Introduction

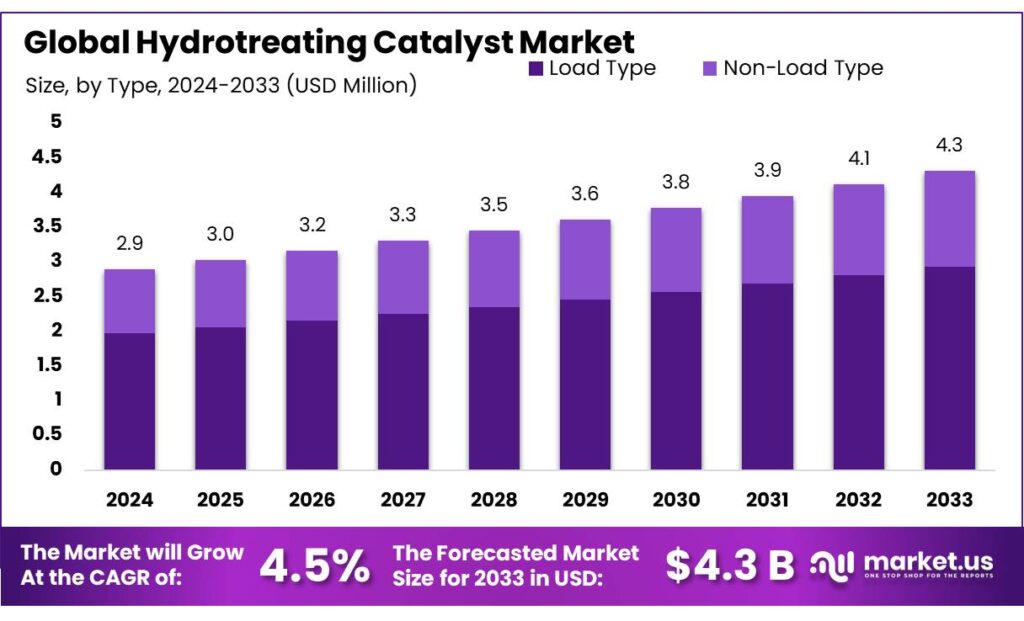

According to Market.us, The global Hydrotreating Catalyst Market is projected to expand from USD 2.9 Billion in 2023 to USD 4.3 Billion by 2033, reflecting a compound annual growth rate (CAGR) of 4.5% during this period.

This growth is primarily driven by the increasing demand for cleaner fuels, necessitated by stringent environmental regulations aimed at reducing sulfur emissions. Hydrotreating catalysts play a crucial role in refining processes by removing impurities such as sulfur, nitrogen, and metals from petroleum products, thereby enhancing fuel quality and compliance with emission standards. The market’s expansion is further supported by advancements in catalyst technologies, which improve efficiency and longevity, as well as the rising global energy consumption that boosts the need for refined petroleum products.

Additionally, the ongoing modernization and expansion of refineries, particularly in emerging economies, present significant opportunities for market growth. However, challenges such as fluctuating raw material prices and the high costs associated with catalyst production may impact the market’s trajectory. Despite these challenges, the hydrotreating catalyst market is expected to experience steady growth, driven by the global emphasis on environmental sustainability and the continuous evolution of refining technologies.

Key Takeaway

- Hydrotreating Catalyst Market size is expected to be worth around USD 4.3 billion by 2033, from USD 2.9 billion in 2023, growing at a CAGR of 4.5% .

- Load-type hydrotreating catalysts held a dominant market position, capturing more than a 68.7% share of the market.

- Zeolites held a dominant market position in the hydrotreating catalyst market, capturing more than a 38.7% share.

- Diesel Hydrotreat held a dominant market position in the hydrotreating catalyst market, capturing more than a 48.7% share.

- Refining segment held a dominant market position in the hydrotreating catalyst market, capturing more than a 69.7% share.

- Asia Pacific dominated the market, accounting for 43.3% of the global share, valued at USD 1.2 billion.

Factors affecting the growth of the Hydrotreating Catalyst Market

- Environmental Regulations: Governments worldwide are implementing stricter environmental laws to reduce air pollution. These regulations require refineries to produce cleaner fuels with lower sulfur content, increasing the demand for hydrotreating catalysts that help remove impurities from petroleum products.

- Rising Energy Demand: Global energy consumption is on the rise, driven by industrialization and population growth. This surge leads to higher production of refined petroleum products, thereby boosting the need for hydrotreating catalysts to ensure fuel quality and compliance with environmental standards.

- Technological Advancements: Ongoing research and development have led to more efficient and durable hydrotreating catalysts. Innovations in catalyst composition and manufacturing processes enhance performance, making them more effective in removing contaminants and extending their operational lifespan.

- Refinery Capacity Expansion: To meet the growing demand for cleaner fuels, refineries are expanding and upgrading their facilities. These expansions necessitate the adoption of advanced hydrotreating catalysts to improve processing capabilities and product quality.

- Economic Factors: Fluctuations in crude oil prices and the costs of raw materials used in catalyst production can impact the market. High production costs may pose challenges for manufacturers, potentially affecting the overall growth of the hydrotreating catalyst market.

Top Trends in the Global Hydrotreating Catalyst Market

- Stricter Environmental Regulations: Governments worldwide are enforcing more rigorous environmental laws to reduce sulfur emissions from fuels. This has led to a higher demand for hydrotreating catalysts, which are essential in producing cleaner fuels.

- Advancements in Catalyst Technology: Ongoing research and development have resulted in more efficient and durable hydrotreating catalysts. Innovations in catalyst composition and manufacturing processes enhance performance, making them more effective in removing contaminants and extending their operational lifespan.

- Expansion of Refining Capacities: To meet the growing demand for cleaner fuels, refineries are expanding and upgrading their facilities. These expansions necessitate the adoption of advanced hydrotreating catalysts to improve processing capabilities and product quality.

- Shift Towards Renewable Feedstocks: There is a growing emphasis on sustainability, leading to increased use of bio-based feedstocks for fuel production. Hydrotreating catalysts are essential for converting these renewable materials into high-quality, low-sulfur fuels, aligning with global trends toward biofuels.

- Regional Market Growth: The Asia-Pacific region is experiencing significant growth in the hydrotreating catalyst market, driven by rapid industrialization, increasing energy demand, and stringent environmental regulations. Countries like China and India are leading contributors to this regional market expansion.

Market Growth

The global hydrotreating catalyst market is projected to expand from USD 2.9 billion in 2023 to USD 4.3 billion by 2033, reflecting a compound annual growth rate (CAGR) of 4.5% during this period. This growth is primarily driven by the increasing demand for cleaner fuels, necessitated by stringent environmental regulations aimed at reducing sulfur emissions.

Hydrotreating catalysts play a crucial role in refining processes by removing impurities such as sulfur, nitrogen, and metals from petroleum products, thereby enhancing fuel quality and compliance with emission standards. The market’s expansion is further supported by advancements in catalyst technologies, which improve efficiency and longevity, as well as the rising global energy consumption that boosts the need for refined petroleum products.

Additionally, the ongoing modernization and expansion of refineries, particularly in emerging economies, present significant opportunities for market growth. However, challenges such as fluctuating raw material prices and the high costs associated with catalyst production may impact the market’s trajectory. Despite these challenges, the hydrotreating catalyst market is expected to experience steady growth, driven by the global emphasis on environmental sustainability and the continuous evolution of refining technologies.

Regional Analysis

In 2023, Asia Pacific dominated the hydrotreating catalyst market, accounting for 43.3% of the global share. This is due to rapid industrialization, increasing automotive production, and investments in refining capacities. North America, Europe, Middle East & Africa, and Latin America are also significant players in the market. North America adheres to environmental regulations, while Europe invests in advanced hydrotreating technologies. The Middle East & Africa region is expanding refining capacities, while Latin America is growing due to revitalizing its oil and gas sector.

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | USD 2.9 Billion |

| Forecast Revenue 2033 | USD 4.3 Billion |

| CAGR (2024 to 2033) | 4.5% |

| Asia Pacific Market Share | 43.3% |

| Base Year | 2023 |

| Historic Period | 2020 to 2022 |

| Forecast Year | 2023 to 2033 |

Market Drivers

The hydrotreating catalyst market is driven by stringent environmental regulations, such as the International Maritime Organization’s 0.50% sulfur limit for ship fuel oil. This is aimed at reducing air pollution and mitigating its impact on human health and the environment. The demand for clean fuels, such as ultra-low sulfur diesel (ULSD), has increased as countries comply with emission standards.

Technological advancements in catalyst formulations and global refining capacity expansion, particularly in Asia and the Middle East, support the growth of the hydrotreating catalyst market. Governments and industry collaboration also contribute to the push for cleaner fuel production, offering incentives for refineries to upgrade facilities and adopt cleaner technologies.

Market Restraints

The hydrotreating catalyst market faces several challenges, including high costs, economic downturns, fluctuating crude oil prices, availability of alternative refining technologies, regulatory and market uncertainty, and the complexity and risk of catalyst deactivation. The high cost of developing, producing, and implementing advanced catalysts, as well as the need for significant modifications to existing refinery operations, can be prohibitive for operators.

Economic downturns and fluctuating crude oil prices can also deter investments in upgrading facilities, impacting profit margins and limiting the adoption of new technologies. Alternative refining technologies like gas-to-liquid and coal-to-liquid may also limit the adoption of new hydrotreating catalysts. The complexity and risk of catalyst deactivation can also limit the effectiveness and economic viability of using advanced hydrotreating catalysts.

Opportunities

The hydrotreating catalyst market is experiencing significant growth due to the increasing global demand for ultra-low sulfur diesel (ULSD). This demand is driven by stricter environmental regulations, such as the Euro 6 standards in Europe, which mandate a maximum sulfur content of 10 ppm in diesel fuels. Emerging markets, such as Asia-Pacific, Latin America, and parts of Africa, are experiencing rapid industrial growth, increased automotive production, and urbanization, leading to higher fuel consumption.

Technological advancements in catalyst formulations and applications, such as research into novel materials and regenerable catalysts, are also enhancing refining efficiency. The integration of renewable feedstocks in traditional refining processes is also a key opportunity, particularly in the aviation and marine sectors. Government policies and incentives are also catalyzing market growth.

Report Segmentation of the Hydrotreating Catalyst Market

By Type

In 2023, Load-type hydrotreating catalysts dominated the hydrotreating catalyst market, accounting for over 68.7%. These catalysts are preferred in the petroleum refining industry for their efficiency in removing impurities like sulfur, nitrogen, and metals. Non-Load Type catalysts, on the other hand, are used for less rigorous impurity removal, lighter crude oils, or specific refining processes. The hydrotreating catalyst market continues to expand due to environmental compliance and cleaner fuel production.

By Material

Zeolites dominate the hydrotreating catalyst market in 2023, accounting for 38.7% of the market share. These high-porosity materials are used to remove impurities from crude oil, improving refining efficiency. Chemical compounds, including alumina and silica, account for 30% of the market. Precious metals like nickel and molybdenum are also crucial in hydrotreating catalysts, accounting for 24.3%. Other materials, including novel composites and mixed metal oxides, are being explored for improved performance.

By Application

In 2023, Diesel Hydrotreat held a 48.7% market share, primarily due to demand for ultra-low sulfur diesel. Lube Oils followed, accounting for 26% of the market. Naphtha, used in petrochemicals and gasoline blending, represented 18% of the market. The remaining 7.3% was used in refining heavier oils and specialty chemicals, achieving specific chemical qualities for industrial applications. Hydrotreating catalysts are essential for removing contaminants and improving diesel quality.

By End-Use

In 2023, the Refining segment dominated the hydrotreating catalyst market, accounting for over 69.7%. This sector uses hydrotreating catalysts to produce cleaner fuels by removing impurities from crude oil. Diesel hydrotreat is crucial for ultra-low sulfur diesel, meeting environmental standards. Lube oils and naphtha also play significant roles in the market, improving engine efficiency and longevity.

Recent Development of the Hydrotreating Catalyst Market

- By concentrating on the creation and application of cutting-edge catalysts made to satisfy ever-tougher international environmental regulations, Shell continued to increase its clout in this industry in 2023.

- By utilizing its broad experience in chemical engineering and catalyst technologies, BASF maintained its market position in 2023.

Competitive Landscape

The hydrotreating catalyst market is characterized by intense competition among key players striving to enhance their market positions through innovation, strategic partnerships, and expansion initiatives. Major companies in this sector include Shell, BASF SE, Grace, Albemarle Corporation, Honeywell International Inc., Haldor Topsoe A/S, Axens, Johnson Matthey, JGC C&C, China Petrochemical Corporation, Arkema, Exxon Mobil Corporation, DuPont, UNICAT Catalyst Technologies, LLC, Criterion, Chemie, MOGAS Industries, Inc., and SIE NEFTEHIM, LLC.

These firms focus on developing advanced catalyst technologies to meet the growing demand for cleaner fuels and to comply with stringent environmental regulations. Collaborations and acquisitions are common strategies employed to expand product portfolios and global reach.

For instance, Advanced Refining Technologies (ART), a joint venture between Chevron and Grace, is a notable player in this market. Additionally, companies are investing in research and development to create more efficient and durable catalysts, aiming to improve refinery performance and reduce operational costs. The competitive landscape is further influenced by regional market dynamics, with Asia-Pacific emerging as a significant growth area due to rapid industrialization and increasing energy consumption.