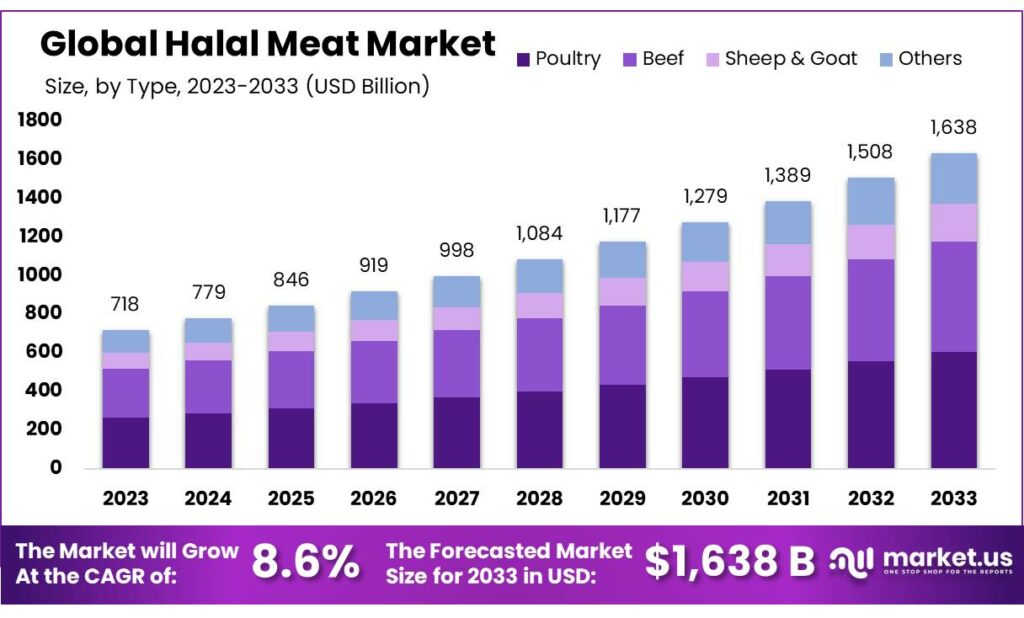

According to Market.us, The Global Halal Meat Market was valued at USD 718 Billion and is expected to reach USD 1638 Billion in 2033. Between 2023 and 2033, this market is estimated to register a CAGR of 8.6%.

The global halal meat market is experiencing robust growth, driven by increasing Muslim populations and rising awareness of halal food principles. This market encompasses meat that adheres to Islamic dietary laws, characterized by specific, humane slaughtering processes and the absence of pork products. Consumer demand is not only surging in predominantly Muslim countries but also in Western nations with growing Muslim communities.

Key factors propelling this market include the expanding availability of halal products in supermarkets and specialty stores and the rising preference for ethical and religiously compliant foods among consumers. Market dynamics are also influenced by stringent regulatory frameworks ensuring authenticity and quality, further boosting consumer confidence and demand for halal meat products.

Key Takeaway

- The Global Halal Meat Market is expected to reach USD 1638 billion by 2033, with an 8.6% CAGR between 2023-2033.

- Poultry Dominance: Poultry hold a 35.3% market share in 2024 due to versatility and lower fat content.

- Certification Preference: Solid Halal Certification captures over 64.2% market share, emphasizing consumer trust.

- Packaging Preference: Fresh meat dominates with an 85.6% market share, driven by freshness and taste.

- Distribution Channel: Convenience Stores lead with 72.4% market share, offering accessibility and extensive products.

- End-user Dominance: Household Consumers hold a 34.5% market share, driving market demand.

- Regional Analysis: Asia Pacific dominates the market with a 38.9% share, driven by the Muslim population and investments.

- The University of Missouri found that the average price of Halal meat in the United States was 20% higher than conventional meat in 2023.

- University of Florida found that the demand for Halal meat in the United States is expected to increase by 10% annually until 2024 due to the growing Muslim population.

Factors affecting the growth of the Halal Meat Market

- Rising Muslim Population: The primary driver of the halal meat market is the increasing Muslim population worldwide. With Islam being one of the fastest-growing religions, the demand for halal meat, which is prepared according to Islamic laws, is naturally on the rise.

- Growing Awareness and Acceptance: There is a growing awareness and acceptance of halal products among both Muslim and non-Muslim consumers. This is driven by perceptions of halal meat being healthier or of higher quality due to its stringent preparation and processing standards.

- Globalization of Trade: Increased globalization has facilitated the wider distribution of halal products, allowing them to reach non-traditional markets where there may be burgeoning Muslim communities or where local consumers are seeking alternative products.

- Regulatory Support: In many countries, governments are implementing clearer regulations and standards for halal certification, which help standardize the market and build trust among consumers. This is crucial for market expansion both domestically and internationally.

- Economic Growth in Muslim-majority Countries: As economies in Muslim-majority countries grow, so does consumer spending power, which increases the demand for certified halal products. This economic factor is complemented by urbanization trends that also contribute to market growth.

Top Trends in the Global Halal Meat Market

- Expansion of Consumer Base: Initially targeted primarily at Muslim consumers, halal meat products are increasingly being sought by a broader audience who perceive halal certification as a mark of quality assurance and ethical production.

- Integration of Blockchain Technology: To enhance transparency and traceability in halal meat production, companies are adopting blockchain technology. This innovation helps in documenting and verifying every step of the meat processing chain, from slaughter to packaging, ensuring compliance with halal standards.

- Growth in Online Retail: The expansion of e-commerce platforms offering halal-certified products has been pivotal in accessing wider markets. Consumers can now verify halal credentials online, review product sourcing, and purchase with confidence from certified suppliers.

- Higher Demand for Processed Halal Meat Products: There is a growing consumer preference for convenience, driving demand for processed and pre-cooked halal meats, such as sausages and deli meats.

- Stringent Regulatory Compliance: Countries with significant Muslim populations are tightening their regulatory frameworks to ensure that halal standards are met across the production and supply chain.

- Innovative Marketing Strategies: Producers and retailers are using innovative marketing strategies to educate consumers about the benefits of halal meat and to differentiate their products in the marketplace.

Market Growth

The Global Halal Meat Market is experiencing robust growth, driven by increasing Muslim populations and rising awareness of halal principles among non-Muslim consumers. It is projected to expand at a significant compound annual growth rate (CAGR). The demand for halal meat is supported by stringent compliance with ethical slaughtering practices and quality assurance, which are influencing consumer preferences globally.

Key factors contributing to market expansion include technological advancements in meat processing and a growing retail presence. The Asia-Pacific region holds a substantial market share due to its large Muslim demographic. Furthermore, the market is witnessing a surge in demand from Western countries, where consumers are progressively choosing halal meat for its perceived quality and health benefits. The industry’s growth is also bolstered by supportive government initiatives promoting halal certifications.

Regional Analysis

In 2023, Asia Pacific dominated the global halal meat market with a 38.9% share, largely due to its substantial and growing Muslim population in countries like Indonesia, Pakistan, Malaysia, and India. These nations, being among the most densely populated Muslim regions globally, create a strong, steady demand for Halal-certified meat.

Additionally, significant investments in Halal food market infrastructure and certification processes in the Asia Pacific enhance the region’s reputation and capabilities as a major exporter of Halal meat. Meanwhile, the Middle East and Africa also play crucial roles in the market, driven by their strict adherence to Islamic dietary laws. Countries such as Saudi Arabia, the UAE, and South Africa are key contributors, bolstering the demand both locally and internationally.

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | USD 718 Billion |

| Forecast Revenue (2033) | USD 1638 Billion |

| CAGR (2024 to 2033) | 8.6% |

| Asia Pacific Market Share | 38.9% |

| Base Year | 2023 |

| Historic Period | 2020 to 2022 |

| Forecast Year | 2024 to 2033 |

Market Drivers

The Halal Meat Market is primarily driven by the increasing global Muslim population, which seeks meat products compliant with Islamic dietary laws. This demographic shift has prompted wider acceptance and demand for halal-certified products. Additionally, non-Muslim consumers are gravitating towards halal meat, perceiving it as a healthier, higher-quality option due to its stringent preparation standards. International trade policies and regulations also significantly influence the market, as countries with large Muslim populations often import substantial quantities of halal meat, fostering global trade links.

Furthermore, technological advancements in meat processing and logistics have enhanced distribution channels, making halal meat more accessible worldwide. The rising trend of organic and ethically produced food also complements the growth of the halal meat market, aligning with the ethical slaughtering practices mandated by halal certification.

Market Restraints

The Halal Meat Market faces several restraining factors that impact its growth and distribution on a global scale. Stringent religious compliance requirements pose a significant challenge, as any deviation in the slaughtering processes can lead to non-compliance with halal standards, affecting market acceptability.

Additionally, the lack of uniformity in halal certification standards across different regions creates barriers to entry into international markets. Supply chain complexities, including the need for dedicated facilities and transport to avoid cross-contamination with non-halal products, further escalate operational costs and complicate logistics. Moreover, the perception issues and cultural resistance in non-Muslim countries can limit market penetration and consumer base expansion. These factors collectively inhibit the broader adoption and scalability of halal meat products in diverse markets.

Opportunities

The halal meat market presents significant growth opportunities due to rising demand from Muslim populations and growing consumer awareness of ethical and high-quality food products. Expanding global markets, particularly in non-Muslim majority countries, highlight the untapped potential for halal-certified products. Key opportunities include diversifying product offerings such as organic, processed, and ready-to-eat halal meats to cater to evolving consumer preferences. E-commerce is also a burgeoning channel, offering convenient access to halal products.

Additionally, businesses can benefit from certifications and partnerships with Islamic organizations to build trust and authenticity. Investment in sustainable and transparent supply chains aligns with global trends in conscious consumerism, further enhancing market competitiveness. Overall, the halal meat industry is poised for robust growth, driven by demand for both traditional and innovative halal food products.

Report Segmentation of the Halal Meat Market

By Type Analysis

The Poultry segment dominated the global halal meat market, accounting for a 35.3% share, propelled by its adaptability to various cuisines and its lower fat content relative to other meat types. Poultry, particularly chicken, is favored for its health benefits as a source of lean protein and its wide culinary application across different cultures. Economically, poultry production offers advantages such as lower costs and faster production cycles, facilitating stable market supply and competitive pricing. The segment’s strong compliance with Halal standards and its appeal to both Muslim and non-Muslim consumers further solidify its leading position in the market.

By Certification Type Analysis

Solid Halal Certification dominated the market, holding a 64.2% share, indicating a strong global preference for halal-certified meat products. This certification ensures compliance with Islamic dietary laws, appealing to Muslim consumers and those seeking food that conforms to religious practices. Conversely, non-certified meat products, which may lack halal labeling or certification, captured the remaining market share, attracting consumers with different priorities such as taste, convenience, or cost. The prominence of Solid Halal Certification highlights the significant role of religious dietary preferences in the global meat market, with a projected increase in demand for halal-certified products likely to drive market growth further.

By End-User Analysis

Solid fresh meat dominated the global halal meat market with an 85.6% share, reflecting a strong consumer preference for fresh over frozen products. Fresh halal meat is favored for its quality, taste, texture, and nutritional value, which align with consumer preferences for natural, minimally processed foods. It is especially popular for both daily meals and special occasions. Conversely, frozen halal meat holds a smaller market share but is crucial in areas with limited fresh meat access, offering extended shelf life and convenience. As health consciousness rises, demand for fresh halal meat is expected to grow, although frozen meat remains important for its convenience and accessibility.

By Distribution Channel Analysis

The Convenience Stores segment captured a significant 72.4% share of the global halal meat products market, underscoring their role as the primary channel for distribution. These stores meet consumer demands for quick, easy access to groceries, aligning with the on-the-go lifestyle and immediate needs prevalent today. Their strategic locations and extended hours enhance their appeal, offering consumers efficient shopping experiences. Additionally, supermarkets and hypermarkets contribute to building consumer trust by focusing on the quality, safety, and Halal certification of their meat products. Their large scale allows for competitive pricing and promotions, making Halal meat more accessible to a broader range of consumers.

Recent Development of the Halal Meat Market

- In August 2023, BRF announced establishing a joint venture in partnership with the Halal Products Development Company (HPDC), a subsidiary under the purview of Saudi Arabia’s sovereign wealth fund, the Public Investment Fund (PIF). This development marks the formalization of an earlier memorandum that was publicly announced in October 2022. As per the terms of the agreement, BRF’s ownership stake in the venture will amount to 70%, while HPDC will hold a 30% interest.

- In June 2023, the Halal Products Development Company (HPDC) unveiled a significant strategic collaboration with Tanmiah Food Company, a prominent player in the food manufacturing sector within Saudi Arabia. HPDC, a company under the Public Investment Fund (PIF) umbrella, introduced this groundbreaking partnership as a proactive initiative aimed at bolstering and domesticating the halal products market in the Kingdom while fostering its growth regionally and globally.

Competitive Landscape

In the evolving landscape of the global Halal meat market, key players such as BRF Global, Amana Foods, and Al Islami Foods continue to exert substantial influence through their expansive distribution networks and compliance with stringent Halal standards. Entities like Tariq Halal and Tahira Foods Ltd are distinguishing themselves by catering to the rising demand for ethically sourced and processed meat. Furthermore, the SIS Company and Al Kabeer Group ME are leveraging technological advancements to enhance supply chain efficiency and product traceability, critical factors in ensuring Halal compliance and winning consumer trust.

Prairie Halal Foods and Nema Halal are capitalizing on the trend towards organic and free-range Halal meats, which appeal to health-conscious consumers. Meanwhile, Thomas International and Al-Aqsa are focusing on expanding their market presence by entering new geographical territories with significant Muslim populations. The French company DOUX continues to strengthen its foothold in both Middle Eastern and European markets by emphasizing quality and sustainability.

Emerging companies like Herd & Grace are innovating within the sector by integrating modern marketing techniques with traditional Halal values, thereby appealing to younger demographics. Collectively, these companies are poised to drive forward the global Halal meat market through innovation, adherence to Halal certification, and responsiveness to consumer preferences.