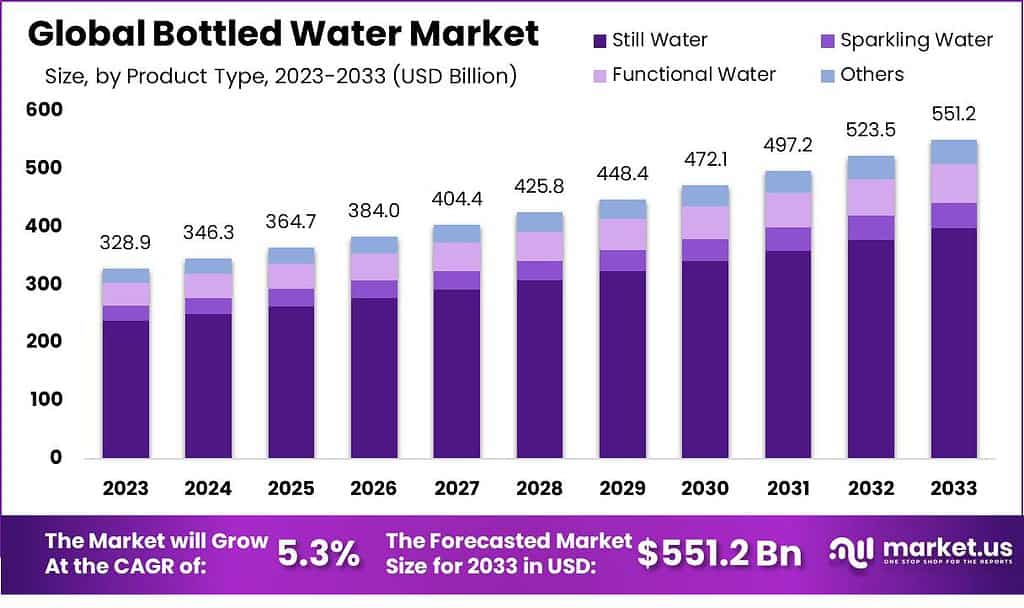

According to Market.us, The Global Bottled Water Market size is expected to be worth around USD 551.2 Billion by 2033, from USD 328.9 Billion in 2023, growing at a CAGR of 5.3% during the forecast period from 2023 to 2033. Asia Pacific dominates the Bottled Water market, capturing 46% of the market share, valued at USD 151.2 billion in 2023, with significant growth anticipated.

The Bottled Water Market has witnessed significant growth, driven by increasing health awareness and consumer demand for convenient, safe drinking options. This market trend is further fueled by concerns over water quality and accessibility in urban and polluted areas. As consumers globally shift towards healthier lifestyles, the preference for bottled water over sugary drinks has surged, positioning it as a healthier alternative. The industry has also seen a rise in demand for premium and functional waters, which include added health benefits such as vitamins and minerals.

However, the environmental impact of plastic bottles has led to a push for sustainable packaging solutions within the sector, influencing consumer preferences and industry practices. Overall, the bottled water market continues to expand, adapting to evolving consumer demands and environmental considerations.

Key Takeaway

- The Global Bottled Water Market is expected to reach USD 551.2 billion by 2033. It is projected to grow at a CAGR of 5.3% from 2023 to 2033.

- Product Types: Still Water is the dominant segment in 2023, holding a market share of 72.3%.

- Packaging Plastic Bottles are the most popular packaging choice, with a market share of 68.5% in 2023.

- Distribution Channels: Online distribution is dominant, commanding a market share of 90.1% in 2023.

- Asia Pacific (APAC) held a dominant market position in the Bottled Water market, capturing more than a 46% share.

Factors affecting the growth of the Bottled Water Market

- Health Awareness: Increased consumer awareness regarding the health benefits associated with drinking clean and pure water is a significant driver. As consumers become more health-conscious, the demand for bottled water surges as an alternative to sugary drinks and other beverages perceived as less healthy.

- Water Quality Concerns: Issues related to the contamination of municipal water supplies and the general perception of tap water safety drive consumers towards bottled water. Incidents of water pollution and infrastructure aging in many regions enhance the reliance on bottled water for daily consumption needs.

- Innovations in Packaging: The market has witnessed innovations such as biodegradable bottles, recyclable materials, and lightweight packaging designs that not only appeal to environmentally conscious consumers but also reduce shipping costs and carbon footprints.

- Regulatory Standards: Stringent regulations regarding water quality and safety enforced by governments worldwide reassure consumers about the quality of bottled water. These standards, while ensuring product safety, also pose barriers to entry into the market, affecting competition and innovation.

- Lifestyle Trends: There is a growing trend of premiumization in bottled water, where consumers are willing to pay more for products that offer added health benefits, unique packaging, or originate from exotic locations. This trend is particularly strong in urban areas among middle to high-income consumers.

- Environmental Concerns: While the bottled water market is growing, it faces criticism from environmental groups concerned about plastic waste and its lifecycle impact.

Top Trends in the Global Bottled Water Market

- Premiumization: Premium bottled water brands that offer added health benefits, such as added minerals or alkaline pH levels, are seeing increased consumer interest. This trend is also marked by a rise in the consumption of artisanal or naturally sourced waters, which are often marketed with an emphasis on purity and origin.

- Sustainability Initiatives: Environmental concerns are prompting both manufacturers and consumers to consider the sustainability of bottled water. This includes innovations in packaging, such as biodegradable materials and reusable bottles, as well as initiatives aimed at reducing the carbon footprint of production and distribution processes.

- Flavored and Functional Waters: The market is experiencing growth in the segments of flavored and functional waters, which offer consumers variety along with health benefits such as added vitamins and electrolytes.

- Smart Packaging Technologies: Technology integration into packaging, such as QR codes and smart labels that provide consumers with information about the product’s source and footprint, is becoming more prevalent.

- Home and Office Delivery Services: The demand for home and office delivery of bottled water has increased, particularly in the context of ongoing global health concerns. This trend has been facilitated by the rise of e-commerce and the expansion of online platforms that offer direct-to-consumer delivery options.

Market Growth

The global bottled water market is experiencing significant growth, driven by increasing health awareness and a shift towards healthier hydration options. The demand is further bolstered by consumer preferences for convenient, safe, and portable drinking solutions. Innovations in packaging and a rising inclination towards premium mineral waters are enhancing market prospects. Moreover, the industry is witnessing a surge in eco-friendly packaging solutions, responding to consumer demands for sustainability. The Asia-Pacific region represents a substantial share of the market, fueled by growing populations and urbanization. This market’s expansion is supported by strategic investments and expansions by key industry players.

Regional Analysis

The Asia Pacific (APAC) dominated the Bottled Water market with over a 46% share, driven by rapid urbanization, population growth, and increased demand for clean water. Valued at USD 151.2 billion, the region’s market is bolstered by health-conscious trends and diverse product offerings, from purified to functional waters. North America also held a significant share, fueled by health trends and a shift from sugary drinks, with companies focusing on eco-friendly packaging.

Europe’s market growth was driven by demand for premium mineral and spring waters, supported by strict quality regulations. Latin America experienced rising demand due to urbanization and health awareness, favoring bottled water over sugary beverages. In the Middle East and Africa, growth was spurred by water scarcity, tourism, and demand for portable hydration, with innovations like flavored and vitamin-enriched waters.

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | USD 328.9 Billion |

| Forecast Revenue (2033) | USD 551.2 Billion |

| CAGR (2024 to 2033) | 5.3% |

| Asia Pacific Market Share | 46% |

| Base Year | 2023 |

| Historic Period | 2020 to 2022 |

| Forecast Year | 2024 to 2033 |

Market Drivers

The increasing health consciousness among consumers significantly influences the bottled water market, as many opt for water over sugary and calorie-rich beverages, viewing it as a healthier alternative. Additionally, the convenience and portability of bottled water make it an attractive choice for individuals on the go, particularly in areas where tap water quality is compromised.

Moreover, heightened environmental awareness has boosted the demand for sustainable packaging, prompting water companies to adopt recyclable materials. The market has also expanded through the introduction of flavored and functional waters, like those enhanced with vitamins or electrolytes, appealing to diverse consumer preferences and offering added hydration benefits.

Market Restraints

The bottled water industry is scrutinized for its environmental impact, particularly due to the generation of plastic waste, prompting demands for sustainable packaging solutions. This shift towards eco-friendly alternatives may lead to increased operational costs. Additionally, the availability of high-quality tap water presents significant competition in certain regions, potentially restraining market expansion. The industry is also challenged by stringent safety and quality regulations, which impose considerable costs and compliance burdens on manufacturers.

Furthermore, consumer trust can be compromised by negative perceptions regarding the purity and sourcing of bottled water, influenced by reports of contamination or unethical practices, thereby affecting consumer choices.

Opportunities

The global bottled water market is experiencing significant growth, driven by increasing health awareness and rising disposable incomes. As consumers increasingly prioritize hydration and wellness, the demand for convenient, safe, and healthy hydration solutions is rising. This shift presents substantial opportunities for market entrants and existing players to innovate in product offerings, particularly in the premium segment, which promises added minerals and enhanced taste.

Furthermore, the trend towards sustainability is influencing product packaging decisions, creating demand for eco-friendly and biodegradable materials. Strategic investments in branding and distribution can enable companies to capitalize on these trends, securing a competitive edge in a rapidly evolving market landscape.

Report Segmentation of the Bottled Water Market

By Product Type Analysis

The Bottled Water market was primarily dominated by the Still Water segment, holding a significant 72.3% market share, favored for its pure and uncarbonated nature appealing to health-conscious consumers. Although not as dominant, the Sparkling Water segment maintained a solid market presence, appreciated for its effervescent qualities. The Functional Water segment, offering added health benefits like minerals and vitamins, also showed notable growth by targeting health-focused consumers. Overall, Still Water led the market, reflecting a strong preference for simplicity and natural hydration.

By Packaging Analysis

The Bottled Water market’s packaging sector was predominantly led by Plastic Bottles, which captured a significant 68.5% market share. The preference for plastic bottles is largely due to their convenience, portability, and robust availability. Their lightweight and durable characteristics further cement their appeal among both manufacturers and consumers.

Meanwhile, Cans held a smaller yet notable share, appealing particularly to environmentally conscious consumers due to their recyclability and perceived environmental friendliness. With increasing emphasis on sustainability, the demand for canned bottled water is projected to rise, indicating a potential shift in consumer preferences towards more eco-friendly packaging solutions.

By Distribution Channel Analysis

The Offline distribution channel, comprising brick-and-mortar stores, commanded a dominant market share of 90.1%, despite the surge in online sales. This enduring preference for physical stores is driven by consumers’ appreciation for the immediacy and tangibility of in-store shopping, which is especially pertinent for products intended for immediate consumption, such as bottled water. Although digital channels offer convenience and a broad selection, the tangible experience of examining products firsthand continues to hold significant appeal, underscoring the sustained importance of offline retail in the distribution landscape.

Recent Development of the Bottled Water Market

- Nestlé’s Sustainable Packaging: In April 2023, Nestle joined forces with Acreto, a company dedicated to sustainable packaging, to introduce a fresh range of bottled water crafted entirely from plant-based materials.

- PepsiCo Taps into Captured Carbon Emissions: In February 2023, PepsiCo collaborated with biotech firm LanzaTech to pioneer a novel method for crafting bottled water derived from captured carbon emissions.

Competitive Landscape

The global bottled water market is shaped significantly by major players like Nestlé, PepsiCo, and The Coca-Cola Company, which dominate with established brands and robust distribution networks. Their ongoing investments in eco-friendly packaging and sustainable sourcing are strategically aligned with consumer preferences for environmentally conscious products. DANONE and Primo Water Corporation are strengthening market positions by leveraging innovative product lines, such as mineral-enriched and alkaline waters, appealing to the health-conscious consumer segment.

Premium brands like FIJI Water, Gerolsteiner, and VOSS cater to high-end consumers, maintaining growth through brand differentiation and exclusive water sources. Nongfu Spring, a key Asian player, continues to expand its influence globally, capitalizing on China’s demand for premium and safe bottled water. Mid-sized companies and regional players add competitive pressure by offering niche products that focus on local consumer trends. Overall, the market’s growth is driven by health and wellness trends, sustainability initiatives, and premiumization strategies among key companies.