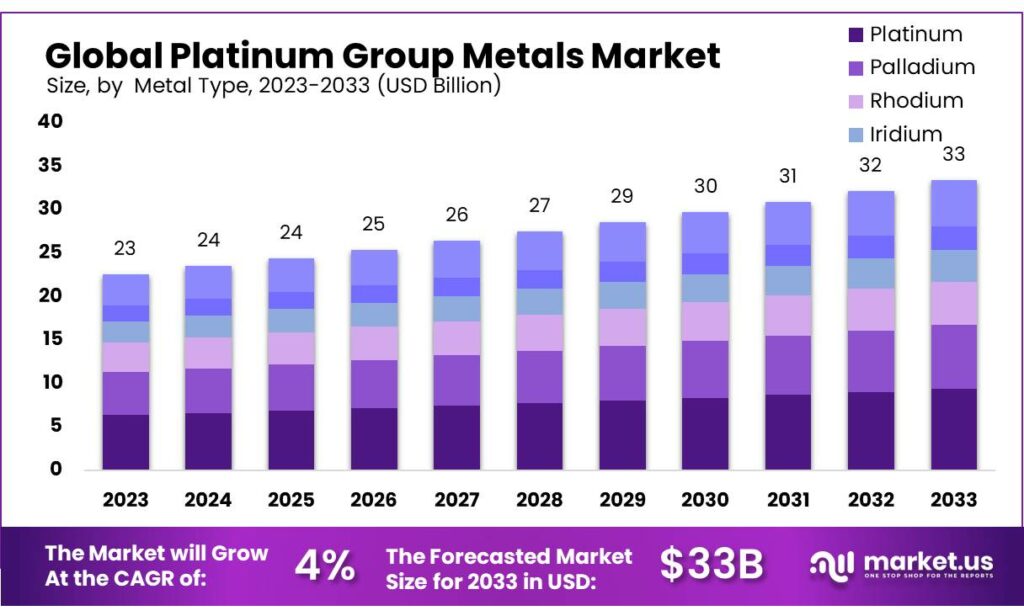

According to Market.us, The Global Platinum Group Metals Market size is expected to be worth around USD 33 Billion by 2033, from USD 23 Billion in 2023, growing at a CAGR of 4.0% during the forecast period from 2023 to 2033. Asia Pacific Driven by growing industrialization and widespread automotive and electronics manufacturing, particularly in China and India, Asia Pacific leads the PGM industry with a 43% share and a USD 9.7 billion valuation.

The Platinum Group Metals (PGM) market is characterized by its vital role in various industrial applications, including automotive catalytic converters, electronics, and jewelry. The demand for these metals, particularly platinum, palladium, and rhodium, is strongly influenced by automotive sector trends and emission regulation compliance. Global supply constraints, primarily from South Africa and Russia, significantly impact market dynamics. Technological advancements in fuel cell technology present new growth opportunities.

However, economic fluctuations and the shift towards electric vehicles pose potential demand risks. Overall, the market exhibits a cautious optimism driven by stringent environmental policies and diversified industrial applications.

Key Takeaway

- The Global Platinum Group Metals Market size is expected to be worth around USD 33 billion by 2033, from USD 23 billion in 2023, growing at a CAGR of 4.0%.

- Platinum Dominance: Platinum holds a 31.3% market share in 2023, favored for automotive and jewelry applications.

- Auto Catalysts Demand: Auto catalysts claim over 26.2% market share in 2023, crucial for emissions control.

- Russia is the world’s largest producer of palladium, accounting for approximately 40% of global production.

- South Africa and Russia together account for over 90% of the world’s rhodium production.

Factors affecting the growth of the Platinum Group Metals Market

- Automotive Industry Demand: The most significant driver for PGMs, notably platinum and palladium, is their use in catalytic converters, which are essential for reducing harmful emissions in vehicles. The health of the global automotive industry, including trends towards automotive electrification, directly impacts demand for these metals.

- Jewelry and Investment Demand: Platinum and palladium are also valued in jewelry manufacturing and as investment commodities. Economic stability and consumer disposable income levels influence their demand in these sectors.

- Mining and Supply Constraints: PGMs are primarily sourced from South Africa, Russia, and Zimbabwe, making geopolitical stability and operational risks in these regions critical. Supply disruptions, whether from political instability, labor strikes, or natural disasters, can significantly impact global metal availability and prices.

- Technological Advancements and Substitution: Advances in material science that lead to the substitution of PGMs with cheaper or more abundant alternatives can affect market dynamics.

- Regulatory and Environmental Considerations: Stricter environmental regulations worldwide, particularly concerning vehicle emissions, have historically boosted demand for PGMs due to their role in pollution control technologies.

- Economic Conditions: The economic backdrop significantly affects PGM demand. Industrial activity, auto manufacturing rates, and consumer behavior are influenced by global economic health, which in turn drives demand for these metals.

Top Trends in the Global Platinum Group Metals Market

- Automotive Catalyst Demand: The largest consumer of PGMs remains the automotive sector, where these metals are used in catalytic converters to reduce harmful emissions.

- Recycling and Secondary Supply: With the high cost and environmental impact of mining, recycling of PGMs from spent catalytic converters and electronic equipment is becoming increasingly significant. The secondary supply of PGMs is expanding, helping to stabilize market prices and ensure sustainable sourcing practices.

- Technological Innovations and Substitution: Research into reducing the PGM content in catalysts and other applications continues to advance. Innovations that allow for the substitution of these metals or more efficient use could significantly alter market dynamics.

- Investment and Financial Markets: PGMs are also viewed as valuable investment assets, akin to gold and silver. Investment demand for these metals can fluctuate based on economic indicators, currency movements, and geopolitical stability, influencing prices and market predictions.

- Geopolitical and Supply Chain Risks: The PGM market is highly concentrated, with the majority of production coming from South Africa, followed by Russia. This concentration introduces significant geopolitical risk, potentially leading to supply disruptions.

- Growth in Fuel Cell Technology: PGMs play a critical role in the burgeoning fuel cell industry, particularly for hydrogen fuel cells used in both automotive and stationary power generation. As governments and industries invest more in hydrogen economies, demand for PGMs in this sector could see substantial growth.

Market Growth

The market for platinum group metals (PGMs), comprising platinum, palladium, rhodium, ruthenium, iridium, and osmium, is experiencing significant growth, driven by diverse industrial applications, stringent emissions regulations, and advancements in technology. In 2023, the demand for these metals saw a substantial increase, particularly in the automotive sector for catalytic converters and in the electronics industry for various components.

Market analysts forecast a steady growth trajectory over the next five years, with a notable expansion in the renewable energy sector, which utilizes PGMs in fuel cell technologies. The strategic expansion of mining operations and recycling initiatives are also pivotal in meeting the rising global demand, ensuring a sustainable supply chain.

Regional Analysis

The Asia Pacific region dominates the global Platinum Group Metals (PGM) market, holding a 43% share valued at USD 9.7 billion, primarily due to rapid industrialization and robust automotive and electronics production, especially in China and India. North America follows, with advances in emission control technologies and a strong automotive industry driving PGM demand. Europe’s market strength derives from strict environmental policies and significant automotive production.

The Middle East & Africa region, although smaller, is expanding due to automotive and industrial applications, with South Africa being pivotal in PGM mining. Latin America is poised for growth in the PGM market, spurred by environmental regulations and manufacturing expansions in the automotive and electronics sectors.

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | USD 23 Billion |

| Forecast Revenue (2033) | USD 33 Billion |

| CAGR (2024 to 2033) | 4.0% |

| Asia Pacific Market Share | 43% |

| Base Year | 2023 |

| Historic Period | 2020 to 2022 |

| Forecast Year | 2024 to 2033 |

Market Drivers

The Platinum Group Metals (PGMs) market is poised for growth, driven primarily by increased demand for catalytic converters in the automotive industry. This surge is a response to tighter global emission standards aimed at reducing vehicle pollutants, benefiting metals like palladium and platinum. The growth trajectory of PGMs is further supported by technological advancements and their broad application across various sectors, including electronics where they are essential in components like capacitors and resistors, and healthcare, notably in cancer treatments and medical devices.

Additionally, the market is bolstered by robust demand for PGM-based jewelry in Asia-Pacific, particularly in China and India, where these metals are prized for their aesthetic and investment value.

Market Restraints

The platinum group metals (PGMs) market faces significant constraints due to high production and maintenance costs. These costs stem from complex, energy-intensive processes needed for extraction and refining, especially in geopolitically unstable regions. Deep mining operations, stringent environmental regulations, and the need for continuous technological advancements further increase expenses. These factors not only diminish profitability for mining companies but also raise prices for PGM-containing products, potentially reducing market demand and encouraging the search for cheaper substitutes. Additionally, volatile PGM prices introduce financial uncertainty, complicating investment and production strategies and thus restraining market growth.

Opportunities

The Platinum Group Metals (PGMs) market presents several opportunities due to their scarcity and critical role in various industrial applications. First, the demand for PGMs in automotive catalytic converters continues to rise, driven by stringent global emission standards. This trend is likely to persist as countries seek to reduce carbon emissions.

Additionally, PGMs are essential in the manufacturing of electronics and medical devices, sectors expected to grow due to technological advancements and an aging global population. There’s also potential in the hydrogen economy, where PGMs are key for fuel cell technology. However, these opportunities come with challenges, such as supply instability from geopolitical tensions in key producing regions, which can drive prices and encourage investment in recycling technologies.

Report Segmentation of the Platinum Group Metals Market

By Metal Type Analysis

Platinum dominated the market with over a 31.3% share, valued for its use in the automotive, jewelry, and chemical sectors due to its corrosion resistance and aesthetic qualities. Palladium, crucial in catalytic converters for gasoline engines, also captured a significant market portion. Rhodium played a key role, primarily in diesel catalytic converters and high-performance alloys, because of its superior catalytic and corrosion-resistant properties. Iridium, used in spark plugs and aerospace components, is notable for its high melting point. Ruthenium, applied in electronics and as a chemical catalyst, is appreciated for its durability. Osmium, rare and dense, is utilized in special alloys and electrical contacts.

By Application Analysis

Auto Catalysts led the market with a 26.2% share, using platinum group metals to reduce vehicle emissions. The Electrical and Electronics segment also held a substantial market share, driven by the demand for metals in devices due to their conductivity and durability. Fuel Cells were significant for their role in clean electricity generation via hydrogen and oxygen reaction. The Glass, Ceramics, and Pigments sector benefited from the catalytic properties of these metals, enhancing product durability and color. Platinum group metals remained crucial in Jewellery for their aesthetic and resistance qualities, and in the Medical sector for their biocompatibility and antimicrobial properties. The chemical sector uses these metals as catalysts in production processes.

Recent Development of the Platinum Group Metals Market

- African Rainbow Minerals (ARM): In 2023, ARM continued its focus on operational excellence and sustainability initiatives across its PGMs portfolio, implementing advanced technologies to enhance production efficiency and reduce environmental impact.

Competitive Landscape

The outlook for key players in the global Platinum Group Metals Market reflects a landscape dominated by significant mining and production companies, such as Anglo American Platinum Limited, Norilsk Nickel, and Sibanye-Stillwater. These entities are poised to leverage extensive resource bases and robust processing capabilities to address rising global demand for platinum group metals (PGMs), driven by applications in automotive catalysts and renewable technologies.

African Rainbow Minerals and Northam Platinum Holdings Limited are anticipated to capitalize on operational expansions and strategic resource management to enhance their market positions. Meanwhile, companies like Johnson Matthey and Implats Platinum Limited are expected to focus on technological advancements and efficiency improvements in metal recovery and catalysis solutions.

With diversified mineral portfolios, global players like Vale and Glencore might increase their investments in PGM assets, responding to the metal’s critical role in green technologies. The market dynamics for these companies are likely to be influenced by regulatory changes, technological advancements, and shifts in consumer and industrial demand, particularly in emerging technologies that rely on PGMs’ unique properties.