Introduction

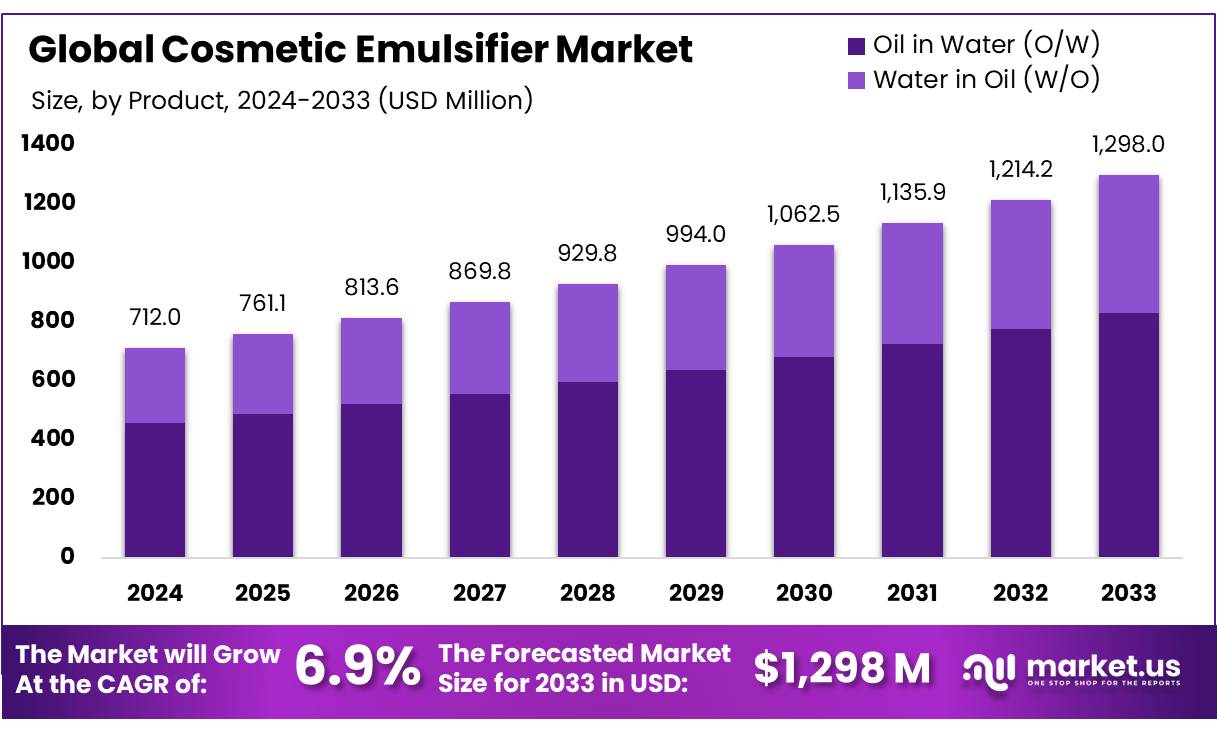

According to Market.us, The global Cosmetic Emulsifier Market is on a robust growth trajectory, projected to expand from USD 712 Billion in 2023 to approximately USD 1298 Million by 2033, marking a compound annual growth rate (CAGR) of 6.9% during the forecast period.

This significant growth is fueled by the escalating demand for personal care products and the rising trend towards more complex formulations in cosmetics. Emulsifiers play a crucial role in the stability and texture of cosmetic products, making them essential in the production of creams, lotions, and other skincare items. The popularity of cosmetic emulsifiers is supported by innovations in bio-based and natural emulsifiers, which cater to the growing consumer preference for sustainable and environmentally friendly products.

Additionally, the expanding global beauty industry presents numerous opportunities for market expansion, as manufacturers continually seek advanced emulsifying solutions to enhance product appeal and functionality. This dynamic market environment is set to drive the widespread adoption and development of new emulsifier technologies, supporting the market’s continued growth and popularity.

Key Takeaway

- Cosmetic Emulsifier Market size is expected to be worth around USD 1298 Million by 2033, from USD 712 Million in 2023, growing at a CAGR of 6.9%.

- Oil in Water (O/W) held a dominant market position, capturing more than a 63.3% share.

- Lactic Esters of Fatty Acids held a dominant market position, capturing more than a 23.4% share.

- Natural held a dominant market position, capturing more than a 63.4% share.

- Skin Care held a dominant market position, capturing more than a 47.8% share.

- North America held a dominant position in 2023, capturing more than 34% of the market share.

Factors affecting the growth of the Cosmetic Emulsifier Market

- Consumer Preferences for Multifunctional Cosmetics: Increasing demand for multifunctional cosmetic products, such as moisturizers with anti-aging properties or sunscreens that hydrate, drives the need for sophisticated emulsifiers. These ingredients help stabilize complex formulations, ensuring that the active ingredients remain effective and the product’s texture stays appealing.

- Shift Toward Natural and Organic Ingredients: There is a significant shift in consumer preference towards natural and organic beauty products. This trend impacts the cosmetic emulsifier market as manufacturers are pushed to develop emulsifiers derived from natural sources that are not only effective but also meet the clean beauty standards demanded by today’s consumers.

- Technological Advancements in Product Formulation: Innovations in emulsification technology allow for the development of more stable and efficient products, which can handle a wider range of pH levels and temperature variations. Advanced emulsifiers enhance the sensory attributes of cosmetics, improving consumer satisfaction and driving market growth.

- Regulatory Frameworks: Stringent regulations regarding cosmetic ingredients influence the development and use of emulsifiers. Compliance with these regulations to ensure consumer safety can drive the adoption of high-quality, approved emulsifiers.

- Growth in the Cosmetics Industry: The overall expansion of the cosmetics industry, particularly in emerging markets, directly impacts the demand for cosmetic emulsifiers. As the market for cosmetics grows, so does the need for key ingredients that make these products effective and appealing.

- Economic Factors: Economic growth boosts consumer spending on personal care products, which in turn increases the demand for cosmetic emulsifiers. Conversely, economic downturns can temper market growth as consumers limit discretionary spending.

Top Trends in the Global Cosmetic Emulsifier Market

- Natural and Sustainable Emulsifiers: With growing environmental concerns and consumer awareness, there is a significant trend towards using natural and sustainable ingredients in cosmetics. Emulsifiers derived from plant sources such as lecithin, glyceryl stearate, and sorbitan olivate are gaining popularity due to their eco-friendly profiles and reduced environmental impact.

- Innovative Textures and Sensory Experiences: Consumers are increasingly seeking products that offer unique textures and enhanced sensory experiences. Emulsifiers play a crucial role in developing such formulations, enabling the creation of lightweight, gel-to-cream, or transforming textures that appeal to consumer desires for novel product applications.

- Cold Process Emulsification: The shift towards energy-saving manufacturing processes is driving the adoption of cold process emulsifiers. These emulsifiers allow for the production of cosmetic products at room temperature, reducing energy consumption and aligning with sustainable manufacturing practices.

- Multifunctional Products: As the trend for multifunctional cosmetic products continues, emulsifiers that can support complex formulations without compromising stability are in high demand. These emulsifiers must efficiently stabilize mixtures of oil and water, incorporate active ingredients, and maintain product efficacy.

- Regulatory Compliance: With strict regulations governing cosmetic products globally, the demand for emulsifiers that meet regulatory standards for safety and efficacy is increasing. Compliance with international guidelines is crucial for market acceptance and growth.

- Personalization and Customization: The trend towards personalized beauty products is influencing the demand for versatile emulsifiers that can accommodate a wide range of ingredients and properties, allowing manufacturers to create customized solutions for different skin types and consumer preferences.

Market Growth

The cosmetic emulsifier market is witnessing substantial growth, fueled by the rising global demand for advanced cosmetic products. Expected to grow from USD 712 million in 2023 to around USD 1298 million by 2033, the market is seeing a robust compound annual growth rate (CAGR) of 6.9%. This growth is driven by consumers’ increasing interest in multifunctional cosmetics that offer additional benefits such as hydration and anti-aging properties in one product. The shift towards natural and organic ingredients has also significantly impacted market expansion, as more consumers seek out products with sustainable and ethically sourced components.

Furthermore, innovations in emulsifier technology have enabled the creation of novel cosmetic textures, enhancing user experience and satisfaction. As the cosmetics industry continues to flourish, particularly in emerging markets, the demand for cosmetic emulsifiers is expected to rise correspondingly, supported by advancements in product formulation and a growing emphasis on sustainability in manufacturing practices. These factors together make the cosmetic emulsifier market a dynamic and rapidly evolving industry segment.

Regional Analysis

North America dominates the global cosmetic emulsifier market, accounting for over 34% of the market share. The US leads due to strict regulations and consumer preference for high-quality personal care products. Europe follows closely, with strict regulations and a focus on sustainability. The Asia Pacific region is experiencing rapid growth, driven by rising disposable incomes and changing beauty standards. Emerging markets include the Middle East and Africa, while Latin America shows moderate growth potential.

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | USD 712 Million |

| Forecast Revenue 2033 | USD 1298 Million |

| CAGR (2023 to 2033) | 6.9% |

| North America Market Share | 34% |

| Base Year | 2023 |

| Historic Period | 2020 to 2022 |

| Forecast Year | 2023 to 2033 |

Market Drivers

The cosmetic emulsifier market is driven by government regulations, technological advancements, and market expansion in emerging regions. The FDA and EC have strict guidelines for the safety and efficacy of cosmetic ingredients, encouraging manufacturers to develop safer emulsifiers. Companies like BASF are introducing new emulsifier formulations to meet consumer demands for long-lasting products. The Asia-Pacific region is experiencing a surge in demand for personal care products, driven by rising disposable incomes and changing lifestyles. Additionally, increased investment in sustainable practices, such as bio-based and biodegradable emulsifiers, is driving market growth.

Market Restraints

The cosmetic emulsifier market faces challenges due to increasing regulatory scrutiny and consumer awareness about ingredient safety. High safety standards set by the European Union, such as EC No. 1223/2009, can be costly for manufacturers. Consumer preference for natural and organic products also demands safer, natural emulsifiers, involving higher research and development costs. Volatility in raw material prices, such as palm oil, can affect production costs and profit margins. Social media and consumer advocacy groups also influence the industry, leading to backlash against synthetic emulsifiers, such as parabens and sulfates, which 47% of consumers actively seek.

Opportunities

The cosmetic emulsifier market is expected to grow due to the growing demand for natural and organic cosmetic products. Government initiatives, such as the European Commission’s “Green Deal” and the U.S. FDA’s “National Organic Program,” are encouraging the use of eco-friendly ingredients in cosmetics. Biotechnology in cosmetic formulations is leading to the development of plant-based emulsifiers, which could reduce the carbon footprint by up to 50%. The global rise in e-commerce is also transforming the beauty and personal care market, allowing smaller brands to reach wider audiences. Regional markets, such as Asia-Pacific, also present unique growth opportunities for emulsifiers catering to local preferences for natural ingredients.

Report Segmentation of the Cosmetic Emulsifier Market

By Product

In 2023, Oil in Water (O/W) emulsifiers dominated the market, accounting for over 63.3%. These lightweight emulsifiers are popular in hydration formulations and are used in lotions and creams. Water in Oil (W/O) emulsifiers are used in moisturizing products. Consumer demand for lighter, easily absorbed products is driving this trend. Both O/W and W/O emulsifiers are expected to evolve to meet evolving consumer needs.

By Product Type

In 2023, Lactic Esters of Fatty Acids held a dominant market position, accounting for over 23.4%. These emulsifiers are popular for their moisturizing properties and stability in formulations. Lecithin is also widely used in skin and hair care products. Mono & Di-glycerides of Fatty Acid are effective in cosmetic applications. Esters of Monoglycerides of Fatty Acid provide emulsification and skin comfort. Polysorbates improve ingredient solubility. Polyglycerol Esters and Polyglycerol Polyricinoleate create stable emulsions.

By Source

In 2023, natural emulsifiers dominated the market, accounting for over 63.4%, due to consumer demand for clean, sustainable beauty products. Synthetic emulsifiers, while smaller, offer consistency and performance. The shift towards natural emulsifiers is driven by consumer awareness of ingredient safety and sustainability, with manufacturers incorporating more natural options to maintain product effectiveness.

By Application

In 2023, Skin Care held a dominant market position with 47.8% share, driven by consumer focus on hydration and anti-aging products. Hair Care also saw a significant share, with emulsifiers in shampoos, conditioners, and treatments enhancing product stability. The makeup segment also saw a rise in demand for advanced emulsifying agents for long-lasting, water-resistant makeup.

Recent Development of the Cosmetic Emulsifier Market

- Cosmetic emulsifiers made from natural sources are part of ADM’s specialized ingredients sector, which saw significant growth in 2023. In order to meet the growing customer demand for safe and clean cosmetics, the company specializes in offering plant-based emulsifiers.

- BASF concentrated on growing its line of emulsifiers in 2023, highlighting natural origin and sustainability. Due to the rising demand for environmentally friendly cosmetics, the company recorded a 12% increase in revenue for its specialized ingredients division.

Competitive Landscape

The competitive landscape of the global cosmetic emulsifier market features a mix of multinational corporations and specialized players, all striving to enhance their market presence through innovation and strategic collaborations. Key companies in the industry include Archer Daniels Midland (ADM), BASF SE, and Cargill, Incorporated, which are recognized for their extensive product portfolios and strong global distribution networks.

These companies focus on developing sustainable and high-performance emulsifiers to cater to the growing demand for eco-friendly cosmetic products. Clariant International Ltd., Evonik Industries AG, and Dow Chemical Co. are also prominent players, leveraging advanced technologies to offer emulsifiers that improve the stability and texture of cosmetic formulations. Companies like Givaudan SA, Symrise AG, and International Flavors & Fragrances Inc. (IFF) combine their expertise in fragrances and flavors with emulsifier technology to create unique cosmetic solutions.

Other notable players include Lonza Group Ltd., Nouryon Chemicals Holding BV, and Koninklijke DSM NV, which are heavily investing in research and development to introduce innovative products that meet regulatory requirements and consumer preferences for natural ingredients. Hallstar Innovations Corp., Solvay, and Stephenson Group Ltd. focus on specialty emulsifiers for niche markets, offering tailored solutions for specific cosmetic applications.

Emerging companies like Spartan Chemical Co. Inc. and Musashino Chemical Laboratory Ltd. are making their mark by targeting regional markets and offering cost-effective emulsifier solutions. The Lubrizol Corp. and Kerry Group plc further diversify the market with their comprehensive range of emulsifiers, enhancing product stability and performance across various cosmetic formulations.