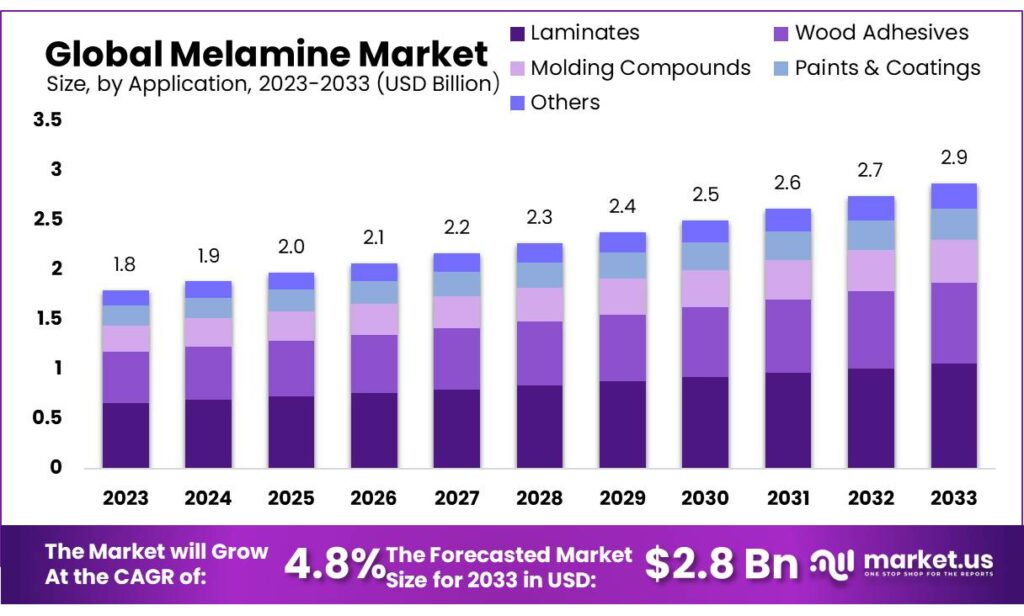

According to Market.us, The Global Melamine Market size is expected to be worth around USD 2.9 billion by 2033, from USD 1.8 billion in 2023, growing at a CAGR of 4.8% during the forecast period from 2023 to 2033. The global melamine market is experiencing significant growth driven by its widespread use in industries like construction, automotive, and textiles. Melamine is primarily used in the production of melamine-formaldehyde resins, which are essential for manufacturing laminates, adhesives, molding compounds, and coatings. The demand for high-pressure laminates in furniture and interior decoration is a key market driver.

Additionally, the automotive sector’s need for lightweight and durable components is pushing up melamine consumption. However, environmental concerns and health hazards associated with melamine usage could restrain market expansion. Market trends indicate a shift towards sustainable practices and the development of eco-friendly melamine resins. Asia-Pacific dominates the market due to its booming construction industry and increasing manufacturing activities.

Key Takeaway

- The Global Melamine Market is projected to grow from USD 1.8 billion in 2023 to USD 2.9 billion by 2033, with a CAGR of 4.8%.

- Building & Construction: Dominates with a 43.5% market share due to the extensive use of melamine in laminates and adhesives.

- Melamine Foam: Dominates with a 58.6% share in 2023, valued for soundproofing and insulation properties.

- Laminates: Hold a 36.8% share due to their use in countertops, cabinetry, and flooring.

- Asia Pacific: Holds 35.4% market share, valued at USD 0.63 billion, driven by industrialization and urbanization in China and India.

Factors affecting the growth of the Melamine Market

- Construction and Renovation Demand: The robust demand for melamine-based laminates and adhesives in the construction and renovation sectors, driven by urbanization and infrastructural development, particularly in emerging economies, significantly impacts market growth.

- Furniture and Interior Design: Melamine is extensively used in the production of decorative laminates used in furniture and interior design. Trends towards more aesthetically pleasing and durable furnishings enhance the demand for melamine.

- Automotive Industry: The automotive sector uses melamine foams for insulation and soundproofing due to their lightweight and thermal resistance properties, contributing to the market growth as the automotive industry evolves towards more energy-efficient designs.

- Regulatory Impact: Environmental regulations regarding formaldehyde emissions influence the production processes and formulations of melamine resins. Stricter controls can restrain market growth or shift the focus towards more sustainable and compliant products.

- Technological Advancements: Innovations in resin technologies that reduce the cost of production or improve the properties of melamine resins can open new applications and markets, driving growth.

- Economic Factors: Economic cycles and the availability of capital for construction and manufacturing projects can fluctuate, impacting the demand for melamine products.

- Health and Safety Concerns: Health risks associated with melamine, especially when used in food contact materials, have led to public scrutiny and could potentially impact its use in certain applications.

Top Trends in the Global Melamine Market

- Eco-friendly Products: There’s a rising demand for environmentally friendly and sustainable products. This has led to the development of low-emission melamine resins that comply with stringent environmental regulations.

- Advancements in Laminates Technology: The use of melamine in high-pressure laminates (HPL) and low-pressure laminates (LPL) for decorative and industrial applications is growing.

- Expansion in Insulation Applications: Melamine foam is recognized for its excellent insulation properties, lightweight, and thermal resistance. It’s increasingly being used in building insulation, automotive applications, and even in aerospace for noise reduction and energy efficiency.

- Diversification into New Applications: Research and development are opening new applications for melamine in coatings, textiles, and paper finishing. These new uses are driven by melamine’s beneficial properties, such as water resistance, hardness, and scratch resistance.

- Integration of Digital Printing Technologies: The furniture and construction industries are increasingly using digital printing technologies to apply decorative patterns directly onto melamine-faced boards.

- Growth in Emerging Markets: Economic growth in Asia-Pacific and other emerging regions is driving the demand for melamine. Urbanization, increasing infrastructure investment, and rising standards of living are contributing to higher consumption in these areas.

- Supply Chain Optimization: Companies are focusing on optimizing their supply chains to reduce costs and improve efficiency. This includes localizing production closer to key markets to reduce logistics costs and improve service delivery.

Market Growth

The Global Melamine Market is projected to witness substantial growth over the coming years, primarily fueled by increasing demand from the construction and automotive industries. As urbanization accelerates, especially in emerging economies, the demand for melamine-based laminates and adhesives in construction applications is expected to surge. Similarly, the automotive sector is leveraging melamine’s thermal resistance and soundproofing qualities, promoting its use in various components.

Additionally, innovations in melamine resins that comply with stricter environmental regulations are opening new markets, particularly in eco-friendly products. The Asia-Pacific region remains a significant driver of this growth, with its robust manufacturing sector and expanding infrastructure projects. However, volatility in raw material prices and environmental concerns could pose challenges to the market’s expansion.

Regional Analysis

The Asia Pacific (APAC) region leads the global melamine market with a 35.4% share, valued at USD 0.63 billion, primarily driven by robust industrialization in China and India. North America also holds a significant market share, supported by its strong industrial base and demand for heat-resistant materials in the construction and automotive sectors.

Europe’s market benefits from a focus on sustainable materials and stringent environmental regulations. The Middle East & Africa region’s growth is fueled by construction and infrastructure investments, though hampered by regional instabilities. In Latin America, growth is driven by the construction and automotive industries, with Brazil and Mexico as key players. This regional analysis highlights the diverse drivers and challenges across the global melamine market.

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | USD 1.8 Billion |

| Forecast Revenue (2033) | USD 2.9 Billion |

| CAGR (2024 to 2033) | 4.8% |

| Asia Pacific Market Share | 35.4% |

| Base Year | 2023 |

| Historic Period | 2020 to 2022 |

| Forecast Year | 2024 to 2033 |

Market Drivers

The global melamine market is primarily driven by the expanding demand in the construction and automotive industries, where it is utilized for its superior flame retardant and high-temperature resistant properties. The growth of the market can also be attributed to the increasing use of melamine in high-pressure laminates, which are extensively employed in furniture, flooring, and paneling applications, contributing to the market’s expansion.

Additionally, innovations in melamine resins, promoting their application in coatings, plastics, and adhesives, further fuel market growth. However, market expansion may be restrained by volatile raw material prices and stringent environmental regulations regarding formaldehyde emissions. Nonetheless, the development of eco-friendly melamine-formaldehyde resins opens new avenues for growth in environmentally sensitive markets.

Market Restraints

The growth of the global melamine market faces several restraints that could impede its expansion. Key among these is the stringent environmental and health regulations concerning formaldehyde emissions, as melamine resins are major formaldehyde releasers. These regulations have tightened globally, pushing manufacturers towards costly reformulations and compliance measures.

Additionally, the fluctuating prices and availability of key raw materials like urea and natural gas directly impact production costs and market stability. Health concerns linked to melamine, especially its use in food contact materials and consumer goods, also pose significant challenges, potentially affecting consumer perceptions and demand. Furthermore, competition from alternative materials that offer similar properties without the associated risks could divert market share from melamine-based products. These factors collectively contribute to the constraints on market growth.

Opportunities

The global melamine market presents several lucrative opportunities for growth and innovation. One significant opportunity lies in the increasing demand for sustainable and eco-friendly building materials, where melamine’s use in low-emission laminates and adhesives can cater to environmentally conscious consumers and regulations.

Additionally, the expansion of the furniture industry, particularly in fast-developing regions like Asia-Pacific, offers a broad market for melamine-infused laminates that provide durability and aesthetic appeal. There is also potential in exploring new applications in high-temperature insulation and soundproofing materials, particularly in the automotive and aerospace sectors. Advancements in technology that improve the safety and environmental impact of melamine resins could open new doors in markets that are sensitive to health concerns. These opportunities indicate a promising future for the melamine market, with ample scope for growth and diversification.

Report Segmentation of the Melamine Market

By Type Analysis

In 2023, Melamine Foam led the melamine market with over 58.6% share, primarily due to its excellent soundproofing and insulation capabilities, making it highly sought after in the construction and automotive sectors. Its lightweight yet strong nature facilitates diverse uses, ranging from industrial applications to everyday consumer products like cleaning sponges.

Meanwhile, Melamine Resin, though smaller in market share, is pivotal in producing laminates and adhesives due to its heat resistance and structural integrity, which are essential for crafting kitchen countertops, wood panel overlays, and other durable surfaces. Both Melamine Foam and Melamine Resin are integral to various industries, with the former being a key player in insulation and soundproofing, and the latter in creating heat-resistant, durable surfaces.

By Application Analysis

In 2023, Laminates led the melamine market with a 36.8% share, driven by melamine’s role in enhancing durability, scratch resistance, and aesthetics, making it ideal for countertops, cabinetry, and flooring. The Wood Adhesives segment also held a significant market presence, leveraging melamine’s strong bonding and moisture-resistant properties for furniture and panel assembly in the woodworking industry.

Molding Compounds represented another key application, used in the production of heat-resistant and rigid items like kitchenware, electrical components, and automotive parts, owing to their high thermal stability and insulation. Additionally, the Paints & Coatings segment capitalized on melamine’s ability to improve hardness, water, and chemical resistance, enhancing the durability of surface finishes. Together, these applications underscore melamine’s versatility across residential, commercial, and industrial sectors.

By End-Use Analysis

In 2023, the Building & Construction sector dominated the melamine market, accounting for over 43.5% of the share. This sector benefits from melamine’s fire retardant and heat resistance qualities, ideal for laminates, adhesives, and decorative materials used in interiors. The Home Appliances segment also heavily utilizes melamine, especially in heat-resistant casings for ovens and microwaves due to its thermal stability and electrical insulation.

In Automotive, melamine provides thermal insulation and soundproofing, enhancing vehicle interiors. The Chemical industry applies melamine in durable resins and coatings, while the Textile sector incorporates it in flame-retardant fabrics for protective clothing and upholstery, leveraging its durability and safety attributes across diverse applications.

Recent Development of the Melamine Market

- In January 2023, OCI NV reported a production increase of 5% compared to the previous year, reflecting improvements in operational efficiency.

- In July 2023, Borealis completed the sale of its nitrogen and melamine business to AGROFERT, valued at EUR 810 million, marking a pivotal shift in its business focus towards sustainable solutions in polyolefins and base chemicals

Competitive Landscape

The global melamine market in 2024 will be shaped by key players with diverse strengths across regions and applications. OCI NV and Borealis AG maintain robust positions in Europe, driven by advanced production facilities and a focus on sustainable solutions. Prefere Resins Holding GmbH and Grupa Azoty leverage specialization in resins, catering to growing demand in the construction and automotive sectors. BASF SE, a global chemical leader, capitalizes on innovation and scale to enhance its melamine portfolio.

In Asia, Henan Xinlianxin Chemicals Group and Sichuan Chemical Works Group dominate, benefiting from high production capacities and competitive costs. Mitsui Chemicals and Nissan Chemical Corporation focus on high-value applications in coatings and adhesives.

Qatar Melamine Company and Eurochem Group secure strategic positions in raw material supply. Meanwhile, Cornerstone Chemical and Gujarat State Fertilizers & Chemicals capitalize on vertical integration to optimize production. Collectively, these players drive growth through innovation, scale, and regional strengths.