Introduction

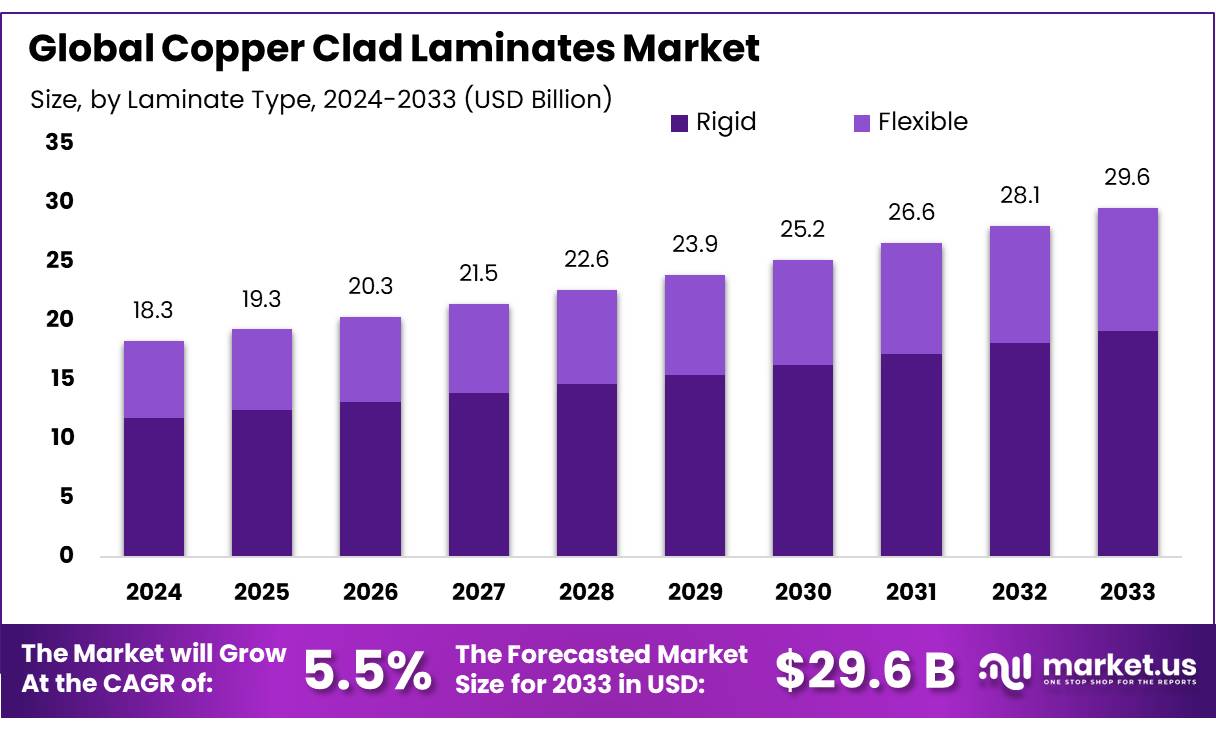

According to Market.us, The global Copper Clad Laminates (CCL) Market is projected to expand from USD 18.3 Billion in 2023 to USD 29.6 Billion by 2033, reflecting a compound annual growth rate (CAGR) of 5.5% during the forecast period from 2023 to 2033.

This growth is primarily driven by the escalating demand for electronic devices such as smartphones, laptops, and wearable technology, which rely on printed circuit boards (PCBs) utilizing CCLs. The proliferation of 5G technology and the Internet of Things (IoT) further amplifies this demand, necessitating advanced PCBs for high-speed data transmission. Additionally, the automotive sector’s shift towards electric vehicles (EVs) and autonomous driving systems increases the need for sophisticated electronic components, thereby boosting the CCL market.

Geographically, the Asia-Pacific region dominates the market, attributed to its robust electronics manufacturing base and favorable government policies supporting technological advancements. However, challenges such as fluctuating raw material prices and environmental concerns related to electronic waste management may impact market dynamics. Despite these challenges, opportunities abound in developing eco-friendly CCLs and expanding applications in emerging technologies, positioning the market for sustained growth.

Key Takeaway

- Copper-Clad laminates Market size is expected to be worth around USD 29.6 billion by 2033, from USD 18.3 billion in 2023, growing at a CAGR of 5.5%.

- Rigid held a dominant market position, capturing more than a 64.6% share of the copper clad laminates market.

- Glass Fiber held a dominant market position, capturing more than a 55.6% share of the copper-clad laminates market.

- Epoxy held a dominant market position, capturing more than a 55.6% share of the copper-clad laminates market.

- Boxes held a dominant market position, capturing more than a 45.7% share of the copper-clad laminates market.

- Computers held a dominant market position, capturing more than a 28.8% share of the Copper Clad Laminates market.

- Automotive held a dominant market position, capturing more than a 37.8% share of the copper-clad laminates market.

- Asia Pacific (APAC) region leading the sector. In 2023, APAC held a dominant market position, capturing approximately 36%.

Factors affecting the growth of the Copper Clad Laminates Market

- Rising Demand for Electronic Devices: The increasing use of smartphones, laptops, and wearable technology drives the need for printed circuit boards (PCBs), which utilize CCLs. This trend is expected to continue as consumer electronics become more integral to daily life.

- Advancements in Communication Technologies: The rollout of 5G networks and the expansion of the Internet of Things (IoT) require advanced PCBs capable of high-speed data transmission, thereby boosting the demand for high-performance CCLs.

- Growth in the Automotive Sector: The shift towards electric vehicles (EVs) and autonomous driving systems increases the need for sophisticated electronic components, leading to a higher demand for CCLs in automotive electronics.

- Technological Innovations: Continuous improvements in CCL materials and manufacturing processes enhance product performance and reliability, making them more attractive for various applications and contributing to market growth.

- Environmental Regulations and Sustainability Concerns: Stricter environmental laws and a growing focus on sustainability encourage the development of eco-friendly CCLs, influencing market dynamics and opening new opportunities for manufacturers.

- Fluctuating Raw Material Prices: Variations in the costs of raw materials, such as copper and resins, can impact production expenses and profit margins, potentially affecting the market’s growth trajectory.

Top Trends in the Global Copper Clad Laminates Market

- Advancements in High-Frequency Materials: The development of high-frequency CCLs is gaining momentum, driven by the need for materials that can support faster data transmission in applications like 5G networks and advanced communication systems.

- Miniaturization of Electronic Devices: The trend towards smaller, more compact electronic devices is leading to the demand for thinner and more flexible CCLs, enabling the production of lightweight and space-efficient gadgets.

- Increased Use in Automotive Electronics: The automotive industry’s shift towards electric and autonomous vehicles is boosting the demand for CCLs, as these vehicles require advanced electronic components for various functions, including safety and infotainment systems.

- Focus on Environmental Sustainability: There is a growing emphasis on developing eco-friendly CCLs, driven by stricter environmental regulations and consumer demand for sustainable products. Manufacturers are exploring recyclable materials and greener production processes to meet these expectations.

- Regional Market Expansion: The Asia-Pacific region continues to dominate the CCL market, supported by its robust electronics manufacturing base and favorable government policies. However, other regions are also witnessing growth due to increasing investments in electronics and automotive sectors.

Market Growth

The global copper clad laminates (CCL) market is projected to expand from USD 18.3 billion in 2023 to USD 29.6 billion by 2033, reflecting a compound annual growth rate (CAGR) of 5.5% during the forecast period from 2024 to 2033. This growth is primarily driven by the escalating demand for electronic devices such as smartphones, laptops, and wearable technology, which rely on printed circuit boards (PCBs) utilizing CCLs. The proliferation of 5G technology and the Internet of Things (IoT) further amplifies this demand, necessitating advanced PCBs for high-speed data transmission.

Additionally, the automotive sector’s shift towards electric vehicles (EVs) and autonomous driving systems increases the need for sophisticated electronic components, thereby boosting the CCL market. Geographically, the Asia-Pacific region dominates the market, attributed to its robust electronics manufacturing base and favorable government policies supporting technological advancements.

However, challenges such as fluctuating raw material prices and environmental concerns related to electronic waste management may impact market dynamics. Despite these challenges, opportunities abound in developing eco-friendly CCLs and expanding applications in emerging technologies, positioning the market for sustained growth.

Regional Analysis

The Asia Pacific region leads the copper clad laminates (CCL) market, accounting for 36% of the global market in 2023. This growth is attributed to China, Japan, and South Korea’s electronics manufacturing industry. North America and Europe follow, driven by advanced electronic applications and stringent regulatory standards. The Middle East and Africa (MEA) and Latin America are also experiencing growth, with MEA projected to grow at a CAGR of 5% from 2023 to 2028.

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | USD 18.3 Billion |

| Forecast Revenue 2033 | USD 29.6 Billion |

| CAGR (2024 to 2033) | 5.5% |

| Asia Pacific Market Share | 36% |

| Base Year | 2023 |

| Historic Period | 2020 to 2022 |

| Forecast Year | 2023 to 2033 |

Market Drivers

The copper clad laminates (CCL) market is experiencing significant growth due to the increasing demand for electronics, particularly in the automotive sector. The global consumer electronics market is projected to reach $522 billion in 2023, driven by the rise in smartphones, laptops, and other electronic devices. The growth is also fueled by government initiatives like the CHIPS and Science Act in the US and the Production Linked Incentive (PLI) scheme in India.

Technological advancements in laminate manufacturing are enhancing the performance and application range of CCLs, with companies investing in high-frequency CCLs for 5G applications. Sustainability trends are also driving manufacturers to adopt eco-friendly practices and materials, creating new growth opportunities.

Market Restraints

The copper clad laminates (CCL) market faces several challenges, including high raw material costs, supply chain disruptions, environmental regulations, technological limitations, and market competition. Copper prices surged to around $10,000 per metric ton in early 2022, affecting profit margins and market competitiveness. Supply chain disruptions, such as the COVID-19 pandemic, have led to delays and shortages in essential materials, limiting market growth.

Environmental regulations, such as the European Union’s RoHS directive, require significant R&D investments, deterring smaller manufacturers from entering the market. Current manufacturing processes may not be suitable for high-frequency CCLs needed for emerging technologies like 5G, leading to a market gap. Intense competition from alternative materials, such as aluminum-based laminates and advanced polymer substrates, also poses a threat to the market.

Opportunities

The copper clad laminates (CCL) market is experiencing significant growth due to the increasing demand for electronics, particularly in consumer electronics and automotive sectors. The global consumer electronics market is projected to reach $1.5 trillion by 2024, with a CAGR of 4.2% from 2021 to 2024. The expansion of 5G technology, with 1.7 billion connections by 2025, necessitates the use of advanced CCL materials.

Government initiatives, such as the Production Linked Incentive (PLI) scheme in India and the US, are also boosting domestic electronics manufacturing. The renewable energy sector is also a critical growth area, with solar photovoltaic capacity expected to double by 2025. Innovations in CCL technology, such as high-frequency CCLs for IoT devices and AI systems, are also driving growth opportunities.

Report Segmentation of the Copper Clad Laminates Market

By Laminate Type

In 2023, Rigid laminates held a dominant 64.6% share of the copper clad laminates market, used in electronics like PCBs and automotive electronics. Demand for these laminates is growing due to the need for reliable devices in telecommunications, automotive, and consumer electronics. Flexible laminates, used in wearable electronics and displays, are also gaining traction.

By Reinforcement Material

In 2023, Glass Fiber dominates the copper-clad laminates market, accounting for 55.6% due to its strength and reliability. Paper Base, accounting for 30%, is preferred for cost-effectiveness and lightweight properties. Emerging compound materials, representing 14.4%, offer unique benefits and drive growth in niche applications.

By Resin

In 2023, Epoxy dominated the copper-clad laminates market with over 55.6% share, renowned for its adhesion and thermal stability. Phenolic laminates, known for their high strength and fire resistance, are used in durability and safety applications. Polyimide laminates, known for their thermal resistance and flexibility, are commonly used in high-performance industries like aerospace and automotive.

By Packaging

In 2023, boxes dominated the copper-clad laminates market, accounting for over 45.7% of the market. These packaging types are preferred for their convenience and protection during transport, and are widely used in retail and industrial settings. Containers are preferred for bulk shipments, storage, and distribution.

By Application

In 2023, computers dominated the Copper Clad Laminates market, accounting for 28.8%. Communication Systems, consumer appliances, vehicle electronics, healthcare devices, and defense technology also contributed to the growth of laminate usage. The demand for high-performance circuit boards, reliable connections, and advanced technologies in these sectors is driving the market’s evolution.

Recent Development of the Copper Clad Laminates Market

- AGC Inc. concentrated on growing its product line in 2023 in order to satisfy the growing need for sophisticated materials in electronics, especially in communication and automotive applications.

- Cipel Italia prioritized sustainability and innovation in 2023, emphasizing environmentally friendly materials that adhere to strict industry requirements.

Competitive Landscape

The copper clad laminates (CCL) market is characterized by intense competition among key players striving to enhance their market positions through innovation, strategic partnerships, and expansion initiatives. Major companies in this sector include AGC Inc., Cipel Italia, Comet Impreglam, Dhan Laminates, Doosan Corporation, Elite Material, Grace Electron Corporation, Guangdong Chaohua Technology, Isola Group, ITEQ Corporation, Kblaminates, Kingboard Laminates Holdings,

Nan Ya Plastics, Panasonic Holdings Corporation, Rogers Corporation, Shandong JinBao Electric Co., Ltd., Shengyi Technology, Sumitomo Bakelite, Sytech Technology Co. Ltd., and Taiwan Union Technology Corporation. These firms focus on developing advanced CCL technologies to meet the growing demand for high-performance electronic components. Collaborations and acquisitions are common strategies employed to expand product portfolios and global reach.

Additionally, companies are investing in research and development to create more efficient and durable CCLs, aiming to improve performance and reduce operational costs. The competitive landscape is further influenced by regional market dynamics, with Asia-Pacific emerging as a significant growth area due to rapid industrialization and increasing energy consumption. Overall, the CCL market is evolving, with companies actively seeking opportunities to strengthen their positions through technological advancements and strategic initiatives.