Introduction

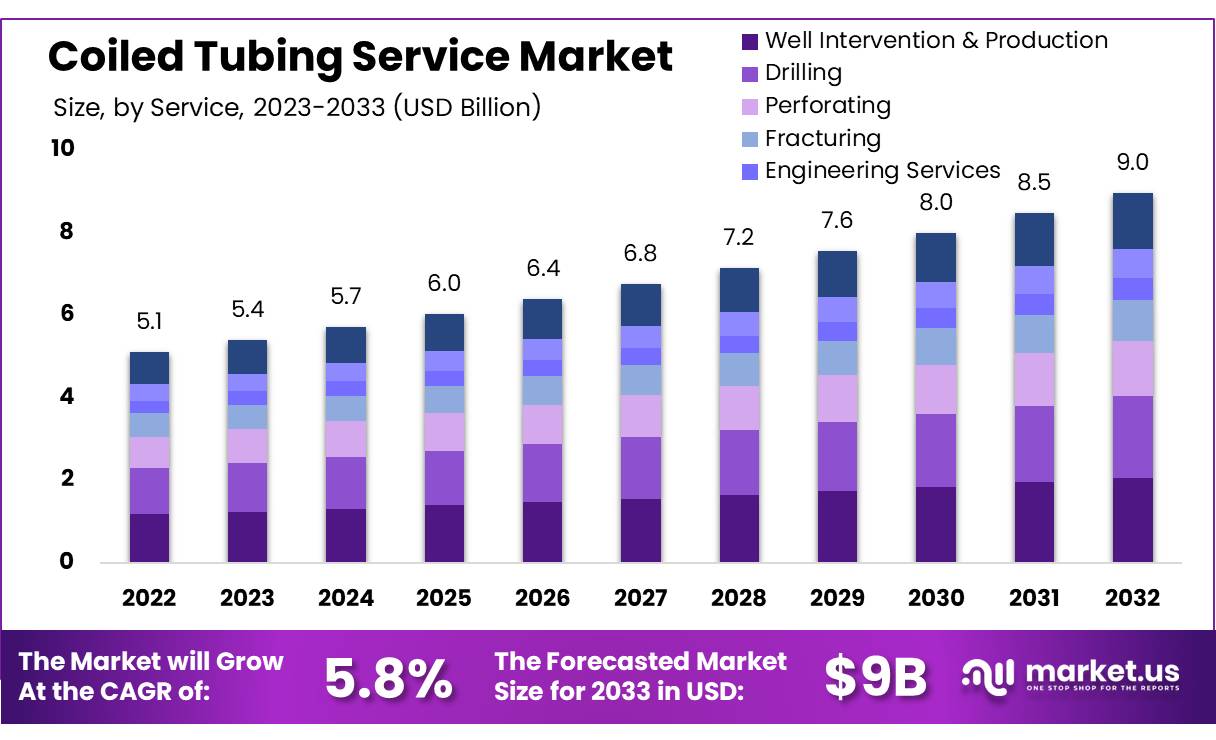

According to Market.us, The Global Coiled Tubing Service Market is on a growth trajectory, projected to expand from USD 5.1 Billion in 2023 to around USD 9.0 Billion by 2033, achieving a compound annual growth rate (CAGR) of 5.8% over the forecast period from 2024 to 2033.

This growth is driven by increasing demand from the oil and gas industry, where coiled tubing is essential for well intervention, drilling, and completion services. The market’s popularity is bolstered by the efficiency and cost-effectiveness of coiled tubing technology in extending the life of existing wells and its capability in complex drilling operations.

Significant advancements in coiled tubing technologies, including real-time data transmission and improved materials for high-pressure and high-temperature environments, contribute to market expansion. Opportunities are particularly prominent in regions with maturing oil fields and in shale reserves where non-conventional extraction methods are prevalent.

Moreover, the push for more sustainable and environmentally friendly drilling practices encourages innovations in this field, further propelling market demand. The strategic emphasis on optimizing operational efficiencies and reducing downtime in oilfield operations will continue to drive significant investments in the coiled tubing services market, making it a critical component in the energy sector’s future.

Key Takeaway

- Coiled Tubing Service Market size is expected to be worth around USD 9.0 Billion by 2033, from USD 5.1 Billion in 2023, growing at a CAGR of 5.8%.

- Well Intervention & Production held a dominant market position in the Coiled Tubing Service Market, capturing more than a 23.4% share.

- Circulation held a dominant market position in the Coiled Tubing Service Market, capturing more than a 24.5% share.

- Hardware held a dominant market position in the Coiled Tubing Service Market, capturing more than a 47.3% share.

- Large Diameter Coiled Tubing held a dominant market position, capturing more than a 56.5% share.

- Onshore held a dominant market position in the Coiled Tubing Service Market, capturing more than a 64.2% share.

- Fracturing held a dominant market position in the Coiled Tubing Service Market, capturing more than a 24.4% share.

- Oil and Gas Industry held a dominant market position in the Coiled Tubing Service Market, capturing more than an 87.8% share.

- Asia Pacific (APAC) is the dominant region in the market, capturing 35% of the global share and generating USD 1.8 billion in revenue.

Factors affecting the Growth of the Coiled Tubing Service Market

- Technological Advancements: Innovations in coiled tubing technology, including enhanced materials for handling high-pressure and high-temperature conditions, have broadened the scope of its applications. These advancements make coiled tubing services more efficient and effective for complex well interventions and extended reach drilling, which are critical in maintaining productivity in challenging oil and gas reservoirs.

- Increasing Energy Demand: As global energy consumption continues to rise, driven by growing populations and industrialization, there is a heightened demand for oil and gas extraction. Coiled tubing services play a crucial role in enhancing oil recovery rates, particularly in mature and declining oil fields, thereby supporting the growing energy demand.

- Cost Efficiency and Time Savings: Coiled tubing operations are valued for their ability to save time and reduce costs in drilling and well maintenance operations. Unlike traditional drilling methods, coiled tubing does not require removing the drill pipe from the well to change tools or perform services, which significantly decreases operation times and enhances cost efficiency.

- Environmental and Regulatory Compliance: The oil and gas industry faces strict environmental regulations which push for cleaner and safer operations. Coiled tubing services, known for their minimal environmental footprint compared to conventional drilling methods, are increasingly preferred as they align with environmental and safety standards.

- Market Expansion into New Geographies: As oil and gas exploration moves into more remote and technically challenging environments, such as deep-water and ultra-deep-water locations, coiled tubing services are increasingly vital. These services are essential for interventions in these harsh conditions where traditional methods may not be viable.

- Shift Towards Horizontal Drilling and Hydraulic Fracturing: The shift towards horizontal drilling and the widespread adoption of hydraulic fracturing (fracking) in non-conventional shale reservoirs have led to increased utilization of coiled tubing for interventions and completions. The flexibility and capability of coiled tubing to work under the geometric constraints of horizontal wells make it indispensable in modern petroleum extraction techniques.

Top Trends in the Global Coiled Tubing Service Market

- Increased Use of Real-time Data: There is a growing trend towards the integration of real-time data and telemetry systems in coiled tubing operations. These technologies enable operators to make more informed decisions on the fly, enhancing the efficiency and safety of well interventions and drilling operations.

- Adoption of Automated Technologies: Automation in coiled tubing services is becoming more prevalent. Automated systems improve precision and control in coiled tubing operations, reducing human error and operational downtime, which is crucial for maintaining productivity and safety standards.

- High-Pressure, High-Temperature (HPHT) Developments: As oil and gas exploration moves into more extreme environments, the demand for coiled tubing capable of withstanding high-pressure and high-temperature conditions has increased. Innovations in materials and engineering are making these operations more feasible and safer.

- Environmental and Regulatory Impacts: The industry is experiencing a push towards adopting greener and more environmentally friendly technologies. Coiled tubing services are part of this trend, as they offer more efficient resource use and reduced environmental footprint compared to traditional methods.

- Expansion in Unconventional Reservoirs: With the maturation of conventional oil fields, there is an increased focus on unconventional reservoirs, such as shale formations, where horizontal drilling and hydraulic fracturing are prevalent. Coiled tubing is essential in these settings for interventions and completions due to its flexibility and capability to operate in the constrained geometries of horizontal wells.

- Focus on Cost Efficiency: In response to fluctuating oil prices and economic pressures, there is a continued emphasis on cost efficiency within the oil and gas industry. Coiled tubing services offer significant cost savings by reducing the time and labor involved in well maintenance and completion, which is critical for maintaining profitability.

Market Growth

The market for Coiled Tubing Services is witnessing notable growth, anticipated to surge from USD 5.1 billion in 2023 to around USD 9.0 billion by 2033, with a compound annual growth rate (CAGR) of 5.8% during the period from 2024 to 2033. This growth is driven primarily by the oil and gas industry’s need for efficient and effective solutions for well interventions, completions, and drilling operations. As global energy demands continue to climb, the pressure to maintain and enhance oil and gas production from both existing and new wells intensifies, leading to a greater reliance on coiled tubing technologies.

These technologies offer significant advantages, such as reduced operation times and minimized environmental impact, making them increasingly popular in the industry. The shift towards more challenging drilling environments, such as deep-water and unconventional shale sites, also propels the demand for coiled tubing services, which are well-suited for these complex scenarios.

Moreover, the ongoing advancements in coiled tubing equipment and techniques, including the adoption of automation and real-time data systems, are improving operational efficiencies and safety, further stimulating market growth. This upward trajectory is supported by continuous innovations and technological enhancements, which help oil and gas companies optimize production and reduce costs, ensuring the sustained expansion of the coiled tubing service market in the coming decade.

Regional Analysis

The Asia Pacific dominates the global coiled tubing market, accounting for 35% of the market share and generating USD 1.8 billion in revenue. North America, driven by technological advancements and extensive shale gas exploration, is a leading region. Europe, with stringent regulatory standards and mature oil fields, focuses on innovative well intervention techniques and environmental sustainability. The Middle East & Africa leverages vast oil reserves to maximize oil recovery through coiled tubing. Latin America, despite being smaller, is investing in offshore exploration and adapting coiled tubing technologies to improve oil fields productivity.

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | USD 5.1 Billion |

| Forecast Revenue 2033 | USD 9.0 Billion |

| CAGR (2024 to 2033) | 5.8% |

| Asia Pacific Market Share | 35% |

| Base Year | 2023 |

| Historic Period | 2020 to 2022 |

| Forecast Year | 2024 to 2033 |

Market Drivers

The Coiled Tubing Service market is growing due to the increasing need for oil well maintenance and enhancement. As oil wells age, they require more frequent maintenance, which coiled tubing services support. The market is also driven by global economic expansion and increasing energy consumption, particularly in developing nations. Technological advancements in coiled tubing, such as real-time data transmission and improved materials, enhance its effectiveness in well interventions and operations.

Market Restraints

The Coiled Tubing Service market faces challenges due to high initial investment costs, ongoing operational costs, and the availability of low-cost alternatives like snubbing units, wireline services, and hydraulic workover units. These costs are particularly high for smaller operators and are particularly prevalent in regions with less favorable economic conditions or smaller oil and gas production activities. These factors pose stiff competition to coiled tubing services.

Opportunities

The Coiled Tubing Service market is experiencing significant growth due to the increasing use of coiled tubing technologies in mature oil fields. As these fields age, the demand for efficient well maintenance and intervention services increases, particularly in maintaining existing wells.

Technological advancements, such as real-time data transmission and advanced materials, are making coiled tubing operations more efficient and cost-effective. Additionally, stringent environmental and operational safety regulations are pushing the industry towards safer and more environmentally friendly interventions.

Report Segmentation of the Coiled Tubing Service Market

By Service

In 2023, Well Intervention & Production held a dominant 23.4% share in the Coiled Tubing Service Market, primarily due to its role in extending the productive life of oil and gas wells. Coiled tubing offers speed, flexibility, and cost-effectiveness compared to conventional drilling rigs. Perforating services, fracturing services, engineering and milling services, and nitrogen services are all essential in this market. Coiled tubing is also used for wellbore clean-up tasks and pressure testing, ensuring well safety and integrity.

By Operations

In 2023, Circulation held a 24.5% share in the Coiled Tubing Service Market, focusing on key operations such as fluid movement, pumping, logging, perforation, and milling. Circulation ensures fluid movement in wellbores for effective cleaning and conditioning, while pumping facilitates hydraulic fracturing and acid stimulation. Logging uses coiled tubing for downhole data gathering, while perforation enhances production in challenging environments. Milling services remove obstructions for well rehabilitation and completion processes.

By Technology/Services

In 2023, hardware dominated the Coiled Tubing Service Market with 47.3% share, encompassing essential components like coiled tubing units, pressure control equipment, and downhole tools. This hardware’s durability and technological advancements ensure efficiency and safety. Software in coiled tubing services optimizes procedures and increases predictability. Solutions, including real-time monitoring and decision support systems, enhance efficiency and outcomes in coiled tubing operations.

By Diameter

In 2023, Large Diameter Coiled Tubing held a dominant market position, dominating the high-pressure and large-scale operations sector with 56.5% share. This segment is ideal for deep well interventions and larger-scale fracturing operations, while Small Diameter Coiled Tubing is preferred for constrained environments and older or delicate wells due to its ease of handling.

By Location

In 2023, onshore operations held a dominant 64.2% share in the Coiled Tubing Service Market, largely due to the accessibility and cost-effectiveness of onshore locations. Offshore operations, while smaller, face challenges due to technical demands and high costs, making them more specialized and technically advanced. Despite their smaller market share, offshore operations remain crucial for efficient coiled tubing services.

By Application

Fracturing holds a 24.4% share in the Coiled Tubing Service Market in 2023, primarily used for hydraulic fracturing, wellbore cleanups, ESP cable convoy services, pipeline cleanouts, fishing operations, cementing, and nitrogen jetting. Coiled tubing is crucial for efficient crack initiation, propagation, continuous pumping, and reaching extended lateral sections of horizontal wells.

It also ensures reliable downhole electrical systems, reduces downtime, and minimizes equipment losses. Its use is essential for well integrity, zonal isolation, and well start-up and maintenance.

By End Use Industry

The Oil and Gas Industry dominated the Coiled Tubing Service Market in 2023, holding a 87.8% share due to its crucial role in exploration, production, and maintenance. The EPC Industry also uses coiled tubing services for commissioning and maintaining oilfield infrastructure, ensuring successful energy project implementation and longevity.

Recent Development of the Coiled Tubing Service Market

- Halliburton reported $5.8 billion in revenue and $606 million in net income in 2024, a 2% increase over the year before.

- Schlumberger’s ACTiveTM real-time downhole coiled tubing services have proven essential in 2023; they use real-time data to optimize treatments and drastically cut down on operating times.

Competitive Landscape

The competitive landscape of the Coiled Tubing Service market is robust and dynamic, featuring a mix of established players and specialized service providers. Among the industry leaders are Schlumberger, Baker Hughes (a GE Company), and Halliburton, which are renowned for their extensive service portfolios and global reach. These companies are at the forefront of technological innovations, offering advanced coiled tubing solutions that address a wide range of challenges in oil and gas well operations.

Other key participants include Essential Coil and Calfrac Well Services, which are known for their focus on North American markets, providing tailored well intervention and management services. National Oilwell Varco is another major contender, offering a variety of equipment and technologies that enhance the efficiency and safety of coiled tubing operations.

Regional players such as COSL – China Oilfield Services Limited, and National Energy Services Company, play critical roles in local markets, expanding the availability of coiled tubing services in Asia and the Middle East, respectively. Companies like C&J Energy Services and Key Energy Services in the U.S. contribute significantly to the market with their specialized well servicing offerings.

Further adding to the competitive dynamics are firms like Archer – the well company, BJ Services, and Global Tubing, LLC, which provide niche services and products, including custom coiled tubing units and proprietary technologies that improve well performance and longevity. Basic Energy Services, Superior Energy Services, and Pioneer Energy Services offer a range of well servicing options that support the maintenance and enhancement of oil and gas production. Antech stands out with its focus on innovation and technology-driven solutions, emphasizing the development of tools and methods that streamline operations and reduce environmental impact.