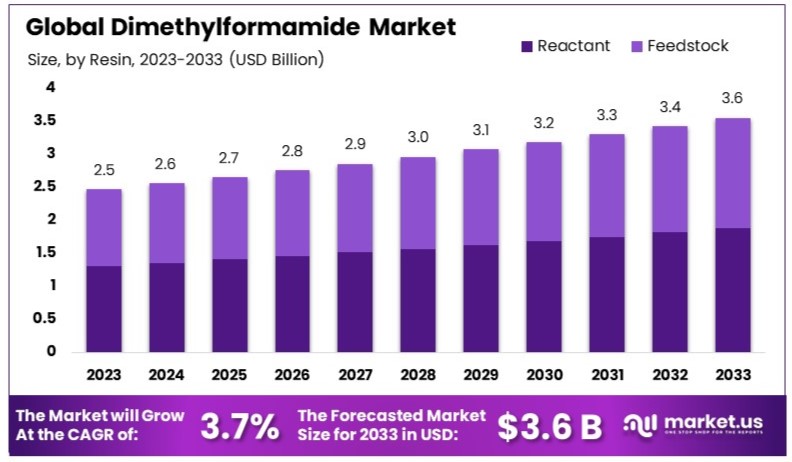

According to Market.us, The Global Dimethylformamide Market size is expected to be worth around USD 3.6 Billion by 2033, from USD 2.5 Billion in 2023, growing at a CAGR of 3.7% during the forecast period from 2024 to 2033. The Dimethylformamide (DMF) market is primarily driven by its extensive use in chemical and pharmaceutical manufacturing, where it serves as a versatile solvent due to its excellent solvation properties. The growth of the DMF market can be attributed to increasing demands in the production of pharmaceuticals and acrylic fibers. Moreover, DMF is integral in developing pesticides, adhesives, and synthetic leathers, further amplifying its market demand.

Asia-Pacific holds the largest share globally, bolstered by robust industrial growth in China and India. However, stringent environmental regulations concerning DMF’s toxicity and potential environmental impact pose challenges to market expansion. Nevertheless, advancements in recycling technologies and the development of bio-based alternatives will likely offer new opportunities for sustainable growth within the DMF market.

Key Takeaway

- The Global Dimethylformamide Market was valued at USD 2.5 billion in 2023 and is expected to reach USD 3.6 billion by 2033, with a CAGR of 3.7%.

- Reactant type holds a major share of 53%, crucial in various chemical reactions.

- Chemicals dominate end-use industries with 46.2%, integral to the global chemical sector.

- APAC holds the dominant market share of 47.6%, equivalent to USD 1.17 billion, driven by expanding industrial applications.

Factors affecting the growth of the Dimethylformamide Market

- Industrial Demand: The demand for DMF is closely linked to the health of various industrial sectors such as pharmaceuticals, agrochemicals, and the manufacture of synthetic fibers, particularly acrylic.

- Regulatory Impact: DMF’s classification as a hazardous chemical in many countries leads to stringent regulations regarding its handling, use, and disposal. These regulations can restrict growth by increasing production costs and limiting its use in certain applications.

- Technological Advancements: Innovations in production technology that improve the efficiency or reduce the environmental impact of DMF production can stimulate market growth. Additionally, advancements in recycling technologies may mitigate environmental concerns and regulatory impacts.

- Environmental Concerns: There is growing awareness of the environmental and health impacts of chemical solvents like DMF. This has led to increased research into and demand for safer, more sustainable solvent alternatives, which could potentially erode DMF’s market share.

- Economic Conditions: The global economic climate affects industrial production and investment in the sectors that use DMF. Economic downturns can reduce demand, while growth phases can enhance it.

- Supply Chain Dynamics: Volatility in the supply of raw materials necessary for DMF production can affect market stability and prices, influencing overall market growth.

Top Trends in the Global Dimethylformamide Market

- Increased Use in Pharmaceuticals: DMF is extensively used as a solvent in pharmaceutical manufacturing, particularly in the production of synthetic peptides and other complex chemicals.

- Shift Towards Sustainable Solvents: Environmental concerns and regulatory pressures are prompting a shift towards greener, more sustainable chemical processes. This trend is leading to the development and adoption of bio-based and less toxic solvent alternatives to DMF, impacting its traditional market spaces.

- Recycling Technologies: Advances in recycling and recovery technologies for solvents like DMF are gaining traction. These technologies not only reduce the environmental impact but also lower the costs associated with solvent consumption and compliance with environmental regulations.

- Expansion in Developing Regions: Rapid industrialization in Asia-Pacific, particularly in China and India, is a significant trend. These regions are experiencing heightened activity in industries that use DMF extensively, such as in the production of acrylic fibers and plastics.

Market Growth

The Dimethylformamide (DMF) market is projected to experience steady growth, driven by its indispensable role across various industrial sectors. Key factors propelling this growth include the expanding pharmaceutical industry, where DMF is crucial for the synthesis of drugs, and the rising demand from the chemical and textile industries, particularly in emerging markets like Asia-Pacific.

The market’s expansion is further supported by the ongoing economic development in these regions, leading to increased industrial activities that require high-performance solvents such as DMF. While environmental concerns and regulatory pressures pose challenges, ongoing innovations in solvent recycling and processing technologies are likely to mitigate these impacts, providing avenues for sustainable growth. Overall, the DMF market is expected to maintain a positive growth trajectory, adapting to evolving industrial demands and regulatory landscapes.

Regional Analysis

The Asia-Pacific (APAC) region dominates the global dimethylformamide market with a 47.6% share, totaling USD 1.17 billion, propelled by rapid industrialization in China and India, favorable policies, and foreign investments. North America follows with a 22% share or USD 540 million, driven by demand in the pharmaceutical and chemical sectors, supported by advanced manufacturing and environmental standards.

Europe holds an 18% share, equivalent to USD 441 million, with its robust pharmaceutical industry and focus on sustainability. The Middle East and Africa represent a 7% market share, about USD 171 million, fueled by chemical industry growth and infrastructure development. Lastly, Latin America has a 5.4% share, valued at USD 135 million, influenced by industrialization and sector expansion.

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | USD 2.5 Billion |

| Forecast Revenue (2033) | USD 3.6 Billion |

| CAGR (2024 to 2033) | 3.7% |

| Asia Pacific Market Share | 47.6% |

| Base Year | 2023 |

| Historic Period | 2020 to 2022 |

| Forecast Year | 2024 to 2033 |

Market Drivers

- Industrial Expansion: Growing industrial activities in pharmaceuticals, chemicals, and textiles, particularly in emerging economies, significantly drive DMF demand.

- Pharmaceutical Applications: DMF’s role as a solvent in drug manufacturing, especially for synthesizing peptides and other complex pharmaceuticals, fuels its market growth.

- Technological Advancements: Innovations in production and recycling technologies improve DMF’s efficiency and environmental footprint, boosting its adoption.

- Economic Growth: Economic development in key regions leads to increased industrial output and, consequently, greater demand for industrial solvents like DMF.

- Versatility of Use: DMF’s effectiveness as a solvent across various applications, including plastics and synthetic fibers, contributes to its sustained demand.

Market Restraints

The growth of the Dimethylformamide (DMF) market faces several restraints, predominantly due to its environmental and health impacts. Stringent global regulations aimed at reducing the use of hazardous chemicals significantly challenge DMF’s market expansion. The classification of DMF as a potential human carcinogen necessitates strict handling and usage protocols, increasing operational costs and limiting its applicability in various industries.

Moreover, the rising environmental awareness and the subsequent shift toward greener, more sustainable solvent alternatives further erode DMF’s market share. Additionally, the volatility in raw material prices can lead to fluctuations in DMF production costs, posing financial challenges for manufacturers. These factors collectively hinder the DMF market’s growth trajectory, impacting both its global demand and supply dynamics.

Opportunities

The global dimethylformamide (DMF) market is experiencing substantial growth, driven by its essential role in the production of acrylic fibers and plastics. As a solvent, DMF is pivotal in the manufacture of polyurethane-based coatings and adhesives, which are increasingly in demand in the automotive and construction industries. The electronics sector also presents significant opportunities due to DMF’s application in the production of circuit boards and electronic components. Asia-Pacific dominates the market, attributed to its expanding industrial base and increasing economic activities, particularly in China and India. However, stringent environmental regulations regarding solvent emissions are prompting innovation in recycling technologies and green solvents, which could reshape the market landscape. Companies positioned to leverage these shifts can capture new growth avenues and enhance their market presence.

Report Segmentation of the Dimethylformamide Market

By Resin Analysis

The Dimethylformamide (DMF) market is segmented by resin, with the Reactant sub-segment accounting for a dominant 53% share, primarily due to its critical role in chemical synthesis and production. DMF is indispensable in the pharmaceutical industry for manufacturing active pharmaceutical ingredients (APIs) and other medicinal compounds, including antibiotics and painkillers. The growing demand for medications and new drug development further propels this segment.

Additionally, in the agrochemical sector, DMF’s utility in producing pesticides and herbicides supports agricultural productivity, responding to the needs of an expanding global population. Although the Feedstock sub-segment is less dominant, it is vital for producing chemicals and polymers used in the textile and automotive industries, underscoring DMF’s broad applicability and importance across multiple sectors.

By End-use Industry Analysis

The Chemicals industry holds a dominant 46.2% share in the Dimethylformamide (DMF) market due to its extensive use in manufacturing processes. DMF, a critical solvent and reactant, is integral in producing pharmaceuticals, agrochemicals, and specialty chemicals, driven by its exceptional solvency properties. Additionally, the Electronics industry heavily utilizes DMF for manufacturing semiconductors and circuit boards, supported by rising demand for advanced electronic devices.

In the Pharmaceutical sector, DMF is essential for synthesizing active pharmaceutical ingredients, contributing to its market growth. The Agrochemical industry also benefits from DMF in producing pesticides and herbicides, necessary for increasing agricultural productivity. Other sectors, like Textiles and Automotive, use DMF for producing polyurethane and acrylic fibers, bolstering its market presence.

Recent Development of the Dimethylformamide Market

- November 2022: Yuanfar Chemical, based in Jiujiang City, Jiangxi Province, announced plans to increase its domestic DMF production capacity by 100,000 tons, bringing the total capacity to nearly 800,000 tons. This expansion aims to meet the increasing demand for DMF in industrial processes.

- 2023: BASF SE reported a revenue of approximately USD 88.65 billion. The company’s strong performance in the chemical sector, including DMF production, significantly contributed to its overall revenue growth.

Competitive Landscape

In 2024, the global Dimethylformamide (DMF) market is poised for significant growth, driven by its extensive applications across industries such as pharmaceuticals, textiles, and electronics. Key players are strategically positioning themselves to capitalize on this demand.

BASF SE continues to leverage its robust chemical manufacturing capabilities to maintain a strong market presence. Balaji Amines and Belle Chemical are focusing on expanding their production capacities to meet the rising global demand. Chemanol is investing in research and development to enhance product quality and application versatility. Eastman Chemical Company is diversifying its product portfolio to cater to a broader range of industrial applications.

Jiutian Chemical Group Ltd. and Luxi Group are strengthening their distribution networks to increase market penetration. Mitsubishi Gas Chemical Company Inc. is emphasizing sustainable production practices to align with environmental regulations. Pon Pure Chemicals Group is enhancing its global supply chain to ensure timely delivery. Shandong Hualu-Hengsheng Chemical Co., Ltd. is focusing on technological advancements to improve production efficiency.