads the global phthalic anhydride market with a 58.6% share, valued at USD 2.46 billion, primarily driven by robust sectors such as construction, automotive, and plasticizers in China and India. Rapid industrialization and substantial investments in infrastructure fortify this dominance, with China’s significant production and consumption underlined by governmental industrial and urban development policies.

North America remains a key player, led by the U.S., with strong demand across automotive, construction, and coatings industries due to technological advancements and substantial consumption of plasticizers and resins. Europe, with its mature industrial landscape and stringent environmental standards, sees significant contributions from Germany, Italy, and the Netherlands, driven by the automotive and construction sectors and a push towards sustainable alternatives.

The Middle East & Africa region benefits from infrastructural and industrial growth, despite potential economic and political hurdles. Meanwhile, Latin America, particularly Brazil and Mexico, witnesses steady market growth supported by governmental infrastructure and industrial initiatives.

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | USD 4.2 Billion |

| Forecast Revenue (2033) | USD 6.4 Billion |

| CAGR (2024 to 2033) | 4.3% |

| Asia Pacific Market Share | 58.6% |

| Base Year | 2023 |

| Historic Period | 2020 to 2022 |

| Forecast Year | 2024 to 2033 |

Market Drivers

The growth of the Global Phthalic Anhydride Market is primarily driven by its extensive use in the production of plasticizers, which are critical in manufacturing flexible PVC used in various applications across the construction and automotive industries. Additionally, the demand for phthalic anhydride in the production of unsaturated polyester resins, widely utilized in fiberglass-reinforced plastics, contributes significantly to market expansion. The burgeoning construction sector, particularly in emerging economies, further amplifies this demand.

Technological advancements in resin formulations and a growing emphasis on sustainable and recyclable materials also propel market growth. Moreover, the Asia-Pacific region, with its rapid industrialization and expanding manufacturing capacities, remains a pivotal driver, solidifying the market’s expansion trajectory in both production and consumption aspects.

Market Restraints

The growth of the Global Phthalic Anhydride Market faces several restraints that could impede its expansion. Primarily, stringent environmental regulations and increasing health concerns over the use of phthalates in consumer products are prompting shifts towards safer, non-phthalate alternatives, impacting the demand for traditional phthalic anhydride-based plasticizers.

Additionally, the volatility of raw material prices, particularly ortho-xylene, poses financial challenges for producers, affecting production costs and market stability. Moreover, the potential for economic downturns can negatively influence key end-use sectors like construction and automotive, thereby reducing demand for phthalic anhydride. These factors collectively create hurdles for market growth, necessitating strategic adjustments by manufacturers to navigate the evolving regulatory and economic landscapes effectively.

Opportunities

The Global Phthalic Anhydride Market presents several opportunities that could further enhance its growth trajectory. One significant opportunity lies in the development and adoption of non-phthalate plasticizers, responding to increasing regulatory pressures and consumer demands for more environmentally friendly products. This shift opens new avenues for innovation in product formulations.

Additionally, the expanding applications of phthalic anhydride in high-performance polyester resins offer opportunities in sectors like automotive and marine, where durable and lightweight materials are increasingly valued. Furthermore, the rising construction activities in emerging markets, particularly in Asia-Pacific, provide a robust demand base that can be tapped into with strategic investments and expansion plans. These opportunities, if leveraged effectively, could significantly influence the market dynamics and growth potential of phthalic anhydride.

Report Segmentation of the Phthalic Anhydride Market

By Production Process Analysis

The O-Xylene Catalytic Oxidation process was the leading method in the Phthalic Anhydride industry due to its efficiency and cost-effectiveness, making it the preferred choice among major manufacturers. The method utilizes the catalytic oxidation of o-xylene under controlled conditions, ensuring high yields of phthalic anhydride. Its popularity is bolstered by the ready availability of raw materials and well-established technological frameworks.

On the other hand, the Naphthalene Catalytic Oxidation method, while holding a smaller market share, plays a crucial role due to its ability to produce higher-purity phthalic anhydride, essential for certain high-quality applications. This method is particularly favored in regions where naphthalene is more accessible or economically viable, utilizing oxidation in the presence of a catalyst.

By Application Analysis

Plasticizers commanded a significant portion of the Phthalic Anhydride market, holding over 55.6% of the market share. This dominance is attributed to the crucial role of phthalic anhydride in manufacturing flexible PVC, widely utilized in automotive and construction industries for its flexibility, durability, and handling ease.

Alkyd Resins, which employ phthalic anhydride in creating durable surface coatings, are essential for their environmental resistance and are used in both interior and exterior applications. Unsaturated Polyester Resins, also dependent on phthalic anhydride, are integral in producing robust products like fiberglass and automotive components, valued for their mechanical strength and environmental resilience. The Dyes and Pigments sector, although smaller, relies on phthalic anhydride for producing vibrant and durable colors in textiles and inks. Additionally, Flame Retardants utilize phthalic anhydride to enhance the safety of materials by reducing their flammability.

By End-Use Analysis

The Building & Construction sector emerged as a dominant force in the Phthalic Anhydride market, commanding over 44.7% market share. This prominence is linked to the extensive incorporation of phthalic anhydride-derived plasticizers in PVC-based applications crucial for modern construction, such as piping and wall coverings, fueled by global urbanization and a surge in demand for robust, economical building materials.

The Automotive sector also captured a significant share, utilizing phthalic anhydride in plasticizers to bolster the flexibility and durability of automotive plastics, crucial for vehicle interiors and components. This sector’s expansion is propelled by increased vehicle production and a shift towards advanced, lightweight materials.

In the Electronics sector, phthalic anhydride’s role in producing insulated and flexible plastic components supports the functionality and safety of a wide range of electronic devices, from consumer electronics to sophisticated electrical systems.

The Textile industry benefits from phthalic anhydride in enhancing the color, texture, and longevity of synthetic fibers and coatings, while the Paints and Coatings sector relies on it for producing alkyd resins, essential for both aesthetic and protective qualities in industrial and decorative paints.

Recent Development of the Phthalic Anhydride Market

- In March 2023 Polynt S.P.A., improvements in production technology boosted output by an additional 5%. During the second quarter, Polynt maintained high production levels, with June marking a 6% increase due to heightened demand in the automotive and construction sectors.

- In 2023, Stepan Company reported consistent monthly production increases due to strong demand. In January, production increased by 3% compared to the previous year.

Competitive Landscape

In the global Phthalic Anhydride Market, the landscape is marked by the significant presence and strategic actions of key players such as Polynt S.P.A., Stepan Company, and Thirumalai Chemicals Ltd., among others. These companies have focused on expanding their production capacities and enhancing their technological capabilities to meet the rising demand in sectors such as plastics, automotive, and construction.

BASF SE and Exxon Mobil Corporation, with their extensive research and development resources, are spearheading innovations in phthalic anhydride applications, potentially reducing environmental impact and improving material efficiency. Similarly, Nan Ya Plastics Corporation and Aekyung Petrochemical Co. Ltd. are capitalizing on their regional market insights to optimize supply chains and penetrate emerging markets more effectively.

Furthermore, companies like I G Petrochemicals Limited and Koppers Inc. are likely to adapt to regulatory pressures by investing in sustainable practices, which could serve as a differentiation strategy in a competitive market. Meanwhile, Asian Paints Ltd. and UPC Technology Corporation are leveraging their expertise in end-user industries to offer tailored solutions that meet specific customer needs.