Introduction

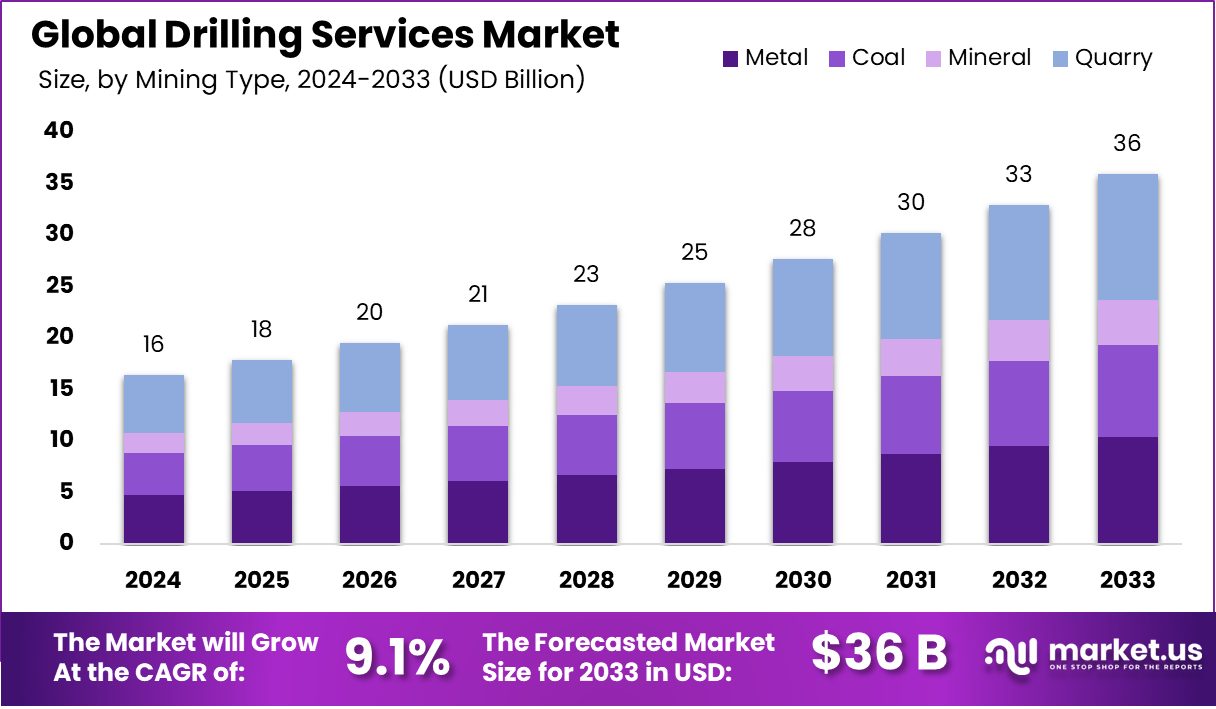

According to Market.us, The global Drilling Services Market is poised for substantial growth over the next decade. From a market size of USD 16.4 Billion in 2023, it is expected to expand to approximately USD 36.0 Billion by 2033, growing at a compound annual growth rate (CAGR) of 9.1%.

This growth is primarily driven by the increasing demand for energy, particularly in oil and gas sectors, which continues to stimulate exploration and drilling activities worldwide. Several factors contribute to the market’s expansion. Technological advancements in drilling techniques, such as directional and horizontal drilling, are improving drilling efficiency and accuracy, making it possible to access previously unreachable reserves.

Additionally, the rising global energy consumption demands more extensive exploration and production efforts, further bolstering the drilling services market. North America is expected to remain a dominant force in the global market, supported by advanced drilling technologies and significant investments in regions like the Permian Basin, which is known for its shale deposits.

The Asia Pacific region is also showing considerable growth potential due to its increasing energy needs and rapid industrialization, which demands more energy resources. The market also sees significant developments from key industry players who are continuously innovating and expanding their service offerings to cater to the growing market demands. Companies like Halliburton, Schlumberger, and Baker Hughes are notable for their contributions to the market through advanced technologies and strategic global operations.

Key Takeaway

- The Global Drilling Services Market is expected to be worth around USD 36.0 Billion by 2033, up from USD 16.4 Billion in 2023, and grow at a CAGR of 9.1% during the forecast period from 2024 to 2033.

- Metal dominated the Open Pit Drilling Services Market with a 29.4% share.

- Directional Drilling dominated with 56.4% of the Drilling Services Market.

- Onshore dominated the Drilling Services Market with a 56.2% share by application.

- The Oil & Gas sector dominated the Drilling Services Market with a 63.3% share.

- The APAC region leads the global drilling services market with a 38% share valued at USD 6.2 billion.

Factors affecting the Growth of the Drilling Services Market

- Global Energy Demand: As the world’s need for energy continues to rise, there’s an increased demand for oil, gas, and minerals. This drives more exploration and drilling activities to meet consumption needs.

- Technological Advancements: Innovations in drilling technologies, such as directional drilling and real-time data monitoring, have enhanced efficiency and reduced costs. These advancements make it feasible to access previously hard-to-reach reserves, boosting market growth.

- Commodity Prices: Fluctuations in oil, gas, and mineral prices directly impact drilling activities. Higher prices can lead to increased exploration, while lower prices may result in reduced drilling operations.

- Environmental Regulations: Stricter environmental laws and sustainability concerns can affect drilling operations. Companies may need to invest in cleaner technologies or face operational restrictions, influencing market dynamics.

- Investment in Exploration: Capital investment in exploration projects is crucial. Economic conditions and investor confidence determine the availability of funds for new drilling ventures.

- Geopolitical Factors: Political stability in resource-rich regions affects drilling activities. Conflicts or policy changes can disrupt operations, while stable environments encourage investment.

- Resource Depletion: As easily accessible reserves dwindle, companies are compelled to explore more challenging environments, such as deepwater or unconventional reserves, impacting the demand for specialized drilling services.

- Environmental Concerns: Growing awareness of environmental impacts leads to stricter regulations and a push for sustainable practices, affecting how drilling services operate.

Top Trends in the Global Drilling Services Market

- Technological Advancements: Innovations such as directional drilling and real-time data monitoring are enhancing efficiency and accuracy in drilling operations. These technologies enable access to previously unreachable reserves, reducing costs and environmental impact.

- Increased Offshore Exploration: There’s a growing focus on offshore drilling, particularly in deepwater and ultra-deepwater regions, due to the depletion of onshore reserves. This shift is driving demand for specialized drilling services capable of operating in challenging marine environments.

- Sustainability and Environmental Concerns: The industry is under pressure to adopt more sustainable practices. This includes reducing carbon emissions and minimizing ecological footprints, leading to the development of greener drilling technologies and methods.

- Digitalization and Automation: The integration of digital technologies, such as the Internet of Things (IoT) and artificial intelligence (AI), is streamlining drilling operations. Automation enhances safety, reduces human error, and improves overall operational efficiency.

- Market Consolidation: There’s a trend towards mergers and acquisitions among drilling service companies. This consolidation aims to combine resources, expand service offerings, and increase market share in a competitive environment.

- Focus on Unconventional Resources: The exploration of unconventional resources like shale gas and tight oil is on the rise. This requires advanced drilling techniques and services, opening new opportunities for specialized providers.

- Geopolitical Influences: Political stability and regulatory policies in resource-rich regions significantly impact drilling activities. Companies are adapting strategies to navigate these geopolitical factors effectively.

Market Growth

The global Drilling Services Market is expected to see strong growth in the coming years, expanding from USD 16.4 Billion in 2023 to approximately USD 36.0 Billion by 2033. This represents a compound annual growth rate (CAGR) of 9.1% during the forecast period. The rise in demand for energy, particularly oil and gas, is a major driver for this growth. As global energy consumption increases, companies are investing heavily in exploration and drilling activities to meet the demand.

Additionally, advancements in drilling technologies, such as horizontal and directional drilling, are making operations more efficient and cost-effective. These innovations enable the extraction of resources from challenging environments like deepwater or shale formations.

Regions such as North America and the Asia-Pacific are leading the market, with significant contributions from areas like the Permian Basin and offshore fields in Southeast Asia. The need for sustainable energy practices and the exploration of unconventional resources like shale gas further boost the market.

Regional Analysis

The Asia Pacific (APAC) region dominates the global drilling services market, with a 38% share valued at USD 6.2 Billion. This is due to offshore drilling activities and energy exploration investments. North America follows, with technological advancements and oil reserves. Europe’s growth is moderate due to environmental regulations and renewable energy.

Middle East & Africa (MEA) has rich petroleum reserves and is growing due to onshore and offshore developments. Latin America, particularly Brazil and Venezuela, is attracting foreign investments to explore pre-salt reserves. These regions have distinct market dynamics and growth potentials.

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | USD 16.4 Billion |

| Forecast Revenue 2033 | USD 36.0 Billion |

| CAGR (2024 to 2033) | 9.1% |

| Asia Pacific (APAC) Market Share | 38% |

| Base Year | 2023 |

| Historic Period | 2020 to 2022 |

| Forecast Year | 2024 to 2033 |

Market Drivers

The global Drilling Services Market is driven by the increasing demand for energy, which is expected to rise by up to 50% by 2050. Technological advancements in drilling technologies, such as automated rigs and real-time data monitoring, have enhanced efficiency and reduced environmental impact, making previously uneconomical reserves viable. Investment in offshore exploration is crucial, as it taps into new and untapped reserves.

The development of unconventional resources, such as shale gas and tight oil, has broadened the market scope, accounting for 70% of total oil and gas production in the United States. Onshore drilling remains cost-effective, as it requires lower capital investment and operational costs, making it an attractive option for producers in low-price oil environments. This cost advantage maintains the competitiveness of drilling services in onshore settings and allows for quicker setup and production start.

Market Restraints

Oil price volatility significantly restrains the Drilling Services Market, as it impacts investment decisions and discourages long-term planning. The shift towards renewable energy sources, such as wind, solar, and hydroelectric power, is also reshaping the energy market landscape. Environmental regulations, such as pollution and habitat disruption, increase operational costs and project timelines, limiting market expansion in ecologically sensitive areas.

Technological challenges include developing high-efficiency, low-cost drilling technologies, but the high cost of research and development and the risk of unproven technologies can restrain market growth. Health and safety concerns in drilling operations also present restraints, as stringent safety protocols can increase operational costs and reduce efficiency. These factors contribute to the market’s instability and potential decline in market growth rates.

Opportunities

The global Drilling Services Market is expected to grow due to the expansion of unconventional resources, digitalization, and automation. The demand for specialized services to exploit these resources is expected to rise, offering opportunities for service providers with the necessary technology. The rise in deepwater drilling projects and increased investment in renewable energy sources are also driving market growth.

Additionally, enhancing safety and environmental sustainability is a priority, with drilling service providers investing in technologies to reduce environmental impact and improve safety protocols. These factors are expected to provide a competitive edge in the market.

Report Segmentation of the Drilling Services Market

By Mining Type

In 2023, Metal held the dominant market position in the Open Pit Drilling Services Market, accounting for 29.4% of the market. This is due to increased demand for metals in industries like electronics and construction, and the efficiency and cost-effectiveness of open pit mining methods. Coal, despite global shifts towards renewable energy, remains crucial in energy production, particularly in developing economies.

By Drilling Type

In 2023, Directional Drilling held a dominant market position in the Drilling Services Market, capturing 56.4% of the share. This method is preferred for its precision and efficiency in reaching oil and gas reserves, outpacing traditional vertical drilling techniques. It’s preferred for accessing difficult-to-reach reservoirs, optimizing extraction, and reducing environmental impact.

By Application

In 2023, Onshore dominated the Drilling Services Market with a 56.2% share, largely due to lower operational costs, logistical complexities, and technological advancements. Offshore drilling, on the other hand, faces challenges due to high investment and technological requirements. The market’s competitive landscape is shaped by geopolitical factors, regulatory frameworks, and advancements in drilling technologies, affecting the future growth potential of each segment.

By End-use

In 2023, the Oil & Gas sector held a dominant market share of 63.3% in the Drilling Services Market, driven by exploration and production in unconventional and offshore oil reserves. The mining industry also plays a significant role, utilizing drilling services for mineral exploration and extraction. Water exploration, a vital sector, is influenced by technological innovations and environmental concerns.

Recent Development of the Drilling Services Market

- In order to increase service life and lower drilling costs per meter, Sandvik unveiled the “Golden Shank,” a new anti-corrosion coating for drill shanks, in February 2024. In underground mines, where corrosive water is employed as a cleansing medium, this technology is designed to endure extreme circumstances.

- A cooperation agreement for drilling activities in the Athabasca Basin in northern Saskatchewan was signed in November 2023 by Team Drilling LP and Des Nedhe Development, which is affiliated with the English River First Nation. With the possibility of expansion to other projects inside the English River First Nation’s ancestral lands, this agreement primarily relates to the Wheeler River Project and the McArthur River Project.

Competitive Landscape

The Drilling Services Market is characterized by a diverse and competitive landscape, featuring a mix of multinational corporations and specialized firms. Key players include industry giants such as Schlumberger, Halliburton, Baker Hughes, and Weatherford, which offer comprehensive drilling solutions and have a significant global presence. These companies are known for their extensive service portfolios and advanced technological capabilities.

In addition to these major corporations, the market comprises specialized companies that focus on niche areas within drilling services. For instance, Gyrodata, Stockholm Precision Tools AB (SPT), and Icefield Tools Corporation are recognized for their expertise in directional drilling and measurement-while-drilling (MWD) technologies. Similarly, Devico AS and Brownline specialize in borehole surveying and directional core drilling services.

Other notable companies include Axis Mining Technology, Scientific Drilling, and Inertial Sensing One AB, which provide advanced downhole navigation and measurement solutions. Nabors Industries and National Oilwell Varco are prominent for their drilling equipment and rig services, while TechnipFMC and Oceaneering offer integrated solutions, particularly in offshore drilling operations.

Regional players such as China Oilfield Services Limited and AlMansoori Specialized Engineering cater to specific markets, leveraging local expertise and resources. Companies like AnTech and Compass Directional Guidance, Inc. focus on specialized drilling tools and technologies, contributing to the market’s innovation landscape.

The competitive environment is further enriched by firms like Archer – the well company, Superior Energy Services, Petrofac, Huracan Pty Ltd., Leam Drilling Systems LLC, NewTech Services, Unitech Drilling Company Limited, DIDRILLSA LTDA, VES Survey International, and Drill Tech Solution, each bringing unique services and solutions to the industry.