Introduction

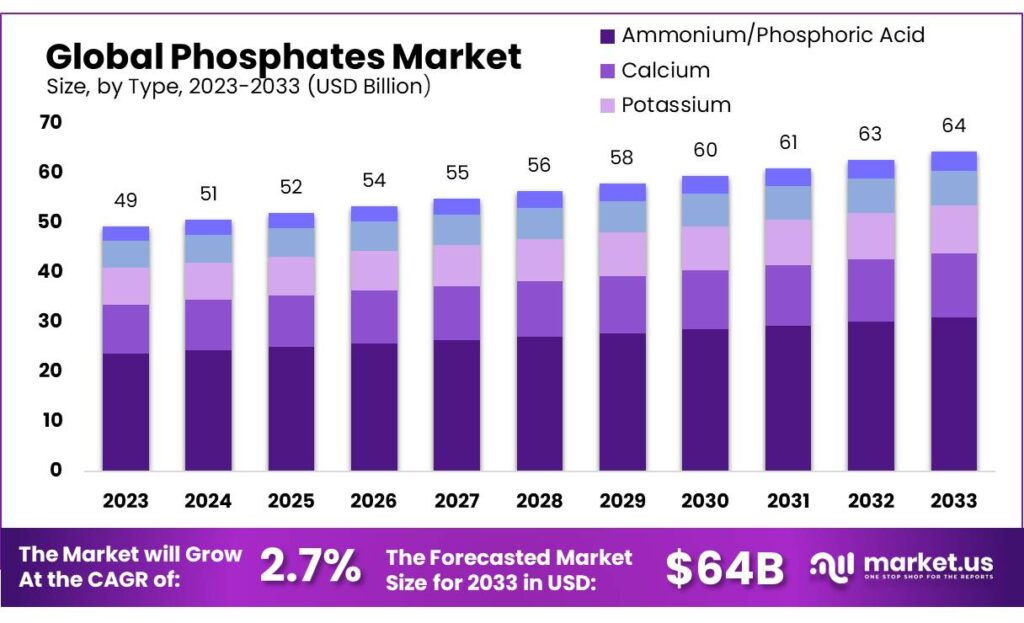

According to Market.us, The global Phosphates Market is set for steady growth, anticipated to expand from USD 49 Billion in 2023 to around USD 64 Billion by 2033, with a compound annual growth rate (CAGR) of 2.7%. This market’s growth is fueled by increasing applications across various industries, including agriculture, food processing, and water treatment.

Phosphates are crucial in agriculture for their role as fertilizers, which enhance soil fertility and crop yields. In the food industry, phosphates are used as additives that help in preserving the quality and safety of foods, acting as emulsifiers, stabilizers, and buffers. The demand for these applications is particularly strong in regions with intensive agricultural practices and growing food industries, such as Asia Pacific and North America.

Water treatment is another significant sector driving the demand for phosphates. They are used to prevent the build-up of scale and corrosion in pipes, which is essential for maintaining the efficiency of municipal and industrial water systems. This application is becoming increasingly important with the global push for more sustainable water management practices.

The phosphates market also benefits from technological advancements and expansions in production capacities by leading companies, which are enhancing their ability to meet global demand. For example, major market players have been actively increasing their production capabilities through strategic expansions and acquisitions to better serve their target markets.

Key Takeaway

- Phosphates Market size is expected to be worth around USD 64 billion by 2033, from USD 49 billion in 2023, growing at a CAGR of 2.7%.

- Ammonium/Phosphoric Acid held a dominant market position, capturing more than a 48.5% share.

- Industrial grade phosphates held a dominant market position, capturing more than a 57.8% share.

- Sedimentary Marine Deposits held a dominant market position, capturing more than a 64.5% share.

- Fertilizers held a dominant market position, capturing more than a 46.6% share.

- Dominating with a 47% market share, APAC’s phosphates market was valued at USD 23.6 billion.

Factors affecting the growth of the Phosphates Market

- Agricultural Demand: Phosphates are crucial in agriculture for their role in fertilizers that boost plant growth and yield, particularly important in regions with rapid population growth which drives the demand for food production.

- Industrial Applications: The use of phosphates extends beyond agriculture into various industrial applications such as metal treatment, water treatment, and the manufacturing of cleaning products. The growth in these industries, especially in emerging economies, supports the demand for phosphates.

- Technological Advancements: Improvements in phosphate mining and processing technology enhance efficiency and reduce costs, contributing to market growth.

- Environmental and Health Regulations: Stricter environmental regulations regarding nutrient runoff and water pollution can limit the use of phosphates. Additionally, health concerns related to excessive phosphate intake, particularly from food additives, may restrain market growth in certain sectors.

- Geopolitical Factors: The distribution of phosphate resources is uneven globally, which can lead to geopolitical issues affecting supply and price volatility.

- Consumer Preferences and Substitution: Increasing consumer awareness of the environmental and health impacts of phosphates is leading to a preference for products with lower or no phosphate content, driving the development of substitutes in detergents and other products.

Top Trends in the Global Phosphates Market

- Agricultural Demand: The predominant use of phosphates as fertilizers in agriculture continues to drive the market. With the global population growing, the demand for enhanced crop yields through effective fertilization is critical, making phosphates essential for agricultural productivity.

- Industrial Applications: Beyond agriculture, phosphates are increasingly utilized in various industrial processes. This includes their use in water treatment to prevent scale and corrosion, in food and beverages as stabilizers and preservatives, and in detergents where they enhance cleaning effectiveness by softening water.

- Environmental Focus: There is a rising trend of environmental awareness that is influencing the phosphates market. Regulations and consumer preferences are shifting towards more sustainable and less environmentally damaging practices, which is pushing innovation in phosphate applications and processing methods.

- Technological Advancements: Innovations in phosphate production and application technologies are leading to more efficient and environmentally friendly solutions. This includes advancements in mining practices and the development of new phosphate-based products for diverse industries.

- Geographical Expansion: The Asia-Pacific region is poised to dominate the phosphates market due to its substantial agricultural activities and industrial growth. Countries like China and India are leading consumers and producers, driven by their large populations and rapid economic development.

Market Growth

The global phosphates market is poised for steady growth, projected to rise from USD 49 Billion in 2023 to around USD 64 Billion by 2033, marking a compound annual growth rate (CAGR) of 2.7%. This growth is primarily driven by the high demand for phosphates in agricultural applications, where they are crucial for fertilizer production that enhances crop yields. Additionally, phosphates are extensively used in various industrial applications including water treatment, where they help prevent scale and corrosion, and in the food industry as preservatives and stabilizers.

The increasing population and consequent rise in food demand further stimulate the market, especially in regions with intensive agricultural activities such as Asia-Pacific, which is expected to dominate the market share. Technological advancements in phosphate mining and processing are also expected to contribute to the efficiency and environmental sustainability of phosphate production, supporting market growth across the globe.

Regional Analysis

The global phosphates market is dominated by Asia Pacific (APAC) with a 47% market share, valued at $23.6 billion. Countries like China and India contribute to the market due to their agricultural activities. North America, with advanced agricultural technologies and sustainable practices, also plays a crucial role. Europe’s stringent environmental regulations influence phosphate production, while the Middle East & Africa (MEA) region, with significant phosphate reserves, is a key exporter. Latin America’s expanding agricultural sector also contributes to the market growth.

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | USD 49 Billion |

| Forecast Revenue 2033 | USD 64 Billion |

| CAGR (2023 to 2033) | 2.7% |

| Asia Pacific Market Share | 47% |

| Base Year | 2023 |

| Historic Period | 2020 to 2022 |

| Forecast Year | 2023 to 2033 |

Market Drivers

The phosphates market is driven by government policies promoting sustainable agriculture, which in turn drives the demand for phosphate fertilizers. In the US, phosphate plays a crucial role in crop growth and soil fertility, and environmental conservation policies encourage its use. The global phosphates market benefits from international trade and agreements, such as OCP’s 2023 agreement with India.

Government and private sector investments in phosphate mining and processing technologies further expand the industry, boosting domestic productivity and enhancing the global supply chain for food security and sustainability.

Market Restraints

The phosphates market faces significant environmental challenges due to its role in water pollution and eutrophication. Phosphates contribute to nutrient pollution, disrupting ecosystems and affecting flora and invertebrates. Regulations controlling phosphate levels complicate market dynamics, affecting planning permissions and limiting development in sensitive areas.

Legal challenges and lawsuits are increasing scrutiny of phosphate mining and fertilizer production, leading to stricter regulations and increased operational costs. Environmental concerns also affect supply chain and market stability, with fear of overexploitation influencing market prices and stability. Supply disruptions can cause significant volatility, impacting global food security and agricultural productivity.

Opportunities

The sustainable phosphorus market, focusing on environmentally responsible phosphorus production and usage, is experiencing significant growth due to the increasing demand for sustainable solutions in agriculture and related industries. The market is driven by the growing trend towards responsible plant nutrition and environmental stewardship, as well as the circular phosphorus economy.

Regulatory support and technological innovations, such as green technologies and bio-based phosphorus sources, are also driving this growth. The economic recovery post-COVID-19 is also driving demand for sustainable phosphorus products, offering substantial economic opportunities for industry stakeholders.

Report Segmentation of the Phosphates Market

By Type

In 2023, Ammonium/Phosphoric Acid held a dominant market position, accounting for 48.5% of the market. Its use in agriculture, animal nutrition, healthcare, pharmaceuticals, and food processing is significant. Potassium phosphates are crucial in food processing, while sodium phosphates are used in detergents and cleaners. Their growth is driven by the need for effective cleaning products.

By Grade

Industrial grade phosphates, with a dominance of over 57.8% in 2023, are crucial in various industries like agriculture, manufacturing, and water treatment. They improve efficiency in metal finishing and cleaning processes. Food & Feed grade phosphates enhance food product quality and safety, while pharmaceutical grade phosphates are used in medical applications for dialysis treatment and intravenous solutions.

By Type of Resource

In 2023, Sedimentary Marine Deposits held a dominant market position, accounting for 64.5% of phosphates. Igneous & Weathered Rock sources, though less common, are crucial for phosphate availability. Biogenic sources, derived from bone deposits, provide a renewable phosphate source valued in organic farming practices.

By Application

In 2023, fertilizers held a dominant market position, accounting for over 46.6%. Phosphates are crucial in agriculture, disinfectants, food & beverages, water treatment chemicals, metal treatment, cosmetics & personal care, and pharmaceuticals. They enhance crop yields, improve water softening and cleaning, maintain product quality, prevent mineral deposits, protect metals from corrosion, enhance paint adhesion, and support product safety and performance.

Recent Development of the Phosphates Market

- Nutrien Ltd. played a prominent influence in the phosphate sector in 2023 by operating four regional product improvement facilities and two large integrated phosphate production facilities.

- A net income of USD 1.2 billion and diluted earnings per share (EPS) of USD 3.50 were attained by Mosaic. The company’s effective operational management and strategic positioning within the global phosphates market were demonstrated by the USD 2.8 billion adjusted EBITDA for the year.

Competitive Landscape

The competitive landscape of the global phosphates market is robust and features a mix of major players that contribute to its dynamic nature. Key companies such as Nutrien Ltd., The Mosaic Company, and YARA International are well-established leaders with significant market shares, primarily due to their extensive production capacities and global distribution networks. These companies are closely followed by EuroChem and Ma’aden-Saudi Arabian Mining Company, which also play critical roles in the production and supply of phosphates, especially in the Middle East and Europe.

Other notable players include PhosAgro, Jordan Phosphates Mines Company (PLC), and OCP Group, each maintaining a strong presence in specific regions and contributing to the global supply of phosphate fertilizers. Companies like Aditya Birla Chemicals and Israel Chemicals specialize in diversified chemical products, including phosphates used across various industrial applications.

Smaller yet significant contributors such as Innophos Holdings, Inc., Chemische Fabrik Budenheim KG, and Haifa Chemicals Ltd. focus on specialized segments of the phosphates market, such as food-grade phosphates and high-purity technical grades. These companies often lead in innovation and sustainability within their niches.

Additionally, regional players like Sichuan Blue Sword Chemical (Group) Co., Ltd., Hubei Xingfa Chemicals Group Co., Ltd., and Yichang Municipal Pacific Chemicals Co., Ltd (YMPCC) serve the expansive Asia-Pacific market, which is crucial due to its high demand driven by agricultural and industrial growth.