Introduction

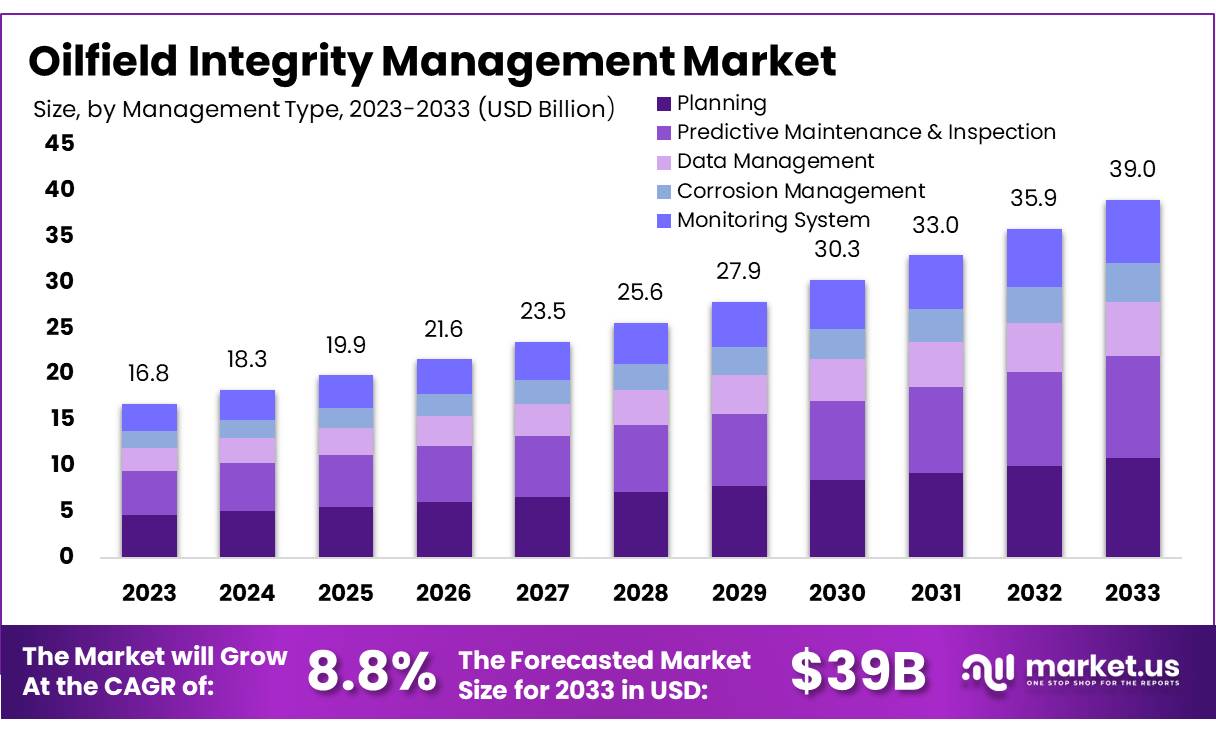

According to Market.us, The global Oilfield Integrity Management Market is poised for substantial growth, with projections indicating an increase from USD 16.8 Billion in 2023 to approximately USD 39.0 Billion by 2033, reflecting a compound annual growth rate (CAGR) of 8.8% during the forecast period from 2024 to 2033.

This expansion is primarily driven by the escalating demand for energy, necessitating the efficient and safe operation of oilfields. The adoption of advanced technologies such as predictive maintenance, real-time monitoring systems, and data analytics has significantly enhanced asset performance and operational efficiency. Additionally, stringent environmental regulations and a heightened focus on safety standards have compelled oil and gas companies to invest in comprehensive integrity management solutions.

The market’s popularity is further bolstered by the increasing complexity of oilfield operations and the imperative to extend the lifespan of aging infrastructure. Opportunities abound in emerging markets, where untapped oil reserves present avenues for exploration and production, thereby amplifying the need for robust integrity management practices. The market’s expansion is also supported by strategic partnerships and technological innovations aimed at optimizing oilfield operations and ensuring environmental compliance.

Key Takeaway

- Oilfield Integrity Management Market size is expected to be worth around USD 39.0 Bn by 2033, from USD 16.8 Bn in 2023, growing at a CAGR of 8.8%.

- Predictive Maintenance & Inspection held a dominant market position, capturing more than a 28.7% share.

- Hardware held a dominant market position in the Oilfield Integrity Management Market, capturing more than a 36.4% share.

- Onshore held a dominant market position in the Oilfield Integrity Management Market, capturing more than a 58.5% share.

- Reliability and Maintenance (R&M) held a dominant market position in the Oilfield Integrity Management Market, capturing more than a 26.1% share.

- Asia Pacific (APAC) is the dominant region in the market, accounting for 34% of the global share and generating USD 5.7 billion in revenue.

Factors affecting the Growth of the Oilfield Integrity Management Market

- Technological Advancements: The integration of digital technologies, such as predictive maintenance, real-time monitoring systems, and data analytics, has significantly enhanced asset performance and operational efficiency. For instance, the adoption of digital twins—virtual replicas of physical assets—has enabled companies to monitor integrity and predict potential failures, thereby reducing downtime and maintenance costs.

- Regulatory Compliance and Safety Standards: Stringent environmental regulations and a heightened focus on safety standards have compelled oil and gas companies to invest in comprehensive integrity management solutions. Compliance with these regulations is essential to avoid penalties and ensure sustainable operations.

- Aging Infrastructure: The increasing complexity of oilfield operations and the imperative to extend the lifespan of aging infrastructure have driven the demand for effective integrity management practices. Regular maintenance and monitoring are crucial to prevent failures and ensure the safe operation of facilities.

- Rising Energy Demand: The escalating global energy demand necessitates the efficient and safe operation of oilfields. As the world population continues to grow and urbanization intensifies, energy consumption is projected to rise significantly, making robust integrity management practices essential.

- Market Competition and Consolidation: Intense competition and consolidation within the oil and gas industry have led companies to focus on operational efficiency and cost reduction. Implementing effective integrity management systems helps companies maintain competitiveness and profitability.

Top Trends in the Global Oilfield Integrity Management Market

- Digitalization and Data Analytics: The integration of digital technologies, such as predictive maintenance, real-time monitoring systems, and data analytics, has significantly enhanced asset performance and operational efficiency. For instance, the adoption of digital twins—virtual replicas of physical assets—has enabled companies to monitor integrity and predict potential failures, thereby reducing downtime and maintenance costs.

- Robotic and Automated Inspection Technologies: The use of robotic non-destructive testing (NDT) tools has become increasingly prevalent. These remotely operated devices assess the structural integrity of installations, minimizing human exposure to hazardous environments and improving inspection efficiency.

- Electrification of Operations: There is a growing shift towards electric-powered drilling rigs and hydraulic fracturing to reduce emissions from diesel-powered equipment. This transition, however, faces challenges related to grid infrastructure and associated costs.

- Regulatory Enhancements for Deepwater Operations: Advancements in technology have enabled operations under extreme subsea pressures, prompting regulatory bodies to introduce new safety measures. For example, the U.S. Bureau of Safety and Environmental Enforcement has implemented regulations targeting projects with pressures exceeding 15,000 PSI or temperatures over 350°F, ensuring safety in deepwater drilling activities.

- Integration of Nonmetallic Materials: The exploration and production industry is increasingly adopting nonmetallic materials, such as reinforced thermoplastic pipes, to enhance corrosion resistance and reduce maintenance costs. These materials offer advantages over traditional metals, contributing to improved asset integrity.

Market Growth

This expansion is primarily driven by the escalating demand for energy, necessitating the efficient and safe operation of oilfields. The adoption of advanced technologies such as predictive maintenance, real-time monitoring systems, and data analytics has significantly enhanced asset performance and operational efficiency.

Additionally, stringent environmental regulations and a heightened focus on safety standards have compelled oil and gas companies to invest in comprehensive integrity management solutions. The market’s popularity is further bolstered by the increasing complexity of oilfield operations and the imperative to extend the lifespan of aging infrastructure.

Opportunities abound in emerging markets, where untapped oil reserves present avenues for exploration and production, thereby amplifying the need for robust integrity management practices. The market’s expansion is also supported by strategic partnerships and technological innovations aimed at optimizing oilfield operations and ensuring environmental compliance.

Regional Analysis

The Asia Pacific region dominates the global oil and gas market, accounting for 34% of the market share and generating USD 5.7 billion in revenue. North America’s market is established due to stringent regulatory standards and technological advancements. Europe follows closely, adopting green technologies and strict regulations. The Middle East & Africa region offers growth opportunities due to vast oil reserves and modernizing infrastructure. Latin America is enhancing its market position by investing in offshore exploration and advanced oilfield integrity management systems.

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | USD 16.8 Billion |

| Forecast Revenue 2033 | USD 39.0 Billion |

| CAGR (2024 to 2033) | 8.8% |

| North America Market Share | 34% |

| Base Year | 2023 |

| Historic Period | 2020 to 2022 |

| Forecast Year | 2024 to 2033 |

Market Drivers

The Oilfield Integrity Management market is undergoing a significant shift due to the increasing focus on energy efficiency and the adoption of electric vehicles (EVs). The global oil demand has returned to pre-pandemic levels in 2023, but peak demand is expected before 2030. The uptake of EVs is projected to reduce oil demand by 5-10 million barrels per day by 2030, with the transition from oil in road transport expected to reach 55-80% by 2050. Despite these declines, oil will continue to play a crucial role in sectors like aviation and chemicals.

Market Restraints

The Oilfield Integrity Management market faces challenges due to high initial implementation costs, including the need for advanced technologies, specialized equipment, and skilled personnel. The industry also faces a shortage of skilled workforce, which can increase operational costs and hinder widespread adoption. Regulatory compliance also complicates compliance efforts and escalates costs.

These challenges highlight the importance of strategic planning and investment in technology for long-term cost savings and efficiency improvements. However, the upfront financial burden and expertise required can restrict adoption, especially in less developed markets or smaller operators.

Opportunities

The Oilfield Integrity Management market is experiencing growth due to the adoption of digital technologies, such as IoT, AI, and cloud computing. These technologies enable real-time monitoring, predictive maintenance, and efficient data analysis. The market is fueled by increased demand for safety measures, operational efficiency, and regulatory compliance. Key players are focusing on remote monitoring and digital twins technology for optimization. High oil and gas production regions are pushing for these technologies to maintain asset integrity.

Report Segmentation of the Oilfield Integrity Management Market

By Management Type Analysis

In 2023, Predictive Maintenance & Inspection dominated the Oilfield Integrity Management Market, capturing 28.7% of the market share. This segment is crucial for preventing equipment failures and minimizing unplanned downtime in oilfield operations. Planning ensures operational continuity and compliance with safety regulations, while data management facilitates real-time data access for informed decisions. Corrosion Management addresses asset degradation in oilfield environments, ensuring reliable operation and environmental compliance.

By Component Analysis

In 2023, hardware dominated the Oilfield Integrity Management Market, capturing 36.4% of the market. This includes essential components like sensors and pipelines, crucial for oilfield operations. Software solutions, fueled by sophisticated algorithms, improved decision-making processes by providing comprehensive insights into operational health, ensuring continuous operation and safety.

By Location Analysis

In 2023, onshore operations held a dominant 58.5% share in the Oilfield Integrity Management Market, largely due to their accessibility, lower costs, and fewer logistical challenges. Offshore operations, despite having a smaller market share, require specialized solutions for safety measures, advanced technology, corrosion management, and structural monitoring due to higher operational risks and costs.

By Application Analysis

In 2023, Reliability and Maintenance (R&M) held a 26.1% share in the Oilfield Integrity Management Market, focusing on preventive maintenance and data management. This segment is crucial for ensuring the safety and performance of oilfield equipment, preventing downtime and costly disruptions. Data Management & Analytics facilitates efficient handling of operational data, while Structural Integrity Management ensures the stability of oilfield structures.

Inspection Services maintain compliance with safety standards, while Pressure Systems Integrity Management focuses on safe operation of high-pressure systems. Subsea Integrity Management addresses challenges in subsea operations, while Pipeline Integrity Management ensures safety and efficiency of pipelines. Leak Detection and Repair are essential for minimizing environmental impact and operational safety.

Recent Development of the Oilfield Integrity Management Market

- With revenues rising to NOK 24.3 billion and an EBITDA of NOK 2.2 billion in 2024, Aker Solutions demonstrated outstanding operational performance and sound financial management.

- The Baker Hughes Company’s dedication to sustainable energy solutions is demonstrated by its significant investment in research and development, which resulted in improvements in new energy orders valued at $750 million in 2023.

Competitive Landscape

The competitive landscape of the Oilfield Integrity Management market is highly dynamic, featuring a range of prominent companies that offer diverse solutions and services aimed at ensuring the integrity and efficiency of oilfield operations. Among the key players are Aker Solutions, Baker Hughes Company, and Schlumberger Limited, which are renowned for their advanced technological solutions and comprehensive service offerings. These companies, alongside others like Halliburton and TechnipFMC plc, focus on providing integrated management systems that enhance the safety and longevity of oilfield assets.

Companies such as Emerson Electric Company and Siemens Limited bring expertise in automation and digital technologies, contributing significantly to the market through innovations in sensors and data analytics. The presence of specialized service providers like Bureau Veritas and SGS SA Corporation underscores the importance of regulatory compliance and certification services, which are crucial for maintaining operational standards and safety.

IBM Inc. and Oracle Corporation are pivotal in the integration of software solutions and data management systems, enabling more efficient data-driven decision-making. National Oilwell Varco and Weatherford are key contributors with their robust equipment and tool offerings that support integrity management operations.

Moreover, companies like Oceaneering International, Inc. and John Wood Group PLC provide specialized services and technologies for subsea and offshore challenges, enhancing their positions in the market through niche expertise and innovative approaches. This competitive scenario is marked by continuous advancements and collaborations, aiming to leverage technological integration and global expansion to meet the growing demands of the oil and gas industry.