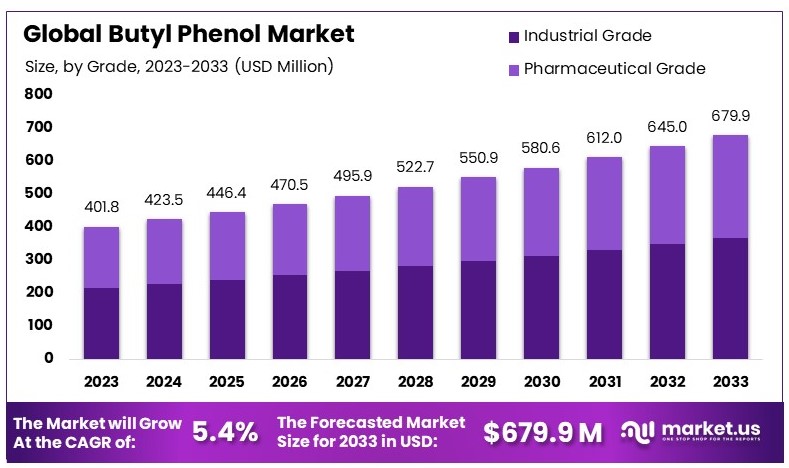

According to Market.us, The Global Butyl Phenol Market size is expected to be worth around USD 679.9 Million by 2033, from USD 401.8 Million in 2023, growing at a CAGR of 5.4% during the forecast period from 2024 to 2033.

The Butyl Phenol market is experiencing robust growth, driven by increasing demand from diverse industries such as plastics, laminates, and pharmaceuticals. Butyl Phenol, used as a chemical intermediate, is critical for producing antioxidants, varnishes, and herbicides. The rising need for these products in developing regions, especially Asia-Pacific, is propelling market expansion. Furthermore, advancements in chemical processing and stringent environmental regulations are pushing for innovations in production methods, enhancing market prospects.

However, volatility in raw material prices and regulatory challenges regarding phenol derivatives could impede growth. The market is also seeing a trend towards sustainable and environmentally friendly alternatives, which opens new avenues for growth through the development of green chemistry solutions. Overall, the Butyl Phenol market is poised for significant development, with ample opportunities for industry participants.

Key Takeaway

- The Global Butyl Phenol Market was valued at USD 401.8 million in 2023 and is expected to reach USD 679.9 million by 2033, with a CAGR of 5.4%.

- Industrial Grade dominates the grades with 54.1%, key for its broad industrial applications.

- The chemical segment leads in application with 30.3%, essential for various chemical processes.

- APAC dominates the market with 42.3%, equivalent to a market value of USD 188.81 million, driven by extensive industrial activities.

Factors affecting the growth of the Butyl Phenol Market

- Industrial Demand: The demand for butyl phenol is primarily driven by its applications in industries such as plastics, lubricants, and rubber chemicals. The expansion of these industries, particularly in emerging economies, significantly contributes to the growth of the butyl phenol market.

- Regulatory Impact: Environmental regulations and health safety standards significantly influence the production and use of butyl phenol. Stricter regulations concerning volatile organic compound (VOC) emissions and the toxicity of chemical substances can restrain market growth by limiting the use of certain types of butyl phenols or mandating the reformulation of products to reduce or eliminate butyl phenol content.

- Technological Advancements: Innovations in production technologies that allow for more efficient synthesis of butyl phenol or its derivatives can lower production costs and reduce environmental impact.

- Global Economic Conditions: The economic environment affects the butyl phenol market as fluctuations in economic activity influence the production volumes in end-use industries. Economic downturns can lead to reduced demand in sectors like automotive and construction, subsequently impacting the demand for butyl phenol.

- Supply Chain Dynamics: Volatility in raw material prices, such as phenol and butanol, can affect butyl phenol production costs and market pricing. Additionally, supply chain disruptions, as observed during global events like the COVID-19 pandemic, can lead to significant fluctuations in market dynamics.

- Market Penetration and Expansion Strategies: Efforts by key players to explore new applications and enter untapped markets also drive the growth of the butyl phenol market.

- Consumer Trends: There is a growing awareness and preference for environmentally friendly and sustainable chemicals, which can influence the types of butyl phenol formulations that are in demand.

Top Trends in the Global Butyl Phenol Market

- Rising Demand in the Paints and Coatings Industry: Butyl phenol is increasingly utilized in the production of epoxy resins, which are essential components in paints and coatings. The expansion of the paints and coatings sector, particularly in industrial and decorative applications, is propelling the demand for butyl phenol.

- Growth in the Automotive and Construction Sectors: The automotive and construction industries are major consumers of butyl phenol, using it in the manufacture of resins, adhesives, and coatings. The ongoing development in these sectors, especially in emerging economies, is contributing to the increased consumption of butyl phenol.

- Expansion in the Asia-Pacific Region: The Asia-Pacific region, notably countries like China and India, is witnessing substantial industrialization and urbanization. This growth is leading to a higher demand for butyl phenol in various applications, including plastics, rubber, and chemicals.

- Environmental Regulations and Sustainability Initiatives: Stricter environmental regulations are influencing the butyl phenol market. Manufacturers are focusing on sustainable production methods and developing eco-friendly products to meet regulatory standards and consumer preferences.

Market Growth

The global butyl phenol market is projected to experience moderate growth over the forecast period, driven by increasing demand from the adhesives, plastics, and rubber industries. The market expansion can be attributed to its widespread use as an intermediate in the production of stabilizers, antioxidants, and resins. Rising consumption in the automotive and construction sectors is further propelling demand, particularly in emerging economies in Asia-Pacific and Latin America.

Additionally, advancements in chemical synthesis technologies and growing awareness of sustainable industrial processes are anticipated to support market growth. However, challenges such as volatile raw material prices and stringent environmental regulations could restrain progress. The competitive landscape is marked by strategic investments and partnerships among key players to enhance production capacity and expand their global footprint.

Regional Analysis

The Asia-Pacific (APAC) region leads the butyl phenol market with a commanding 42.3% share, valued at USD 188.81 million, predominantly due to its robust chemical manufacturing capabilities and the significant demand across various sectors like resins and adhesives. Countries such as China, South Korea, and Japan are pivotal, hosting major global players and extensive production facilities.

North America and Europe follow with market shares of 25.7% and 20.0% respectively, supported by strong chemical industries and regulatory frameworks emphasizing quality and environmental sustainability. Conversely, the Middle East, Africa, and Latin America each hold a 6.0% share, where market expansion is driven by escalating industrial activities and burgeoning chemical production, particularly in the Gulf countries, Brazil, and Mexico.

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | USD 401.8 Million |

| Forecast Revenue (2033) | USD 679.9 Million |

| CAGR (2024 to 2033) | 5.4% |

| APAC Market Share | 42.3% |

| Base Year | 2023 |

| Historic Period | 2020 to 2022 |

| Forecast Year | 2024 to 2033 |

Market Drivers

The increasing demand for butyl phenols is largely driven by the construction, automotive, and agricultural industries. In construction, butyl phenols are essential in phenolic resins for materials like insulation and adhesives, with rising infrastructure projects in Asia-Pacific fueling this demand. Similarly, the automotive industry’s shift towards lightweight, fuel-efficient vehicles has led to a need for butyl phenol-based additives that enhance plastic durability.

Additionally, the agricultural sector’s focus on crop protection promotes the use of butyl phenols in agrochemical formulations, especially in herbicides and insecticides. Each sector’s growth directly impacts the demand for butyl phenols, reinforcing their role in critical applications across industries. These dynamics collectively drive the butyl phenol market’s expansion, responding to the global call for high-quality construction, automotive, and agricultural solutions.

Market Restraints

The butyl phenol market faces several restraints that could impact its growth trajectory. A significant factor is the stringent environmental regulations concerning the production and disposal of phenolic compounds, which include butyl phenol. These regulations are enforced globally to mitigate environmental impact, driving up compliance costs for manufacturers.

Additionally, volatility in the prices of raw materials, such as phenol and butanol, complicates financial forecasting and operational planning for businesses in this sector. Health concerns associated with long-term exposure to butyl phenol also restrict its use in certain applications, necessitating the development of safer alternatives. Furthermore, market saturation in developed regions forces companies to compete intensely on price, which can erode profit margins and discourage new entrants. These factors collectively contribute to the challenging environment faced by the butyl phenol market.

Opportunities

The butyl phenol market presents several opportunities due to its extensive application in various industries. The demand is primarily driven by its uses in the production of antioxidants, lubricating oil additives, and resin systems. There is a growing opportunity in the development of eco-friendly and sustainable chemical formulations, where butyl phenol plays a crucial role due to its effectiveness and efficiency.

Additionally, the expanding automotive and construction industries in emerging economies are expected to further fuel market growth. Manufacturers and stakeholders could benefit from investing in R&D to enhance the product’s applications and environmental profile, positioning themselves advantageously in a competitive market. Moreover, strategic expansions into untapped regional markets could offer new revenue streams and customer bases, promoting sustained growth in the global butyl phenol market.

Report Segmentation of the Butyl Phenol Market

By Grade Analysis

The Butyl Phenol market is largely segmented by grade, with Industrial Grade holding a dominant share of 54.1%. This segment’s prevalence is attributed to its extensive utility across diverse sectors such as chemicals, lubricants, and rubber, where it is prized for its stability and versatility in various applications.

Industrial Grade Butyl Phenol is integral in manufacturing processes, particularly as an antioxidant in rubber and plastics production, enhancing material durability. Its use as an intermediate in chemical synthesis further amplifies its demand, contributing to the development of coatings, adhesives, and resins. While Pharmaceutical Grade Butyl Phenol also contributes to the market, primarily in synthesizing pharmaceutical compounds, its application is narrower, leading to a smaller market share compared to Industrial Grade.

By Application Analysis

In the Butyl Phenol market, the Chemical industry is predominant, holding a 30.3% share due to its critical use in chemical synthesis and production. Butyl Phenol is integral in creating antioxidants, stabilizers, and specialty chemicals, vital for manufacturing processes across various sectors, including automotive, electronics, and construction. Its role is essential in producing advanced materials that require high stability and oxidation resistance, such as coatings, adhesives, and resins.

Significantly, the Lubricant industry utilizes Butyl Phenol to enhance lubricant performance, especially in high-stress conditions, which propels its demand. Despite a smaller market share, the Pharmaceuticals segment depends on Butyl Phenol for producing high-purity active pharmaceutical ingredients. Additionally, its use as an antioxidant in the Rubber industry underscores its importance in improving the durability and performance of rubber products, further supported by demand from the automotive and construction sectors. Collectively, these applications drive the sustained relevance and demand for Butyl Phenol in the market.

Recent Development of the Butyl Phenol Market

- March 2024: The Indian government imposed anti-dumping duties on PTBP imports from South Korea, Singapore, and the USA. The duties range from $208 to $881 per metric ton, depending on the country and producer. This measure aims to protect domestic industries from the adverse effects of dumping.

- April 2024: LyondellBasell announced the acquisition of a 35% stake in Saudi-based National Petrochemical Industrial Company (NATPET) from Alujain Corporation, valued at approximately USD 1.5 billion. This acquisition enhances LyondellBasell’s market presence and expands its product offerings.

Competitive Landscape

In the 2024 global Butyl Phenol market, several key players are poised to shape the industry landscape significantly. SI Group and Sasol continue to lead with robust production capabilities and extensive market reach. These entities leverage advanced manufacturing processes and strategic global networks to meet the rising demand effectively. Sanors and Tasco Group are also prominent, focusing on innovation and sustainability to enhance their competitive edge. Nainkaware Chemicals and Songwon Industrial, known for their specialized production techniques, are expanding their market presence through strategic partnerships and enhanced R&D investments.

Further, Anshan Wuhuan Chemical is making significant strides in optimizing supply chain efficiencies, which is crucial for maintaining its market position. Sigma-Aldrich, under the umbrella of Merck, along with Aurora Fine Chemicals LLC and Merck Millipore, emphasizes high purity and regulatory compliance, catering to niche markets that demand stringent quality standards. These companies collectively drive the market forward through technological advancements, strategic expansions, and a deep focus on customer-centric solutions. Their efforts are instrumental in addressing both existing and emerging market demands, positioning them as leaders in the evolving Butyl Phenol landscape.