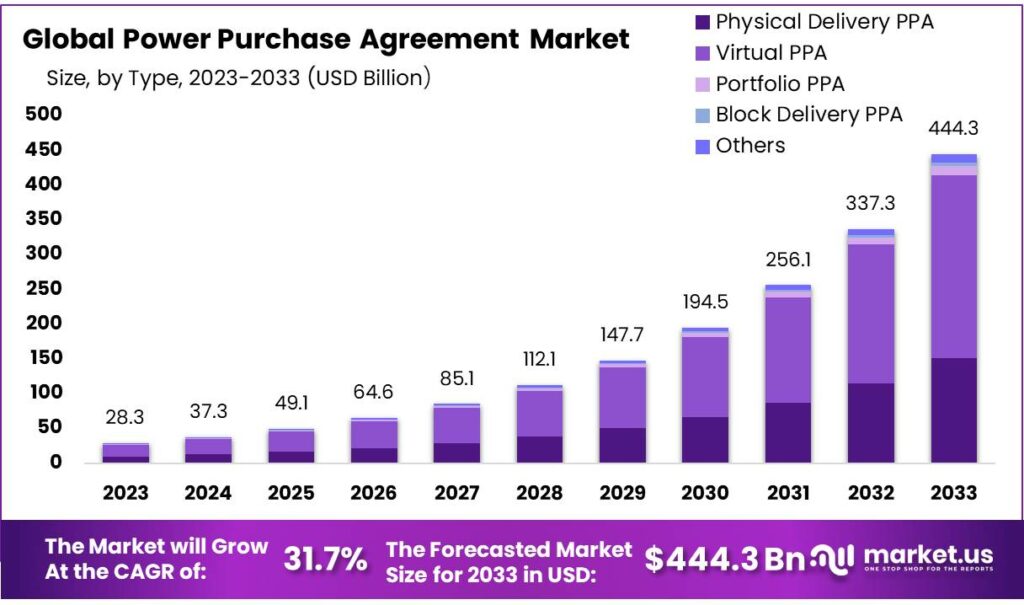

According to Market.us, the Global Power Purchase Agreement Market size is forecasted to exceed USD 444.3 billion by 2033, with a promising CAGR of 31.7% from 2024 to 2033.

Power Purchase Agreements (PPAs) are contractual arrangements where a developer installs, owns, and operates an energy system typically renewable on a customer’s property. The customer buys the electricity generated at a rate usually lower than retail, avoiding upfront costs.

Power Purchase Agreements (PPAs) are favored for promoting stable, cost-effective renewable energy integration without the financial burden of infrastructure development. They are increasingly popular worldwide due to economic and environmental benefits, supported by falling technology costs and favorable policies.

Key Takeaway

- The Global Power Purchase Agreement Market size is expected to be worth around USD 444.3 Bn by 2033, from USD 28.3 Bn in 2023, growing at a CAGR of 31.7% during the forecast period from 2024 to 2033.

- By Type, The Virtual PPAs held a major market share of 59.2% in 2023.

- By Location, The off-site segment dominated the global market with an 83.1% market share in 2023.

- By Category, The Corporate segment accounted for 86.3% of the global market.

- Based on the Deal type, The wholesale segment led the market with a 62.5% market share in 2023.

- By Capacity, The 50-100 MW segment dominated the market in 2023, accounting for over 49.6% market share.

- By Application, The Wind segment accounted for the fastest growth, accounting for 51% CAGR during the forecasted period.

- Based on the End-user, The Commercial segment dominated the market with more than 50% market share in 2023.

- In 2023, North America dominated the market with the highest revenue share of 40.7%.

Factors affecting the growth of the Power Purchase Agreement Market

- Government Regulations and Policies: The regulatory landscape significantly impacts the PPA market. Government incentives for renewable energy, such as tax benefits, subsidies, and grants, along with mandates for green energy procurement, foster a conducive environment for the adoption of PPAs.

- Economic Factors: Economic stability and electricity price volatility influence the attractiveness of PPAs. Stable economic conditions enhance creditworthiness and investment potential, making PPAs more appealing.

- Technological Advancements: Innovations in renewable energy technologies, such as solar photovoltaics, wind turbines, and battery storage systems, enhance the efficiency and cost-effectiveness of energy production.

- Corporate Sustainability Targets: An increasing number of companies are committing to sustainability and setting ambitious carbon-neutral goals. PPAs provide a direct route for these companies to procure renewable energy, which helps them reduce their carbon footprint and meet regulatory requirements or corporate social responsibility goals.

- Market Competitiveness: The entrance of new players in the renewable energy market increases competitiveness and drives innovation and efficiency, making PPAs more accessible and affordable.

Top Trends in the Global Power Purchase Agreement Market

The global Power Purchase Agreement (PPA) market is characterized by a significant shift towards renewable energy sources, primarily driven by sustainability goals and economic incentives. The proliferation of corporate PPAs reflects a growing commitment among large businesses to reduce carbon footprints and secure stable energy costs. Technological advancements in energy storage and grid management are enhancing the viability of PPAs for intermittent power sources like wind and solar.

Additionally, there is an increasing trend of decentralized and digital PPAs facilitated by blockchain technology, enabling transparent and efficient energy transactions. Geographically, emerging markets are witnessing rapid growth in PPA adoption, spurred by increasing energy demand and regulatory support.

Market Growth

The proliferation of virtual power purchase agreements (VPPAs) marks a significant trend in the sustainability efforts of businesses across various sectors, including technology, healthcare, and manufacturing. These agreements not only ensure a fixed, low energy cost but also provide Renewable Energy Certificates, enhancing claims of clean energy utilization. The surge in VPPAs, accounting for over 80% of U.S. PPA contracts in 2019, signifies a shift towards more sustainable energy solutions.

Furthermore, developing nations like India are witnessing increasing investments in renewable resources, presenting substantial opportunities for the expansion of PPAs. Such agreements are essential for the development of renewable energy infrastructures, promoting more reliable and cost-effective power solutions in these regions.

Regional Analysis

In 2023, North America led the Power Purchase Agreement (PPA) market, holding a 40.7% share, driven by strong regulatory support and high adoption by commercial and industrial sectors. Meanwhile, Europe, with a 36.6% CAGR, is expected to soon overtake North America due to strict environmental policies and high corporate demand for renewable energy, with the European PPA market seeing record growth and set to exceed 20 GW in 2024.

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | USD 6.6 Billion |

| Forecast Revenue (2033) | USD 28.3 Million |

| CAGR (2024 to 2033) | 31.7% |

| North America Market Share | 40.7% |

| Base Year | 2023 |

| Historic Period | 2020 to 2022 |

| Forecast Year | 2024 to 2033 |

Market Drivers

The growing demand for renewable energy is poised to significantly boost the global market for Power Purchase Agreements (PPAs). These agreements are crucial for providing financial and contractual stability in renewable energy projects, including solar, wind, hydroelectric, and biomass. In the U.S., corporate purchases of renewable energy have notably driven PPA adoption, with over 70 GW procured since 2014, accounting for more than half of the market by 2022.

Furthermore, as global electricity demand is projected to grow annually by 1.8% until 2050, PPAs provide a safeguard against the volatility of traditional energy prices. By locking in lower and predictable prices for renewable energy, companies can mitigate future cost risks. PPAs ensure a consistent electricity rate over the term of the contract, often spanning 10-25 years, fostering financial predictability and competitive pricing compared to retail electricity rates. This arrangement benefits both renewable energy developers and buyers by offering stability amidst fluctuating market conditions.

Market Restraints

The global power purchase agreements (PPA) market faces challenges due to their limited availability and complex legal environment. PPAs are constrained by varying state laws, with some jurisdictions banning them altogether. These agreements are legally intricate, requiring extensive time and negotiations to address regulatory frameworks across multiple levels.

Additionally, the mismatch between supply and demand for PPAs, exacerbated by the competitive energy market, limits suitable opportunities for developers, hindering the expansion of renewable energy projects and the transition towards a cleaner energy landscape.

Opportunities

The Power Purchase Agreement (PPA) market offers significant opportunities driven by the global energy transition and increasing demand for renewable energy. Key growth areas include corporate PPAs, as businesses aim to meet sustainability goals, and emerging markets in Asia-Pacific and Latin America, where renewable adoption is accelerating. Innovations in battery storage and hybrid projects enhance PPA flexibility and reliability.

Additionally, regulatory support and decarbonization targets provide favorable conditions. The market is poised for expansion as stakeholders seek cost-effective, long-term energy solutions with stable pricing and reduced carbon footprints.

Report Segmentation of the Power Purchase Agreement Market

By Type Analysis

In 2023, The Physical Delivery PPA segment dominated 34% of the renewable energy market, prized for its direct electricity procurement from renewable sources, offering stability and price predictability. Its transparent and reliable structure simplifies transactions and reduces risks, making it highly favored among renewable energy stakeholders.

By Location Analysis

In 2023, Off-site PPAs led the global market with an 83.1% share, favored for their scalability and cost-efficiency. This segment allows organizations to leverage renewable energy from optimal locations, overcoming the spatial and infrastructural limitations of on-site alternatives, thereby enhancing sustainability efforts and potentially lowering operational costs. This dominance highlights its crucial role in advancing a sustainable energy future.

By Category Analysis

The Corporate segment leads the Power Purchase Agreement Market with an 86.3% revenue share, forecasted to grow at a CAGR of 32.8%. This dominance is driven by businesses adopting renewable energies to minimize carbon footprints and stabilize energy costs, using PPAs to hedge against fluctuating energy prices and uphold sustainability commitments. Supportive policies, technological advances, and growing environmental consciousness further amplify this trend.

By Type Analysis

Wholesale PPAs dominate the market with a 62.5% share in 2023, favored for their scalability and predictable pricing. They are pivotal in securing revenue for large-scale renewable projects, bolstered by regulatory support and increasing corporate commitment to sustainability, driving demand for renewable energy procurement.

By Capacity Analysis

The 50-100 MW segment accounted for 49.6% of the Power Purchase Agreement (PPA) market in 2023, leading other categories such as Up to 20 MW, 20-50 MW, and Above 100 MW. This segment is favored due to its scalability and ease of integration into existing power grids, which circumvents substantial infrastructural and regulatory challenges. Such capacity not only allows for economic scaling, reducing costs per megawatt but also enhances project viability, as evidenced by agreements like the PPA between Evonik and EnBW for offshore wind energy.

By Application Analysis

Solar Power Purchase Agreements (PPAs), especially in the solar segment, hold over 51% of the market in 2023 due to their stable pricing model, which appeals to commercial and industrial users. Solar energy’s falling installation costs and scalable nature enhance its economic viability. Technological improvements in photovoltaic cells also boost efficiency, increasing adoption. Additionally, a minor price reduction to $49.09 per megawatt-hour in Q2 2023 has made solar PPAs more financially attractive, encouraging broader use.

By End-Use Analysis

Solar Power Purchase Agreements (PPAs) now hold a dominant 51% market share due to their stable pricing, cost-effectiveness, and accessibility. In Q2 2023, the price fell slightly to $49.09 per MWh, boosting attractiveness. Technological advances in photovoltaic cells have also increased efficiency, encouraging broader use across various sectors, especially as installation costs continue to drop.

Recent Development of the Power Purchase Agreement Market

- In Oct 2023, Statkraft and Chiesi Group signed a 10-year renewable power purchase agreement to supply more than 30 gigawatt-hours per year of renewable energy. This agreement will help Chiesi Group stabilize its electricity costs in the long term and reduce CO2 emissions, equivalent to the annual electricity needs of more than 12,500 households.

- In Oct 2023, RWE signed its first power purchase agreement in the US with the state of New York. The agreement involves the supply of electricity from 1300 MW of offshore wind capacity. The company’s joint venture with grid operator National Grid Ventures was awarded the contract.

- In Sept 2023, Shell Energy Europe signed a 15-year power purchase agreement (PPA) with HANSAINVEST Real Assets to secure 600 megawatts (MW) of capacity at Germany’s largest solar project, the Witznitz Energy Park. The project is being developed by MOVE ON Energy. As part of the agreement, Shell will sell the power generated by 323MW of the solar capacity to Microsoft.

Competitive Landscape

The global Power Purchase Agreement (PPA) market is characterized by the presence of key industry players, including General Electric, Siemens AG, Shell Plc, Statkraft, and several others, each contributing significantly to market dynamics through their diverse range of renewable energy solutions and services.

These companies play a pivotal role in shaping the renewable energy landscape by facilitating the development, financing, and operationalization of renewable energy projects worldwide. The market share among these entities is distributed based on their geographical presence, technological expertise, and the capacity to forge strategic partnerships and agreements.

Companies like Iberdrola, S.A., Ørsted A/S, and Enel Global Trading have been particularly instrumental in advancing the PPA market through their extensive renewable energy portfolios and global reach. The competitive landscape is further enriched by specialized firms like Ameresco and Ecohz, which offer tailored energy solutions to meet the growing demand for sustainable energy sources.

As the market evolves, these key players are expected to drive innovation, expand renewable energy capacities, and thus, play a crucial role in the transition towards a more sustainable energy future.