Introduction

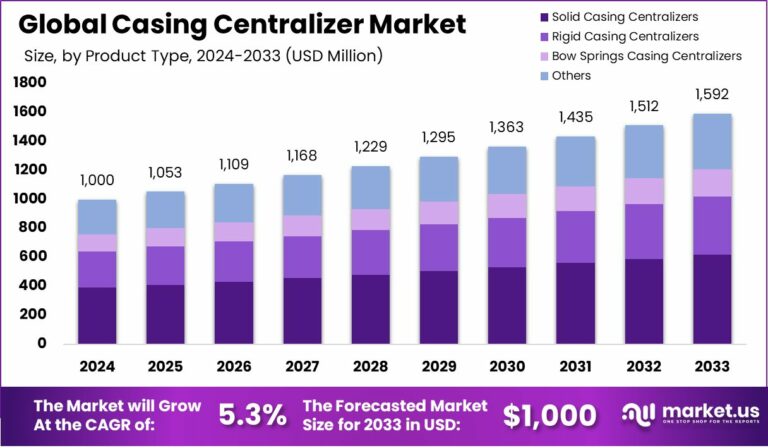

According to Market.us, The global Casing Centralizer Market, poised for notable growth, is forecasted to expand from USD 1000 Million in 2023 to approximately USD 1592 Million by 2033, charting a compound annual growth rate (CAGR) of 5.3% over the forecast period.

This growth trajectory is supported by a confluence of factors, including heightened global energy demands, increasing oil and gas exploration activities, and advancements in drilling technologies. The market’s expansion is further catalyzed by the substantial investments in infrastructure development across key regions such as North America, Asia-Pacific, and the Middle East, where energy consumption patterns are rising steeply.

North America remains a dominant player due to ongoing shale gas explorations and substantial unconventional resource developments, particularly in the U.S. and Canada. Similarly, the Asia-Pacific region is witnessing rapid market growth driven by extensive industrialization and urbanization, necessitating increased oil and gas extraction efforts. Additionally, government initiatives aimed at bolstering oil and gas production capabilities are injecting vigor into the market, notably with projects designed to tap into new oil reserves across various global locales.

The casing centralizer market is seeing significant technological innovations, with companies focusing on the development of more effective centralizer designs to enhance wellbore stability and cementing efficiency, particularly for complex drilling scenarios.

These advancements are crucial in maintaining the integrity of wellbores and optimizing cementing operations to prevent costly drilling issues and ensure environmental safety. The competitive landscape is marked by the presence of key players like Halliburton, Weatherford, and National Oilwell Varco, who are at the forefront of introducing technologically superior products to meet the diverse needs of the oil and gas industry.

Key Takeaway

- The Global Casing Centralizer Market size is expected to be worth around USD 1592 Million by 2033, from USD 1000 Million in 2023, growing at a CAGR of 5.3% during the forecast period from 2024 to 2033.

- The Solid Casing Centralizers segment dominated the market with a 39.6% share.

- Steel dominated the Casing Centralizer Market by material with a 48.6% share.

- Weld-On centralizers dominated the market with a 44.3% share, enhancing oil and gas operations.

- The Medium segment dominated the Casing Centralizer Market with a 52.3% share.

- Oil and Gas Wells dominated the Casing Centralizer Market with a 62.3% share.

- Asia Pacific dominates the casing centralizer market with a 42.4% share, valued at USD 422 million.

Factors affecting the Growth of the Casing Centralizer Market

- Demand for Lightweight and High-Performance Equipment: Athletes and sports enthusiasts seek equipment that enhances performance. Composites, such as carbon fiber, offer high strength-to-weight ratios, making them ideal for manufacturing lightweight and durable sports gear like bicycles, golf clubs, and tennis rackets. This preference drives the adoption of composite materials in sports equipment manufacturing.

- Technological Advancements in Composite Manufacturing: Innovations in production techniques, including automated processes and resin infusion methods, have improved the quality and consistency of composite materials. These advancements enable manufacturers to produce complex designs efficiently, meeting the evolving demands of the sports industry.

- Growing Participation in Sports Activities: An increase in sports participation, driven by rising health awareness and government initiatives promoting physical activity, has expanded the market for sports equipment. This surge in demand positively impacts the sports composites market, as manufacturers strive to meet the needs of a larger consumer base.

- Economic Growth and Rising Disposable Incomes: Economic development, particularly in emerging markets, has led to higher disposable incomes. Consumers are more willing to invest in premium sports equipment made from advanced composite materials, further propelling market growth.

- Environmental and Sustainability Considerations: There is a growing emphasis on sustainability within the sports industry. Composites that are recyclable or have a lower environmental impact are gaining preference among manufacturers and consumers, influencing market dynamics.

- Fluctuating Raw Material Costs: The prices of raw materials used in composites, such as carbon fibers and resins, can be volatile. These fluctuations affect production costs and, consequently, the pricing of sports equipment, impacting market growth.

- Regulatory Standards and Compliance: Adherence to safety and quality standards is crucial in sports equipment manufacturing. Regulations governing material usage and product safety can influence the adoption of composites, as manufacturers must ensure compliance to maintain market credibility.

Top Trends in the Global Casing Centralizer Market

- Technological Advancements: Innovations in materials and design are leading to the development of more efficient and durable casing centralizers. The use of composite materials and advanced manufacturing techniques enhances performance in challenging drilling environments.

- Increased Offshore Drilling Activities: The expansion of offshore oil and gas exploration is driving demand for specialized casing centralizers capable of withstanding harsh marine conditions. This trend is particularly evident in regions like the Middle East and Africa, where offshore projects are on the rise.

- Focus on Wellbore Stability and Integrity: There is a growing emphasis on maintaining wellbore stability to prevent operational issues. Casing centralizers play a crucial role in ensuring proper casing alignment, thereby enhancing cementing quality and overall well integrity.

- Environmental and Regulatory Compliance: Stricter environmental regulations are prompting the adoption of casing centralizers that improve cementing efficiency, reducing the risk of leaks and environmental contamination. Manufacturers are focusing on designs that meet these stringent standards.

- Regional Market Growth: The Asia-Pacific region is witnessing rapid growth in the casing centralizer market, driven by increased energy demand and exploration activities. Countries like China and India are investing heavily in oil and gas infrastructure, boosting market expansion.

- Strategic Collaborations and Acquisitions: Key industry players are engaging in partnerships and acquisitions to enhance their product offerings and market reach. These strategic moves aim to leverage technological expertise and expand global presence.

Market Growth

The global Casing Centralizer Market is experiencing steady growth, driven by several key factors. The increasing demand for oil and gas has led to more drilling activities, both onshore and offshore, which in turn boosts the need for casing centralizers to ensure wellbore stability and efficient cementing operations. Technological advancements have resulted in the development of more effective and durable centralizers, enhancing their performance in challenging drilling environments.

Additionally, stringent environmental regulations require better well integrity, further propelling the adoption of high-quality casing centralizers. The market is also benefiting from significant investments in oil and gas exploration, particularly in regions like North America and the Middle East, where energy consumption is rising. These combined factors contribute to the positive growth trajectory of the casing centralizer market.

Regional Analysis

The Casing Centralizer Market is dominated by Asia Pacific, with a 42.4% share, valued at USD 422 million. This is driven by advanced drilling technologies and stringent safety regulations in North America, while Europe emphasizes wellbore integrity and environmentally sensitive practices. The Middle East and Africa region, with its vast hydrocarbon reserves, sees significant investment in infrastructure, while Latin America is experiencing growth due to offshore and onshore drilling activities.

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | USD 1000 Million |

| Forecast Revenue 2033 | USD 1592 Million |

| CAGR (2024 to 2033) | 5.3% |

| Asia Pacific Market Share | 42.4% |

| Base Year | 2023 |

| Historic Period | 2020 to 2022 |

| Forecast Year | 2024 to 2033 |

Market Drivers

The global energy consumption has led to a surge in oil and gas exploration and extraction activities, resulting in a need for technologies to optimize extraction rates and minimize disruptions. Casing centralizers play a crucial role in these operations by ensuring the structural integrity of the wellbore, preventing casing wear, reducing torque and drag, and improving the efficiency of the cementing process.

Technological advancements in materials and design have also benefited the market, with modern centralizers being produced using durable materials like engineered polymers and composites. These innovations also contribute to safer and more environmentally friendly drilling practices.

Environmental regulations also influence the industry’s operational standards, with casing centralizers being essential for achieving zonal isolation and minimizing environmental impact. Their cost-effectiveness is a driving factor for their adoption, especially in an industry with high capital expenditure and significant financial risks.

Market Restraints

The Casing Centralizer Market faces several challenges, including regulatory and environmental compliance, high initial investment costs, complexity of product development, economic volatility, and geopolitical factors. Regulatory and environmental compliance regulations in the oil and gas sector require rigorous testing and certification, raising production costs and extending time-to-market. High initial investment costs also hinder market entry and expansion.

The complexity of product development increases the time required to bring new products to market and increases risks associated with product failure. Economic volatility affects investment decisions and financial planning, making forecasting and strategic planning challenging. Geopolitical factors, such as trade barriers and sanctions, can restrict market entry and modify global supply chains, leading to increased costs and logistical challenges.

Opportunities

The Casing Centralizer Market is expected to benefit from the expansion in onshore production, driven by the increasing number of onshore wells. The demand for advanced centralizers is expected to rise due to their superior performance in extreme conditions. Sustainability trends are reshaping industry standards, with companies prioritizing environmentally friendly materials and processes.

Smart technologies integration is also transforming the market, facilitating more efficient drilling operations and precise casing placements. Government investments in infrastructure and energy projects are also driving innovation and adoption in the market.

Report Segmentation of the Casing Centralizer Market

By Product Type Analysis

In 2023, the Solid Casing Centralizers segment held a 39.6% share in the market, primarily due to their robust construction and reliable performance in ensuring uniform casing diameters. Rigid Casing Centralizers, known for their fixed-blade configuration, offer enhanced performance in deviated wells, while Bow Springs Casing Centralizers are highly valued for their flexibility and adaptability, enhancing cementing operations efficiency.

By Material Analysis

Steel holds a 48.6% market share in the Casing Centralizer Market in 2023, primarily due to its durability, strength, and lower cost. Aluminum follows with its lightweight properties and corrosion resistance, enhancing centralizer longevity in corrosive environments. Composite materials, such as aluminum, are increasingly being adopted due to their superior performance characteristics, offering advantages in challenging drilling scenarios.

By Connection Type Analysis

In 2023, Weld-On centralizers held a dominant market share of 44.3%, enhancing oil and gas operations. These centralizers are preferred for their robust attachment and minimal shifting during casing operations. The Slip-On segment offers ease of installation and versatility, while the Threaded segment is recognized for precise positioning and stronghold, streamlining the assembly process.

By Casing Centralizer Analysis

The Medium segment dominates the Casing Centralizer Market in 2023, accounting for 52.3% of the market share. This is due to its versatility and suitability across various well diameters. The Small segment caters to niche applications in smaller well sizes, while the Large segment is crucial for deep-water drilling and unconventional resource extraction. The demand for Large casing centralizers is expected to grow due to ongoing exploration of new hydrocarbon reservoirs in complex locations.

By Application Analysis

In 2023, Oil and Gas Wells held a 62.3% market share in the Casing Centralizer Market, primarily due to their demand for efficient oil extraction processes. Casing centralizers ensure structural integrity, prevent casing wear, and enhance cementing. Geothermal Wells use casing centralizers to mitigate risks in high temperatures and corrosive environments. Water Wells use casing centralizers to prevent sedimentation and ensure well longevity in arid or complex geological regions.

Recent Development of the Casing Centralizer Market

- Clariant unveiled PHASETREAT WET in June 2023, a new solution designed to boost centralizer efficiency during offshore drilling operations and improve oilfield chemical performance, particularly in difficult well conditions.

- To meet the increasing needs of deepwater and offshore oil exploration, Summit Casing Equipment introduced a new line of adaptable casing centralizers in the beginning of 2023. By improving adaptation to challenging drilling conditions, this product line seeks to further ensure operational safety.

Competitive Landscape

The Casing Centralizer Market is characterized by a diverse and competitive landscape, featuring both established multinational corporations and specialized regional firms. Prominent industry leaders include Halliburton, Schlumberger, Baker Hughes, and Weatherford, all of which offer comprehensive oilfield services and a wide range of casing centralizer products. National Oilwell Varco (NOV) is another key player, providing extensive drilling solutions and equipment.

In addition to these major companies, several specialized firms contribute significantly to the market. Centek Group is recognized for its innovative centralizer designs, while Sledgehammer Oil Tools Pvt Ltd offers a variety of casing accessories. Maxwell Oil Tools focuses on high-performance centralizers and related equipment. Other notable companies include Summit Casing Equipment, Neoz Energy, and Moonshine Solutions, each providing tailored solutions to meet specific industry needs.

Regional players such as Daiwa Centralizers, Kanai Drilling, and Wuhan Gaoxin Centralizers cater to local markets, offering products that address region-specific requirements. Companies like Geonex Centralizers, C Energy Services, and NTS Group also play vital roles in their respective areas, contributing to the market’s diversity.

The competitive environment is further enriched by firms like Rock Centralizers, Petroleum Machinery, Shanghai Metal Products, and ZICO Group, which provide specialized products and services. Unocal Centralizers and Neoz Energy are also integral to the market, offering unique solutions that enhance wellbore stability and cementing efficiency. This varied competitive landscape fosters innovation and ensures a wide array of options for end-users, driving the overall growth and development of the casing centralizer market.