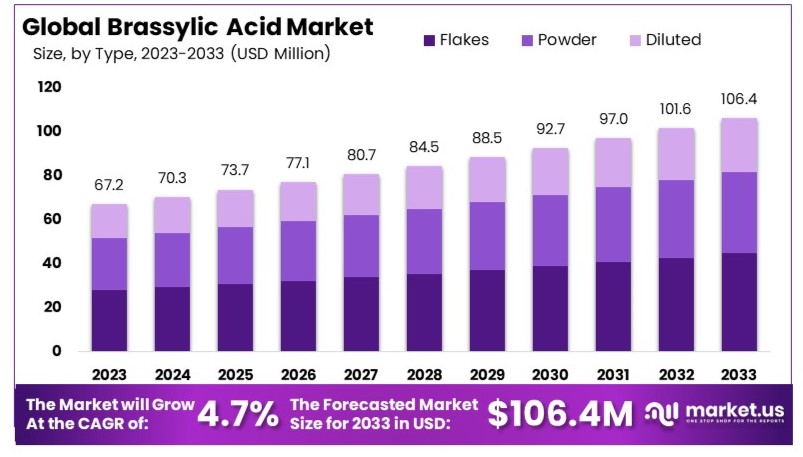

According to Market.us, The Global Brassylic Acid Market size is expected to be worth around USD 106.4 Million by 2033, from USD 67.2 Million in 2023, growing at a CAGR of 4.7% during the forecast period from 2024 to 2033. The Brassylic Acid Market is primarily driven by its applications in the manufacture of perfumes, adhesives, and high-grade lubricants. Derived from erucic acid found in natural oils, brassylic acid is gaining prominence due to its utility in the production of synthetic musk and various polymers.

The global demand for brassylic acid is anticipated to rise, bolstered by the expanding cosmetics industry and an increasing preference for environmentally friendly and sustainable products. The market is also witnessing growth through technological advancements in the extraction process of brassylic acid from natural sources, enhancing its commercial viability and application scope. Key players in the market are focusing on expanding their production capacities to meet the rising demand, which is expected to continue growing in the forecast period.

Key Takeaway

- The Global Brassylic Acid Market was valued at USD 67.2 million in 2023 and is expected to reach USD 106.4 million by 2033, with a CAGR of 4.7%.

- Flakes form leads with 42.4%, preferred for their ease of handling and application.

- Polymers are the primary application at 45.2%, crucial in polymer production.

- APAC dominates with 49.9%, a market value of USD 33.53 million, due to its growing polymer and adhesives industries.

Factors affecting the growth of the Brassylic Acid Market

- Market Demand: Increasing usage of brassylic acid in the production of perfumes, adhesives, and lubricants drives demand. The cosmetic industry, in particular, utilizes brassylic acid in synthetic musk and other fragrances, aligning with consumer preferences for sophisticated scent profiles.

- Environmental Regulations: Stricter environmental regulations promote the use of bio-based products, positioning brassylic acid as an appealing alternative due to its derivation from renewable sources. Compliance with sustainability standards is crucial for companies to maintain market relevance and consumer trust.

- Technological Advancements: Innovations in extraction and synthesis techniques enhance the efficiency and cost-effectiveness of brassylic acid production. Improved technology facilitates access to high-purity brassylic acid, which is critical for high-performance applications in advanced materials and fine chemicals.

- Global Economic Conditions: Economic fluctuations can impact production costs and consumer spending, affecting the demand for end products containing brassylic acid. A stable economic environment supports market growth through sustained investments and consumer purchasing power.

- Supply Chain Dynamics: The availability and price volatility of raw materials, primarily erucic acid from natural oils, can significantly affect brassylic acid production. Efficient supply chain management is essential to mitigate risks associated with raw material sourcing and distribution.

- Market Penetration and Expansion: The ability of market players to penetrate emerging markets and expand their geographical footprint plays a critical role. Focusing on untapped markets with growing industrial sectors can provide new growth avenues for brassylic acid producers.

Top Trends in the Global Brassylic Acid Market

- Shift Toward Bio-based Products: There is a notable shift towards sustainable and eco-friendly materials within various industries, including cosmetics, automotive, and pharmaceuticals.

- Advanced Applications in Nylon Production: Brassylic acid is being increasingly utilized in the synthesis of high-performance polyamide (nylon) variants. These nylons are sought after for their superior properties such as resistance to wear and corrosion, fueling innovations, and demand in the automotive and electronics industries.

- Innovation in Extraction Techniques: Technological advancements in the extraction of brassylic acid from plant-based sources, like castor oil and rapeseed oil, are improving yields and reducing production costs.

- Expansion in Cosmetic Applications: The cosmetics industry continues to expand the use of brassylic acid beyond traditional fragrances into more diverse product lines including skin care and hair care products.

- Geographical Market Expansion: Companies are increasingly looking at expanding their presence into emerging markets in Asia-Pacific and Latin America, where industrial growth is robust. These regions offer new opportunities for market penetration due to rising consumer incomes and industrial development.

- Strategic Alliances and M&A: There is a trend towards mergers, acquisitions, and strategic partnerships among key players to enhance their market share and improve distribution networks globally.

Market Growth

The Global Brassylic Acid Market is experiencing significant growth, driven by its expanding applications in various industries such as cosmetics, lubricants, and polymers. Market growth is further fueled by the increasing adoption of sustainable and bio-based products, aligning with global environmental regulations and consumer preferences for green products. Technological advancements in the extraction and synthesis of brassylic acid have also enhanced its production efficiency and purity, making it more attractive for high-performance applications.

Moreover, the cosmetic industry’s robust expansion, particularly in emerging markets, contributes to the rising demand for brassylic acid used in fragrances and skin care products. The market is expected to continue its upward trajectory, supported by strategic investments in R&D and geographical expansion by key players.

Regional Analysis

The Asia-Pacific (APAC) region dominates the global brassylic acid market with a 49.9% share, valued at USD 33.53 million. This is driven by rapid industrial growth, a robust manufacturing base, and high demand from the polymer and cosmetics sectors. Low production costs, raw material availability, and favorable government policies further enhance APAC’s position.

North America holds 20% (USD 13.41 million), fueled by demand in polymers and automotive industries, supported by advanced technologies and regulatory frameworks. Europe, with an 18% share (USD 12.04 million), benefits from strong cosmetics and polymer sectors, emphasizing sustainability and R&D.

The Middle East and Africa account for 7% (USD 4.7 million), driven by industrial expansion and infrastructure development. Latin America holds 5.1% (USD 3.41 million), supported by industrialization and diverse applications. APAC’s share is expected to grow further, supported by industrial and technological advancements.

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | USD 67.2 Million |

| Forecast Revenue (2033) | USD 106.4 Million |

| CAGR (2024 to 2033) | 4.7% |

| Asia Pacific Market Share | 49.9% |

| Base Year | 2023 |

| Historic Period | 2020 to 2022 |

| Forecast Year | 2024 to 2033 |

Market Drivers

The Brassylic Acid Market is primarily propelled by its increasing utilization in the production of high-performance polyamides and fragrances. A significant driver is the growing trend towards sustainable and eco-friendly products, which encourages the adoption of bio-based brassylic acid across various industries, including automotive, electronics, and personal care. Technological advancements in production processes have also optimized the extraction and synthesis of brassylic acid, reducing costs and improving efficiency, thus making it more accessible for broader applications.

Additionally, the expansion of the cosmetics sector, especially in emerging economies, has heightened demand for natural fragrance components, further boosting market growth. These factors collectively drive the global market for brassylic acid, aligning with consumer preferences and regulatory demands for environmentally sustainable materials.

Market Restraints

The expansion of the Brassylic Acid Market faces several restraints that temper its growth. Key among these is the volatility in the prices of raw materials such as erucic acid, derived from natural oils, which can lead to fluctuations in production costs and impact profitability. The complexity and cost of the production process for brassylic acid also pose significant challenges, particularly in achieving high purity levels necessary for specific applications.

Additionally, while driving the demand for sustainable products, stringent environmental regulations can also increase compliance costs and operational complexities for producers. Moreover, competition from synthetic alternatives, which are often more cost-effective, further constrains the market. These factors collectively create barriers to entry and expansion, potentially limiting the market’s overall growth potential.

Opportunities

The Brassylic Acid Market presents numerous opportunities for growth and expansion. The rising global demand for sustainable and eco-friendly products opens significant avenues for brassylic acid, particularly in industries prioritizing green manufacturing processes, such as automotive and textiles. The expanding applications of brassylic acid in niche markets, including high-performance lubricants and adhesives, provide further opportunities for market penetration.

Moreover, emerging markets in Asia-Pacific and Latin America offer new prospects due to their rapid industrial growth and increasing environmental consciousness. There is also potential for innovation in production technologies that could reduce costs and enhance the efficiency and environmental footprint of brassylic acid manufacturing. Additionally, strategic partnerships and collaborations can facilitate access to new markets and distribution channels, amplifying market reach and impact.

Report Segmentation of the Brassylic Acid Market

By Form Analysis

The Brassylic Acid market is segmented primarily by form, with Flakes leading at 42.4% due to their ease of handling and versatility across various industries. Flakes are particularly favored in the production of high-performance polymers and adhesives, contributing to enhanced material properties such as strength, flexibility, and durability. These characteristics are critical in sectors like automotive, aerospace, and construction.

The Powder form, preferred for its fine granularity, finds use in cosmetics and specialty chemicals, while the Diluted form is essential in applications needing lower acid concentrations, aiding in chemical synthesis and formulations. Together, these forms meet diverse industrial requirements, underlining the robust demand and functional adaptability of Brassylic Acid.

By Application Analysis

Polymers dominate the brassylic acid market, holding a 45.2% share, driven by demand from the automotive and construction industries. Brassylic acid enhances polymer properties, making them essential for lightweight, high-performance vehicle components and durable construction materials. The automotive sector uses these polymers in bumpers, dashboards, and trims, supporting fuel efficiency and safety.

In construction, brassylic acid-based polymers are applied in pipes, fittings, and insulation, providing resistance to corrosion and extreme temperatures. Other significant applications include adhesives, which benefit from enhanced bonding strength, and lubricants, valued for improved thermal stability and reduced friction. Brassylic acid also serves as a fixative in fragrances, catering to the personal care sector. Additionally, it finds use in coatings, resins, and specialty chemicals, ensuring continued demand across diverse industries.

Recent Development of the Brassylic Acid Market

- 2023: Evonik Industries reported a revenue of approximately USD 18 billion. The company’s focus on expanding its chemical production capabilities, including brassylic acid, has contributed to its strong financial performance.

- 2023: UBE Industries reported a revenue of USD 6.5 billion. The company continues to invest in research and development to enhance its product offerings and maintain its market position.

Competitive Landscape

The brassylic acid market in 2024 is shaped by a range of global players, each contributing to advancements and competitive dynamics within this specialty chemical industry. Evonik Industries and Cathay Industrial Biotech are noted leaders, leveraging extensive R&D capabilities to drive high-quality, sustainable production processes. Beyo Chemical Co. Ltd and Palmary Chemical stand out for their emphasis on cost-effective manufacturing, catering to increasing demand across diverse end-user industries such as cosmetics and polymers. Unisource Chemical Pvt. Ltd and Shanghai Kaleys Holding Co. Ltd contribute regional strength, bolstering local supply chains and meeting demand in Asia’s expanding markets.

Meanwhile, companies like Nangtong Senos Biotechnology Co. Ltd and Zibo Guangtong Chemical Co. Ltd focus on product innovation, enabling customized solutions for specific applications. Larodan AB, although smaller, remains a niche player recognized for specialized offerings, further enhancing the overall value and diversity of brassylic acid solutions in the global market.