Introduction

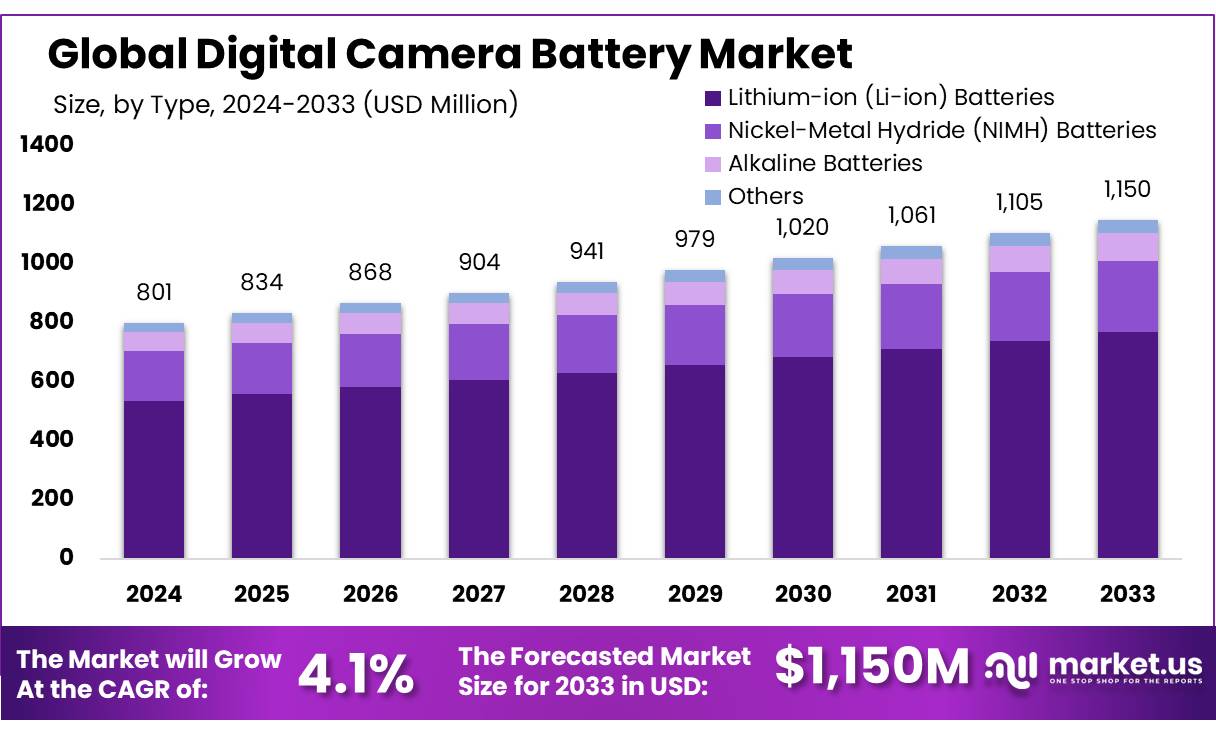

According to Market.us, The global Digital Camera Battery Market is poised for considerable growth over the next decade, expanding from USD 801 Million in 2023 to an expected USD 1150 Million by 2033, with a compound annual growth rate (CAGR) of 4.1%.

This market’s growth is driven by the increasing demand for digital cameras influenced by the rise in social media use and the resurgence of tourism, which fuels the need for durable and long-lasting camera batteries. Market expansion is further supported by technological advancements in battery technology, which enhance the performance and longevity of camera batteries. This includes innovations in lithium-ion batteries, which are predominant in the market due to their efficiency and capacity to hold a charge longer compared to other types.

The Asia-Pacific region is currently leading the market, driven by high internet penetration and a surge in digital camera usage for content creation on social media platforms. This trend is expected to continue, keeping Asia-Pacific at the forefront of market demand. Additionally, North America and Europe are also significant markets, with advancements in digital camera technologies and high consumer spending power boosting the demand for camera batteries.

Key Takeaway

- Digital Camera Battery Market size is expected to be worth around USD 1150 billion by 2033, from USD 801 Million in 2023, growing at a CAGR of 4.1%.

- Lithium-ion (Li-ion) batteries held a dominant market position, capturing more than a 67.4% share.

- DSLR cameras held a dominant market position, capturing more than a 33.3% share.

- 1000-2000mAh held a dominant market position, capturing more than a 37.2% share.

- Standard Batteries held a dominant market position, capturing more than a 72.2% share.

- Proprietary Chargers held a dominant market position, capturing more than a 62.6% share.

- Photography held a dominant market position, capturing more than a 54.3% share.

- Amateur Photographers held a dominant market position, capturing more than a 33.2% share.

- Online Retail held a dominant market position, capturing more than a 43.4% share.

- North America currently dominates the digital camera battery market, holding a significant 41.2% market share.

Factors affecting the growth of the Digital Camera Battery Market

- Technological Advancements: Innovations in battery technology, particularly the development of lithium-ion batteries, have significantly impacted the market. These batteries are favored for their long life and efficiency in power management. However, the challenge remains to extend their lifespan and reduce degradation over time, as these batteries tend to lose capacity after numerous charge cycles.

- Environmental Regulations: Stringent environmental regulations regarding the disposal and recycling of batteries influence market dynamics. Manufacturers are pushed to develop more eco-friendly batteries and improve recycling processes to comply with these regulations and address sustainability concerns.

- Market Demand for Cameras: The demand for various types of digital cameras, including SLR and pocket cameras, directly affects the digital camera battery market. As the popularity of these cameras increases, so does the demand for high-quality batteries that can provide longer operational times without frequent replacements.

- Economic Factors: Global economic conditions, including fluctuations in the cost of raw materials and changes in consumer spending power, can also impact the market. For instance, improved economic conditions and lower prices for lithium-ion batteries in certain regions are driving the market growth.

- Competitive Landscape: High competitive rivalry in the market compels companies to innovate and improve their offerings. The presence of major players like Canon, Nikon, and Sony, who not only produce cameras but also develop batteries, intensifies this competition. These companies continuously strive to enhance battery performance and capacity to maintain or increase their market share.

- Geographical Trends: Regional market dynamics also play a significant role. For example, the Asia Pacific region shows significant growth due to rapid urbanization, industrialization, and a high rate of adoption of digital technologies which drive the demand for digital camera batteries.

Top Trends in the Global Digital Camera Battery Market

- Advancements in Battery Technology: Manufacturers are focusing on developing batteries with higher energy density, faster charging capabilities, and longer life cycles. This includes innovations in lithium-ion batteries, which are predominant in the market due to their efficiency and capacity to hold a charge longer compared to other types.

- Shift Towards Mirrorless Cameras: The increasing popularity of mirrorless cameras, which are lighter, more compact, and offer better performance compared to traditional DSLRs, has led to a growing demand for high-capacity, lightweight batteries that are compatible with these advanced cameras. As mirrorless cameras gain more market share, battery manufacturers are developing specialized high-performance batteries to meet the growing power needs.

- Environmental Sustainability: With increasing environmental concerns, both consumers and manufacturers are shifting towards rechargeable batteries that offer longer life cycles and reduce the need for frequent replacements. This move is also aligned with global initiatives for sustainable energy and waste reduction.

- Integration of Smart Features: Batteries with smart charging capabilities, battery health monitoring, and energy optimization features are becoming more common. These smart batteries can communicate with cameras to manage power more efficiently, ensuring that users get the maximum battery life out of their devices. This trend is particularly evident in high-end professional cameras, where photographers require reliable and efficient power sources for prolonged use.

- Regional Market Growth: The Asia-Pacific region is leading the global camera battery market due to the presence of key manufacturers and a rising consumer base for digital cameras. Countries like China, Japan, and South Korea are major hubs for camera production, and this, in turn, boosts the demand for camera batteries. Moreover, the increasing use of drones for photography and videography in North America and Europe is another significant factor contributing to the market expansion.

Market Growth

The global Digital Camera Battery Market is projected to grow from USD 801 Million in 2023 to USD 1150 Million by 2033, exhibiting a compound annual growth rate (CAGR) of 4.1% during the forecast period. This growth is driven by the increasing demand for digital cameras, particularly among photography enthusiasts and professionals. Technological advancements in battery technology, such as the development of lithium-ion batteries with higher energy densities and longer life cycles, are also contributing to market expansion.

Additionally, the rising popularity of mirrorless cameras and action cameras, which require more durable and longer-lasting power sources, is further boosting the demand for high-performance camera batteries. Geographically, the Asia-Pacific region is leading the market due to the presence of key manufacturers and a growing consumer base for digital cameras. Countries like China, Japan, and South Korea are major hubs for camera production, which in turn boosts the demand for camera batteries.

Regional Analysis

North America leads the digital camera battery market with a 41.2% share, valued at USD 330.09 million. Europe follows closely, with high-quality digital photography devices in countries like Germany, the UK, and France. Asia Pacific is rapidly growing due to rising disposable incomes and expanding retail sectors. Middle East & Africa and Latin America are emerging markets with growing potential due to tourism, interest in photography, economic development, and internet penetration.

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | USD 801 Million |

| Forecast Revenue 2033 | USD 1150 Million |

| CAGR (2023 to 2033) | 4.1% |

| North America Market Share | 41.2% |

| Base Year | 2023 |

| Historic Period | 2020 to 2022 |

| Forecast Year | 2023 to 2033 |

Market Drivers

The US Department of Energy has allocated USD 3.5 billion to boost domestic battery production, a key factor in the digital camera battery market. The funding is part of the Biden-Harris Administration’s Investing in America agenda, aiming to increase domestic manufacturing of advanced batteries and reduce dependency on imported materials. The initiative also catalyzes innovation and research in battery technology, ensuring U.S. manufacturers can meet global demands for more efficient and durable batteries. The DOE’s investment supports the creation of high-quality, unionized jobs, contributing to a stronger economy and supporting the manufacturing sector’s growth.

Market Restraints

The rising cost of raw materials, particularly lithium and cobalt, is a significant restraining factor for the growth of the digital camera battery market. These materials are essential for lithium-ion batteries, and their high cost leads to increased production costs for battery manufacturers. This, in turn, limits the adoption of advanced, high-end camera batteries, especially in cost-sensitive markets. Environmental regulations also pose challenges, as they require manufacturers to comply with stringent recycling and disposal requirements, impacting profit margins and market expansion efforts.

Opportunities

The digital camera battery market is experiencing significant growth due to advancements in battery technology. This is driven by increased R&D efforts in material sciences, aiming to enhance the performance and efficiency of batteries used in digital devices. Lightweight, higher energy densities batteries are crucial for portable and user-friendly cameras. Rechargeable batteries are also being adopted due to environmental concerns. The demand for these advanced battery technologies is expected to rise further with the increasing popularity of digital cameras in various applications. Companies are investing in next-generation battery technologies to meet the evolving needs of the market.

Report Segmentation of the Digital Camera Battery Market

By Battery Type Analysis

In 2023, Lithium-ion batteries dominated the digital camera battery market with a 67.4% share, outperforming NiMH and Alkaline alternatives. Lithium-ion batteries are preferred due to their high energy density, long lifespan, and rechargeability. NiMH batteries are cost-effective and environmentally friendly, offering a balance between performance and price. Alkaline batteries, a smaller segment, are used in lower-end digital cameras and devices with low power output. However, their use is limited due to their disposable nature and lower energy efficiency compared to rechargeable alternatives.

By Camera Type Analysis

In 2023, DSLR cameras held a 33.3% market share, primarily due to their high image quality and versatility. Mirrorless cameras are gaining ground due to their compact size and lightweight design, offering similar image quality and less power consumption. Compact digital cameras, while declining due to smartphones, still hold a niche due to their ease of use and affordability. Action cameras, particularly in adventure and sports, are popular due to their rugged design and long-lasting batteries. 360-degree cameras, though holding the smallest market share, are emerging as a fascinating segment due to their ability to capture a full spherical view.

By Capacity Analysis

In 2023, batteries with capacities ranging from 1000-2000mAh held a dominant market share, capturing 37.2%. These batteries are popular due to their versatility, meeting power needs of both compact and higher-end digital cameras without adding significant weight or cost. They cater to a wide spectrum of users, from casual photographers to enthusiasts. The 2000-3000mAh capacity segment is crucial for demanding digital cameras, while the 3000mAh capacity segment is ideal for high-end cameras, such as professional-grade DSLRs and video cameras.

By Technology Analysis

In 2023, Standard Batteries held a dominant 72.2% market share in the digital camera battery market, favored for their reliability and cost-effectiveness. Smart batteries, with built-in indicators and management systems, gained popularity among tech-savvy photographers and professionals. These batteries offer features like charge level indicators, temperature control, and intelligent power management, enhancing battery life and user experience.

By Charging Analysis

In 2023, proprietary chargers dominated the market with a 62.6% share, ensuring optimal charging performance and safety for camera models. Professional photographers prefer proprietary chargers for compatibility and faster battery life. USB charging, a convenient alternative, gained popularity in consumer and mid-range camera markets due to its ease of use and universal availability. The trend towards USB-C standards is growing.

By Application Analysis

In 2023, photography held a dominant market share of 54.3%, encompassing both amateur and professional photography. This segment requires reliable and long-lasting batteries for extensive shoot sessions. Videography, driven by platforms like YouTube, TikTok, and Instagram, demands robust battery solutions for longer operational times and quick recharges. The Mixed Use segment includes digital cameras and batteries designed for both photography and videography, appealing to users who frequently switch between modes. While this segment holds a smaller share, its relevance is increasing as more consumers seek all-in-one devices for creative pursuits.

By End-User Analysis

In 2023, amateur photographers held a 33.2% market share, primarily due to their affordability and user-friendly cameras. Professional photographers, on the other hand, require high-performance, reliable batteries for intensive use in challenging environments. They demand batteries with extended life and rapid charging capabilities to avoid downtime during critical shooting moments. Prosumers, who bridge the gap between amateur and professional photographers, invest in higher-quality equipment with features like longer battery life and faster recharge times. Commercial/industrial users, including businesses and professionals, require high reliability, extended battery life, and environmental-friendly capabilities.

By Distribution Channel Analysis

In 2023, Online Retail dominated the market with 43.4% share, thanks to convenience and e-commerce platforms. Offline retail, including camera stores and electronics shops, remains vital for hands-on shopping experiences. Offline retail outlets offer personalized services and after-sales support, valued by amateur and professional photographers. Direct Sales through Original Equipment Manufacturers (OEM) is a targeted approach where camera manufacturers sell batteries directly to consumers.

Recent Development of the Digital Camera Battery Market

- With a significant market share in 2023, Canon Inc. is a major participant in the digital camera battery industry. The company shipped almost 3.3 million digital cameras that year, accounting for 46.5% of all sales.

- BowerUSA concentrated on offering affordable solutions in 2023 that were compatible with a variety of camera types and catered to both professional and hobbyist photographers.

Competitive Landscape

The Digital Camera Battery Market is characterized by a diverse range of companies, each contributing to the industry’s growth and innovation. Key players include BowerUSA, Canon Inc., Duracell Inc., Energizer Holdings Inc., Fujifilm, Nikon Corporation, Olympus Corporation, OM Digital Solutions Corporation, Panasonic Corporation, Phottix, ProMaster, RICOH Imaging Company Ltd., Samsung, SIGMA Corporation, and SONY ELECTRONICS INC.

These companies offer a variety of battery solutions tailored to different camera models and user needs. For instance, Canon, Nikon, and Sony not only manufacture cameras but also produce proprietary batteries designed to optimize the performance of their devices. Duracell and Energizer, renowned for their expertise in battery technology, provide reliable power options compatible with various camera brands. Specialized accessory manufacturers like Phottix and ProMaster focus on producing high-quality, third-party batteries and related accessories, catering to both amateur and professional photographers seeking cost-effective alternatives.

The competitive landscape is marked by continuous innovation, with companies striving to enhance battery life, reduce charging times, and improve overall efficiency. This competition drives technological advancements, resulting in better products for consumers. Additionally, the market is influenced by factors such as brand reputation, product reliability, and the ability to meet evolving consumer demands, including the need for environmentally friendly and sustainable battery solutions.