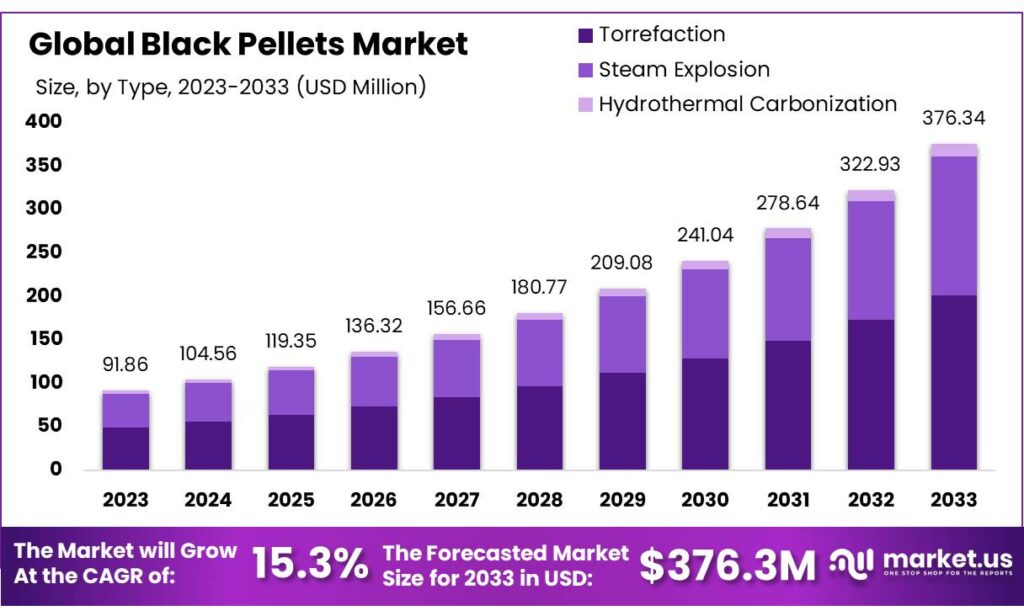

According to Market.us, the Global Black Pellets Market size is forecasted to exceed USD 376.34 Million by 2033, with a promising CAGR of 15.3% from 2024 to 2033.

The global Black Pellets Market was valued at USD 91.86 Million in 2023. The “Black Pellets Market” refers to the segment of the industry that focuses on using composite materials to produce Black Pellets equipment.

Black pellets are an advanced form of biomass that serves as a sustainable alternative to traditional fossil fuels and white wood pellets. These pellets are torrefied, meaning they are partially combusted at high temperatures, which increases their energy density and water resistance. This process enhances their combustion efficiency and storage stability, making them a more reliable and cleaner energy source. Black pellets can be co-fired with coal in existing power plants without significant modifications, offering a seamless transition towards greener energy solutions.

Key Takeaway

- In 2023, the global black pellets market generated a revenue of USD 91.86 million, with a CAGR of 15.3%, and is expected to reach USD 376.34 million by the year 2033.

- Among black pellet types, the torrefaction type held the majority of the revenue share at 53.6%.

- Based on feedstock types, wood residue accounted for the largest market share with 64.3%.

- Among applications, heat generation accounted for the majority of the black pellets market share at 54.9%.

- Based on end-user, the residential sector dominated the market with a share of 44.5%.

- The European region led the market by securing a market share of 59.5% in 2023.

Factors affecting the growth of the Black Pellets Market

- Environmental Regulations and Policies: Stringent environmental regulations across various countries, especially in Europe and North America, are driving the adoption of cleaner and more sustainable energy sources. Black pellets, with their reduced greenhouse gas emissions compared to fossil fuels, are becoming increasingly favored under these regulatory frameworks.

- Energy Sector Decarbonization: The global push for decarbonization in the energy sector is prompting utilities and industries to shift towards renewable energy sources. Black pellets, due to their higher energy content and better combustion properties compared to conventional biomass, are seen as an effective tool in achieving these decarbonization goals.

- Advancements in Torrefaction Technology: Technological improvements in the torrefaction process have enhanced the quality and reduced the cost of black pellets. These advancements make black pellets a more viable option for large-scale energy production.

- Supply Chain and Logistics Improvements: Developments in the logistics and supply chain management of biomass fuels have improved the availability and cost-effectiveness of black pellets. Enhanced supply chain efficiencies reduce transportation costs and mitigate the risk of supply disruptions, making black pellets more attractive to energy producers.

- Growing Demand for Renewable Energy: The increasing demand for renewable energy sources from both public and private sectors is a significant driver for the black pellets market. As organizations and governments aim to fulfill renewable energy targets and reduce carbon footprints, the demand for biomass as a renewable energy source rises accordingly.

Top Trends in the Global Black Pellets Market

The global black pellets market is experiencing substantial growth, driven by increased demand for renewable energy sources and technological advancements in biomass processing. Key trends in this market include the widespread adoption of torrefaction technology which enhances the energy density and hydrophobic properties of the pellets, making them more efficient and durable for energy production.

Wood residues are the primary feedstock, providing a cost-effective and abundant source for pellet production, and are a major contributor to the market’s expansion. The market is segmented by various applications including power generation, heating, and industrial processes, with significant growth particularly in power generation due to the pellets’ suitability for co-firing in coal power plants.

Market Growth

The global black pellets market is poised for growth as countries and companies focus on sustainable energy to reduce carbon footprints and meet net-zero targets. Black pellets offer high energy density and are compatible with existing coal-fired plants, facilitating a smooth transition to renewables. Enhanced by policies and incentives that favor low-carbon energy, their demand is set to rise, supported by investments in renewable technologies under global climate agreements like the Paris Agreement.

Regional Analysis

In 2023, Europe led the black pellets market with a 59.5% share, driven by advanced regulatory frameworks, strategic energy policies, and sustainability commitments. Initiatives like the EU Renewable Energy Directive and national incentives in countries like Sweden and Finland have fostered the adoption of black pellets. Europe’s robust biomass infrastructure and focus on energy security further support its market dominance.

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | USD 91.86 Million |

| Forecast Revenue (2033) | USD 376.34 Million |

| CAGR (2024 to 2033) | 15.3% |

| Europe Market Share | 59.5% |

| Base Year | 2023 |

| Historic Period | 2020 to 2022 |

| Forecast Year | 2024 to 2033 |

Market Drivers

The global black pellets market is booming as demand for cleaner energy increases in response to climate change concerns. Black pellets are produced through torrefaction, a process that improves their energy density and water resistance, making them suitable for direct use in coal-fired power plants with minimal changes. This compatibility aids the transition from coal, aligning with policies like the EU’s Renewable Energy Directive and the US Clean Power Plan, which promote renewable energy to reduce carbon emissions.

Financial incentives from governments also enhance the economic attractiveness of black pellets, making them a competitive, sustainable energy source that helps energy producers meet emission standards and benefit from subsidies and tax incentives.

Market Restraints

The global black pellets market is growing due to a shift towards cleaner energy, yet it faces significant challenges from the availability and cost volatility of biomass feedstocks like forestry residues and agricultural by-products. Seasonal variations, sustainable practices, and competition from other industries exacerbate supply inconsistencies and price fluctuations, impacting production costs and market stability.

Additionally, logistical and regulatory issues further strain the supply chain, affecting the economic viability of black pellet production and hindering its expansion in the competitive renewable energy landscape.

Opportunities

The global black pellets market is poised for growth as renewable energy becomes a priority worldwide, driven by efforts to reduce carbon footprints and achieve net-zero emissions. Black pellets offer a higher energy density and better storage than traditional biomass and can be integrated into existing coal power plants with minimal retrofitting. This compatibility reduces initial investment and facilitates a gradual transition to renewable energy.

Increased production of black pellets through sustainable methods like torrefaction enhances their efficiency and handling. Supportive legislation, incentives, and international climate agreements further bolster the market, making black pellets an attractive, low-carbon energy solution.

Report Segmentation of the Black Pellets Market

By Type Analysis

In 2023, Torrefaction led the black pellets market with a 53.6% share, driven by the process’s ability to produce higher-density, hydrophobic pellets ideal for co-firing in coal plants, thereby reducing modifications. Their enhanced calorific value and storage efficiency, along with superior resistance to degradation, position torrefied pellets as a cost-effective, sustainable energy alternative amid stricter environmental policies.

By Feedstock Type Analysis

Wood residues, including sawdust, chips, and bark, dominate the black pellet market, holding a 64.3% share due to their abundance and cost-effectiveness as by-products of forestry activities. These residues are advantageous for pellet production as they lower procurement and production costs, enhance resource utilization, and offer environmental benefits. Supported by strong supply chains, high energy content, technological compatibility, and favorable regulations, wood residues are the preferred feedstock, making black pellets increasingly competitive in the energy market.

By Application Analysis

In 2023, the black pellets market saw heat generation as its dominant application, securing 54.9% of the market due to its high efficiency and renewable qualities. The drive towards sustainable heating solutions across various sectors, alongside the increase in energy costs and environmental consciousness, has boosted the demand for black pellets. Supportive government regulations and incentives promoting renewable energy and reducing emissions further encourage this trend. Technological advancements in heating systems also facilitate the integration and adoption of black pellets, enhancing their popularity in the heat generation sector.

By End-User Analysis

The residential sector dominates the black pellets market, holding a 44.5% share, driven by heightened eco-awareness among homeowners and the appeal of black pellets as a sustainable, cost-effective heating alternative. Supported by government incentives and advances in heating technology, these carbon-neutral pellets are increasingly preferred for their operational efficiency, affordability, and ease of use, aligning with consumer trends toward green energy solutions.

Recent Development of the Black Pellets Market

- In May 2024, Valmet and Wilhelmina announced their collaboration in engineering to support the advancement of the innovative TG2 Black Pellet Plant in Kuantan, Malaysia.

- In November 2022, The Norwegian company Arbaflame was converting forestry waste into premium-quality, sustainable pellets capable of substituting coal in power plants. Recently, it completed its third shipment to Europe.

- In October 2021, The Idemitsu Kosan Company manufacturing facility for black pellets in Vietnam, aimed at reducing CO2 emissions for Japanese coal customers. The goal was to expand the black pellet supply base to achieve an annual production of 300,000 tons within three years.

Competitive Landscape

The global Black Pellets market sees The Idemitsu Kosan Company and Valmet leading in technology and innovation, while Bionet and Airex Energy Inc. excel in sustainable sourcing. Companies like Zilkha Biomass Energy and Blackwood Technology are pivotal in expanding market reach, particularly in emerging economies, enhancing the industry’s growth prospects.