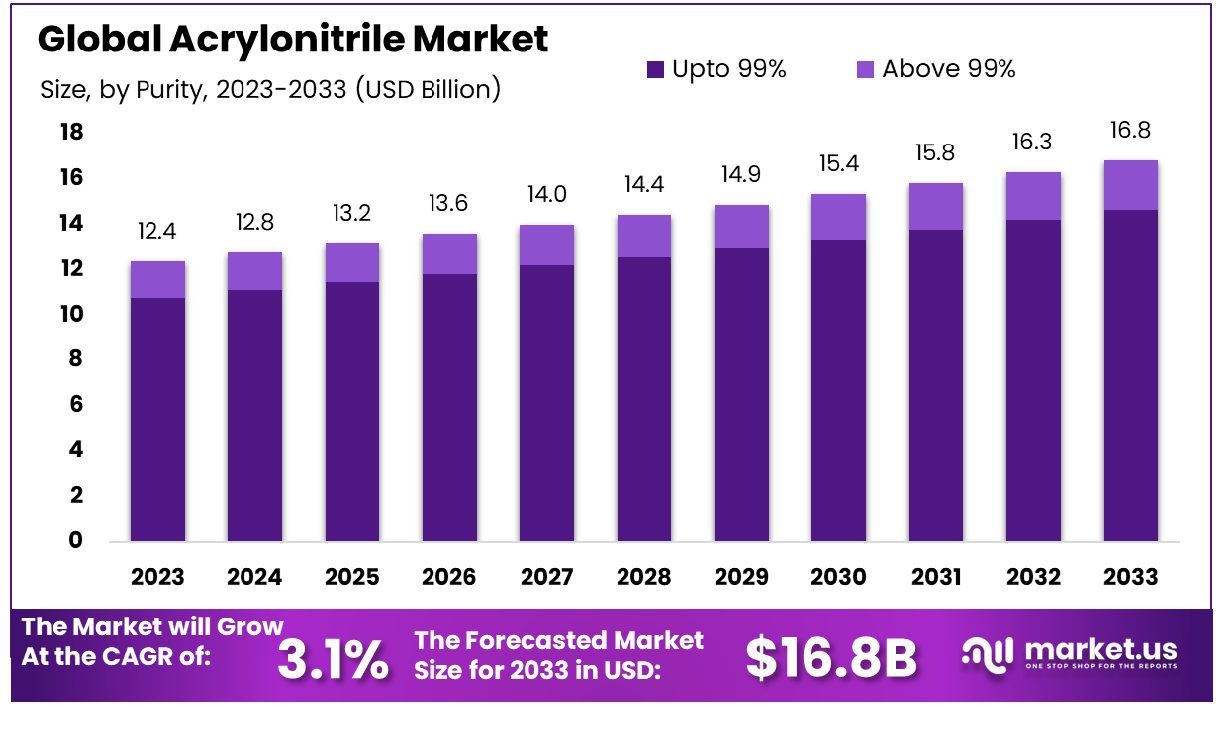

According to Market.us, The Global Acrylonitrile Market size is expected to be worth around USD 16.8 Billion by 2033, From USD 12.4 Billion by 2023, growing at a CAGR of 3.1% during the forecast period from 2024 to 2033. The global acrylonitrile market is currently driven by a robust demand from key industries such as automotive, construction, and textiles.

Acrylonitrile, a crucial precursor for synthetic fibers like acrylic and modacrylic, and plastics such as acrylonitrile butadiene styrene (ABS), is experiencing significant demand. This is largely fueled by the expanding automotive sector which utilizes ABS in manufacturing components due to its strength and lightweight properties. The market’s expansion is further supported by growth in the construction sector where acrylonitrile-based products are preferred for their durability and resistance to weather conditions. Moreover, advancements in carbon fiber technology, which relies heavily on acrylonitrile as a raw material, are set to propel market growth, particularly in the aerospace and renewable energy sectors.

Key Takeaway

- The Global Acrylonitrile Market is projected to grow from USD 12.4 billion in 2023 to USD 16.8 billion by 2033, at a CAGR of 3.1%.

- Asia-Pacific Acrylonitrile Market holds a 50.2% share, valued at USD 6.2 billion.

- Above 99% acrylonitrile constitutes 86.7% of market purity.

- Acrylic fibers represent 27.3% of acrylonitrile applications.

- The automotive sector consumes 43.3% of the acrylonitrile market share.

- Indirect sales dominate with 54.3% of distribution sales.

Factors affecting the growth of the Acrylonitrile Market

- Industrial Demand: The demand from key sectors like automotive, textiles, and construction significantly impacts market dynamics. As these industries expand, particularly in emerging economies, the demand for acrylonitrile for products like ABS plastics and synthetic fibers rises.

- Technological Innovations: Advances in technology that improve the efficiency of acrylonitrile production processes or enhance product quality can drive market growth.

- Supply Chain Dynamics: The availability of raw materials (propylene and ammonia), and the operational efficiency of acrylonitrile manufacturing plants, affect production levels and market stability. Disruptions in the supply chain, such as those caused by geopolitical issues or natural disasters, can lead to volatility in prices and availability.

- Regulatory Impact: Environmental regulations concerning the production, handling, and disposal of acrylonitrile and its derivatives can restrict market growth. Stringent regulations in regions like Europe and North America require manufacturers to invest in cleaner technologies and safer practices, potentially increasing operational costs.

- Economic Factors: Economic conditions that influence consumer spending and industrial investment directly affect the acrylonitrile market. Economic downturns can reduce demand in key sectors such as construction and automotive, while economic booms can enhance it.

- Market Penetration in Emerging Regions: The expansion into new geographical markets, particularly in Asia-Pacific regions like China and India, offers significant growth opportunities due to rapid industrialization and urbanization.

- Environmental Concerns and Alternatives: Growing environmental concerns and the push towards more sustainable materials could hinder the acrylonitrile market. The development and adoption of alternative materials that are less harmful to the environment could pose a competitive threat.

Top Trends in the Global Acrylonitrile Market

- Increasing Use of ABS Plastics: Acrylonitrile butadiene styrene (ABS) continues to see growing demand, particularly in the automotive and electronics industries, due to its durability, strength, and lightweight properties.

- Expansion in Carbon Fiber Applications: The demand for carbon fibers is escalating, particularly in the aerospace, automotive, and wind energy sectors. Acrylonitrile is a primary precursor in carbon fiber production.

- Growth in Developing Economies: Rapid industrialization and urbanization in Asia-Pacific countries, especially China and India, are driving demand for acrylonitrile.

- Sustainability and Recycling Initiatives: As environmental concerns rise, the industry is focusing on more sustainable production processes and the recycling of acrylonitrile-containing products.

- Regulatory Influence and Compliance: Stricter environmental and safety regulations worldwide are pushing companies to adopt safer, cleaner, and more sustainable practices in the production of acrylonitrile and its derivatives.

- Strategic Alliances and Expansions: Companies are increasingly engaging in strategic alliances, mergers, and expansions to enhance their market presence and operational capabilities. This trend is evident with global players expanding their production capacities and geographical reach to tap into high-growth markets.

Market Growth

The global acrylonitrile market is poised for substantial growth, primarily fueled by its extensive applications across diverse industries. Key drivers include the rising demand for acrylonitrile-butadiene-styrene (ABS) in the automotive and consumer electronics industries, where it is prized for its durability and lightweight properties. Additionally, the expanding market for carbon fiber, used increasingly in aerospace and renewable energy sectors, is significantly boosting acrylonitrile consumption.

The market’s growth is also supported by robust industrial activities in Asia-Pacific, particularly in China and India, where rapid urbanization and industrialization spur demand. However, growth is tempered by environmental concerns and stringent regulations, pushing the industry towards more sustainable practices and materials. Overall, the market outlook remains positive, with steady growth anticipated over the coming years.

Regional Analysis

The Acrylonitrile Market is dominated by the Asia-Pacific region, holding a 50.2% share and is valued at USD 6.2 billion. This dominance is supported by strong manufacturing sectors, substantial investments in chemical and petrochemical infrastructure, and increasing demand from the automotive and electronics industries, with China, Japan, and South Korea leading the way.

North America ranks second, emphasizing innovation and sustainability in chemical manufacturing, bolstered by stringent environmental regulations. Europe shows moderate growth, driven by its advanced automotive and aerospace industries and strict chemical production regulations. Meanwhile, the Middle East & Africa and Latin America are emerging markets with potential, benefiting from strategic positioning in global petrochemicals and growing industrial bases, respectively.

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | USD 12.4 Billion |

| Forecast Revenue (2033) | USD 16.8 Billion |

| CAGR (2024 to 2033) | 3.1% |

| Asia Pacific Market Share | 50.2% |

| Base Year | 2023 |

| Historic Period | 2020 to 2022 |

| Forecast Year | 2024 to 2033 |

Market Drivers

The global acrylonitrile market is primarily driven by its extensive use in the manufacture of acrylic fibers, which are integral to the textile industry. Additionally, acrylonitrile is a key component in the production of acrylonitrile butadiene styrene (ABS) plastics, widely used in the automotive, electronics, and construction sectors due to their high strength and versatility. The expanding automotive industry, particularly in emerging economies, significantly contributes to the demand for ABS plastics, thus propelling the acrylonitrile market.

Furthermore, the increasing adoption of lightweight materials in automotive manufacturing to improve fuel efficiency and reduce emissions is expected to further boost the market growth. Environmental regulations and advancements in recycling technologies also play crucial roles in shaping the market dynamics by promoting sustainable production processes.

Market Restraints

The expansion of the global acrylonitrile market faces several key restraints. Environmental concerns top the list, as acrylonitrile production involves toxic byproducts and significant emissions, leading to stringent regulatory oversight. The cost and complexity of complying with these environmental regulations can hinder operational flexibility and profitability. Volatility in the prices and availability of raw materials, such as propylene and ammonia, also pose a significant challenge, impacting production costs and market stability.

Additionally, the development and adoption of alternative materials that are less harmful to the environment pose a competitive threat to acrylonitrile, particularly in industries focusing on sustainability. These factors collectively contribute to constraining the market growth, despite the strong demand in key application sectors.

Opportunities

The acrylonitrile market presents numerous opportunities for growth and expansion, driven by several emerging trends. The increasing adoption of lightweight and high-strength materials in the automotive and aerospace industries offers significant potential for acrylonitrile-based carbon fibers. Additionally, the ongoing development of new applications for acrylonitrile in water treatment and pharmaceuticals opens new avenues for market expansion. The shift towards more sustainable practices and materials also presents opportunities for innovation in production processes, including recycling and waste reduction techniques.

Moreover, the expanding economies of the Asia-Pacific region, particularly in China and India, provide a fertile ground for market penetration and increased consumption due to their growing industrial sectors. These opportunities, if leveraged effectively, can substantially elevate the market presence and profitability of acrylonitrile producers.

Report Segmentation of the Acrylonitrile Market

By Purity Analysis

In 2023, The “Above 99%” purity segment dominated the Acrylonitrile Market, commanding an 86.7% share, reflecting a robust demand for high-quality acrylonitrile used in acrylic fibers, ABS resins, and SAN resins. These sectors benefit from its high strength, thermal stability, and chemical resistance. The “Up to 99%” segment, serving less critical uses, caters to markets where cost and specific application needs dictate lower purity. The continued dominance of the “Above 99%” segment is driven by technological advances in production and stringent regulations demanding higher purity standards. Ongoing R&D investments to further enhance purity are expected to sustain its market leadership, with a focus on increasing production capacity and technological innovation.

By Application Analysis

Acrylic Fibers dominated the Acrylonitrile Market By Application segment with a 27.3% share, chiefly utilized in textile manufacturing for garments, home furnishings, and industrial textiles. Their resistance to various deteriorative agents and colorability underscore their extensive use. Other key segments include Adiponitrile for Nylon-66 synthesis, Styrene Acrylonitrile (SAN) for consumer goods, and Acrylonitrile Butadiene Styrene (ABS) for automotive and electronics, highlighting the material’s versatility. Acrylic fibers lead in demand, propelled by global fashion trends and synthetic fibers’ cost and durability advantages. Despite facing environmental challenges, this segment is poised to maintain its market prominence through sustainable innovations, appealing to an eco-conscious demographic.

By End-use Analysis

The Automotive sector dominated the Acrylonitrile Market’s end-use segment, holding a 43.3% share. Primarily used in manufacturing Acrylonitrile Butadiene Styrene (ABS) plastics, acrylonitrile contributes significantly to creating lightweight, strong, and heat-resistant components that enhance fuel efficiency and reduce emissions in vehicles. While the Automotive sector leads, Textiles and Electronics also utilize acrylonitrile extensively for synthetic fibers and durable plastic components, respectively. Facing evolving market dynamics and heightened environmental concerns, these sectors are innovating to meet sustainability demands and technological advancements. Continued R&D investment is essential for maintaining competitiveness in this changing landscape, focusing on sustainability and innovation to meet strict environmental standards and consumer preferences.

By Distribution Sales Analysis

Indirect sales dominated the Acrylonitrile Market’s distribution model, accounting for 54.3% of sales, primarily through distributors and resellers. This preference for indirect channels is driven by their ability to extend market reach, especially in areas where direct sales are impractical due to logistical or cost limitations. While indirect sales excel in broadening access and leveraging local market knowledge, direct sales remain critical for manufacturers requiring strict control over their supply chains and customer interactions. As digital platforms grow, they present new opportunities for enhancing direct sales, although the synergy of both channels will likely continue to shape competitive strategies in the global market landscape.

Recent Development of the Acrylonitrile Market

- In June 2023, INEOS Nitriles has recently introduced Invireo™, a pioneering bio-based acrylonitrile that aims to significantly reduce greenhouse gas emissions. This new product, produced at their facility in Cologne, Germany, offers a 90% reduction in carbon footprint compared to conventional acrylonitrile products.

- In June 2023, Cornerstone contemplated the addition of a new acrylonitrile production train in the U.S., with a capacity of 130,000 tonnes per year, expected to commence operations in 2023.

Competitive Landscape

The global acrylonitrile market in 2024 continues to be shaped by the activities of key players including Asahi Kasei Advance Corp., Ascend Performance Materials, INEOS, Mitsubishi Chemical Corporation, and Sumitomo Chemical Co., Ltd., among others. These companies are at the forefront due to their extensive production capacities, strategic global networks, and advanced technological implementations for acrylonitrile production. Mitsubishi Chemical Corporation and INEOS, in particular, are noted for their robust supply chain and innovation in sustainable production processes, which are critical for maintaining competitive advantage in this sector.

Moreover, Ascend Performance Materials and Formosa Plastics Corp. are significant contributors to the market’s expansion through their focus on optimizing production efficiency and enhancing the quality of acrylonitrile, which is essential for downstream applications such as acrylic fibers and acrylonitrile butadiene styrene (ABS) plastics. The strategic expansions and joint ventures undertaken by these firms are pivotal in their aim to meet the growing global demand, especially from emerging markets where industrial growth continues to drive acrylonitrile consumption. Overall, the competitive landscape in 2024 is marked by innovation, efficiency improvements, and strategic global expansions.