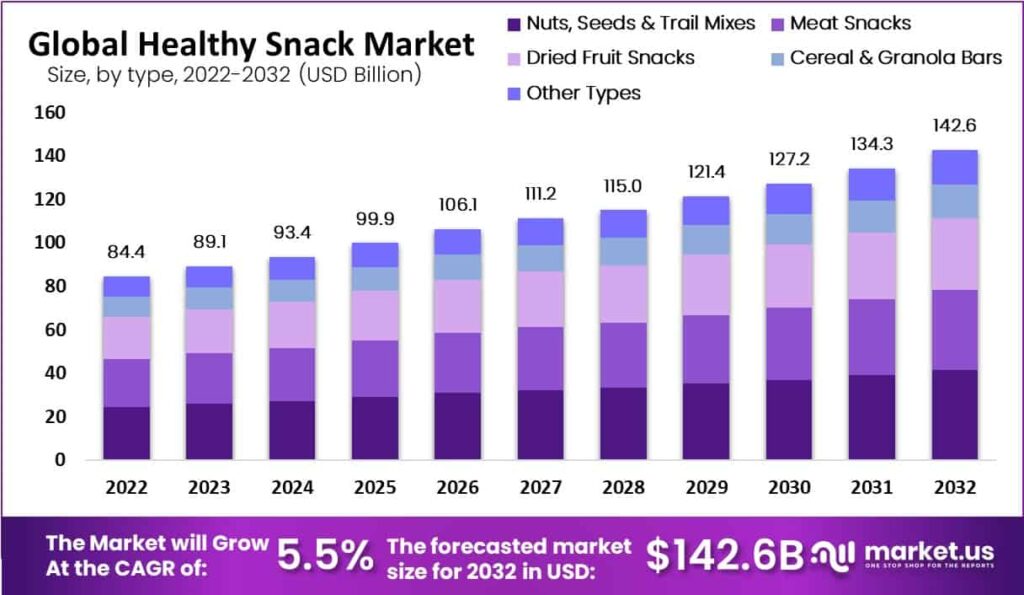

According to Market.us, The Global Healthy Snack Market size is expected to be worth around USD 142.6 Billion by 2033, from USD 89.1 Billion in 2023, growing at a CAGR of 5.5% during the forecast period from 2024 to 2033.

The surge in demand for healthy snacks is propelled by increased health consciousness and lifestyle-related ailments like obesity and diabetes, which emphasize the importance of nutritious eating. This trend is bolstered by consumer preferences for convenience, leading to a shift toward snacks that support overall health without sacrificing flavor or practicality. Major investments by companies like PepsiCo further reflect the growing market potential for innovative, healthier snack options.

Key Takeaway

- The Global Healthy Snack Market size is expected to be worth around USD 142.6 Bn by 2033, from USD 89.1 Bn in 2023, growing at a CAGR of 5.5% during the forecast period from 2024 to 2033.

- Fruit, Nuts, and Seeds held a dominant market position, capturing more than a 38.2% share.

- Bags and Pouches held a dominant market position, capturing more than a 41.8% share.

- Hypermarkets/Supermarkets held a dominant market position, capturing more than a 44.2% share.

- North America is the leading region in the healthy snack market, commanding a 38.9% share.

Factors affecting the growth of the Healthy Snack Market

- Health and Wellness Trends: Increasing awareness of health and wellness is driving consumers to choose healthier snack options. Snacks that are low in sugar, calories, and unhealthy fats, but high in protein, fiber, and other beneficial nutrients are in demand.

- Demographic Shifts: Different age groups have varying snack preferences. Millennials and Gen Z, for instance, often favor snacks that not only are healthy but also offer convenience and align with their ethical and environmental values.

- Innovation in Product Offerings: Companies are constantly innovating to capture consumer interest. This includes the development of new flavors, the reformulation of traditional snacks into healthier versions, and the use of alternative, nutrient-rich ingredients.

- Label Transparency and Clean Labeling: Consumers are increasingly scrutinizing product labels, seeking transparency regarding ingredients. Clean labeling, which involves using fewer and more recognizable ingredients, has become a significant draw.

- Convenience: The fast-paced lifestyle of modern consumers increases the demand for snacks that are easy to consume on the go. This trend encourages the development of portable and convenient packaging.

Top Trends in the Global Healthy Snack Market

- Increased Demand for Plant-Based Snacks: The rise in veganism and concerns over animal welfare are propelling the demand for plant-based snacks. Products such as nuts, seeds, and vegan bars are gaining popularity as consumers seek out healthier, sustainable options.

- Functional Snacks on the Rise: There is a growing consumer interest in snacks that not only satisfy hunger but also provide functional benefits, such as protein-rich nuts and seeds, antioxidant-rich berries, or snacks fortified with vitamins and minerals. This trend is supported by the increasing consumer focus on holistic health and wellness.

- Clean Label Products: Transparency in ingredients continues to be a key factor in consumer choices. Snacks that contain natural, non-GMO, and organic ingredients with no artificial additives are increasingly favored. The clean label trend has been expanding across global markets, highlighting a shift towards simplicity and purity in snacking.

- Innovative Flavors and Ingredients: Consumers are increasingly adventurous, seeking out novel flavors and exotic ingredients. Incorporation of superfoods like quinoa, chia, and kale into snacks is appealing to health-conscious consumers looking for both taste and nutritional value.

- Expansion in Retail Channels: The availability of healthy snacks is expanding beyond health food stores to include supermarkets, convenience stores, and online platforms. This accessibility makes it easier for consumers to make healthy choices more regularly.

Market Growth

The healthy snack market has experienced significant growth as consumers increasingly prioritize wellness and nutrition. Driven by rising health awareness and changing dietary preferences towards more wholesome, minimally processed snacks, this sector is witnessing a surge in demand for options like fruits, nuts, seeds, and nutrition bars. Market expansion is further fueled by innovations in product offerings, including organic and non-GMO ingredients, which cater to specific dietary needs and lifestyle choices.

As the global health trend continues, the market is projected to maintain its upward trajectory, supported by robust marketing strategies and distribution channel expansions. The inclusion of health-centric snacks in retail and online platforms enhances accessibility, propelling market growth.

Regional Analysis

North America leads the healthy snack market with a 38.9% share, driven by a significant rise in the consumption of nutritious snacks in the U.S. since the COVID-19 epidemic. Europe ranks second, spurred by trends in on-the-go nutrition and increasing recognition of functional foods’ health benefits. The European market sees growth in granola bars and innovative snack portfolios, backed by major corporate investments. Asia-Pacific is poised for rapid growth due to rising disposable incomes and a focus on “better-for-you” products. However, regions like the Middle East, Africa, and South America show lower market shares due to minimal product penetration.

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | USD 89.1 Billion |

| Forecast Revenue (2033) | USD 142.6 Billion |

| CAGR (2024 to 2033) | 5.5% |

| North America Market Share | 38.9% |

| Base Year | 2023 |

| Historic Period | 2020 to 2022 |

| Forecast Year | 2024 to 2033 |

Market Drivers

The global demand for functional foods is propelling the growth of the healthy snacks market, as these products are increasingly sought to enhance overall health and reduce the risk of chronic lifestyle-related diseases. Functional ingredients like proteins, micronutrients, and fiber are becoming staples in mainstream retail offerings, supporting consumer trends towards healthier eating options for weight management and improved digestive and cardiovascular health.

Additionally, the market is bolstered by the rising popularity of convenience foods and on-the-go snacking. Busy lifestyles drive the demand for ready-to-eat snacks that offer quick nutrition and satiety, with portion-controlled packs ideal for energy boosts during hectic days, thus furthering the expansion of the healthy snacks sector.

Market Restraints

The growth of the healthy snacks market faces notable obstacles due to processing complexities. Key consumer preferences, such as texture and crispness, are compromised when traditional constituents like fats and sugars are minimized or omitted in favor of whole grains. This alteration affects the moisture retention and binding properties critical to the desired texture of the snack. Similarly, the market for fruit and vegetable snacks encounters issues related to shelf stability and preservation.

Moreover, the trend towards clean-label products, which eschew additives and preservatives, poses further challenges in maintaining emulsification, stabilization, and a creamy texture. These hurdles are continually being addressed through innovations and technological developments in processing techniques.

Opportunities

The consumption of healthy snack options has seen a notable increase as it emerges as one of the most widely consumed food groups. As consumer awareness and responsibility grow, many individuals are turning to healthy snacks as a substitute for traditional meals. This shift is influenced by a demand for snacks that are not only nutritious and health-oriented but also affordable and conducive to active, mobile lifestyles.

The trend towards premiumization in healthy snacks is fostering innovation and expanding product variety, although manufacturers must navigate challenges such as avoiding unusual ingredients and overly bold flavors to maintain broad appeal globally. Moreover, the convenience factor is significantly boosting the sales of ready-to-eat snacks through online platforms, making healthy snacks a highly popular category in the online food market. This dynamic is contributing to growth in regional market sectors, driven by a consumer base seeking both health benefits and convenience.

Report Segmentation of the Healthy Snack Market

By Type Analysis

The Fruit, Nuts, and Seeds segment dominated the healthy snacks market with a 38.2% share, driven by consumer preferences for natural and minimally processed options. The Frozen & Refrigerated segment enhanced snack quality through advanced preservation technologies, aligning with the nutritional demands of busy consumers. Bakery products have evolved with healthier ingredients, offering comfort foods that meet health standards. Savory snacks like vegetable chips and whole-grain crackers cater to the desire for tasty yet healthful alternatives. Bars and confectionery segments, favored for their convenience, support active lifestyles with products like protein bars. The Dairy segment, rich in protein and calcium, continues to grow with the introduction of low-fat and fortified options.

By Packaging Analysis

Bags and pouches dominated the healthy snacks packaging market with a 41.8% share, attributed to their convenience, lightweight, and freshness preservation. These traits make them highly suitable for on-the-go consumption. Boxes, used mainly for cereals, bars, and baked goods, also play a critical role due to their durability and branding potential, which is particularly appealing to health-conscious consumers.

Meanwhile, cans, though less commonly used, are selected for their long shelf life and protective qualities, ideal for nuts, seeds, and certain fruit snacks. Jars, often made of glass or high-quality plastic, cater to the premium segment, favored for packaging gourmet items and aligning with the environmental values of consumers.

By Distribution Channel Analysis

Hypermarkets and supermarkets led the healthy snacks market distribution channels, holding a 44.2% share. These venues are preferred for their extensive product range and convenience. Meanwhile, convenience stores are integral for providing quick, accessible snack options to busy professionals and commuters. Specialty stores serve a niche market with products like organic and gluten-free snacks. Online retail has also expanded notably, favored for its convenience and the ability to compare products. Additional channels include vending machines in schools and offices, farmers markets, and subscription services, which are tailored to specific consumer preferences and locations.

Recent Development of the Healthy Snack Market

- In December 2022, Agthia, a food and beverage company based in the United Arab Emirates, announced that it had acquired a 60% stake in Abu Auf, an Egypt-based company that makes healthy snacks and coffee products. Tamiya Capital owns the remaining 10%, and the founders of Abu Auf retained a 30% stake.

- In August 2022, Mondelez International Inc., an American food- and beverage company, announced that it had completed its acquisition of Clif Bar & Company. Clif Bar & Company is a top provider of energy bars with organic ingredients in America. The acquisition increased Mondel’z International’s snack business value to over US$ 1 Billion.

Competitive Landscape

In the 2024 global healthy snack market, key players are pivotal in driving trends and expanding market share through innovative product offerings and strategic positioning. PepsiCo Inc. and Nestle S.A. are at the forefront, capitalizing on their extensive distribution networks and diversified product portfolios to meet increasing consumer demand for nutritious and convenient snacking options. Unilever PLC leverages its global presence to innovate in plant-based and sustainable snack solutions, appealing to health-conscious consumers worldwide.

Tyson Foods Inc. focuses on protein-rich snacks, catering to a growing demographic attentive to dietary protein intake. Meanwhile, Kellogg Company and B & G Foods Inc. are expanding their healthy snack lines, incorporating organic and non-GMO ingredients to enhance their appeal. Mondelēz International continues to dominate with its vast array of popular healthier snack brands, adapting to consumer preferences for both indulgence and nutrition.

Emerging players like Harvest Almond Snacks and Happytizers Pvt Ltd are carving out niches with unique, culturally inspired offerings, which resonate well with local tastes and preferences. Collectively, these companies are setting competitive benchmarks in the healthy snack industry, fostering a dynamic market environment conducive to growth and innovation.