Introduction

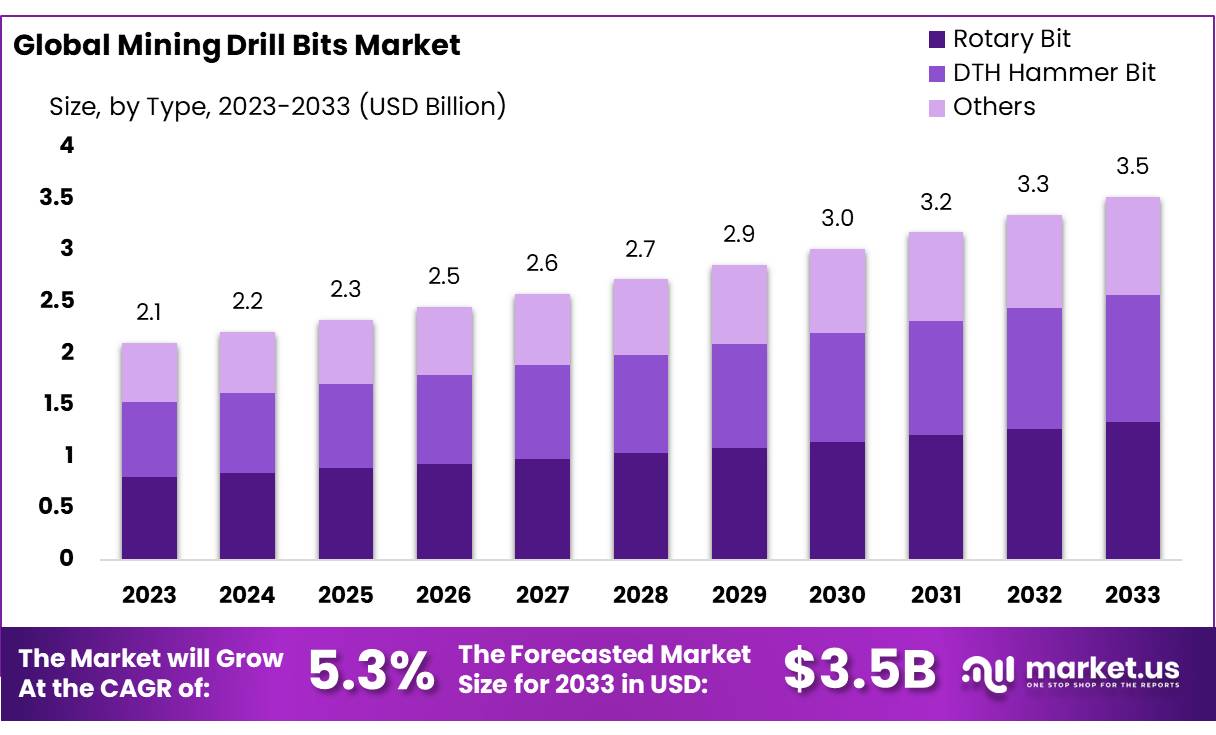

According to Market.us, The global Mining Drill Bits Market is poised for significant growth, with the market size projected to reach approximately USD 3.5 Billion by 2033, up from USD 2.1 Billion in 2023. This growth reflects a compound annual growth rate (CAGR) of 5.3% during the forecast period from 2024 to 2033.

The increasing demand for mining operations, coupled with advancements in drilling technologies, is driving the market’s expansion. As mining activities become more complex and deeper, the need for high-performance drill bits is surging. The market is also benefiting from the rising global demand for minerals used in various industries, including construction, automotive, and electronics. Furthermore, the expansion of mining activities in emerging economies, particularly in Asia-Pacific and Latin America, is creating new opportunities for drill bit manufacturers.

Technological innovations, such as the development of more durable and efficient drill bits, are expected to further enhance market prospects. The shift towards automation and the adoption of more sustainable mining practices are also contributing to the growth of the market, as they necessitate the use of advanced drilling equipment. As mining companies increasingly invest in equipment that enhances productivity while reducing environmental impact, the mining drill bits market is expected to experience substantial growth over the next decade.

Key Takeaway

- Mining Drill Bits Market size is expected to be worth around USD 3.5 Billion by 2033, from USD 2.1 Billion in 2023, growing at a CAGR of 5.3%.

- Rotary Bit segment held a dominant position in the mining drill bits market, capturing more than a 38.4% share.

- PDC (Polycrystalline Diamond Compact) Diamond held a dominant market position, capturing more than a 38.5% share.

- Diesel Operated Mining Drills held a dominant market position, capturing more than a 58.7% share.

- Rotary Mining Drill held a dominant market position, capturing more than a 33.4% share.

- Handhold Mining Drill held a dominant market position, capturing more than a 28.5% share.

- Liquid Filled drill bits held a dominant market position, capturing more than a 43.3% share.

- Below 8 inches held a dominant market position, capturing more than a 45.5% share.

- Surface Mining held a dominant market position, capturing more than a 64.5% share.

- Asia Pacific (APAC) stands as the dominating region, accounting for a substantial 37% of the market share, translating to USD 0.79 billion.

Factors affecting the Growth of the Mining Drill Bits Market

- Rising Demand for Minerals and Metals: The global demand for minerals and metals—especially precious metals (such as gold and silver) and industrial minerals (such as copper and lithium)—has increased steadily. This demand is largely driven by industrialization, urbanization, and technological advancements that require these raw materials. The need for mining operations to meet this demand directly boosts the consumption of mining drill bits, which are essential tools for excavation in the mining industry.

- Technological Advancements in Drill Bit Design and Materials: Innovations in the design and materials used in mining drill bits are significantly improving their performance. New drill bit technologies, such as polycrystalline diamond compact (PDC) bits, are enhancing drilling efficiency and durability. These advancements are reducing maintenance costs and downtime for mining operations, making mining more cost-effective and driving market growth.

- Expansion of Mining Activities Globally: The growth of mining activities, particularly in emerging economies like China, India, and several African nations, is a key driver for the drill bits market. As new mining projects are initiated and mining sites are expanded, the demand for high-quality drill bits rises. Exploration activities in new, often challenging terrains, such as deep-sea and remote locations, also require more advanced and specialized drilling equipment.

- Increasing Focus on Automation and Efficiency: Automation in the mining industry is becoming more prevalent. Automated and remotely operated mining drills are becoming a standard in many operations, reducing labor costs and improving safety. These automated systems rely on advanced drill bits that are more efficient and durable, leading to an increased demand for high-performance products.

- Mining Safety and Environmental Regulations: Stricter safety and environmental regulations are influencing the mining industry’s choice of equipment. Drill bits that offer better safety features (such as reducing the risk of equipment failure) and that comply with environmental standards (by minimizing dust or improving energy efficiency) are in high demand. Additionally, advancements in eco-friendly mining technologies, including energy-efficient and noise-reducing drill bits, are promoting growth in this segment.

- Increasing Exploration in Challenging Geographies: As easily accessible mineral deposits are depleted, mining companies are increasingly exploring deposits in challenging geographies, such as deep underground, arctic, or offshore locations. These areas require specialized drill bits that can withstand extreme conditions like high temperatures, pressures, and abrasive materials, driving the demand for more advanced and durable products.

- Fluctuating Raw Material Prices: The cost of raw materials used in manufacturing mining drill bits, such as steel, tungsten, and diamond, can impact the overall price of the products. Price volatility in these raw materials can affect profit margins for drill bit manufacturers and influence the pricing strategies in the market. However, the growing demand for drilling equipment generally compensates for these fluctuations, sustaining market growth.

- Sustainability and Eco-friendly Practices: There is a rising emphasis on sustainability and eco-friendly practices across the mining industry. The development of drill bits designed to reduce environmental impact (such as minimizing carbon emissions during production or reducing waste) is becoming a significant factor. Mining companies are increasingly focused on sustainable practices, which is promoting the adoption of advanced and energy-efficient drill bits.

Top Trends in the Global Mining Drill Bits Market

- Shift Towards High-Performance Drill Bits: One of the key trends in the mining drill bits market is the growing demand for high-performance drill bits. These include Polycrystalline Diamond Compact (PDC) bits and diamond-impregnated drill bits. These tools are more durable, efficient, and cost-effective, especially for hard rock and deep mining operations. PDC bits, in particular, offer better penetration rates, longer tool life, and lower operational costs, making them highly favored for both exploration and production drilling.

- Automation and Remote Drilling Technologies: Automation is one of the most significant trends in the mining sector, and it extends to the drilling process. Automated and remote-controlled drill rigs allow operators to manage drilling operations from a safe distance, often from central control rooms. This is particularly important in hazardous mining environments, such as underground or offshore drilling. Advanced autonomous drill bits are designed to integrate seamlessly with automated drilling systems, reducing labor costs and improving safety.

- Sustainability and Eco-Friendly Drilling Solutions: As the global mining industry faces increasing pressure to adopt sustainable practices, there is a growing trend towards developing eco-friendly drill bits. Manufacturers are focusing on drill bits that reduce environmental impact, such as low-emission manufacturing processes, energy-efficient designs, and reduced waste production. Additionally, drill bits that minimize dust generation or reduce noise pollution are gaining popularity in environmentally-conscious markets.

- Advancements in Material Science: Innovations in materials used in drill bit manufacturing are one of the main drivers of technological advancements in the market. Tungsten carbide, high-grade steel, and polycrystalline diamonds are commonly used in drill bit production, and ongoing research is focused on improving the quality and durability of these materials. Nanomaterials and composite materials are also being explored to further improve the performance of drill bits, particularly for challenging geological conditions.

- Customization and Specialized Drill Bits: The trend towards customization is becoming increasingly important as mining operations are becoming more specialized. Drill bits are now being designed for specific types of mining activities, such as oil and gas exploration, diamond mining, or coal mining, each of which requires specific bit configurations to address unique geological conditions. Manufacturers are offering tailor-made solutions to meet the requirements of these different industries, enhancing drilling efficiency and productivity.

- Focus on Enhanced Safety Features: With safety being a top priority in the mining industry, drill bit manufacturers are increasingly designing products with enhanced safety features. Drill bits equipped with automatic shut-off mechanisms, sensors for real-time performance monitoring, and fail-safe designs help prevent accidents and ensure smoother operations. The integration of these features into drill bits is becoming a key differentiator for manufacturers.

- Growth in Exploration of Challenging Mining Locations: As easily accessible mineral reserves deplete, mining companies are turning to more challenging and less explored locations, such as deep-sea mining, arctic mining, and remote terrain. These locations often require specialized drilling technologies, including advanced drill bits that can withstand extreme conditions like high pressure, temperature, and abrasion. The need for these specialized tools is driving demand for drill bits that are engineered for durability in harsh environments.

- 3D Printing and Additive Manufacturing in Drill Bit Production: The use of 3D printing and additive manufacturing in the production of mining drill bits is emerging as a trend that allows for faster, more cost-effective manufacturing processes. These technologies enable the creation of complex, highly specialized designs that may not be feasible with traditional manufacturing methods. Moreover, 3D printing can reduce waste material and allow for quick prototyping of new drill bit designs.

- Integration of IoT (Internet of Things) for Performance Monitoring: The integration of IoT in mining equipment, including drill bits, is another important trend. IoT-enabled drill bits are equipped with sensors that collect and transmit data on their performance in real time. This data is analyzed to predict wear and tear, optimize maintenance schedules, and improve drilling efficiency. As mining operations become more data-driven, the demand for smart drill bits with IoT capabilities is increasing.

Market Growth

The global Mining Drill Bits Market is expected to grow steadily over the next several years, driven by several key factors. As demand for minerals and metals increases due to industrialization and urbanization, mining companies are expanding their operations, which boosts the need for efficient and reliable drilling tools. The market is also benefitting from advances in drilling technology, with new high-performance drill bits—such as polycrystalline diamond compact (PDC) bits—offering longer lifespans, better efficiency, and lower operating costs.

Additionally, mining operations are increasingly turning to automation and remote drilling technologies, which rely on advanced drill bits that can perform under demanding conditions, further pushing market growth. The rise in exploration activities in deeper and more challenging terrains, such as deep-sea and arctic mining, is also driving demand for specialized drill bits designed to withstand extreme conditions.

At the same time, sustainability is becoming a higher priority in the mining sector, leading to a growing focus on environmentally friendly drilling solutions, such as energy-efficient drill bits and low-emission manufacturing processes. As mining companies adopt these new technologies to improve efficiency, safety, and environmental impact, the market for mining drill bits is expected to continue expanding.

Regional Analysis

The Asia Pacific dominates the Mining Drill Bit Market, accounting for 37% of the market share. This is due to extensive mining activities, investments in metal exploration, and rich mineral reserves. North America, particularly the US and Canada, is focusing on energy resource extraction. Europe, with stringent environmental regulations and sustainable practices, is a mature market.

Middle East & Africa is a growing market with potential due to mineral-rich Africa and oil-abundant Middle Eastern countries. Latin America has extensive mineral resources and ongoing investments in mining technologies.

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | USD 2.1 Billion |

| Forecast Revenue 2033 | USD 3.5 Billion |

| CAGR (2024 to 2033) | 5.3% |

| Asia Pacific Market Share | 37% |

| Base Year | 2023 |

| Historic Period | 2020 to 2022 |

| Forecast Year | 2024 to 2033 |

Market Drivers

The Mining Drill Bits Market is driven by the global demand for minerals and metals, driven by sectors like construction, automotive, electronics, and energy. Infrastructure development and technological advancements in drilling equipment are bolstering market growth. The push towards renewable energy sources and increased mineral mining for critical materials like copper and lithium are driving demand. Asia-Pacific regions, with significant mineral reserves, lead in market share due to increased coal-fired power production and mineral industrial use.

Market Restraints

The mining drill bits market faces restraining factors due to stringent environmental regulations aimed at mitigating environmental impacts like land degradation and water pollution. These regulations require companies to adopt cleaner technologies, which can increase operational costs and require additional investment in equipment.

Compliance with these standards also influences the type of technology and equipment used, potentially deterring investment in new projects. Innovation in drill bit technology, aimed at reducing emissions, has spurred more efficient solutions, but the initial investment required can affect the adoption rate of new technologies in the mining sector.

Opportunities

The electrification of mining operations presents a significant growth opportunity for the mining drill bits market. As the global mining industry transitions towards cleaner practices, the demand for electrically powered equipment is increasing.

This shift requires significant investment in mining infrastructure and opens new markets for drill bits designed for electrically powered equipment. The adoption of electrification aligns with global energy consumption trends, with a push towards renewable sources, reducing operational costs and meeting regulatory and societal expectations.

Report Segmentation of the Mining Drill Bits Market

By Type Analysis

In 2023, the Rotary Bit segment dominated the mining drill bits market with 38.4% share, favored for efficiency and effectiveness. Fixed Cutter Bits, Roller Cone Bits, and DTH Hammer Bits were also popular choices due to their precision, durability, and high penetration rates. These bits are essential for oil and gas extraction, hard rock mining, and deep hole drilling.

By Material Analysis

In 2023, PDC Diamond drill bits dominated the market with 38.5% share, favored for durability and efficiency in hard rock formations. Tungsten Carbide bits, known for their toughness, were also popular for drilling through abrasive materials. Steel drill bits, despite being more traditional, held a substantial share due to their cost-effectiveness and versatility, particularly for softer rock types.

By Operation Type Analysis

In 2023, Diesel Operated Mining Drills held a dominant market share, capturing over 58.7% due to their robust power and mobility. However, battery/electric drills are gaining traction due to their lower environmental impact and noise levels, making them ideal for underground operations. The industry’s shift towards sustainable practices is expected to boost electric drills’ popularity.

By Drilling Technique Analysis

In 2023, the Rotary Mining Drill held a 33.4% market share, renowned for its versatility and efficiency in mining operations. The Track Mining Drill, known for its mobility, was followed by the Compact Core Mining Drill, known for its precision and ability to extract core samples. Down-the-Hole (DTH) Mining Drills were particularly useful in hard rock environments. The Tophammer Mining Drill was highly efficient in fractured rock conditions.

By Mounting Analysis

In 2023, Handhold Mining Drill held a 28.5% market share, renowned for portability and ease of use. Pusherleg Mining Drill enhances drilling precision and reduces operator fatigue, while Rig Mining Drills provide stability for heavy-duty projects. Column & Bar Mining Drills are designed for precise hole placement in vertical or angled applications.

By Drill Fluid Used Analysis

In 2023, Liquid Filled drill bits dominated the market with 43.3% share, primarily due to their efficiency in cooling and lubricating the drill bit and cutting surface. Foam Filled drill bits, suitable for unstable formations, lift drill cuttings to the surface and reduce environmental impact. Air Filled drill bits are cost-effective and simple, suitable for less complex geological conditions.

By Size Analysis

In 2023, drill bits sized Below 8 inches held a 45.5% market share, favored for their versatility and efficiency in drilling operations. These bits are used in mineral exploration, extraction, construction, and civil engineering. Drill bits sized 8-11 inches are ideal for larger operations, balancing depth and precision. Drill bits above 11 inches are essential for major mining and quarrying operations, including mineral extraction and civil engineering.

By Application Analysis

Surface Mining, with a dominant market share of 64.5% in 2023, is a cost-effective and safer method for extracting minerals like coal, precious metals, and aggregates. Underground Mining, with a smaller share, is crucial for deeper resources, often driving innovation in drill bit durability and performance.

Recent Development of the Mining Drill Bits Market

- Atlas Copco AB demonstrated a good performance with noteworthy accomplishments in 2023, further solidifying its position in the mining drill bits industry.

- Boart Longyear, a world leader in the supply of drilling services and equipment, kept up its innovative streak in the mining drill bit market in 2023.

Competitive Landscape

The Mining Drill Bits Market is highly competitive, with several key players dominating the landscape. Companies in this space are continuously innovating to provide high-performance and specialized products that meet the evolving needs of the mining industry. Leading manufacturers are investing in research and development to improve drill bit efficiency, durability, and cost-effectiveness. They are also focusing on expanding their product portfolios and increasing their global footprint to cater to the growing demand for mining equipment across diverse regions.

Atlas Copco AB, Epiroc AB, and Boart Longyear are among the major players that have a significant presence in the mining drill bits market. These companies offer a wide range of products, from standard drill bits to highly specialized tools used in challenging mining environments. Caterpillar Inc., a global leader in heavy machinery, also manufactures mining drill bits as part of its extensive portfolio, benefiting from its strong distribution network and brand recognition.

Other notable companies like Sandvik AB, Mitsubishi Materials Corporation, and Robit Plc are focusing on developing innovative drill bit technologies, such as PDC bits and diamond-impregnated bits, which are increasingly in demand due to their superior performance and long lifespan. Companies such as Komatsu Ltd., Liebherr, and Doosan Corporation also provide high-quality mining drill bits as part of their mining equipment offerings, leveraging their expertise in heavy equipment manufacturing to enhance their product performance.

Additionally, firms like Brunner and Lay Inc., Glinik Drilling Tools, MICON Drilling GmbH, and Western Drilling Tools cater to niche segments of the market by offering customized solutions and specialized drill bits for specific mining applications. Xiamen Prodrill Equipment Co., Ltd. and Changsha Heijingang Industrial Co. Ltd. are significant players in the Asian market, supplying mining drill bits for both regional and global projects.

The competition in the market is driven not only by product quality and innovation but also by pricing strategies, after-sales service, and the ability to meet industry-specific regulations and standards. As the demand for mining drill bits continues to rise due to expanding mining operations and technological advancements, the competitive landscape will likely become even more dynamic, with companies striving to differentiate themselves through product innovation and global reach.