Introduction

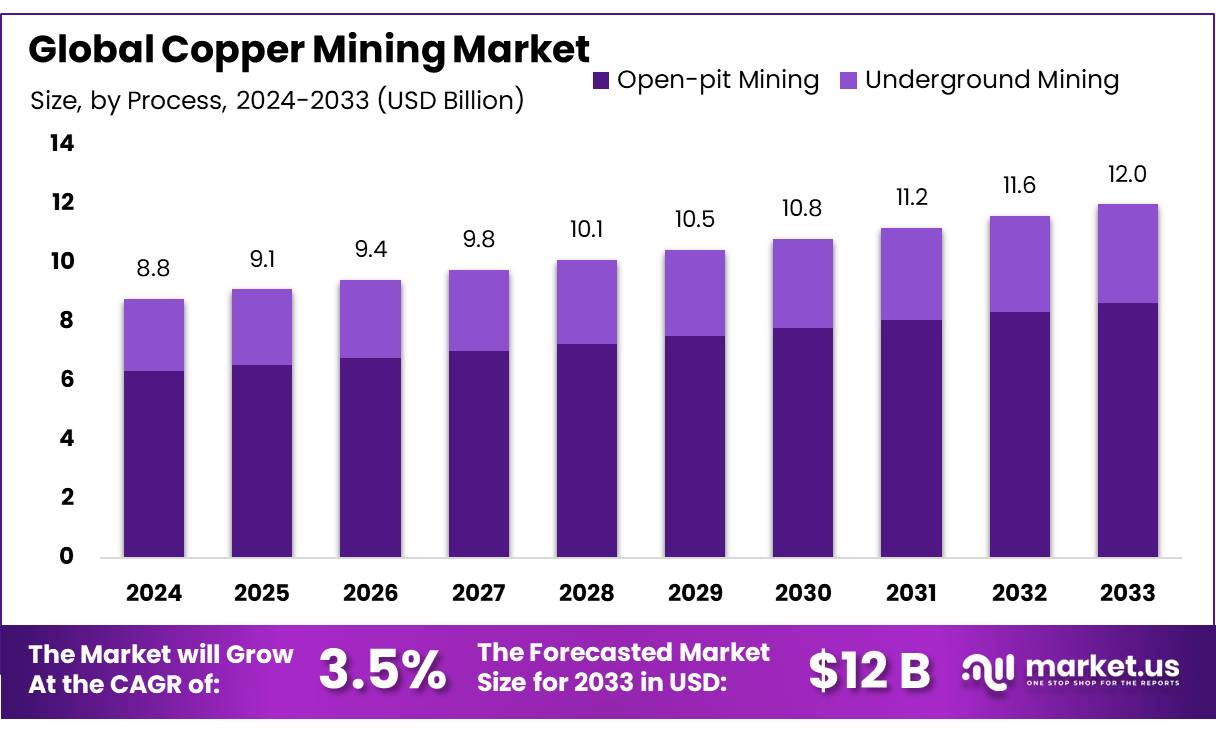

According to Market.us, The global Copper Mining Market is poised for significant growth in the coming years, driven by rising demand from key industries such as electronics, construction, and renewable energy. The market, valued at approximately USD 8.8 Billion in 2023, is projected to reach USD 12 Billion by 2033, reflecting a compound annual growth rate (CAGR) of 3.5% from 2024 to 2033.

This expansion is primarily fueled by the increasing need for copper in the production of electrical components, wiring, and green technologies like electric vehicles (EVs) and solar panels. As the world shifts toward sustainable energy solutions, the demand for copper, a critical component in these technologies, is expected to grow steadily.

Additionally, the booming construction sector, especially in emerging economies, is further driving the need for copper in infrastructure and residential development projects. Copper mining operations are also expanding in response to rising market demand, with opportunities emerging in regions with rich copper reserves, including Latin America and Africa. The market’s growth potential is supported by advancements in mining technology, which enable more efficient extraction processes, reducing operational costs and improving profitability.

Furthermore, as the global economy recovers and industrial production increases, the copper mining market is expected to benefit from improved supply chain dynamics and higher commodity prices. With the continuous expansion of green energy initiatives and infrastructure projects worldwide, copper mining remains a strategically important sector for economic development and innovation. The industry’s strong growth outlook presents considerable opportunities for investors and stakeholders looking to capitalize on rising demand and market expansion.

Key Takeaway

- Copper Mining Market size is expected to be worth around USD 12 Bn by 2033, from USD 8.8 Bn in 2023, growing at a CAGR of 3.5%.

- Open-pit Mining held a dominant market position, capturing more than a 72.4% share.

- 1.0% – 1.5% copper grade segment held a dominant market position, capturing more than a 38.4% share.

- Primary copper held a dominant market position, capturing more than an 84.3% share.

- Metal Processing Industry held a dominant market position in the copper mining sector, capturing more than a 56.3% share.

- Building & Construction Industry held a dominant market position in the copper mining market, capturing more than a 44.2% share.

- Asia Pacific (APAC) dominates the copper mining market with a 41% share, translating to a market size of USD 3.6 billion.

Factors affecting the Growth of the Copper Mining Market

- Rising Demand from Key Industries: The increasing demand for copper from industries such as electronics, electric vehicles (EVs), renewable energy, and construction is a major growth driver. Copper is essential in the production of electrical wiring, components for renewable energy technologies, and EV batteries. As global efforts to transition to cleaner energy sources intensify, the demand for copper, particularly in green technologies, is expected to grow significantly. The global push for electrification and sustainable energy solutions will keep copper in high demand.

- Technological Advancements in Mining: Technological innovations in mining operations are contributing to the market’s growth. Advances in extraction techniques, automation, and data analytics are improving the efficiency and productivity of mining operations. Technologies like remote-controlled equipment, drone surveillance, and real-time data monitoring help reduce costs, increase operational efficiency, and minimize environmental impacts. These innovations enable mining companies to access deeper or more complex copper reserves, which could have previously been unprofitable.

- Geopolitical Factors and Resource Availability: The geographical distribution of copper resources plays a significant role in shaping the copper mining market. The largest reserves are located in countries like Chile, Peru, and China, and geopolitical issues in these regions can affect the global supply chain. Any disruptions, such as labor strikes, regulatory changes, or political instability, can influence production and copper prices. Additionally, the ongoing trade policies and tariffs between major mining countries, particularly China and the U.S., can affect market dynamics.

- Environmental and Sustainability Regulations: Increasing environmental concerns and stricter regulations are reshaping the copper mining sector. Companies are facing pressure to adopt sustainable mining practices, reduce carbon emissions, and minimize environmental damage. Regulatory requirements related to waste management, water usage, and land reclamation are growing more stringent, which can impact operational costs and profitability. As consumers and investors alike demand greener, more sustainable practices, copper mining companies are being forced to adopt cleaner, more efficient technologies.

- Fluctuating Copper Prices: Copper prices are influenced by global economic conditions, supply-demand imbalances, and speculative trading. Volatility in copper prices can create uncertainty for mining companies. A drop in prices, often driven by economic slowdowns or oversupply, can significantly affect the profitability of mining operations. Conversely, price increases, driven by rising demand or supply constraints, can stimulate further investment in copper mining and exploration activities.

Top Trends in the Global Copper Mining Market

- Increased Focus on Sustainability and Green Mining Practices: Sustainability is a top priority for copper mining companies. With growing pressure from governments, consumers, and environmental groups, the industry is increasingly adopting greener practices. This includes reducing carbon emissions, minimizing water usage, and managing waste more effectively. Many mining companies are investing in energy-efficient technologies and exploring cleaner methods of copper extraction, such as bioleaching, which uses bacteria to extract copper from ore, reducing the environmental impact compared to traditional methods.

- Growth of Electric Vehicles (EVs) Driving Copper Demand: One of the most prominent trends influencing the copper mining market is the increasing adoption of electric vehicles (EVs). Copper is a critical component in EVs, used in batteries, wiring, and electric motors. As more countries introduce stricter environmental regulations and as consumer demand for EVs rises, the copper required for these vehicles is expected to increase dramatically. This trend is pushing copper demand to new heights, which in turn is encouraging investment in copper exploration and mining to meet future needs.

- Automation and Digitalization in Mining Operations: The copper mining industry is increasingly embracing automation and digital technologies to improve operational efficiency and reduce costs. From autonomous trucks and drilling systems to AI-powered predictive maintenance, these technological advancements are enhancing productivity, safety, and precision in mining operations. Digitalization, including the use of real-time data analytics, is helping companies optimize supply chains, monitor environmental impacts, and improve decision-making. This trend is expected to continue as mining companies seek ways to boost profits while reducing risks and operating costs.

- Increased Investment in Exploration and Expansion: To meet the growing demand for copper, especially driven by the renewable energy and electric vehicle sectors, mining companies are focusing on expanding their operations and exploring new copper reserves. Major copper-producing regions like Latin America, Africa, and parts of Asia are seeing increased exploration activities, as well as efforts to reopen older mines. As a result, more resources are being allocated to discover untapped copper deposits, and advanced extraction technologies are being used to make previously unprofitable mines viable.

- Supply Chain Diversification and Risk Mitigation: Geopolitical risks, such as trade tensions, labor strikes, and regulatory changes in major copper-producing countries, have prompted mining companies to seek diversification in their supply chains. To mitigate risks and ensure stable copper supply, companies are exploring new mining jurisdictions and establishing strategic partnerships in emerging markets. This trend is also driving the development of more resilient logistics networks and alternative sourcing strategies to ensure that supply chains remain stable in the face of unexpected disruptions.

- Recycling and Circular Economy: Copper recycling is gaining momentum as an important trend in the global copper market. The demand for copper is prompting industries to increase recycling efforts, particularly in electronics, cables, and other copper-rich products. Copper is 100% recyclable without losing its quality, making it an ideal material for circular economy initiatives. By recycling copper from old equipment and products, companies can help alleviate supply pressures while reducing the environmental impact associated with new mining. The growing focus on the circular economy is encouraging more investment in recycling technologies and infrastructure.

- Advancements in Ore Processing Technologies: As copper ores become more difficult to access, mining companies are investing in new processing techniques to extract copper from lower-grade ores. Innovations such as flotation, solvent extraction, and electrowinning (SX-EW) are helping improve the efficiency of copper extraction, reducing the need for high-grade ores and enabling miners to process more complex materials. Additionally, improvements in ore processing technology are helping to reduce energy consumption and the environmental footprint of copper mining.

Market Growth

The Copper Mining Market is expected to experience steady growth in the coming years, driven by several key factors. From a market size of approximately USD 8.8 billion in 2023, it is projected to reach around USD 12 billion by 2033, growing at a compound annual growth rate (CAGR) of 3.5% during the forecast period from 2024 to 2033.

This growth is largely fueled by the increasing demand for copper in industries such as electronics, renewable energy, and electric vehicles (EVs). Copper plays a crucial role in the manufacturing of electrical components, batteries, and solar panels, all of which are vital to the global shift towards cleaner, more sustainable energy solutions.

The rapid adoption of electric vehicles, in particular, is expected to significantly boost copper demand, as these vehicles require large amounts of copper for wiring and batteries. Additionally, ongoing investments in infrastructure and construction, especially in emerging economies, will further drive the demand for copper. As the global economy recovers and industrial production ramps up, the need for copper in manufacturing and infrastructure projects is set to grow.

Technological advancements in mining techniques and ore processing are also contributing to market growth by improving the efficiency and profitability of copper extraction. As new reserves are discovered and mining operations become more cost-effective, copper production is expected to increase, meeting the rising demand. Furthermore, the growing focus on sustainable mining practices and recycling is helping to address environmental concerns while supporting the industry’s long-term growth prospects. With these factors combined, the copper mining market is positioned for a positive growth trajectory over the next decade.

Regional Analysis

The Copper Mining Market is dominated by Asia Pacific (APAC) with a 41% share, with a market size of USD 3.6 billion. North America has advanced mining technologies and substantial reserves, while Europe is driven by automotive and electrical industries. Latin America has vast natural resources, while the Middle East & Africa (MEA) shows potential for growth due to untapped reserves and increasing investments in mining infrastructure. Challenges include political instability and operational risks.

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | USD 8.8 Billion |

| Forecast Revenue 2033 | USD 12 Billion |

| CAGR (2024 to 2033) | 3.5% |

| Asia Pacific (APAC) Market Share | 41% |

| Base Year | 2023 |

| Historic Period | 2020 to 2022 |

| Forecast Year | 2024 to 2033 |

Market Drivers

The copper mining industry is experiencing accelerated global demand due to the energy transition towards renewable energy and electrification. The rapid adoption of electric vehicles and renewable energy infrastructure is increasing the demand for copper, which is crucial for green technologies. The International Energy Agency predicts that copper demand will increase by 50% by 2040 under the Net Zero Emissions by 2050 scenario.

Government policies and initiatives, such as the Inflation Reduction Act in the US and similar legislation in Europe, Australia, and Canada, are also supporting this trend. This presents both challenges and opportunities for growth and innovation in the industry.

Market Restraints

The copper mining industry faces significant challenges due to stringent environmental regulations. These regulations aim to minimize environmental impact but can hinder operational efficiency and cost-effectiveness. They impact various aspects of the mining process, including exploration, extraction, waste management, and mine closure. Environmental assessment processes, such as the Impact Assessment Act, add complexity and time to project timelines.

In Quebec, the legal framework and extended permitting guidelines can hinder investment. The Canadian government’s water usage and effluent quality standards also complicate operations, necessitating advanced water treatment solutions and increased operational costs. These regulations increase upfront and operational costs, restraining the growth and expansion of the copper mining industry.

Opportunities

The copper mining industry is experiencing significant growth due to the global shift towards renewable energy and electrification, driven by technologies like electric vehicles, wind turbines, solar panels, and expanding electrical grids. The International Energy Agency (IEA) highlights the importance of minerals like copper in clean energy transitions. Investment in critical mineral development is also increasing, supporting the speed and affordability of clean energy transitions.

The demand for copper in transport and electricity grid expansion is expected to increase eleven-fold by 2050, highlighting its crucial role in modern infrastructure. The copper mining sector is expected to benefit from these developments and represent a lucrative long-term investment.

Report Segmentation of the Copper Mining Market

By Process Analysis

Open-pit mining, with a 72.4% market share in 2023, is preferred due to its cost-effectiveness and efficiency in extracting minerals from large, near-surface deposits. This method is widely adopted in regions with easily accessible mineral deposits. Underground mining, on the other hand, is less dominant but essential for extracting high-value minerals deep below the earth’s surface, requiring advanced technology and skilled labor.

By Grade Analysis

In 2023, the 1.0% – 1.5% copper grade segment held a 38.4% market share, balancing ore quality and extraction cost. This range is popular for mining operations due to its purity and availability in major deposits. The 0.5%-1.0% grade segment offers a middle ground, suitable for modern applications. Above 1.5% grade copper is sought after due to its high purity, but its rarity makes it less popular.

By Product Type Analysis

Primary copper, a key component in various industrial applications, dominated the market in 2023 with over 84.3% share. This type, produced directly from ores, is highly desirable due to its high conductivity and durability. Secondary copper, a smaller segment, is also vital due to environmental concerns and sustainable practices, as it uses less energy.

By Application Analysis

In 2023, the Metal Processing Industry dominated the copper mining sector, accounting for 56.3% of the market. Copper is crucial for manufacturing metal products and components in construction, electrical systems, and machinery. The Chemical Industry also uses copper as a catalyst in chemical reactions.

By End User Analysis

The Building & Construction Industry, Equipment Manufacturers, and Transportation and Infrastructure Industries all rely on copper for its superior electrical and thermal properties, durability, and resistance to corrosion. Copper is used in electrical wiring, plumbing, heating, cooling systems, architectural elements, and roofing materials. As global focus shifts towards electric vehicles, demand for copper in these sectors is expected to grow.

Recent Development of the Copper Mining Market

- Amerigo experienced difficulties in 2023 that affected its capacity to produce, resulting in a production output of 57.6 million pounds of copper, a decrease from the year before. The business was able to maintain a cash cost of USD 2.17 per pound for the year in spite of these difficulties.

- Anglo American alone greatly increased Anglo American’s output in 2023, helping to raise the yearly production of copper by 24% to 826,000 metric tons.

Competitive Landscape

The competitive landscape of the global Copper Mining Market is marked by the presence of several large, well-established players, alongside smaller firms and emerging companies. Major mining corporations dominate the market, contributing significantly to global copper production. Companies like BHP Billiton Ltd., Anglo American, and Rio Tinto are among the industry leaders, with vast mining operations across key copper-producing regions such as Chile, Peru, and Australia. These companies have substantial resources and advanced technologies, allowing them to maintain competitive advantages in extraction efficiency, cost control, and resource management.

Other prominent players include Freeport-McMoRan Inc., Codelco, and Southern Copper Corp., all of which are involved in large-scale mining projects with a strong global presence. Codelco, based in Chile, is the world’s largest producer of copper, while Freeport-McMoRan operates some of the most productive copper mines globally. Similarly, Southern Copper Corp. is a key player in both production and processing, with a strong foothold in North and South America.

Mid-sized and smaller companies such as First Quantum, Glencore International AG, and Amerigo Resources Ltd. also play a significant role in the market, focusing on operational efficiency, technological innovation, and sustainable mining practices to stay competitive. Companies like Zijin and Bougainville Copper Limited represent important players in emerging copper regions, expanding their market share through strategic investments and exploration activities.

Additionally, firms like African Copper Plc., Dot Resources Ltd., and Global Hunter Corp. are making their mark by exploring untapped copper reserves and seeking to develop new mining projects in regions with significant copper deposits, particularly in Africa and Asia. With varying levels of production capacity, technological adoption, and geographic reach, these companies collectively shape the competitive dynamics of the copper mining sector. As demand for copper continues to rise, these players will likely compete to secure key resources and maintain their market position in a rapidly evolving industry.