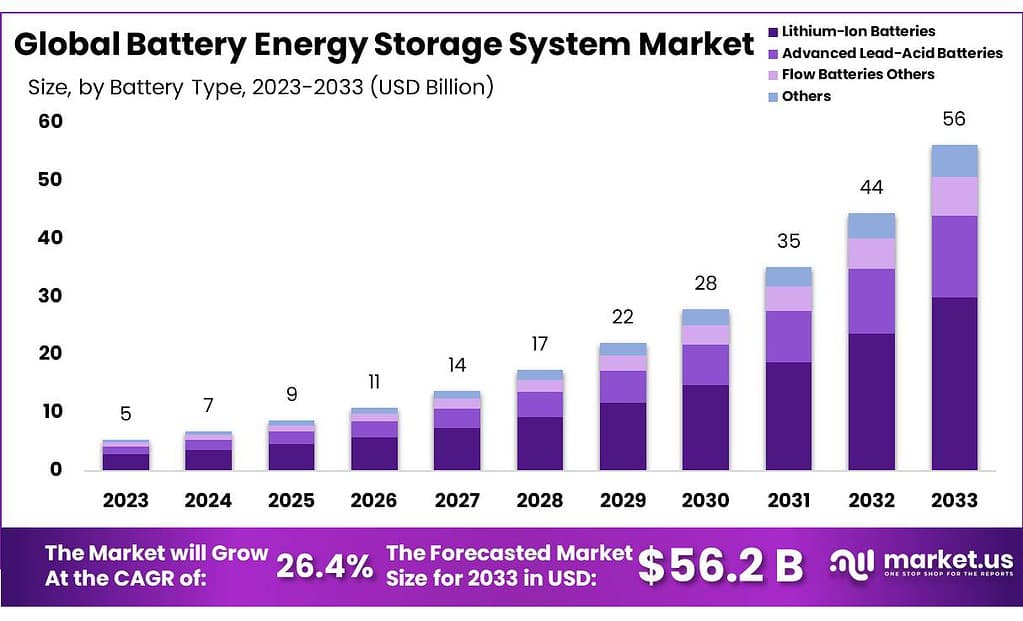

According to Market.us, the Global Battery Energy Storage Systems Market size is forecasted to exceed USD 56.2 billion by 2033, with a promising CAGR of 26.4% from 2024 to 2033.

Battery Energy Storage Systems (BESS) are critical components in the transition toward more resilient and efficient energy networks. These systems store electricity derived from both renewable and conventional sources during periods of low demand and release it during peak usage times. This capability enhances grid stability, increases energy security, and facilitates the integration of renewable energy sources.

BESS technology supports various applications, including peak shaving, load shifting, and emergency backup power, making it indispensable for managing energy supply and demand. As such, these systems play a pivotal role in optimizing energy costs and reducing environmental impact.

Key Takeaway

- The Battery Energy Storage Systems Market size is expected to be worth around USD 56.2 Bn by 2033, from USD 5.4 Bn in 2023, growing at a CAGR of 26.4% during the forecast period from 2024 to 2033.

- The Battery segment held a dominant market position, capturing more than a 75.4% share.

- On-grid systems held a dominant market position in the Battery Energy Storage Systems (BESS) market, capturing more than a 74.4% share.

- Utility-owned systems held a dominant market position in the Battery Energy Storage Systems (BESS) market, capturing more than a 51.1% share.

- Energy capacity between 100 to 500 MWh held a dominant market position, capturing more than a 45.4% share.

- Front-of-the-meter systems held a dominant market position in the Battery Energy Storage Systems (BESS) market, capturing more than a 57.3% share.

- The Utility segment held a dominant market position in the Battery Energy Storage Systems (BESS) market, capturing more than a 45.5% share.

- Asia Pacific leads with 43.8% of the market revenue in 2023.

Factors affecting the growth of the Battery Energy Storage Systems Market

- Technological Advancements: The development and refinement of battery technologies significantly affect market dynamics. Innovations in lithium-ion batteries, along with emerging technologies such as solid-state batteries and flow batteries, enhance the efficiency, capacity, and safety of storage systems.

- Government Policies and Regulatory Frameworks: Supportive regulatory policies, including subsidies, incentives, and renewable integration targets, are pivotal in promoting the deployment of battery energy storage systems.

- Decreasing Costs: The market is benefiting from the declining costs of battery production, primarily driven by economies of scale and advancements in manufacturing techniques.

- Energy Transition Towards Renewables: The global shift toward renewable energy sources to mitigate climate change impacts drives the demand for effective energy storage solutions. BESS plays a crucial role in managing the intermittency of solar and wind energy, thus facilitating a stable energy supply and enhancing grid reliability.

- Increase in Energy Consumption and Peak Load Management: As global energy consumption rises, utilities and energy providers are increasingly investing in energy storage systems to manage peak loads and improve grid management.

Top Trends in the Global Battery Energy Storage Systems Market

- Increased Deployment of Renewable Energy Sources: The expansion of renewable energy, such as solar and wind, which are intermittent in nature, necessitates reliable energy storage solutions. Battery energy storage systems are critical in managing power supply fluctuations and ensuring consistent energy availability, which can substantially enhance grid stability.

- Cost Reductions and Economic Viability: The market has witnessed a significant reduction in the cost of battery storage systems over the past decade. Economies of scale, coupled with technological improvements, have led to more competitive pricing, making BESS a more attractive option for energy storage.

- Expansion in Utility-Scale Projects: The utility segment is experiencing robust growth with an increasing number of large-scale battery storage projects being deployed. These projects are essential for balancing supply and demand, providing emergency backup power, and enhancing the operational capabilities of grids.

- Integration with Electric Vehicle Charging Infrastructure: As electric vehicle (EV) adoption grows, the demand for associated charging infrastructure presents a substantial opportunity for BESS. Batteries can play a crucial role in managing the load and providing stability to the grid during peak charging times.

- Rise of Residential and Commercial Applications: There is a growing trend of deploying BESS in residential and commercial settings for energy management and backup power. This trend is driven by the desire for energy independence and the need to mitigate electricity costs.

- Advancements in Energy Management Software: The development of sophisticated energy management systems, using artificial intelligence and machine learning, enhances the operational efficiency of battery storage systems.

Market Growth

The global battery energy storage systems market is experiencing substantial growth, primarily driven by the increasing adoption of renewable energy sources and the escalating demand for grid stability and energy management solutions. This surge is facilitated by technological advancements in battery technologies, including lithium-ion and flow batteries, which offer higher efficiency and longer lifecycles. Government initiatives promoting energy sustainability and substantial investments in smart grid infrastructure are further catalyzing market expansion. Key market players are focusing on strategic collaborations and technological innovations to enhance their market footprint and meet the rising global demand.

Regional Analysis

The Asia Pacific led the global battery energy storage market, holding 43.8% of its revenue, driven by rapid population growth and escalating electrical demand in countries like China, India, Japan, and Australia. This demand is amplified by the integration of renewable energy sources and the need for distributed power generation. Meanwhile, North America, led by the U.S., ranks second due to robust energy storage safety regulations and well-established energy markets. Significant contributions also come from Canada and Mexico, bolstering the region’s market presence in battery storage solutions.

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | USD 5.4 Billion |

| Forecast Revenue (2033) | USD 56.2 Billion |

| CAGR (2024 to 2033) | 26.4% |

| Asia Pacific Market Share | 43.8% |

| Base Year | 2023 |

| Historic Period | 2020 to 2022 |

| Forecast Year | 2024 to 2033 |

Market Drivers

The market for battery energy storage systems (BESS) is driven by several key factors. First, the increasing adoption of renewable energy sources, such as solar and wind, which require storage solutions to manage intermittency and maintain grid stability, is a significant driver. Second, technological advancements are lowering the cost and improving the efficiency of batteries, making BESS more competitive.

Additionally, government policies and subsidies supporting clean energy initiatives are accelerating BESS deployment. There’s also a growing need for grid modernization and energy security, which BESS directly supports by providing backup power and enhancing grid resilience. Lastly, the electric vehicle (EV) market expansion indirectly boosts BESS demand through developments in battery technology and manufacturing scale.

Market Restraints

The market for battery energy storage systems faces several constraints that inhibit its growth. High initial investment and maintenance costs are significant barriers, as the procurement of advanced battery technologies and associated infrastructure requires substantial capital outlay. Additionally, regulatory challenges and the complexity of compliance across different jurisdictions can delay project approvals and implementations. Technical limitations related to battery life, efficiency, and energy density also pose challenges.

Environmental concerns regarding the disposal and recycling of battery systems further complicate market expansion. Lastly, market penetration is hindered by the intermittent nature of renewable energy sources, which these storage systems often support, leading to variability in performance and reliability.

Opportunities

The reduction in lithium-ion battery prices can be attributed to technological advancements, increased scale of production, and enhanced manufacturing efficiencies. These factors have significantly decreased the cost per kilowatt-hour (kWh), rendering Battery Energy Storage Systems (BESS) more economically viable and accessible. This affordability facilitates investment in more robust systems capable of managing power needs during outages or peak demand periods.

Consequently, the decline in battery costs is a pivotal driver for the expansion of the BESS market, enhancing their competitiveness and appeal as a solution for reliable and uninterrupted power supply.

Report Segmentation of the Battery Energy Storage Systems Market

By Element Analysis

The Battery segment dominated the Battery Energy Storage Systems market with over 75.4% share, primarily driven by the adoption of lithium-ion batteries. These batteries are crucial for their high energy density and efficiency in residential, commercial, and grid-scale projects, overshadowing other components like PCS and BMS.

By Battery Type Analysis

Lithium-ion batteries dominated over 72.3% of the BESS market, favored for their efficiency and longevity, especially in electronics, EVs, and grid storage. Lead-acid batteries, though less efficient, remain popular for their cost-effectiveness and recyclability in utility storage. Flow Batteries, though a minor market share, are preferred for long-term energy storage, crucial for stabilizing renewable energy outputs.

By Connection Type Analysis

On-grid systems dominated the Battery Energy Storage Systems market with a 74.4% share, vital for grid stability and renewable energy integration. Meanwhile, off-grid systems are crucial for reliable power in remote areas, often combined with renewables to create self-sustaining systems, popular where grid expansion is costly or impractical, serving from individual homes to entire communities.

By Ownership Analysis

Utility-owned systems dominated the BESS market with a 51.1% share, favored for their capacity to manage large-scale infrastructure and enhance grid stability. Customer-owned systems are gaining traction among energy-conscious residential and commercial users for cost management and energy independence. Meanwhile, third-party-owned systems are popular in the commercial sector, offering a balance by alleviating direct management and upfront costs for businesses seeking energy savings.

By Energy Capacity Analysis

Battery Energy Storage Systems (BESS) with a capacity of 100-500 MWh dominated the market, holding over 45.4% share, favored for their flexibility in medium to large-scale energy storage. Systems under 100 MWh serve smaller applications, enhancing energy independence with minimal infrastructure. Systems above 500 MWh, though fewer, are essential for large-scale utility applications, stabilizing grids and facilitating renewable energy integration, proving critical for future energy management strategies.

By Storage System Analysis

Front-of-the-meter (FTM) battery energy storage systems (BESS) dominated the market, commanding over 57.3% share, mainly used by utilities and power producers to manage grid loads and enhance reliability. While FTM systems address grid-scale energy needs, behind-the-meter (BTM) systems, used in residential and commercial settings, are gaining traction for their cost-saving potential and control over energy use, despite a smaller market share.

By Application Analysis

The Utility segment led the Battery Energy Storage Systems market with over 45.5% share, crucial for grid management and renewable integration. The Commercial segment also leverages these systems for energy cost reduction and reliability, notably in high-energy industries. Meanwhile, the Residential sector is growing as homeowners pair storage with solar panels to enhance energy independence and provide outage backup, although it commands a smaller market share.

Recent Development of the Battery Energy Storage Systems Market

- General Electric announced its recent renewable hybrid factory that expanded its manufacturing capacity for power electronics systems in solar and battery energy storage We will customize the research for you, in case the report listed above does not meet your exact requirements. Our custom research will comprehensively cover the business information you require to help you arrive at strategic and profitable business decisions.

- Toshiba Corporation introduced the 125VDC SCiB Energy Storage System (ESS), which combines the dependability of Lithium Titanium Oxide (LTO) battery chemistry with a flexible and expandable cabinet design. It is made suitable for integration with Uninterruptible Power Systems (UPS) or DC Load applications.

- LG Energy Solution successfully acquired NEC Energy Solutions, a grid battery integrator based in the United States, from its parent company, NEC Corporation. This strategic move aims to enhance LG Energy Solution’s Energy Storage System (ESS) business portfolio by expanding its offerings.

Competitive Landscape

The global Battery Energy Storage Systems market is projected to be significantly influenced by several key players, each contributing unique technological advancements and strategic market positioning. Companies such as Tesla and LG Energy Solutions are poised to leverage their robust manufacturing capabilities and R&D initiatives to meet the escalating demand for efficient energy storage solutions. Siemens AG and ABB Ltd., with their deep industrial knowledge and expertise in energy management, are expected to enhance their offerings, driving integration across renewable energy systems.

Moreover, BYD Company Limited and Samsung SDI are likely to expand their global footprint by capitalizing on the growing adoption of electric vehicles and renewable energy installations, which require advanced battery storage systems. Emerging players like Fluence Energy and VRB Energy are set to disrupt the market with innovative technology and customizable solutions tailored to utility-scale applications. The strategic collaborations and technological innovations introduced by these companies are anticipated to propel the market forward, as they adapt to the evolving regulatory landscapes and increasing environmental concerns.