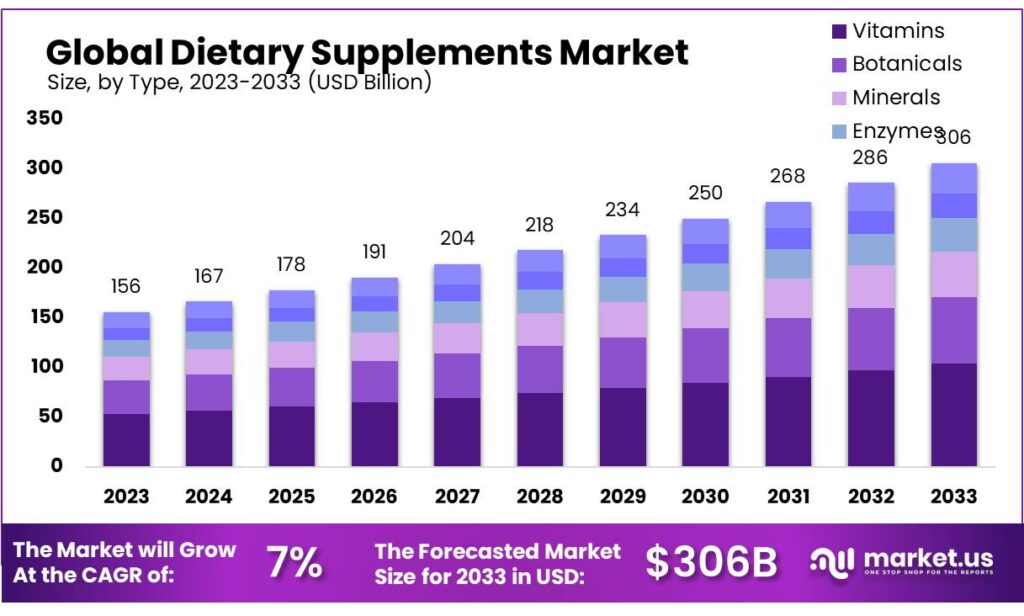

According to Market.us, The Global Dietary Supplements Market size is expected to be worth around USD 306 billion by 2033, from USD 156 billion in 2023, growing at a CAGR of 7.0% during the forecast period from 2023 to 2033. This expansion is driven by rising health consciousness, an aging population, and a growing interest in preventive healthcare. There is a notable surge in demand for products that cater to general health, energy and weight management, and immune support.

The market is witnessing a shift towards natural and organic products, with consumers preferring supplements made from whole food sources over synthetic ones. Personalization and customization of supplements tailored to individual health goals and needs are also becoming increasingly popular.

Regionally, Asia Pacific is poised for the fastest growth due to increased health awareness and rising consumer spending on health products. In contrast, North America and Europe continue to expand steadily with a focus on wellness and preventive measures supported by a regulatory framework that ensures the quality and safety of dietary supplements.

Key Takeaway

- The Dietary Supplements Market is projected to reach USD 306 billion by 2033, growing at a CAGR of 7.0% from 2023’s USD 156 billion.

- Vitamins led the market in 2023, capturing over 34.5% share, driven by rising consumer awareness of nutritional deficiencies.

- Tablets dominated the market form-wise with a 21.2% share in 2023, valued for convenience and precise dosage.

- Additional Supplements: This segment held the largest market share, meeting consumer demand for added nutritional benefits, comprising over 34.4% in 2023.

- Energy & Weight Management: The leading application segment in 2023, capturing over 32.4% share, reflecting consumer focus on a healthy lifestyle.

- Infant Market Dominance: In 2023, the infants’ segment held the largest market share, accounting for over 34.5%, driven by demand for convenient and nutritious meals.

- Offline channels dominated with over 78.3% market share in 2023, favored for traditional retail experiences like supermarkets.

Multivitamins are the most commonly used dietary supplements in the US, with over 50% of adults reporting their use.

Factors affecting the growth of the Dietary Supplements Market

- Increased Health Awareness: The rising awareness of health and wellness among consumers globally drives the demand for dietary supplements.

- Aging Population: An aging global population is a significant driver of the dietary supplements market. Older adults are increasingly turning to dietary supplements to help manage age-related conditions and improve their quality of life.

- Preventive Healthcare: There is a growing trend towards preventive healthcare, where individuals use dietary supplements to prevent chronic diseases and maintain health. This shift is supported by both medical advice and consumer health consciousness, further bolstered by the increasing availability of scientific research supporting the efficacy of certain supplements.

- Innovation and Product Availability: Technological advancements in production processes have led to the development of a wide range of dietary supplement products, including organic, non-GMO, and allergen-free options, which cater to a broad spectrum of consumer preferences and dietary restrictions.

- Regulatory Support: In many markets, regulatory frameworks are becoming more supportive of dietary supplements, although the degree and nature of regulation vary significantly by region.

- E-commerce Growth: The expansion of e-commerce has significantly impacted the dietary supplements market. Online sales channels provide consumers with easy access to a vast array of products, often at competitive prices, with the added convenience of direct-to-home shipping.

- Personalization and Customization: There is an increasing demand for personalized nutritional supplementation driven by consumer desires for products tailored to their specific health needs and conditions.

Top Trends in the Global Dietary Supplements Market

- Expansion of Personalized Nutrition: There is a growing demand for personalized dietary supplements tailored to individual health needs, dietary preferences, and genetic profiles. Companies are leveraging advances in technology and genomics to develop customized product offerings that cater to specific consumer requirements.

- Rise in Plant-Based Supplements: The shift towards plant-based diets has extended into the dietary supplements market, with an increasing number of consumers opting for herbal and plant-based products. This trend is supported by the perception of these supplements as ‘cleaner’ and more sustainable compared to their synthetic counterparts.

- Innovations in Formulation and Delivery Systems: Advances in formulation technologies are enabling the development of novel dietary supplements with improved bioavailability and convenience. Innovations such as nanoencapsulation and time-release capsules are enhancing the effectiveness and consumer appeal of these products.

- Integration of Digital Tools: The integration of digital tools, including mobile apps and wearable devices, is facilitating the tracking of health metrics and the personalized recommendation of dietary supplements. This trend is fostering a more integrated approach to personal health management.

Market Growth

The dietary supplements market has experienced significant growth in recent years, driven by increasing health awareness and a rising prevalence of chronic diseases. Factors such as an aging population, a growing fitness trend among all age groups, and a surge in consumer interest in preventative healthcare contribute to this upward trend. Additionally, the demand for supplements containing vitamins, minerals, and herbal extracts is increasing, fueled by consumers seeking to boost immunity, especially in the wake of the COVID-19 pandemic. Innovations in product formulations, coupled with effective marketing strategies, are also key contributors to the market’s expansion. North America and Asia-Pacific are particularly dynamic regions, showing robust growth in this sector.

Regional Analysis

The Asia Pacific region dominates the global ready meals market with a commanding 27% share, driven by escalating demand in healthcare, food services, and convenience sectors. The rapid expansion of the food industry and heightened consumer awareness are fueling this growth. Key contributors include China, India, Japan, South Korea, Australia, and New Zealand, all of which are experiencing increased production and consumption of ready meals.

In North America, the market is growing significantly, propelled by economic advancements and a preference for convenient, healthy meal options, especially in the United States and Canada.

Europe is also seeing robust growth, spurred by demand in food retail, catering, and hospitality sectors. The region’s emphasis on convenience foods to complement busy lifestyles is enhancing the uptake of ready meals, making Europe a pivotal player in this industry.

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | USD 156 Billion |

| Forecast Revenue (2033) | USD 306 Billion |

| CAGR (2024 to 2033) | 7.0% |

| Asia Pacific Market Share | 27% |

| Base Year | 2023 |

| Historic Period | 2020 to 2022 |

| Forecast Year | 2024 to 2033 |

Market Drivers

The dietary supplements market is driven by several key factors. Increasing consumer awareness of health and wellness significantly propels the demand for dietary supplements. An aging global population and rising incidences of chronic diseases have also accelerated the market’s growth, as individuals seek preventive healthcare measures and lifestyle-related disease management through supplements. The expansion of distribution channels, particularly online platforms, enhances accessibility and convenience for consumers, further boosting market penetration.

Additionally, the growing fitness trend worldwide supports the surge in demand for sports nutrition supplements. Regulatory support for safe and effective products also contributes positively to market expansion. However, market growth is moderated by the scrutiny of regulatory bodies, which ensures compliance and safety in supplement manufacturing and claims.

Market Restraints

The dietary supplements market faces several constraints that hinder its growth. Regulatory hurdles are prominent, with stringent government policies and approval processes creating significant barriers to entry and product launches. Consumer skepticism regarding the efficacy and safety of these products also impacts market expansion.

Additionally, the market is affected by the challenge of adulteration and the presence of counterfeit products, which undermines consumer trust and poses health risks. Global supply chain disruptions, often caused by geopolitical tensions or pandemics, further restrict market growth by impacting ingredient sourcing and distribution. Moreover, intense competition from pharmaceutical alternatives and other wellness products can divert consumer spending away from dietary supplements. Together, these factors can significantly restrain the market’s growth trajectory.

Opportunities

The global dietary supplements market presents significant growth opportunities driven by increasing health awareness and aging populations. There is a rising demand for supplements that support immune health, weight management, and overall wellness. The market’s expansion is further fueled by the growing preference for plant-based and organic products, reflecting a shift towards natural and sustainable health solutions. Technological advancements in production and distribution channels have also enabled wider market reach and customization of supplements, catering to individual health needs and preferences.

Additionally, the entry of pharmaceutical and food & beverage companies into the supplements space is creating a dynamic competitive landscape, offering numerous investment and collaboration opportunities. This trend is poised to continue, as consumer health consciousness and preventive healthcare measures are increasingly prioritized.

Report Segmentation of the Dietary Supplements Market

By Type Analysis

In 2023, the vitamins segment emerged as the leader in the Ready Meals market, accounting for over 34.5% of the market share. This dominance is driven by heightened consumer awareness of nutritional deficiencies and a demand for convenient, nutrient-dense meals. The segment’s growth is further bolstered by the strategic enrichment of ready meals with vitamins to enhance their health benefits.

The botanicals segment, though smaller, is gaining traction due to its natural health advantages and flavor contributions to ready meals. Following closely, the minerals segment capitalizes on the shifting consumer preference toward diets enriched with minerals that support bone health and immune function.

The enzymes and probiotics segments, known for their digestive and gut health benefits, also play significant roles in the market. Together, these segments underscore the industry’s commitment to innovation and catering to the evolving preferences for convenient, health-focused meal options.

By Form Analysis

In 2023, the Ready Meals market saw tablets leading with over a 21.2% share due to their convenience, precise dosage, and long shelf life. Capsules also performed strongly, favored for their ease of ingestion and options for nutrient release timing, catering to health-conscious consumers. Soft gels gained popularity for their quick absorption and effectiveness with oil-based supplements like omega-3s.

Powders attracted users with their customizable dosing and ease of mixing with food or drinks, while gummies grew rapidly in appeal across all ages due to their enjoyable flavors and simple intake. Liquids, valued for their quick absorption and accessibility to those who struggle with solids, solidified a strong market position. Each format meets distinct consumer preferences, driving diversification and growth in the sector.

By Function Analysis

In 2023, the Ready Meals market was prominently led by the Additional Supplements segment, which secured over a 34.4% market share. This trend reflects a growing preference among consumers for meals that provide not just satiety but also enhanced nutritional value, including vitamins, minerals, and other essential nutrients aimed at boosting overall health in conjunction with a regular diet.

The market also saw significant growth in Medical Supplements, tailored to support specific health conditions and dietary requirements, emphasizing the surge in consumer interest in functional foods and their health benefits. Furthermore, the Sports Nutrition Supplements segment gained traction, catering to the dietary needs of athletes and fitness enthusiasts focused on optimizing performance and recovery through nutritionally enriched meals. These trends underline a broader shift towards health-conscious eating and integrated dietary strategies in wellness and fitness routines.

By Application Analysis

In 2023, the Ready Meals market saw Energy & Weight Management as its leading segment, capturing over 32.4% share, driven by a consumer focus on healthy lifestyles and effective weight control. This was followed by the General Health segment, which caters to a broad audience seeking balanced diets to enhance overall well-being. The Bone & Joint Health category has also grown, responding to the aging population’s needs for nutrients that support bone density and joint mobility.

Additionally, the Gastrointestinal Health segment, emphasizing probiotics and digestive health, reflects rising consumer interest in maintaining a healthy gut. Moreover, segments like Immunity, Cardiac Health, Diabetes, and Anti-cancer have seen increased demand for ready meals fortified with specific nutrients to support immune systems, heart health, blood sugar control, and cancer prevention strategies.

By End-use Analysis

In 2023, the Ready Meals market saw Energy & Weight Management as its leading segment, capturing over 32.4% share, driven by a consumer focus on healthy lifestyles and effective weight control. This was followed by the General Health segment, which caters to a broad audience seeking balanced diets to enhance overall well-being. The Bone & Joint Health category has also grown, responding to the aging population’s needs for nutrients that support bone density and joint mobility.

Additionally, the Gastrointestinal Health segment, emphasizing probiotics and digestive health, reflects rising consumer interest in maintaining a healthy gut. Moreover, segments like Immunity, Cardiac Health, Diabetes, and Anti-cancer have seen increased demand for ready meals fortified with specific nutrients to support immune systems, heart health, blood sugar control, and cancer prevention strategies.

By Distribution Channel Analysis

In 2023, the Offline distribution channel maintained a dominant position in the market, securing over 78.3% share, primarily driven by traditional retail venues such as supermarkets, convenience stores, and hypermarkets. These channels are favored for their direct access to ready meals, allowing consumers to physically inspect products, achieve immediate purchase satisfaction, and adhere to familiar shopping practices.

Conversely, Online channels, though holding a smaller market share, are experiencing growth due to the expanding influence of e-commerce. These channels appeal to consumers by offering the convenience of home delivery, a broader assortment of products, and potential cost savings, catering to those seeking effortless meal options and access to items not typically found in local stores.

Recent Development of the Dietary Supplements Market

- Amway Corp.: A multinational direct-selling company specializing in health, beauty, and home care products, including dietary supplements.

- Abbott: A global healthcare company known for its wide range of nutritional products, including dietary supplements, infant formula, and medical devices.

- Bayer AG: A German multinational pharmaceutical and life sciences company that produces various consumer health products, including vitamins and dietary supplements.

Competitive Landscape

In the global dietary supplements market key players such as Amway Corp., Abbott, and Bayer AG continue to dominate due to their extensive product ranges and robust distribution networks. Companies like Glanbia plc and Pfizer Inc. are leveraging their strong R&D capabilities to innovate and cater to the growing consumer demand for personalized and efficacy-driven supplements. Archer Daniels Midland and NU SKIN are enhancing their market positions through strategic acquisitions and expansions into emerging markets, which allows them to capitalize on regional growth opportunities.

Additionally, GlaxoSmithKline plc. and Herbalife Nutrition Ltd. are focusing on expanding their digital and direct-to-consumer sales channels, which have proven vital in maintaining customer engagement in a rapidly changing retail landscape. Nature’s Sunshine Products, Inc. and XanGo, LLC are differentiating themselves with unique product formulations that emphasize natural ingredients and certified organic sources, appealing to health-conscious consumers.

Moreover, smaller players such as RBK Nutraceuticals Pty Ltd and American Health are carving niches with specialized products that address specific health concerns, including immune support and digestive health. DuPont de Nemours, Inc., Good Health New Zealand, Nature’s Bounty, and NOW Foods are anticipated to maintain competitive edges by emphasizing transparent labeling and sustainable sourcing practices, aligning with global trends towards ethical consumerism in the dietary supplements market.